On Thursday, Bullish said net income for the quarter ended Dec. 31, 2025, fell to a loss of $563.6 million, or $3.73 per diluted share, compared with a $158.5 million profit a year earlier. The swing was driven largely by changes in the fair value of digital assets and investments, along with higher expenses tied to market conditions and accounting remeasurements.

Beneath that headline loss, the exchange posted a markedly different picture on an adjusted basis. Adjusted revenue climbed to $92.5 million in the fourth quarter, up from $55.2 million a year earlier, while adjusted EBITDA rose to $44.5 million from $15.8 million. Adjusted net income reached $28.9 million, more than seven times the prior-year figure.

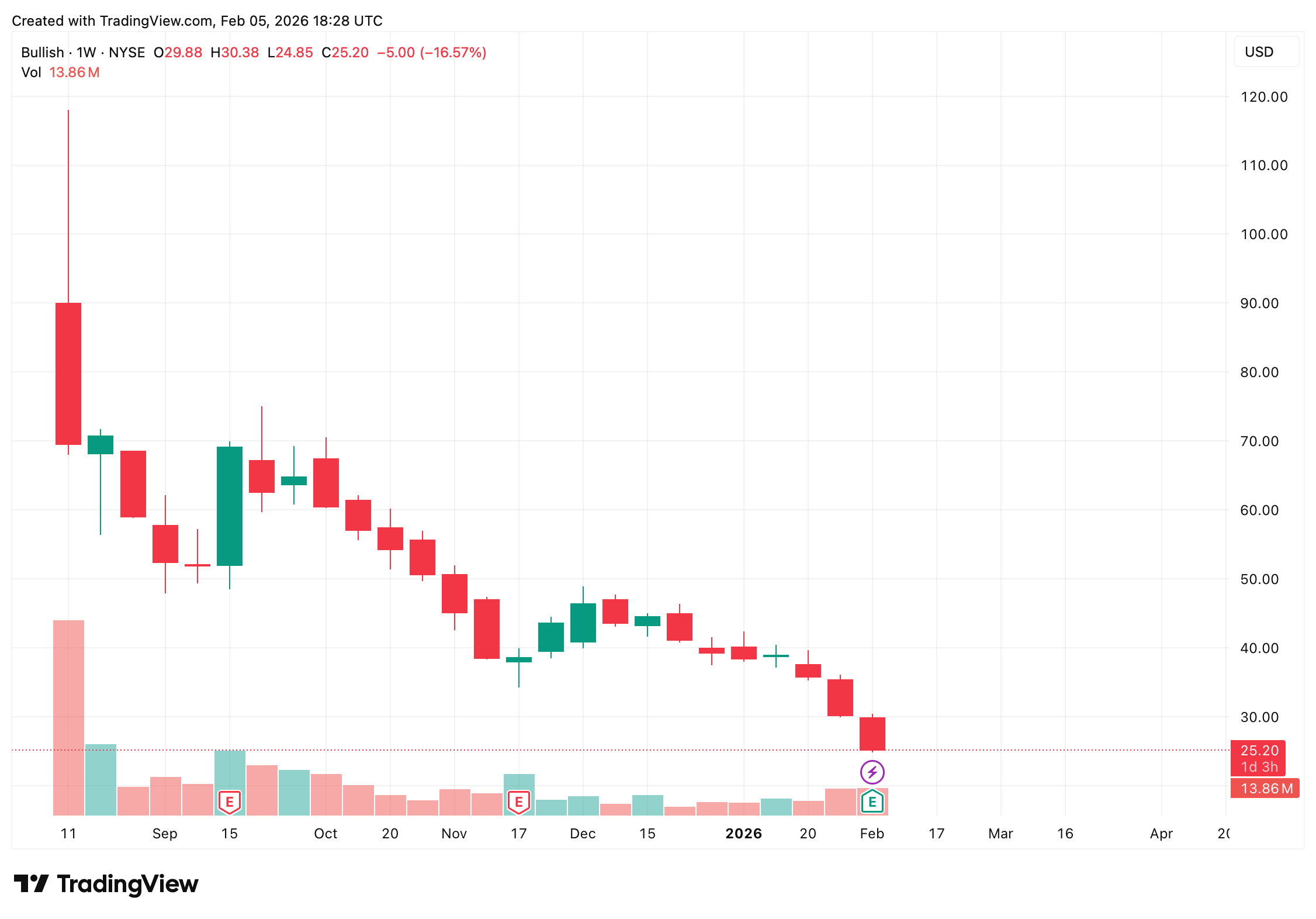

Bullish’s stock BLSH is down today more than 7% around 1:30 p.m. Eastern Time on Feb. 5, 2026. Over the last five sessions, BLSH has lost more than 21% and it is down 38% this month.

The earnings report published by Bullish also noted that trading activity remained quite substantial. Digital asset sales totaled $64.3 billion for the quarter, slightly below the $66.0 billion logged in the same period of 2024. For the full year, digital asset sales reached $244.8 billion, compared with $250.2 billion in 2024.

The standout growth area was derivatives. Bullish disclosed that its bitcoin options market surpassed $9 billion in cumulative trading volume and reached an open interest (OI) high of $4 billion through Jan. 31, 2026, making it the No. 2 venue globally for BTC options open interest at the time.

Subscription, services, and other revenue also expanded, benefiting from liquidity services, institutional partnerships, and contributions from Coindesk-related businesses. That segment helped offset softer adjusted transaction revenue, which slipped year over year as spreads tightened.

On the balance sheet, Bullish reported gross liquid assets of $3.72 billion at year-end, with net liquid assets of $2.86 billion, reflecting higher digital asset holdings and cash compared with the prior year. Total assets rose to $3.96 billion from $3.05 billion. Bullish also ranks as the sixth-largest publicly traded company by the amount of BTC sitting on its balance sheet.

Management framed the quarter as a transition period. CEO Tom Farley explained that the company is positioned to benefit from increased onchain adoption, while CFO David Bonanno pointed to expanding operating leverage and record adjusted results.

Also read: ‘I’ll Keep Buying’: Dave Portnoy Doubles Down on XRP as Price Falls

Looking ahead, Bullish guided for 2026 subscription, services, and other revenue of $220 million to $250 million, with adjusted operating expenses projected between $210 million and $230 million. Finance expense is expected to land between $52 million and $60 million.

The takeaway: accounting volatility weighed heavily on reported profits, but the exchange’s core businesses—especially bitcoin options—are scaling quickly, giving investors plenty to argue about beneath the red ink.

- Why did Bullish post such a large Q4 loss?

The loss was driven mainly by fair-value adjustments on digital assets and investments under IFRS accounting. - How did Bullish perform on an adjusted basis?

Adjusted revenue, EBITDA, and net income all rose sharply year over year in the fourth quarter. - What stood out in Bullish’s trading activity?

Its bitcoin options market topped $9 billion in volume and hit $4 billion in open interest. - What is Bullish forecasting for 2026?

The company expects $220 million to $250 million in subscription and services revenue with controlled operating expenses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。