作者:VanEck

编译:Felix, PANews

进入 2026 年,更清晰的财政和货币信号支撑着更积极的风险偏好,人工智能、私募信贷、黄金、印度和加密货币等领域都将迎来更具吸引力的投资机会。

要点:

- 2025 年末 AI 相关股票大幅回调,重置了估值,使得 AI 及相关主题的投资机会更具吸引力。

- 黄金继续作为全球货币资产重新崛起,回调提供了更佳的入场时机。

- 经历艰难的 2025 年后,商业发展公司(BDCs)目前提供了更具吸引力的收益率和估值。

- 印度仍然是一个高增长潜力的投资市场,而加密货币长期看涨,但短期走势信号复杂。

随着迈入 2026 年,市场处于一种罕见的环境:明朗。尽管选择性仍然至关重要,但围绕财政政策、货币政策方向以及主要投资主题的这种明确性支持着更积极的风险偏好策略。

在去年末部分 AI 相关股票出现剧烈回调后,如今的 AI 交易比 10 月份“令人窒息”的高位更具吸引力。值得注意的是,此次回调发生的同时,对计算、代币和生产力提升的潜在需求依然强劲。

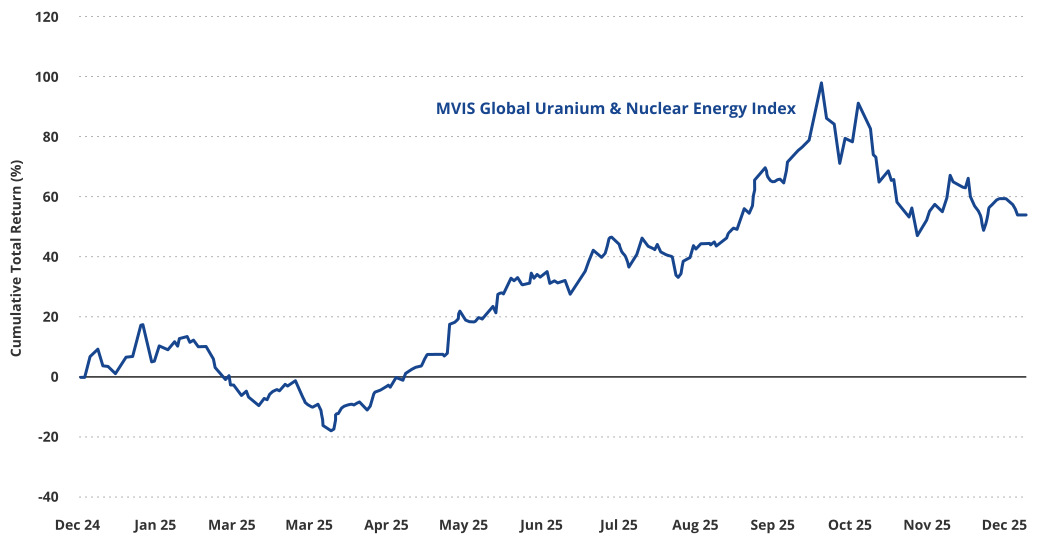

与之相关的主题,例如与 AI 驱动电力需求挂钩的核能,也出现了显著的价格调整。这种调整改善了具有中长期视野的投资者的风险回报状况。

未来财政和货币政策意外事件减少

对市场而言,最重要的进展之一是美国财政状况的逐步改善。尽管赤字仍处于高位,但其占 GDP 的比例已从疫情期间的历史高点下降。这种财政稳定有助于锚定长期利率,并降低尾部风险。

在利率方面,美国财政部长 Scott Bessent 将当前利率水平描述为“正常”,这颇具深意。市场不应指望 2026 年出现激进或破坏稳定的短期降息。相反,前景指向政策稳定、适度调整和更少的冲击。这也是市场前景更加明朗的原因之一。

核能股票在第四季度出现回调:

来源:彭博社。数据截至 2025 年 12 月 31 日

商业发展公司重新受到关注

商业发展公司(BDCs)在 2025 年经历了艰难的一年,但此次调整带来了机会。由于收益率仍具吸引力,且信贷担忧已在很大程度上被市场消化,BDCs 目前比一年前更具吸引力。

其背后的管理公司(如 Ares)也是如此,这些公司目前的估值与其长期盈利能力和过往业绩相比,已变得更加合理。

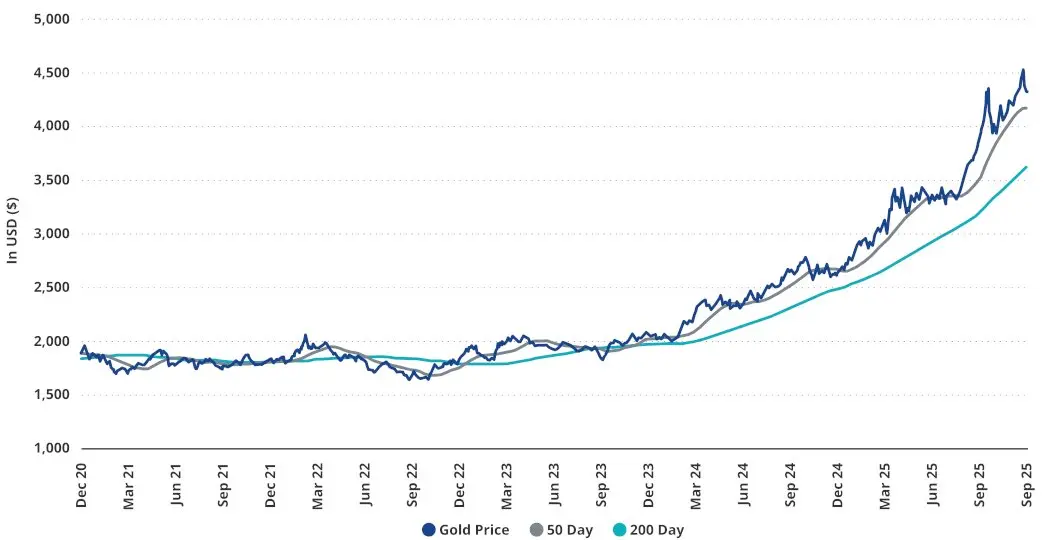

黄金作为全球货币资产

在各国央行需求和全球经济日益摆脱美元主导地位的推动下,黄金正继续重新崛起为领先的全球货币。尽管从技术角度来看,黄金价格似乎已经过高,但 VanEck 认为此次回调是增持的良机。其结构性优势依然存在。

黄金价格高于支撑位,但需求依然强劲:

来源:彭博社。数据截至 2025 年 12 月 31 日

印度和加密货币的投资机会

除美国市场外,印度仍是一个极具潜力的长期投资市场,这得益于其结构性改革和持续的增长动力。

在加密货币领域,比特币传统的四年周期在 2025 年被打破,使得短期信号变得复杂。这种背离支持了未来 3 至 6 个月更为谨慎的短期展望。然而,VanEck 内部并非普遍持有这种观点,Matthew Sigel 和 David Schassler 对近期周期持更为积极的态度。

相关阅读:VanEck报告:比特币进入结构性再平衡,为2026年上涨蓄力

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。