Authors: Zhao Ying, Bao Yilong, Wall Street Journal

Amazon's stock price has fallen for nine consecutive days, setting a record for the longest consecutive decline in nearly 20 years.

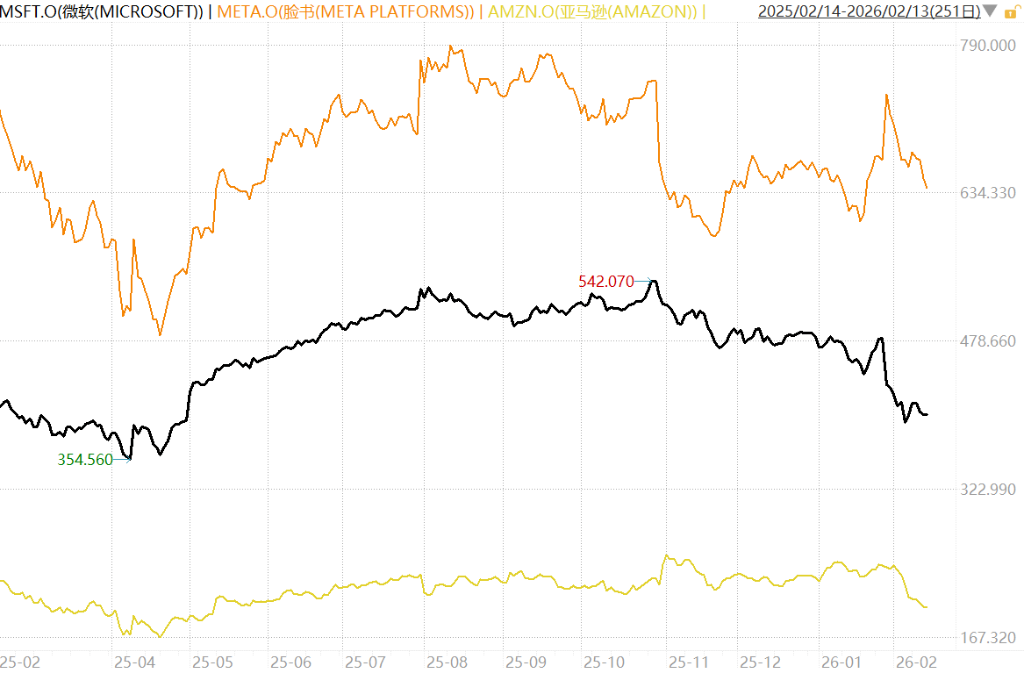

After entering a technical bear market on Thursday, becoming the second company within the Mag7 to fall into a bear market, Amazon's stock price continued to decline on Friday.

Investors have strongly resisted the tech giant's aggressive artificial intelligence spending plans, leading to a significant drop in these star stocks.

On Friday, Amazon's stock closed at $198.79, down over 23% from recent highs, and officially fell below the bear market threshold the previous day, Thursday.

Among the four major cloud service providers, Amazon is planning the highest capital expenditure in 2026, reaching $200 billion.

Amazon, Microsoft, Meta, and Alphabet are expected to have a total capital expenditure of $650 billion in the AI sector in 2026.

Meta could be the next member of the Mag7 to enter a bear market, having fallen 19.6% from last year's peak by market close on Friday, just 0.4% away from the 20% threshold of a bear market. Despite Meta's fourth-quarter revenue and earnings exceeding Wall Street expectations, increased AI spending and profit margin pressure have undermined investor confidence.

Microsoft was the first member of the Mag7 to enter a bear market. The company's stock price fell into a bear market on January 29, after the previous day's announcement of Azure cloud business growth that did not meet investor expectations. At market close on Friday, Microsoft’s stock price had dropped 27.8% from recent highs.

(Price Trend of Amazon, Microsoft, and Meta over the past year)

Investors Rotate within Mag 7, Free Cash Flow Pressure Highlighted

Mike Treacy, Vice President of Risk at Apex Fintech Solutions, stated that the recent sell-off highlights the widening differentiation among Mag7 members.

Since last autumn, investors have withdrawn from OpenAI transactions related to Microsoft, Nvidia, and Oracle, favoring the Alphabet and Broadcom ecosystems instead.

Treacy noted that Alphabet's vertically integrated technology stack somewhat offsets concerns over excessive spending, shielding the stock from the most severe impacts of the tech sell-off. Alphabet's stock closed on Thursday down 9.2% from recent highs.

Treacy indicated that Google's self-sufficiency should command a premium compared to other companies, which may be adversely impacted by some link in the supply chain.

Amazon, Microsoft, and Meta's stock prices have suffered greater impacts as investors are less confident that these companies' AI spending will generate sufficient investment returns.

For Amazon, an increase in capital spending levels could lead to its free cash flow turning negative this year, meaning the company would need to start entering the debt market to raise more capital.

Treacy believes that the next important catalyst for AI transactions will be Nvidia's earnings report released on February 25. This performance report will show whether the AI boom is cooling off or if Nvidia has successfully captured the billions of dollars spent by its largest customers in this field.

Related reading: Trading Moment: AI Panic Escalates on the Eve of CPI, Bitcoin Fluctuates at the Bottom, Difficult to Replicate the "Spring Festival Market"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。