Author: Lao Bai

Two years later, V once again sends a tweet, and I will also follow up on that research report from two years ago, with the same timing, February 10th.(Related Reading: ABCDE: Analyzing AI + Crypto from the Perspective of the Primary Market)

Two years ago, V had already implicitly expressed that he was not very optimistic about the various Crypto Helps AI that were popular at that time. The three major trends at that time were computational power assetization, data assetization, and model assetization. My research report from two years ago mainly discussed some phenomena and doubts observed in the primary market regarding these three trends. From V's perspective, he still sees more potential in AI Helps Crypto.

The examples he mentioned at that time were:

- AI as a participant in the game;

- AI as the game interface;

- AI as the game rules;

- AI as the game objectives;

In the past two years, we have actually made many attempts in Crypto Helps AI, but the outcomes have been sparse. Many tracks and projects are simply - issuing a token and that's it, with no real business Product-Market Fit, which I refer to as “tokenization illusion.”

1. Computational Power Assetization - Most cannot provide commercial-grade SLA, are unstable, and frequently go offline. They can only handle simple inference tasks for small and medium models, mostly serving edge markets, with income not linked to tokens…

2. Data Assetization - High friction on the supply side (retail investors), low willingness, and high uncertainty. On the demand side (enterprises), what is needed are structured, context-dependent, trustworthy, and legally responsible professional data suppliers, which DAO entities in Web3 projects find it hard to provide.

3. Model Assetization - Models themselves are a non-scarce, replicable, fine-tunable, and rapidly depreciating process asset, rather than a final asset. Hugging Face is itself a collaboration and dissemination platform, more like GitHub for ML rather than an App Store for models, hence the so-called “decentralized Hugging Face” aimed at tokenizing models has mostly ended in failure.

Moreover, over the past two years, we have also tried various “verifiable inference,” which is also a typical story of using a hammer to find a nail. From ZKML to OPML to Gaming Theory, etc., even EigenLayer has transformed its Restaking narrative into one based on Verifiable AI.

But the situations in the Restaking track are similar - very few AVS are willing to continuously pay for the additional verifiable security.

Likewise, verifiable inference is mostly about verifying “things that no one really needs to be verified”; the threat model on the demand side is extremely vague - who exactly are we defending against?

AI outputs errors (model capability issues) far more often than AI outputs being maliciously tampered with (adversarial issues). Everyone has seen various security incidents on OpenClaw and Moltbook recently, and the real problems arise from:

- Wrong strategy design

- Too many permissions granted

- Unclear boundaries

- Unexpected interactions from tool combinations

- ...

There is virtually no “model being tampered with,” or “inference process being maliciously rewritten” as some imaginary nails.

Last year, I shared this picture; I wonder if any old friends remember it.

This time, the thoughts that V provided are clearly more mature than two years ago, also due to the progress we have made in various directions such as privacy, X402, ERC8004, and prediction markets.

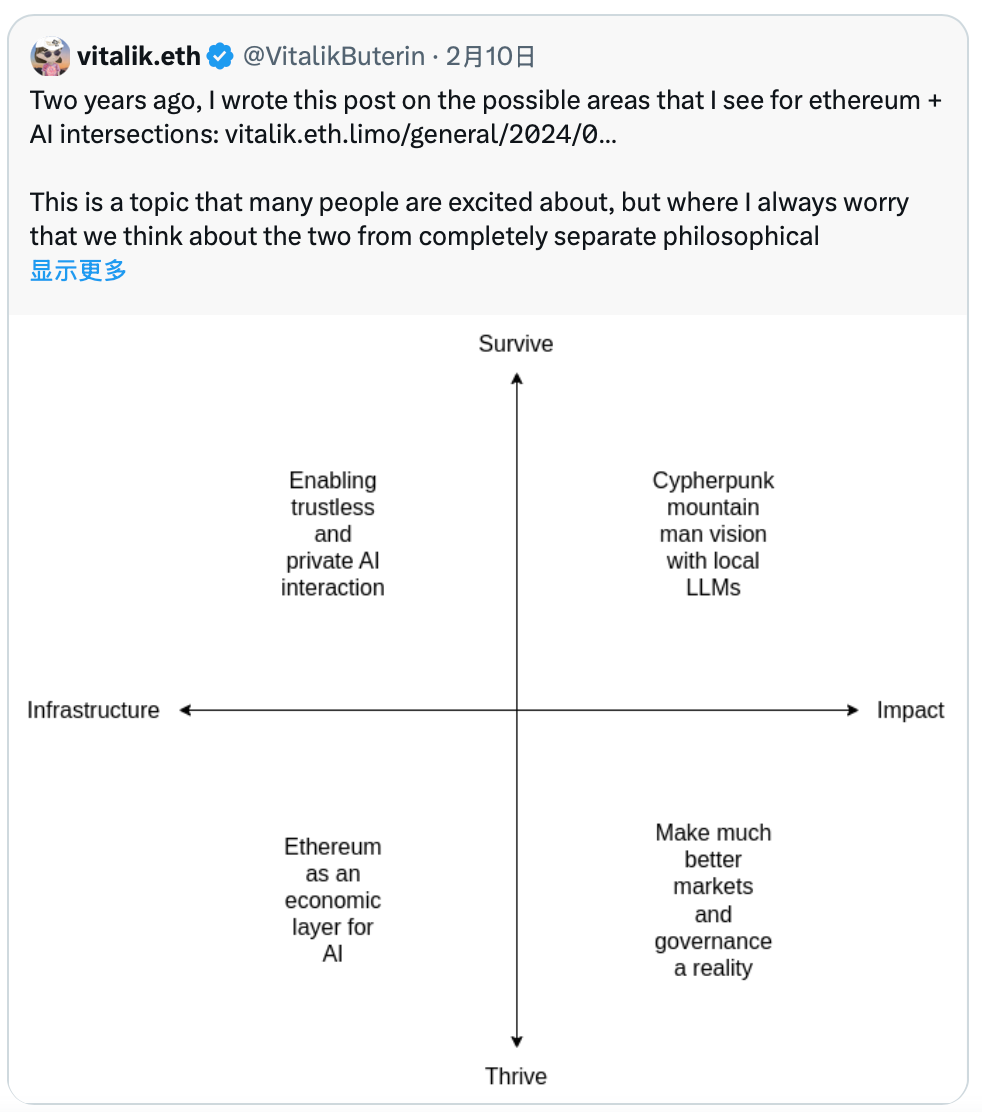

We can see that the four quadrants he delineated this time, half belong to AI Helps Crypto, and the other half belongs to Crypto Helps AI, rather than the obvious leaning towards the former two years ago.

Top left and bottom left - Utilizing Ethereum's decentralization and transparency to solve AI's trust and economic collaboration issues

1. Enabling trustless and private AI interaction (Infrastructure + Survival): Utilizing ZK, FHE, and other technologies to ensure privacy and verifiability in AI interactions (not sure if the verifiability in inference I mentioned earlier counts).

2. Ethereum as an economic layer for AI (Infrastructure + Prosperity): Allowing AI agents to make economic payments through Ethereum, recruit other bots, deposit collateral, or establish a reputation system, thereby building decentralized AI architecture rather than being restricted to a single dominant platform.

Top right and bottom right - Utilizing the intelligent capabilities of AI to optimize user experience, efficiency, and governance in the crypto ecosystem:

3. Cypherpunk mountain man vision with local LLMs (Impact + Survival): AI as the “shield” and interface for users. For instance, local LLMs (large language models) can automatically audit smart contracts and validate transactions, reducing reliance on centralized front-end pages and ensuring individual digital sovereignty.

4. Make much better markets and governance a reality (Impact + Prosperity): AI deeply involved in prediction markets and DAO governance. AI can act as an efficient participant, amplifying human judgment through large-scale information processing, addressing previous issues like insufficient human attention, high decision costs, information overload, and voter apathy in various market and governance contexts.

Previously, we crazily wanted Crypto to Help AI, while V was standing on the other side. Now we have finally met in the middle, but it seems that there is no relation to various XX tokenizations, or what AI Layer1 that is. Hopefully, two years from now, when we look back at today's post, there will be some new directions and surprises.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。