The second trading day of February delivered a clear shift in tone. After bitcoin’s strong start to the month, capital rotated quickly, leaving BTC ETFs under pressure while altcoin funds quietly absorbed inflows.

Bitcoin spot ETFs recorded a $272.02 million net outflow, spread broadly across the complex. Fidelity’s FBTC led the exits with $148.70 million, followed by Ark & 21Shares’ ARKB at $62.50 million and Grayscale’s GBTC with $56.63 million. Additional pressure came from Grayscale’s Bitcoin Mini Trust ($33.80 million), Bitwise’s BITB ($23.42 million), Vaneck’s HODL ($4.81 million), and Franklin’s EZBC ($2.19 million).

Blackrock’s IBIT stood out as the lone bright spot, pulling in $60.03 million, but it was not enough to offset the broader selling. Trading activity remained elevated at $8.59 billion, while total net assets slipped below the psychological $100 billion mark to $97.01 billion.

Third day of inflow for Ether ETFs over the past 10 days of trading.

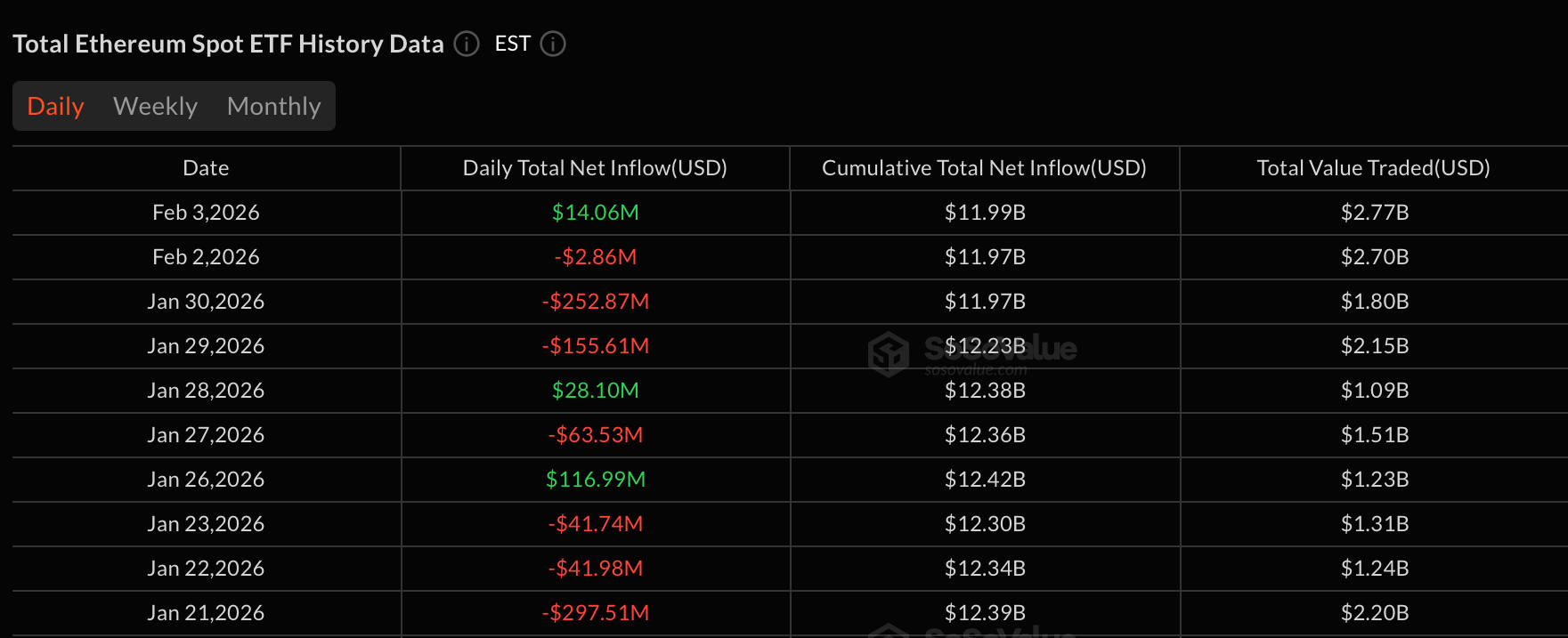

Ether spot ETFs ended the day modestly higher despite mixed flows. Blackrock’s ETHA led inflows with $42.85 million, joined by Grayscale’s Ether Mini Trust ($19.12 million) and ETHE ($8.25 million). Smaller additions rounded out the gains, but they were partially offset by a $54.84 million exit from Fidelity’s FETH and a $2.46 million outflow from Vaneck’s ETHV. The result was a $14.06 million net inflow. Total value traded reached $2.77 billion, even as net assets eased to $13.39 billion.

XRP spot ETFs delivered one of the day’s strongest performances, attracting $19.46 million in net inflows. Franklin’s XRPZ led with $12.13 million, while Bitwise’s XRP added $4.82 million and Grayscale’s GXRP brought in $2.51 million. Trading volume totaled $49.17 million, with net assets holding steady at $1.11 billion.

Solana spot ETFs also closed green, though modestly. The group posted a $1.24 million net inflow, supported by entries into Fidelity’s FSOL ($1.19 million), Franklin’s SOEZ ($856.16K), and Invesco’s QSOL ($354.49K). These were partially offset by exits from Vaneck’s VSOL ($653.36K) and 21Shares’ TSOL ($503.03K). Total value traded reached $58.02 million, while net assets slipped to $854.30 million.

Read more: Bitcoin ETFs Roar Into February With $562 Million Inflow

In summary, the day pointed to a market rotating rather than retreating. Bitcoin absorbed heavy redemptions, but capital found its way into ether, XRP, and solana, signaling that investor appetite for crypto exposure remains intact, just more selective.

- Why did Bitcoin ETFs see large outflows?

Investors rotated after January’s rebound, pulling $272 million from BTC funds and pushing net assets below $100 billion. - Which crypto ETFs attracted inflows instead?

Ether, XRP, and solana ETFs turned green, signaling selective risk-taking rather than a full market exit. - What stood out among Bitcoin ETF issuers?

Blackrock’s IBIT was the only BTC fund with inflows, adding about $60 million despite broad selling elsewhere. - What does this divergence say about market sentiment?

Capital is rotating within crypto, with investors favoring specific assets over broad Bitcoin exposure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。