Organized by: Deep Tide TechFlow

Guest: Chase, former listing manager at Binance

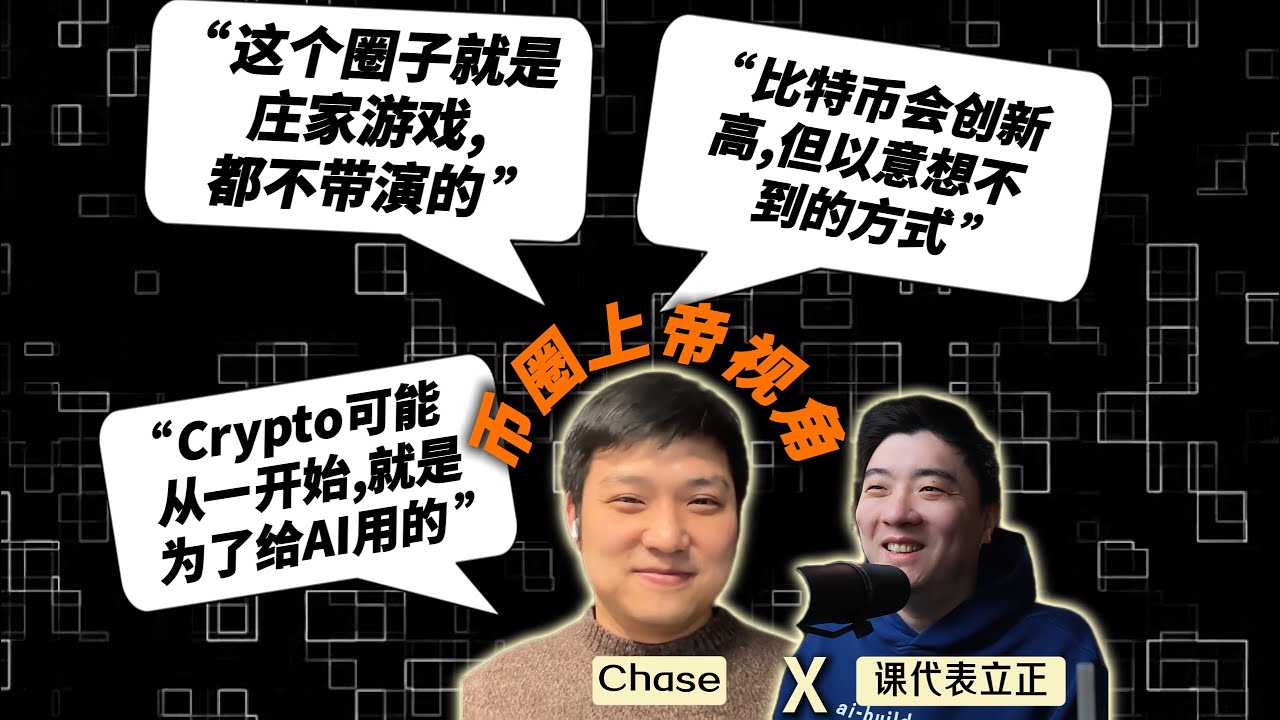

Podcast source: Class Representative Stand at Attention

Original title: Is Bitcoin manipulated? A former exchange executive reveals how the masters declare sovereignty to the world

Broadcast date: February 10, 2026

Guest Identity: Chase, former listing manager at Binance. During his tenure, he oversaw about 1,000-2,000 projects, responsible for the token issuance (Launch) of about 100 projects, with the data he handled being of extremely high quality, representing a top-level perspective in the industry.

Core Perception: He believes the cryptocurrency circle (especially in the exchange environment) is a financial battleground that "does not act." Unlike the stock market, which still retains the disguise of financial reports, this realm is filled with liquidity games and market maker manipulation. He observed that Bitcoin's K-line can be manipulated by masters to create perfect "artificial shapes" to declare sovereignty. In this market, information, traffic, attention, and even insider information itself are assets, and as long as there is liquidity, they can be priced.

Highlights of Insight

- Macroeconomics and Cryptocurrency Valuation Logic

• The reality of the bull market in US stocks: Since the Internet bubble, the S&P 500 has been in a long-term bull market, but when compared to gold, this may not be the case. The core reason for this phenomenon is the continuous expansion of money supply.

• Support for asset prices: Newly generated money must seek asset carriers. Growth in goods and services (GDP) does not keep pace with the speed of money printing and credit growth, and excess money must flow to new asset classes, forming bubbles. Cryptocurrencies, due to their low-cost issuance and lack of need for centralized verification, have become an excellent vessel for absorbing global excess liquidity.

• Valuation system in the cryptocurrency circle: Unlike traditional finance, which looks at cash flow, the short-term performance of cryptocurrency assets is determined by three factors:

1. Liquidity

2. Traffic/Attention

3. Tokenomics

- Market Manipulation and "Master" Mindset

• Can Bitcoin be manipulated?: Yes. Chase has observed Bitcoin rising consecutively for 7 days within a week with almost the same magnitude and trading volume, followed by a sharp drop. This is not natural fluctuation, but rather a large capital group (masters/market makers) signaling to the market — "I control the rhythm, those who understand should follow, those who don’t will be eliminated."

• Everything can be priced: In the Crypto world, information, traffic, and even insider information (like Polymarket prediction markets) can be assetized. When most people form a "consensus," it is often time for reverse harvest.

• A market without acting: Exchanges like Binance vividly demonstrate what naked trading looks like. Here, there are value investors, but more prevalent are market makers who see through liquidity and short-term benefits; this is a financial battleground that does not act.

- Frontier Trends: The Combination of AI Agents and Crypto

• The measurement dilemma of AI: The future economic volume generated by AI agents will exceed that of humans, but the existing GDP system cannot measure the micro transactions (API calls, data exchanges) of AI.

• Crypto as infrastructure: Crypto is inherently suitable as financial infrastructure for AI. It provides precise measurement and settlement for every small transaction without the cumbersome trust processes required by banking systems. Crypto might be for AI use, not human use.

- Industry Insights and Wealth Opportunities

• The exorbitant profits of stablecoins: Tron hosts a significant amount of USDT. Tether, the issuer of USDT, made a profit of about $15 billion in a year, surpassing the combined losses of OpenAI and Anthropic. This is a risk-free arbitrage model relying on the spread of US Treasury bonds, representing the industry's true "cash cow."

• Capital egalitarianism: The most significant change in production relationships brought by Crypto is the concept of "capital egalitarianism." Regardless of who you are, as long as you meet the criteria, you can receive equal returns (like DeFi yields), breaking the traditional bank's differential treatment of retail and high-net-worth clients.

• Advice for practitioners:

◦ On getting rich quickly: This industry indeed has windfall opportunities, and diligent ordinary people (like chasing airdrops) might earn more than in traditional manufacturing, but ultimately, significant money flows to "top players" or is redistributed.

◦ Advice for newcomers: First, understand two things — Bitcoin (as an asset allocation) and stablecoins (as payment innovation). Don’t focus only on speculation; recognize the opportunities brought by payment system innovation.

◦ Prediction for 2026: Bitcoin will rise, but in ways you might not expect (through pricing all information and liquidity games).

Opening and Guest Introduction: Power of the Binance Listing Manager

Class Representative: Hello everyone, welcome Chase, a very mysterious figure in the cryptocurrency circle, to our program. So Chase, please introduce yourself.

Chase: Hello everyone, I used to be a powerful figure, now I’m a bit out of the spotlight, haha. I have resigned to pursue my dreams, giving up significant power. Hello, I'm Chase, as the class representative mentioned, my most recent job was as a Listing Manager at Binance, the largest cryptocurrency exchange in the cryptocurrency circle. This job was mainly to help these founders mint their tokens. At the exchange, Binance has actually managed to reach a trading volume level comparable to Nasdaq from the time I joined to my departure, so the scale is substantial.

Class Representative: Let me explain your job to everyone. These people issue a coin, but if they want to trade on Binance, which has a trading volume comparable to Nasdaq, it will go through your team. My understanding is that you might not want to say this, but it’s somewhat similar to the role of the securities regulatory body deciding whether a company can go public. So all the founders are very... haha.

Chase: There are functional similarities, but legally it cannot be defined that way.

Class Representative: Okay, please continue. How large is your team and what role do you play within it?

Chase: Our team consists of about ten people. My official title is Listing Building Manager. We had 4 people, there are even fewer now. We had 4 people who could genuinely approach others, discuss and clarify their doubts, guide them, and explain how A, B, C, D should be done. That's about it.

Class Representative: Wow, I feel that your background provides several very important pieces of information. First, you must have seen many projects; you are perhaps one of the people who has seen the most Crypto projects in the world, because that is your job. And because you actually do wield real power, we won’t shy away from saying that, especially as you are about to leave, so there’s no conflict of interest. Founders value you highly, and the core resources and information you can obtain are very firsthand and very real. Including your ability to form judgment. Thirdly, one of your jobs is also to communicate with the industry, so you must have formed your own views or insights as well. I think these aspects give you a unique position. What do you feel you can share with everyone today?

Chase: What I can share the most is the data I put in and how the entire model has transformed from that. And I feel that my data is quite high quality, so it shouldn't be garbage. I can share what is virtually the highest quality data that I’ve got. From the time I joined the company to last year, I have looked at about 1,000 to 2,000 projects in a total of approximately two and a half years. Last year, about 100 projects I supported successfully launched tokens.

Class Representative: Tell us what the concept behind these numbers is, whether looking at projects or launching them.

Chase: When looking at projects, you can understand that it's similar to how VC evaluates projects. You need to look at the deck, examine the teams, discuss with them, and make your own judgments; that’s the basics. A VC typically looks at around 200 projects a year and does pretty well if they manage that. You must continue to communicate with the founders. However, during my more than two years, I looked at over 1,000 and managed to launch around 100 alone last year. What does 100 mean? Binance had only launched around twenty or so when I first joined in one year, and in the second year, we launched about fifty to sixty. By the third year, last year, I alone launched 100, and then, suddenly a bull market came. How many did we launch in total? Probably around 250, 300 altogether.

Class Representative: You single-handedly accounted for nearly half the total.

Chase: About a third. No, no, it's about a third. Because there are only four of us, right? The screening success rate is about 5% to 10%.

Worldview of Crypto: Tertiary Industry and AI Infrastructure

Chase: I want you to help everyone interpret this world. Many people who may not understand Crypto do not understand this world. First, you can consider it a virtual world. This world has its own set of economic circulation mechanisms. If you consider it a country, it needs the dollar to support liquidity. However, its output, its export, is its service. It only has service; it only has the tertiary sector. What does it need as its primary industry? It needs computing power and electricity.

Class Representative: How should this statement be understood? What does it mean that the output is from the tertiary industry? Because we often say, isn't it possible to use Bitcoin to buy pizza? That's not the case, right?

Chase: The reason I say it is the tertiary industry is that Bitcoin, although it has a large market share, around 50% to 60%, is not the core of the industry. We can blow bubbles where it serves as a store of value, but it cannot provide many services. A store of value is essentially what we call liquidity support. Why do I say it's the tertiary industry? For instance, after Ethereum emerged, many smart contracts enabled features like DeFi, which can significantly disrupt traditional finance. I remember a few weeks ago, there were comments that in the next two years, when we reach 2026 and 2027, almost all mainstream institutions on Wall Street will be chain-based.

Class Representative: Regarding DeFi, we previously invited Richard Yozhong (founder of Huma Finance) to our channel to talk about his project, which primarily helps companies engaged in trade reduce friction in finance, whether exchanging currency or borrowing, helping them reduce friction and improve efficiency—providing a service that brings clear value to traditional or non-Crypto businesses.

Chase: Right.

Class Representative: Can you list some of the major points in your view?

Chase: What you just mentioned is about the service and value output of the industry externally, which is certainly valid. But aside from that, this industry has its unique aspects. For example, Flash loans, which most people haven’t heard of. What does it mean? For instance, if you go to a bank to borrow money, you must either have collateral or have a very high credit score or something—there must be something for the bank to lend you. The ability of Flash loans allows you to complete borrowing and repayment without any collateral while simultaneously posing no risk to the bank. Almost all Crypto related to payments can enable this.

Chase: The most important thing, which I might soon write a paper on, is related to AI. Let’s say five years from now, if AI continues to develop according to our current scaling laws, the number of AI agents will surely exceed the human population, right? Based on this assumption, how do you measure the economic behavior generated between AI agents? When you call its API, fine, you're currently on a subscription model. However, often, I might only need to use a lot of long-tail data that only you possess, or only I have. How is a single call settled? You get a very, very small amount of data, and the existing banking system can't help settle it. All economic behaviors need to be measured first, and then everyone must trust this for it to succeed. This is also where Crypto can enable or collaborate with AI. That's why many people in the circle think that Crypto itself might not be designed for human use; perhaps it is structured this way for AI use.

Class Representative: When interviewing Yozhong, he also mentioned, which I still remember, that he believes AI is productivity while Crypto represents production relationships.

Chase: In fact, Crypto also has productivity and production relationships. But Crypto can truly change production relationships because, ideologically speaking, there is a concept of capital egalitarianism involved. If you were living on the mainland now, you would be accustomed to Alipay, accustomed to Yu'ebao, where your money automatically generates interest, which is very natural. But in North America or Europe, you might still have to go to the bank, where thresholds exist, and the interest rates are very low. But Crypto fully equalizes the world. Money is money, no matter whose it is. As long as it is deposited and meets my standards, you can receive the same returns.

Macroeconomic Perspective: US Stocks, Gold, and Monetary Illusions

Class Representative: As you just mentioned, payments themselves constitute a large system, and Crypto can provide a lot of value in this regard. Changing production relationships is also valuable. Are there any other significant points you see in the value of Crypto?

Chase: Speaking more realistically, it can help carry greater liquidity for all countries with excessive liquidity without affecting inflation.

Class Representative: I see the value store. Do you think there's a significant difference between this and gold?

Chase: That’s an excellent question. You see, in the link I shared with you, there’s a chart. What does this chart show? First, let me ask you a question, do you think US stocks from the Dot-com Bubble to now are in a bear market or a bull market?

Class Representative: It’s a bull market.

Chase: Exactly, using the S&P 500, it is indeed a bull market. But for gold, it has been in a bear market. That's what the chart is illustrating.

Class Representative: Right. Interesting. It suggests that the money you've printed has driven the growth of the S&P 500, but it still hasn't exceeded the growth rate of gold in terms of anti-inflation. Wow, so the S&P is...

Chase: This is research published by Lyn Alden, a very famous author. I can give you the link later.

Class Representative: Interesting, interesting, interesting. This is a significant shift in my understanding of investments. Previously, the economics I learned about discounted future income seemed reasonable, but later I realized that many people said the US stock market was a bubble that needed to burst every ten years, yet that never happened. Why? I later thought, it’s because once the money gets printed excessively, it has nowhere to go. Previously, no one could generate so much money, but now it’s being produced in abundance; it has to go somewhere.

Chase: Exactly. Our growth in goods and services, let's say, annually is around 5%. Your money issuance and credit growth far exceed this speed. So, aside from turning excess money into bubbles, it must find new services or assets to price. Why are there new assets to price? Because the Crypto space can issue assets continually at very low costs, and you don’t need a central institution to verify this. Once people believe your asset holds value, new liquidity will come in and absorb this liquidity.

Class Representative: As long as you verify it yourself.

Chase: Yes, it requires your own judgment.

Class Representative: Not just you! You!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。