Last week, CoinDesk received documents in response to a New York state Freedom of Information Law request about the details of Tether’s reserves. These documents were released two years after our original filing in 2021 and only after a full-blown legal fight with Tether, which CoinDesk won in February.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Tether had billions of dollars’ worth of commercial paper issued by financial institutions worldwide. It tapped a number of banks to hold its funds, and it had to detail its procedures with the New York State Attorney General’s office (NYAG) even after settling the regulator’s inquiry into the company.

Whether the Tether stablecoin (USDT) has been fully backed with reserves has been a question for years. In 2019, skeptics were vindicated after the New York Attorney General’s office announced there was a roughly $850 million hole caused by Tether loaning funds from its reserve to Bitfinex, its sister company. Still, Tether claimed it had patched the hole and was fully backed again in the years following that announcement.

On the morning of June 15, CoinDesk’s counsel with Klaris Law emailed a handful of editors (including yours truly) to let us know the New York State Attorney General’s FOIL officer had finally emailed us documents responsive to a request filed in June 2021.

Among these documents were details about the commercial paper and securities issued by an international suite of banks to Tether; portfolio reports from banks that held Tether’s funds and letters from Tether’s counsel to the NYAG detailing the company’s know-your-customer (KYC) and other protocols.

In the FOIL request, CoinDesk asked for “a copy of the asset reserve composition details backing the stablecoin Tether ($USDT) for Tether Operations Limited. These details should have been provided to the OAG as part of the investigation into iFinex which was settled earlier this year. I'm specifically only looking for information about what is backing Tether's reserves, including the document Tether claims to have sent OAG in May 2021.”

I don’t really have a lot more to add at this point than what we’ve already published so I’ll just send you to that article.

One interesting detail is Tether’s response. The company published a statement before any CoinDesk reporters even had a chance to dig into the documents we received, and published a second one on Friday after Bloomberg published a story on the documents (also prior to CoinDesk publishing anything).

As of press time for this newsletter, Tether has yet to respond to an initial list of detailed questions sent to the company on Friday through external spokespeople as of time of writing.

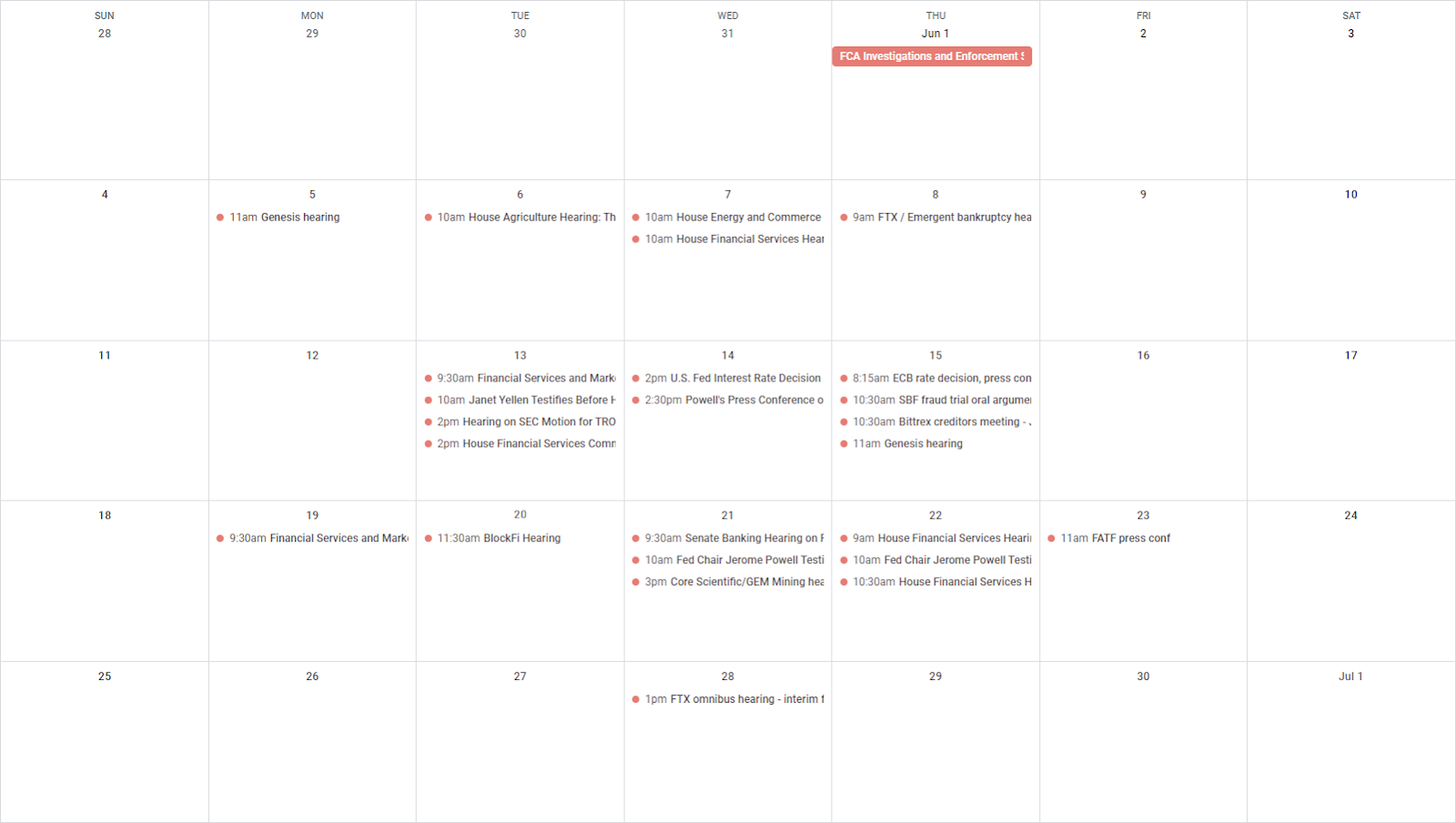

Monday

Tuesday

Wednesday

Thursday

Friday

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。