Document No. 42 is currently the most precise and complete legal normative document in the field of virtual currency-related business.

Written by: Crypto Salad

The central bank and eight ministries jointly issued regulatory provisions related to virtual currencies and the tokenization of real-world assets (RWA): People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, Financial Regulatory Bureau, China Securities Regulatory Commission, State Administration of Foreign Exchange "Notice on Further Preventing and Dealing with Risks Related to Virtual Currencies" (Yin Fa [2026] No. 42) (hereinafter referred to as "Document No. 42").

Previously, there were rumors in the industry about the new regulations being released. After the official document was published, the content dimensions were rich, and Crypto Salad felt that the previous compliance exploration in the RWA field was almost entirely covered in the documents from the eight departments and the securities regulatory commission.

Let’s quickly read through:

Nature of Document No. 42

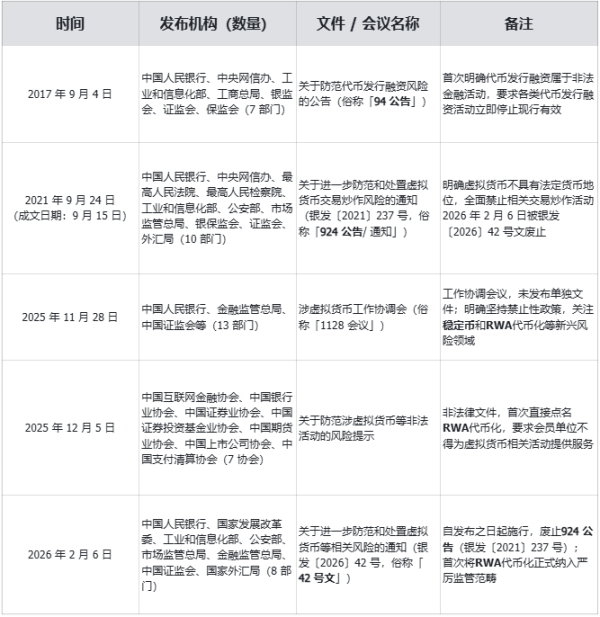

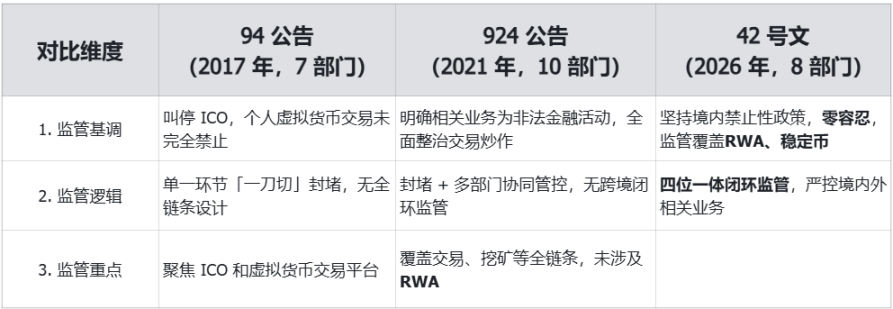

In 2017 and 2021, the regulatory authorities issued Announcement No. 94 and Announcement No. 924, respectively. Since then, there has been a long period without a complete legal document in this field; the work coordination meeting of thirteen ministries and commissions at the end of 2025 and the risk warning from seven associations do not constitute formal legal document upgrades. Below is a comparison of the nature of five core related documents:

Core Conclusion: Document No. 42 is currently the most precise and complete legal normative document in the field of virtual currency-related business, and Announcement No. 924 has been officially repealed with its implementation.

Core Differences Between Document No. 42 and Previous Virtual Currency Regulatory Documents

(1) Comprehensive Expansion of Regulatory Objects

New core regulatory objects: For the first time, the tokenization of real-world assets (RWA) and stablecoins are included in the core regulatory scope, expanding the regulatory dimension from purely virtual currency trading speculation to a "virtual currency + RWA + stablecoin" three-in-one full-chain regulation.

Stablecoin regulation details: It clarifies that "stablecoins pegged to fiat currencies have effectively performed part of the functions of fiat currencies in circulation," and prohibits "any domestic or foreign entity or individual from issuing stablecoins pegged to the Renminbi abroad without the approval of relevant departments in accordance with the law."

RWA clear definition: It is defined as "the activity of using cryptographic technology and distributed ledgers or similar technologies to convert ownership, income rights, etc., of assets into tokens (certificates) or other rights, bonds, and certificates with token (certificate) characteristics, and to issue and trade them."

(2) Enhanced Issuing Departments and Legal Effectiveness

Document No. 42 is jointly issued by the central bank, the National Development and Reform Commission, and other eight departments, and has reached consensus with the Central Cyberspace Administration, the Supreme Court, and the Supreme Procuratorate, with the approval of the State Council, significantly enhancing the issuing level and legal effectiveness compared to previous documents.

(3) Updated and Improved Legal Basis

New higher-level legal bases such as the "Law of the People's Republic of China on Futures and Derivatives," "Securities Investment Fund Law of the People's Republic of China," and "Regulations on the Administration of Renminbi of the People's Republic of China" have been added, providing more comprehensive legal support; at the same time, some documents in Announcement No. 924, such as the "Regulations on the Administration of Futures Trading" and "Decision of the State Council on Cleaning Up and Rectifying Various Trading Places to Effectively Prevent Financial Risks," have been deleted, making the legal application more precise.

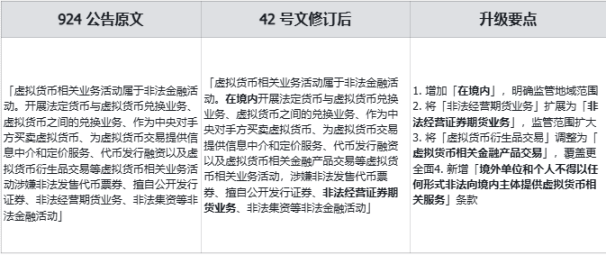

(4) Precise Upgrade of Virtual Currency Qualitative Statements

(5) New Definitions of RWA and Stablecoins

Document No. 42 adds specific clauses defining the nature of RWA: "Activities related to the tokenization of real-world assets conducted within the territory and providing related intermediary and information technology services, etc., that involve illegal issuance of token certificates, unauthorized public issuance of securities, illegal operation of securities and futures businesses, illegal fundraising, and other illegal financial activities, should be prohibited; except for relevant business activities conducted based on specific financial infrastructure with the approval of the competent business authority in accordance with the law."

It also clarifies the ban on RWA services from abroad: "Foreign entities and individuals are prohibited from illegally providing real-world asset tokenization-related services to domestic entities in any form."

Core Conclusion: Based on the above clauses, it can be clearly stated:

RWA projects within the territory, service providers within the territory — Illegal

RWA projects within the territory, service providers outside the territory — Illegal

Similar nature NFT projects, suspected of illegal issuance of token certificates — Illegal

RWA projects outside the territory, suspected of illegal fundraising within the territory — Illegal

(6) Detailed Division of Responsibilities Among Regulatory Departments, from Multi-Department Coordination to Dual-Track Regulation

Announcement No. 924 only established a multi-department coordination work mechanism: "The People's Bank of China, together with the Central Cyberspace Administration, the Supreme People's Court, the Supreme People's Procuratorate, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the Banking and Insurance Regulatory Commission, the Securities Regulatory Commission, the Foreign Exchange Bureau, and other departments, established a work coordination mechanism."

Document No. 42 innovatively implements a dual leadership system, clearly dividing regulatory responsibilities into two lines:

Virtual currency regulation: Led by "the People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the Financial Regulatory Bureau, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments to improve the work mechanism."

RWA regulation: Led by "the China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the Financial Regulatory Bureau, the State Administration of Foreign Exchange, and other departments to improve the work mechanism."

Core Conclusion:

The previous issue of inadequate multi-department coordination has been resolved due to the clear higher-level laws and responsibility mechanisms, leaving no room for evasion or negligence in handling.

Market entities intending to explore related businesses can clearly understand the government's power list and scope of responsibilities, reducing business misjudgments.

(7) Local Responsibility of Departments Strengthened

Document No. 42, based on Announcement No. 924, adds that "specific responsibilities are led by local financial management departments, with branches and dispatched agencies of the State Council's financial management departments, as well as telecommunications authorities, public security, market regulation, and other departments participating, in coordination with cyberspace departments, people's courts, and people's procuratorates," clarifying the leading departments and cooperation mechanisms at the local execution level, further solidifying local regulatory responsibilities.

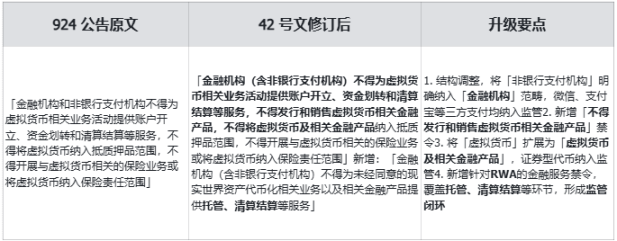

(8) Strengthening Management of Financial Institutions

(9) Expanded Regulation of Intermediaries and Technical Service Institutions

Announcement No. 924's regulatory scope only targeted virtual currency-related services, while Document No. 42 adds: "Relevant intermediary institutions and information technology service institutions shall not provide intermediary, technical, and other services for unauthorized real-world asset tokenization-related businesses and related financial products," officially expanding the regulatory scope to intermediaries and technical service providers in the RWA field.

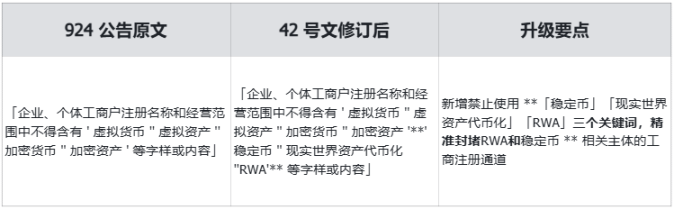

(10) Tightening of Market Entity Registration Management

(11) Strengthening of Mining Regulation Policies

Announcement No. 924 only mentioned "achieving full-chain tracking and all-time information backup for virtual currency 'mining,' trading, and exchange." Document No. 42 separately lists detailed regulations in Article 9, clearly stating that "it is strictly prohibited for 'mining machine' manufacturing enterprises to provide 'mining machine' sales and other services within the territory," cutting off the mining industry chain from the source; compared to the monitoring requirements of Announcement No. 924, the new regulations are stricter, more enforceable, and clarify the processing mechanism for relevant departments after receiving clues.

(12) Innovation in Regulation of Overseas Issuance

Document No. 42 combines new changes in the development of the overseas crypto field, adding dual prohibitions on overseas issuance for cross-border businesses:

Without the approval of relevant departments in accordance with the law, domestic entities and their controlled foreign entities are prohibited from issuing virtual currencies abroad.

Regarding RWA: "Domestic entities directly or indirectly conducting real-world asset tokenization businesses in the form of foreign debt abroad, or conducting asset securitization-like businesses based on domestic asset ownership, income rights, etc., abroad, shall be strictly regulated by the National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments according to their responsibilities, in accordance with the principle of 'same business, same risk, same rules.'"

Core Conclusion: Based on the above clauses, it can be clearly stated:

Issuance of non-RWA type tokens abroad without underlying assets — Illegal

Securities-type tokenization behaviors similar to foreign debt, equity, ABS nature — Legally permissible under strict regulation

Legal RWA regulatory principles — Refer to securities business "same business, same risk, same rules."

(13) Strengthening of Regulation on Overseas Business of Domestic Financial Institutions, Solidifying Responsibilities

Document No. 42 adds: "Overseas subsidiaries and branches of domestic financial institutions providing real-world asset tokenization-related services abroad must act prudently in accordance with the law, equipped with professional personnel and systems, effectively preventing business risks, strictly implementing customer access, suitability management, anti-money laundering, and other requirements, and integrating into the compliance risk management system of domestic financial institutions," achieving penetrating regulation of cross-border businesses.

Core Conclusion: Based on the above clauses, it can be clearly stated:

Overseas branches (branches, offices, etc.) of domestic financial institutions may conduct tokenization-related businesses.

Overseas branches conducting tokenization businesses must comply with both local laws and Chinese regulatory requirements, fulfilling highly prudent, anti-money laundering, and other legal obligations.

Business information and data from overseas branches must be fully integrated into the compliance risk management system of domestic financial institutions.

(14) Coverage of Regulation on Intermediary Institutions Providing Cross-Border Services

Document No. 42 adds: "Intermediary institutions and information technology service institutions providing services for domestic entities directly or indirectly conducting real-world asset tokenization businesses in the form of foreign debt abroad, or conducting real-world asset tokenization-related businesses based on domestic rights abroad, must strictly comply with legal regulations, establish and improve relevant compliance internal control systems according to relevant normative requirements, strengthen business and risk control, and report or file the relevant business activities with the relevant management departments," formally bringing intermediary institutions providing cross-border services into the regulatory scope.

Core Conclusion: Based on the above clauses, it can be clearly stated:

Law firms, technology companies, and other intermediary institutions may provide tokenization-related services within the controlled regulatory scope.

Intermediary institutions conducting tokenization businesses must have a complete risk control and internal control system, and the status of business activities must be reported or filed with regulatory departments.

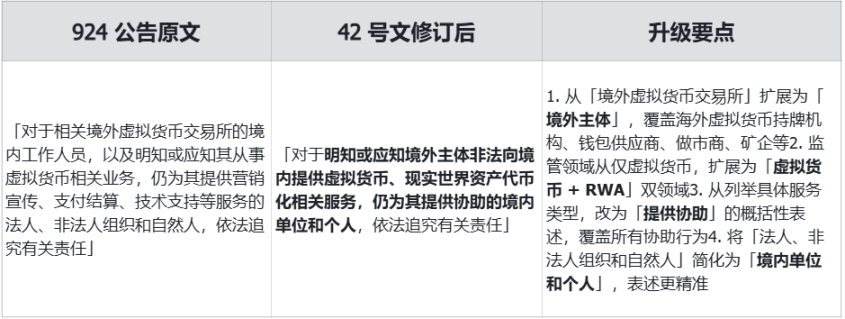

(15) Expansion of the Scope of Legal Responsibility Subjects

(16) Optimization of Civil Liability Clauses

Announcement No. 924 states: "Any legal person, non-legal entity, and natural person investing in virtual currencies and related derivatives, which violates public order and good customs, shall have their relevant civil legal acts invalid." Document No. 42 has been revised to: "Any unit and individual investing in virtual currencies, real-world asset tokens, and related financial products, which violates public order and good customs, shall have their relevant civil legal acts invalid," expanding the investment targets from "virtual currencies and related derivatives" to "virtual currencies, real-world asset tokens, and related financial products," providing more comprehensive regulatory coverage.

Core Conclusion: Various fundraising activities under the name of RWA targeting domestic investors will have their relevant investment rights not protected by law.

Current Status and Future Trends of RWA Business

The concept and projects of RWA originated overseas, similar to the early STO concept, but with broader imaginative space, referred to in the industry as "everything can be RWA." Discussions about RWA in China began to heat up gradually from 2024, peaking in volume from June to August 2025. This trend is closely related to the entry of major domestic institutions such as Ant Group, JD.com, and Guotai Junan, as well as the upgrade of crypto regulations and the introduction of stablecoin regulations in regions like the United States and Hong Kong.

Current Mainstream RWA Projects and Underlying Assets

Emerging operational cash flow assets such as renewable energy and computing power

Traditional operational assets such as commercial leasing

Cultural IP appreciation consumer goods projects

Physical assets such as real estate, antiques, artworks, and minerals

Other types of assets

Mainstream RWA Financing Solutions for Practitioners

In countries and regions with clear regulatory provisions, conducting securities-type token issuance for the above categories 1 and 2 assets — completely legal, but with the highest regulatory requirements and operational costs.

Issuing on domestic platforms such as cultural exchanges, digital exchanges, and industrial exchanges for the above category 3 assets and NFTs — lower regulatory requirements, not explicitly identified as illegal.

Issuing tokens for the above categories 4 and 5 assets on centralized and decentralized exchanges abroad, lacking cash flow support — seemingly backed by underlying assets, but in reality, high-risk behaviors of recruiting participants, speculation, fundraising, and market control, which have not yet been precisely defined in legal texts.

Due to significant differences in the characteristics of underlying assets, fundraising targets, operational norms, and the values of project parties, there are many edge-case operational methods in the RWA field, and practitioners also exhibit behaviors that deliberately blur regulatory boundaries. Without strict regulation, it is easy to see bad money driving out good money, leading to frequent high-risk projects and collective fraud incidents. Currently, the participants in this field are mixed, including domestic and foreign securities institutions, issuance service providers, overseas exchanges, digital brokers, data service providers, and domestic property trading platforms.

However, with the issuance of Document No. 42, everything has changed. Through careful analysis, we can see the regulatory authorities' thoughts and concepts:

Legislators have comprehensively considered the laws and regulations of regions such as the United States, Europe, and Hong Kong, referencing them in regulatory aspects and expressions, achieving moderate alignment with international regulations.

The new regulations comprehensively cover emerging fields such as stablecoins and RWA, while also filling in the past regulatory gray areas regarding mining machine sales and mining law enforcement.

In areas where technological maturity is insufficient and the power to set game rules is not mastered, the regulatory attitude is to clearly block, preventing financial risks.

For necessary overseas financing rule alignment, especially for tokenization projects implemented under strict standards in countries and regions with clear regulatory rules, a participation window is still reserved for domestic financial institutions and intermediary service institutions.

Core Regulatory Logic Comparison Table of Announcement No. 94, Announcement No. 924, and Document No. 42

China Securities Regulatory Commission: What Administrative Licenses Correspond to RWA Projects?

As the regulatory authority for RWA business, the China Securities Regulatory Commission promptly issued Announcement No. 1 of 2026 "Regulatory Guidelines for the Issuance of Asset-Backed Securities Tokens for Domestic Assets Abroad."

The guidelines clearly state:

The issuance of asset-backed securities tokens for domestic assets abroad must strictly comply with laws, administrative regulations, and relevant policy provisions regarding cross-border investment, foreign exchange management, and network and data security, and fulfill the approval, filing, or security review procedures required by the aforementioned regulatory authorities.

If the domestic entity controlling the underlying assets has any of the following circumstances, it shall not conduct related business:

(1) Prohibited from financing through the capital market by laws, administrative regulations, or national relevant provisions;

(2) Determined by the relevant competent department of the State Council that the issuance of asset-backed securities tokens abroad may endanger national security;

(3) The domestic entity or its controlling shareholders or actual controllers have committed criminal offenses such as embezzlement, bribery, misappropriation of property, or disruption of the socialist market economy order in the last three years;

(4) The domestic entity is under legal investigation for suspected criminal or significant illegal activities, and there is no clear conclusion;

(5) There are significant ownership disputes regarding the underlying assets, or the assets are legally non-transferable;

(6) The underlying assets fall under the prohibited circumstances specified in the negative list for domestic asset securitization business.

Before conducting related business, the RWA project parties need to file a report with the China Securities Regulatory Commission, providing a complete set of issuance materials for overseas, and fully explaining the information of the domestic filing entity, underlying asset information, token issuance plan, etc. After the filing is completed by the China Securities Regulatory Commission, the filing information will be publicly announced on the website. [Key Point: For projects that tokenize domestic assets or income rights for financing abroad, obtaining this filing from the China Securities Regulatory Commission can be understood as a legal project.]

In addition, for RWA projects that have completed issuance, the China Securities Regulatory Commission will also implement ongoing management during their operation, continuously supervising and maintaining information communication with overseas institutions.

Crypto Salad believes that with the issuance of the above documents, RWA, this new phenomenon, has finally been clarified and has survived, returning to the logic of issuance and regulation of securities-type tokens. Although more details have not been released, the regulatory gray areas regarding RWA and stablecoins over the past three years have been completely clarified, and with legislative guarantees, regulation now has a handle, and practitioners have guidance.

Special Statement: This article is an original work by the Crypto Salad team, representing only the personal views of the author and does not constitute legal consultation or legal advice on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。