When financial reports become the ECG of Bitcoin prices, Strategy is no longer a company but an experiment on whether faith can overcome gravity.

Strategy is becoming the world's first publicly traded company whose life and death are entirely determined by the price of a decentralized asset.

On February 5, this company announced a figure that could directly collapse any traditional business: a net loss of $12.4 billion in a single quarter.

But what truly deserves attention is not the $12.4 billion itself, but what it reveals: Strategy is no longer a company that can be measured by "profit" or "loss."

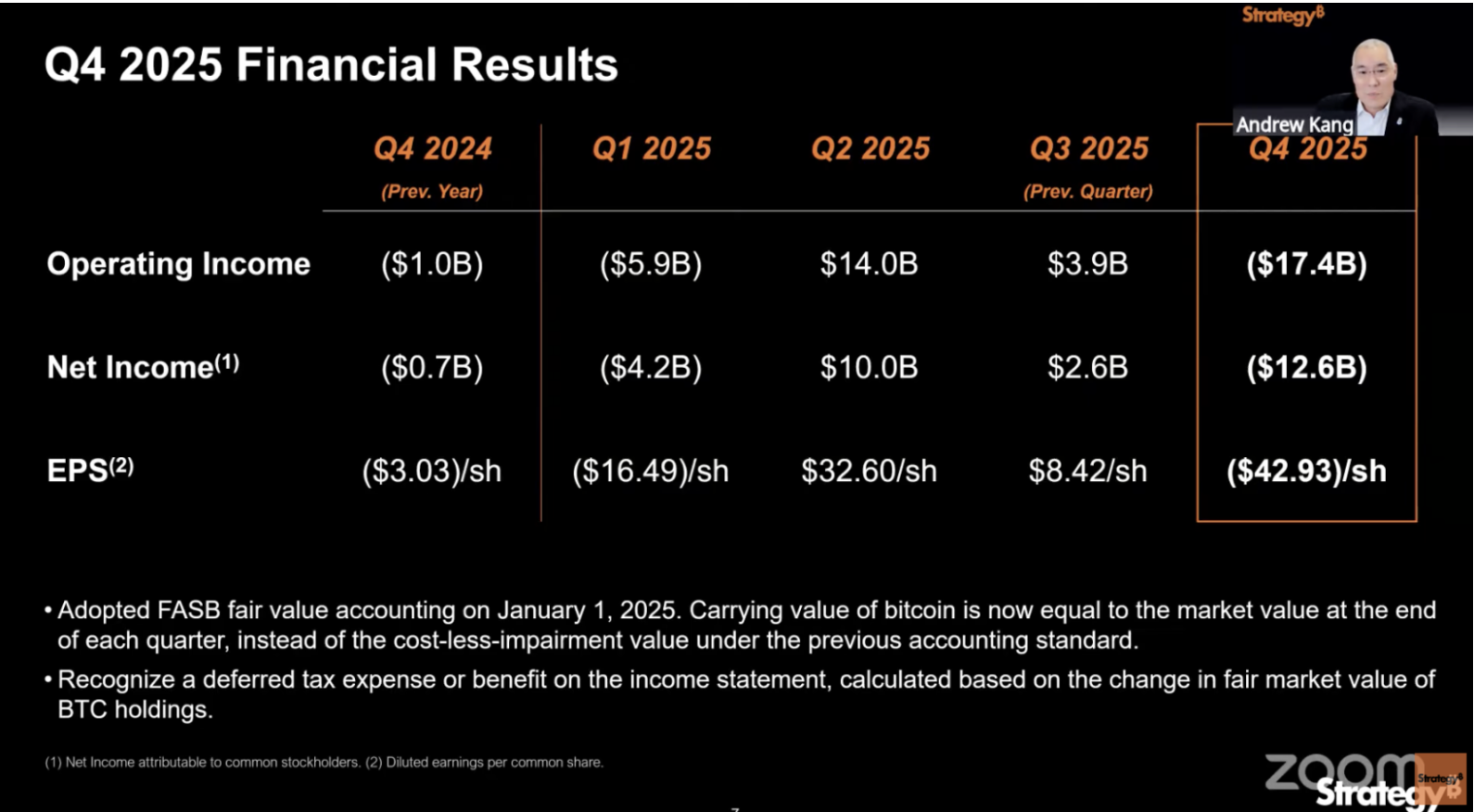

The financial report shows that Strategy had an operating loss of $17.4 billion, with a gross margin dropping from 71.7% in the same period last year to 66.1%. This $17.4 billion operating loss almost entirely stems from a single source: the unrealized asset impairment triggered by the decline in Bitcoin prices in Q4.

In simple terms, the price of Bitcoin on December 31 was lower than on September 30.

2025 is the first year that Strategy will apply fair value accounting principles for the entire year. Under this set of rules, every heartbeat of Bitcoin's price directly impacts the income statement. In Q3, Bitcoin rose, resulting in earnings of $8.42 per share, and everyone was happy; in Q4, as Bitcoin fell, losses surged like a flood.

Strategy's financial report reads more like a quarterly health check report for Bitcoin prices rather than a business performance statement.

And the real problem lies here.

Two sets of books, two 2025s

After reviewing Strategy's Q4 financial report, I found a fundamental reading barrier:

No matter which standard you use to look at it, the numbers in its financial report can actually deceive you.

First, let's talk about the company's own standards. Strategy invented a metric called BTC Yield, which measures how much the number of Bitcoins corresponding to each share of MSTR has increased.

For the entire year of 2025, this number is 22.8%, which looks impressive.

But this metric only counts the number of Bitcoins, regardless of price. The company issued shares to raise funds when Bitcoin was at $100,000 and bought coins when it was at $80,000; BTC Yield still appears positive, while shareholders' money has actually shrunk.

Additionally, the report mentions $8.9 billion in "BTC dollar earnings," which is the same issue.

This figure is calculated based on Bitcoin's price of about $89,000 at the end of the year. On the day the report was released, Bitcoin had already fallen below $65,000. The snapshot from December 31 is no longer valid today and has a certain lag.

Now, let's talk about Generally Accepted Accounting Principles (GAAP), which are the accounting rules that all publicly traded companies in the U.S. must follow.

According to this set of rules, Q4 lost $12.4 billion, and the annual loss was $4.2 billion. The numbers are alarming, but they also cannot be taken at face value.

2025 is the first year that Strategy will account for Bitcoin at fair value. Simply put: at the end of each quarter, look at the market price of Bitcoin; if it rises, count it as profit; if it falls, count it as a loss, regardless of whether you have actually sold any.

In Q3, Bitcoin rose to $114,000, showing a large profit on paper; in Q4, it fell back to $89,000, resulting in a $17.4 billion loss. Not a single penny actually left the company.

So the true situation of this financial report is:

Strategy's own metrics avoid price risk, while the massive losses under accounting standards exaggerate the actual danger. Understanding this, the execution aspect for 2025 becomes clear.

Throughout the year, approximately 225,000 Bitcoins were actually purchased, accounting for 3.4% of the global circulation, five types of preferred stock products were launched, and cash on hand reached a historic high of $2.3 billion. As a capital operation, this was indeed a textbook-level year.

But all these achievements point to the same result: Strategy is more reliant on Bitcoin's price movements than it was a year ago.

Therefore, the more Strategy does in 2025, the more reasons it has to need Bitcoin to rise in 2026. However, at present, the continuous decline of Bitcoin clearly does not meet Strategy's expectations.

Buying coins for $25.3 billion, but generating an annual bill of $888 million

In 2025, Strategy raised $25.3 billion, becoming the largest equity issuer in the U.S. for the second consecutive year.

A company with quarterly software revenue of $120 million raised funds equivalent to 200 times its software revenue. Almost all the money was used to buy Bitcoin.

How did they raise it?

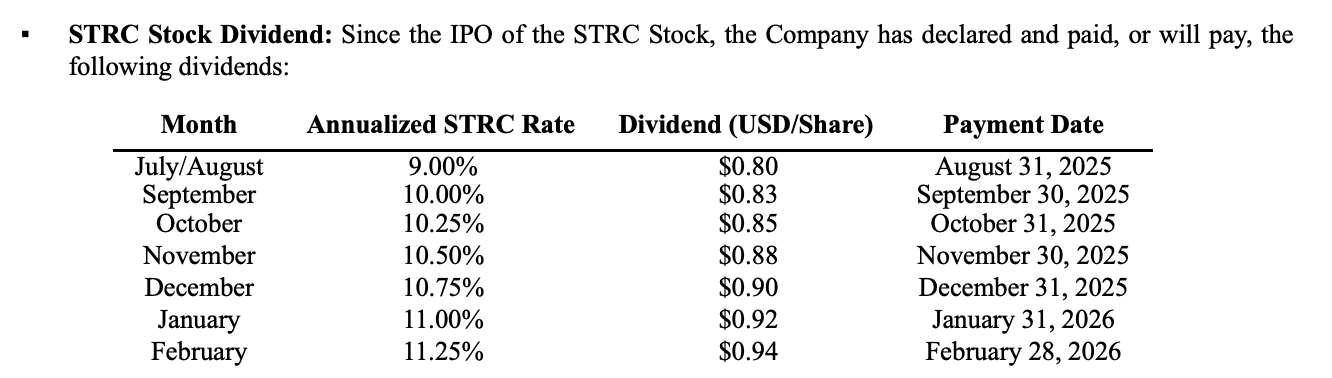

In the past, it was simple: issue stock for cash. In 2025, there was an additional step: the company intensively issued five types of preferred stock products, essentially repackaging Bitcoin into fixed-interest financial products, selling them to institutional investors seeking stable returns.

Bitcoin itself does not generate any interest, but Strategy managed to create a financial product line with yields ranging from 8% to 11.25%.

So, what is the cost?

By the end of the year, these preferred stocks, along with debt interest, generated approximately $888 million in fixed expenses annually. The company's total software revenue for the year was $477 million, which couldn't even cover half of it.

The management's response was to establish a cash reserve of $2.25 billion in Q4, claiming it would cover two and a half years.

But this money was itself raised through low-priced stock issuance. Saylor admitted during the earnings call that several weeks of issuance at the beginning of the year led to a decrease in the number of Bitcoins corresponding to each share, diluting shareholders' holdings.

He stated that he does not intend to repeat this operation, "unless it is to defend the company's credit." The so-called defense of credit means paying that $888 million bill.

This is the core weakness of Strategy's capital model:

Financing to buy coins requires the stock price to maintain a premium, maintaining that premium requires a good BTC Yield, and a good BTC Yield requires continuous coin purchases.

When Bitcoin rises, this cycle self-reinforces; when it falls, every link reverses. And now, there is an additional fixed expense of $888 million each year that must be fed, regardless of whether Bitcoin rises or falls.

An unrealized loss of $9 billion, but short-term issues are not significant

As of February 5, the day the financial report was released, Bitcoin had fallen to about $64,000. Strategy's average holding cost is $76,052.

With 713,502 Bitcoins, the total cost is $54.26 billion, and the market value is about $45.7 billion. This is the first time since starting to buy Bitcoin in 2020 that the overall holding is at an unrealized loss.

Four months ago, Bitcoin was still around its historical high of $126,000, and at that time, the unrealized gain on this holding exceeded $30 billion.

However, an unrealized loss does not equate to a crisis.

Strategy has no forced liquidation mechanism, which is different from the leveraged long positions being liquidated in the crypto market. With $2.25 billion in cash on hand, based on the annual fixed expense of $888 million, it can last for two and a half to three years without financing.

But "surviving without financing" is precisely the state that Strategy cannot afford.

As mentioned in the previous chapter, the operation of this machine relies on continuous financing to buy coins. Once it stops, BTC Yield goes to zero, and Strategy degenerates into a passive Bitcoin fund without management fees but burdened with high dividends.

Passive funds do not need to trade at a premium; investors can directly buy spot ETFs, which have lower fees and more transparent structures.

Therefore, the risk of Strategy going bankrupt is far less than the risk of the Bitcoin flywheel coming to a halt.

When will the flywheel be forced to stop? There is a hard deadline.

Strategy holds about $8.2 billion in convertible bonds, with a weighted average maturity of 4.4 years, and the earliest investor redemption window is in Q3 2027. If Bitcoin prices are still low at that time, bondholders can demand early redemption from the company.

In the worst-case scenario, Strategy may need to sell a large amount of Bitcoin or find ways to raise money at the worst market conditions.

There is about a year and a half until that window.

Whether the $2.25 billion cash reserve can last until then is not the issue; the issue is what Strategy will use to respond if Bitcoin has not returned above the cost line by then.

The price of faith

The previous chapter stated that Strategy will not die in the short term. But the market clearly does not think so.

MSTR has fallen from a high of $457 in November last year to around $107 now, a decline of over 76%. During the same period, Bitcoin fell from $126,000 to $65,000, a drop of 48%.

The decline in Strategy's stock price is 1.6 times that of Bitcoin, and the premium is evaporating rapidly.

However, Saylor himself shows no signs of contraction.

During the earnings call, Saylor acknowledged that cash reserves might be used to address convertible bond redemptions and dividend payments, but he simultaneously insisted there are no plans to sell Bitcoin.

As long as Bitcoin rises, this capital machine can self-reinforce, even appearing like a perpetual motion machine. But once prices stagnate or decline for an extended period, it will face the most basic judgment from the capital market for the first time:

Historically, no financial structure has been able to permanently resist gravity through individual will. Will Strategy be any different?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。