Author: Shen Hui & Zhang Jieyu, Yuan Chuan Investment Review

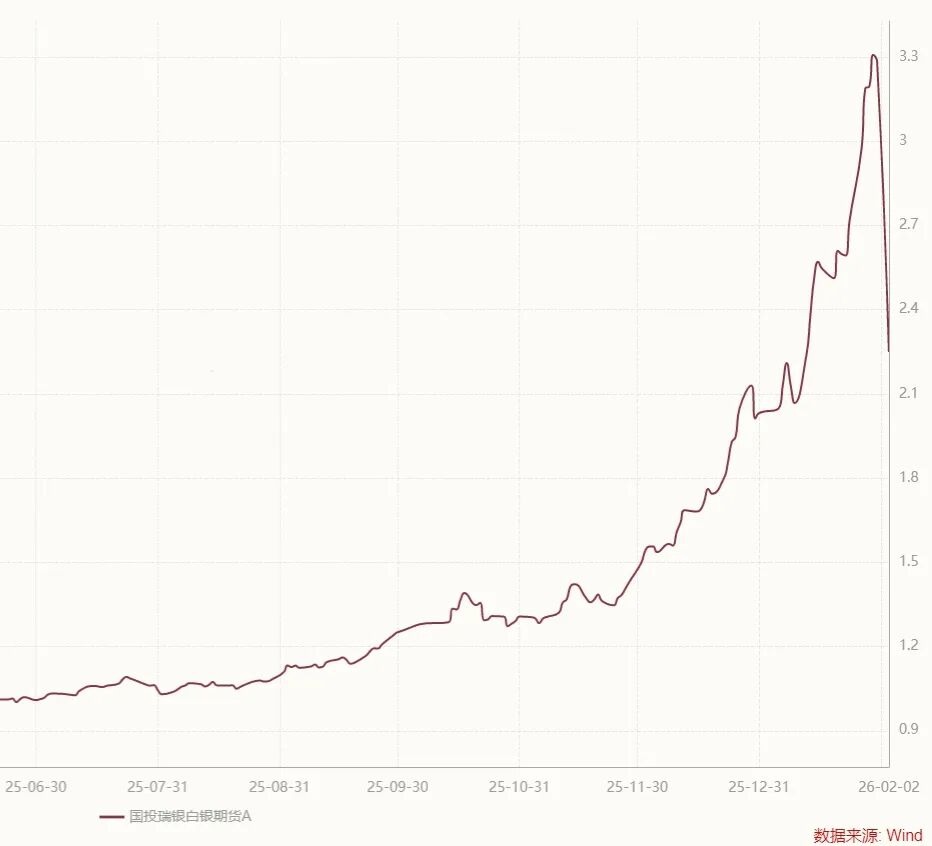

Before January 30, the Guotou Ruijin Silver LOF rose 263.13% in one year, ranking first among all public fund products in the market.

As the only fund in the domestic market that can invest in silver futures, despite issuing 20 premium risk warnings since the beginning of the year, it has been difficult to suppress the market filled with animal spirits and the crazy enthusiasm for long positions. The Silver LOF has continuously hit the daily limit, even reaching an on-market premium of 61.6%.

The "wool party" of the internet followed suit, giving birth to the craziest public fund market in history.

If you feel like going to work every day is like visiting a grave, just take some time to buy 100 units of Silver LOF in your securities account, and sell it like a stock two days later. The on-market premium arbitrage profit of over 50 yuan will fall from the sky, making the tiny red envelopes look insignificant. If you mobilize all six wallets of your family, find a broker with a 10% subscription fee and no fees, you might even be able to afford a meal at Xinrongji for the New Year's Eve dinner.

Because of this, during the hot market, 400,000 people joined this arbitrage every day.

However, there is an important but forgotten premise—silver prices did not experience violent fluctuations.

If nothing unexpected happens, surprises are bound to come, and the celebration was soon interrupted by the collapse of silver.

Last Friday, spot silver plummeted 26%, marking the largest intraday drop in history. On Monday, the Silver LOF resumed trading and hit the daily limit down. After hours, Guotou Ruijin estimated the off-market net value based on international futures prices, showing a drop of -31.5%. Whether chasing the limit up or trying to take advantage of the situation, everyone was silent that night:

This led to the actual premium rate soaring to over 100%, facing at least several limit downs in the future. If one did not withdraw immediately before the suspension last week, it would be like welding the car door shut and getting locked in for a beating.

The theme fund bull market, soaring premiums, and rampant arbitrage posts, followed by a violent drop in net value—history seems to enter a certain cycle, reminiscent of the 2015 bull market, which was equally hot but ultimately left a mess of graded B funds.

"Downward Adjustment" Crisis

To address the gap between international silver prices and the limits on Shanghai silver's rise and fall, Guotou Ruijin announced last night a -31.5% drop for the off-market Silver LOF fund, setting a record for the largest single-day drop in public funds history.

However, the way this record was established is full of controversy.

On the evening of February 2, Guotou Ruijin announced that the old method could not objectively reflect fair value and that it would be valued according to international asset prices, ultimately recording a -31.5% drop. If the valuation method were not changed, based on Shanghai silver futures, the net value would drop by at most 17%, which means a direct additional drop of 14.5%. Those who bought A shares for arbitrage and those who bought C shares to go long on silver were all caught off guard.

This almost unilateral valuation adjustment naturally triggered dissatisfaction among investors:

First, the late-night announcement caught those who redeemed during the day off guard, causing a psychological blow equivalent to mistakenly bottom-fishing graded B funds during the last bull market, only to immediately encounter a downward adjustment, making them feel as if their bodies were drained of energy facing the expanding losses.

Second, when prices rise, the net value follows Shanghai silver, but when prices fall, losses must be borne as global citizens. The temporary modification of valuation rules is unfair; it’s like in the Champions League final, where Barcelona had three goals disallowed for offside, and UEFA announced the cancellation of the offside rule, making all goals valid.

Guotou Ruijin responded that if they announced in advance, it might be interpreted as intentionally guiding investors not to redeem, leading to speculation that the fund's asset liquidity was severely problematic, causing market panic and a run on the fund.

If the original valuation method were used, a one-time drop of over 30% would take several days to complete, allowing quick movers to create a run, which might prevent Guotou Ruijin from selling on the futures side. The implied liquidity risk is severe, and from the perspective of quickly and steadily avoiding operational risks, it seems reasonable.

However, for those rushing to take advantage of the "on-market premium" arbitrage, it was a huge blow—when submitting redemption requests, the rules were still the original rules, and the expectation was to take advantage of the Shanghai silver trading mechanism. Who knew the final whistle had blown, and the fund company would come out saying the rules had to change, leaving everyone unable to escape.

Investors in C shares who rushed in thinking silver was still rising were merely buying a Shanghai silver futures fund, but experiencing the brutality of the international futures market; those who happily learned to shift from off-market to on-market with A shares discovered they were far from the dream of "risk-free arbitrage."

This lesson was clearly taught in 2015. After the peak of the June bull market, most stocks faced consecutive limit downs. At that time, the most innovative public fund product—graded B—began to show "arbitrage" opportunities, with some graded B net values dropping daily by 20%-30%, while the trading prices of graded funds could only drop by 10% each day.

This led to two problems: the premium rate of lower net value graded B soared rapidly, generally exceeding 100%; on the other hand, the premium rate became "valuable but illiquid," leaving investors holding graded B shares trapped on limit downs, unable to exit at fair prices, waiting passively for the downward adjustment of graded B, further expanding losses.

In the last bull market, many only knew that graded B had leverage when prices rose, unaware that when prices fell too much, graded B also had a downward adjustment mechanism. Once it fell below 0.25, the fund would ignore the high market price at which you bought (e.g., 0.5 yuan) and forcibly convert it based on the real low net value, causing the high premium bubble you paid to instantly vanish, leading to massive losses.

However, at that time, some investors still bought in a moth-to-the-flame manner on the downward adjustment benchmark date, but when the market fell, most people lacked the ability to catch falling knives, resulting in a brutal outcome. The wave of downward adjustments in graded B did not change based on the subjective will of bottom-fishers, making it the most tragic battlefield for public funds during the 2015 stock market crash.

Ultimately, this graded fund, once marked by innovation, completely exited the industry stage in disgrace.

It should be noted that the Silver LOF itself does not have a downward adjustment mechanism, but the free fluctuation of international silver prices and the bugs in the rise and fall limits of Shanghai silver ultimately led to the new generation of holders experiencing the "leverage" sensation of graded B under the overnight modified valuation rules.

Did this bug exist beforehand? Yes. But did people realize it? Perhaps even Guotou Ruijin was not prepared with a contingency plan, which is why they hastily provided this inevitably criticized solution at ten o'clock at night.

Bull Market Reflection

Looking back at the Silver LOF and graded B in two bull markets, it seems that history does not simply repeat itself, but always carries similar rhymes.

Graded B left a bad memory for old stockholders because of its leverage property. Graded funds split the mother fund into A shares (stable income side) and B shares (aggressive leverage side), with B borrowing money from A, where A earns interest and B bears the volatility—amplifying profits when prices rise and suffering multiple losses when prices fall, further amplifying losses if the downward adjustment mechanism is triggered.

Although the Silver LOF does not have built-in leverage, the high volatility of precious metals and the "rule risk" of the underlying assets represent a huge blind spot for many buyers.

From an emotional perspective, losing money in a bull market is certainly painful, but seeing friends make money is even more heart-wrenching. The extreme FOMO mentality requires tools with extreme volatility to overtake. Whether it’s the current Silver LOF or the graded B of the past, both have been driven to significant premiums.

High premiums attract swarms of arbitrageurs like locusts.

In June 2015, the scale of graded funds soared to 500 billion, with 41 graded funds doubling their net values in six months. The ChiNext B bought by private equity tycoon Wang Penghui rose more than twice. Because subscription and redemption were closed, ICBC 100B hit eight consecutive limit ups, with a premium rate as high as 78.29%. The Belt and Road B saw its scale grow 11 times in a week, with nearly 4 billion in funds achieving arbitrage.

At that time, the graded fund red book "Graded Funds and Investment Strategies" was published, with a passionate recommendation from the chief of quantitative finance, Gao Zijian, stating that graded funds are a product unmatched in the global capital market.

Just as many learned about Silver LOF arbitrage from Xiaohongshu, at that time, public accounts and Jisilu were filled with arbitrage posts. Jiqing also popularized graded fund arbitrage—under the optimistic sentiment of the bull market, B shares would appear at a premium due to frenzied buying, while A shares would be neglected and appear at a discount. If the sum of the prices of A and B still showed a premium compared to twice the net value of the mother fund, it would invite arbitrageurs to clean it out.

Interestingly, holders of graded B saw the emergence of quantitative arbitrage products from Fushang, Mingcong, Tianyan, and Sheny. As early as 2013, Qiu Huiming led the development of the Zhiyuan CTA product line after joining Fushang, which included graded fund arbitrage and cross-market commodity arbitrage strategies. Just a year later, he left to establish Mingcong, while Fushang gradually faded from the front line, and Mingcong became a leading player in the industry.

The current Silver LOF arbitrage is a grassroots arbitrage, placing institutions on the sidelines.

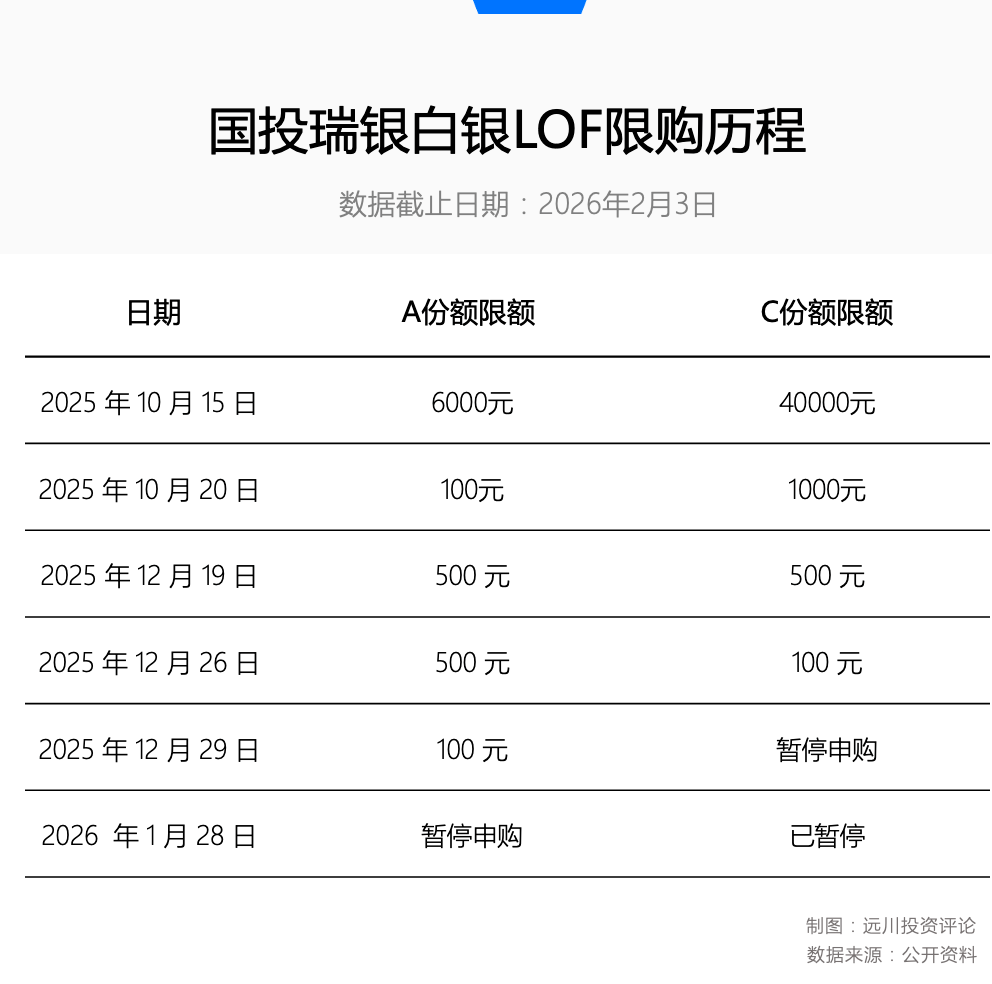

Since October last year, the A shares of Silver LOF experienced a limit purchase journey from 6000 yuan to 100 yuan to 500 yuan to 100 yuan, until the suspension of subscriptions on January 28. On one side, silver surged to create an "epic cup handle," while on the other side, the arbitrage quota was extremely limited, causing the Silver LOF premium to quickly soar over 30%. Guided by the detailed tutorials on Xiaohongshu, retail arbitrageurs flooded in, with the Silver LOF shares increasing by 4 billion in just the fourth quarter.

Faced with the high premium, Guotou Ruijin could not lift the purchase limit and could only weakly issue premium risk warnings every day. This is because public funds have dual restrictions on speculative positions in silver futures for general months: first, a single public fund's position in a single silver futures contract cannot exceed 10% continuously; second, the overall speculative position limit is 18,000 lots.

When the fund scale reaches the ceiling of silver futures positions, subscriptions must be suspended, leading to a severe mismatch between speculative demand and selling supply, and only a sharp drop in silver prices can end the premium situation.

In fact, no matter how many risk warning announcements the fund company issues, if they merely vaguely state, "The trading price of this fund in the secondary market, in addition to the risk of fluctuations in the fund share net value, will also be affected by market supply and demand relationships, systemic risks, liquidity risks, and other factors, which may cause investors to face losses," it will only be ignored by ordinary novices lacking imagination for losses.

When the fund company writes down terms like "net value fluctuation risk, market supply and demand relationship, systemic risk, liquidity risk," did they ever think that one day risk would arrive in this manner?

If institutions themselves did not foresee this, how could many inexperienced investors predict it? If institutions could foresee it, why not clarify "risk" more clearly in the repeated risk warnings?

Epilogue

When the bull market sentiment of the people reaches a climax, is the purchase limit really effective?

In 2016, the real estate purchase limits were layered on, unable to stop people from getting fake divorces, issuing false income certificates, and registering social security in different places to buy more houses; in 2021, the star fund managers of public funds launched popular products, all limited in purchase or allocated by proportion, unable to stop the enthusiasm of the people borrowing money to subscribe for fear of insufficient allocation.

The essence of a fast bull market is excess liquidity.

When emotions are still high, the term "purchase limit" will be automatically translated as "scarcity"; but when the crash begins, no amount of risk warning announcements will withstand the overwhelming public sentiment, becoming mere scraps of paper that cannot block the sandstorm.

Each generation has its own graded B, and the next time will not be Silver LOF. What everyone can learn is perhaps just to weigh their own weight when they see the "purchase limit cannot stop buying enthusiasm" madness again in the future, check their investment records, and then work hard to restrain themselves, putting all their energy into avoiding social media altogether.

Every year's college entrance exam questions are different, but that doesn't mean repeatedly studying "Five Years of College Entrance Exams and Three Years of Simulations" is useless.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。