All eyes are fixed on Strategy as the spot price of bitcoin had slipped below the company’s $76,052 average cost per coin earlier in the day. The stock followed along all the benchmark U.S. indexes, which ended the day in red.

The latest bitcoin pullback from the $78,000 area to an intraday low of $72,863, followed by a swift move back above the $74,900 to $75,100 range, then above $76,000 again by 4 p.m. EST, has pushed BTC prices down another 2.1% on the day. This sharp move weighed on several digital asset treasury (DAT) firms linked to bitcoin and the broader crypto market, including Strategy.

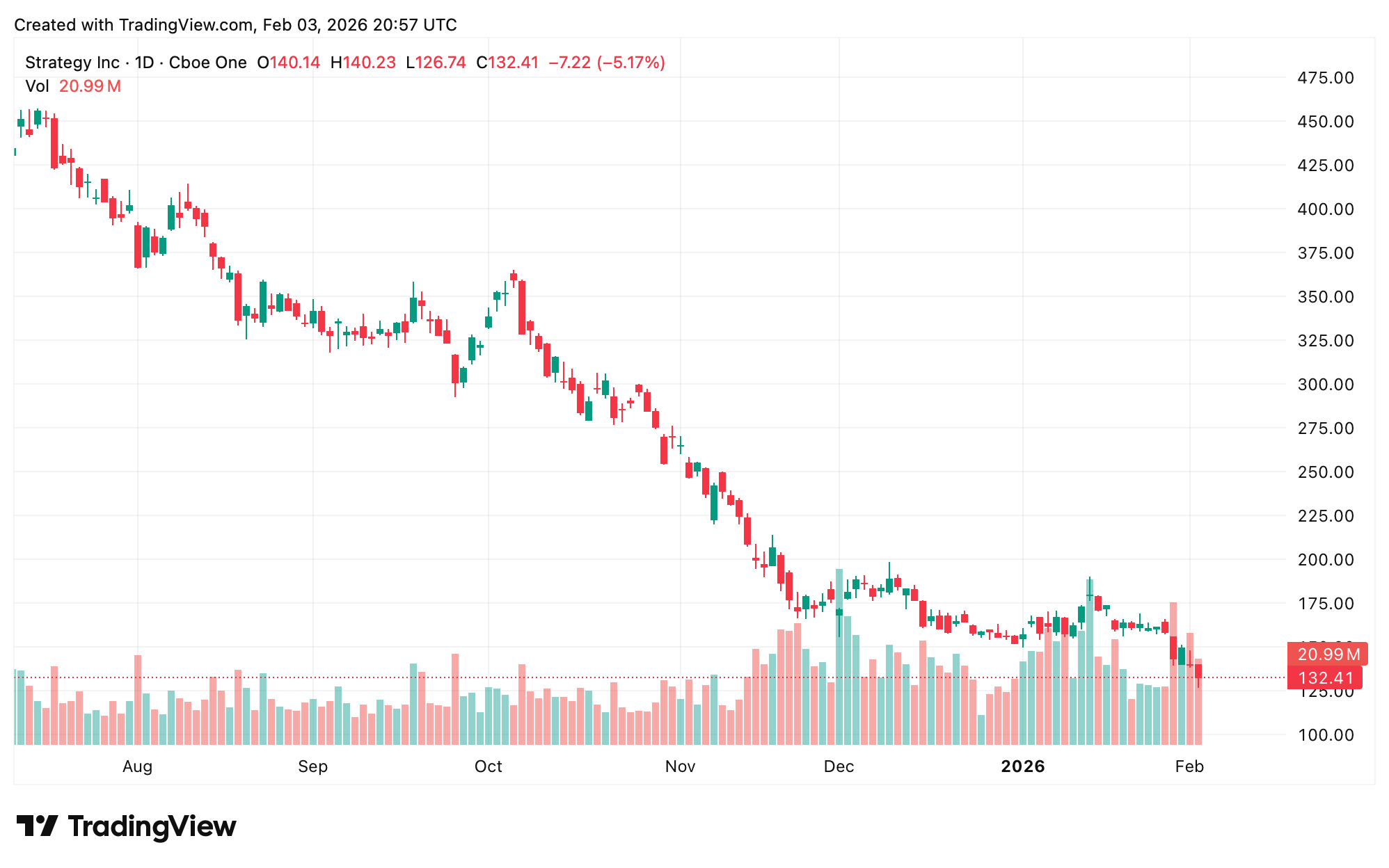

The company’s Nasdaq-listed shares, MSTR, fell 5% today, and over the past week the stock has shed more than 14.9%. Moreover, Strategy’s shares are down more than 65% over the past six months. Despite the downturn, Strategy founder Michael Saylor appears unfazed by lower prices and the slide in his company’s shares.

Saylor insisted:

“The Rules of Bitcoin: 1. Buy Bitcoin. 2. Don’t Sell the Bitcoin.”

Strategy now finds itself in an awkward middle ground: bitcoin is trading extremely close the company’s average cost, turning that once-comfortable benchmark into a pressure point. Yet the math cuts both ways. If prices slip further, the same decline that bruises the balance sheet today could hand the company an opportunity next week to reset its average cost lower, effectively rewriting the narrative with the same tool it has leaned on before—more accumulation.

MSTR shares on Nasdaq just before close. By 4 p.m. EST, when Wall Street closed, BTC was holding above the $76,000 zone. How long that lasts is anyone’s guess.

Whether that’s discipline or defiance depends on where bitcoin heads next, and how much patience investors still have. Still, there’s an unresolved tension hanging over the setup. Lower prices can be framed as a strategy only if the market eventually cooperates, and timing has a habit of humbling even the most convicted buyers.

People tend to think Strategy can keep its footing even if bitcoin sinks to $50,000 because its hefty bitcoin stash isn’t facing instant liquidation or margin calls, giving the company room to ride out price swings without being forced into panic selling.

Also read: Bitcoin Drops to $72,863 Low After Short‑Lived Bounce Meets Heavy Selling

With an average purchase price just above $76,000 per bitcoin, a drop to $50,000 would translate into unrealized losses, but MSTR’s balance sheet—stacked with low-interest convertible notes that don’t come due anytime soon—leaves plenty of oxygen, so long as interest payments are covered by some sort of cash flow or the company taps the market for fresh capital.

For now, Strategy is suspended between risk and resolve, with its next move obscured by price noise and market mood. The playbook may be familiar, but the outcome isn’t, and that lingering uncertainty is doing more talking than any slogan ever could.

The company’s good fortune might still have a pulse as BTC’s spot price tries to claw its way back toward the $77,000 handle at press time at 4:30 p.m. EST. That said, bitcoin bears are still manning the gates, and they don’t look eager to budge.

- Why did Strategy’s stock fall today?

MSTR slid as bitcoin dropped below Strategy’s average cost per coin, tightening investor focus on its balance sheet exposure. - What is Strategy’s average bitcoin purchase price?

Strategy’s average cost sits around $76,052 per bitcoin, very close to the spot market price. At 4 p.m. EST on Tuesday, BTC managed to buoy back just above $76,000. - Is Strategy at risk of forced bitcoin sales?

No, the company’s bitcoin holdings are not tied to margin calls or immediate liquidation triggers. - Why do investors still watch Strategy closely?

Strategy acts as a leveraged proxy for bitcoin, making its stock highly sensitive to daily price moves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。