Author: Cecelia, Deep Tide TechFlow

Will DEX Really Replace CEX?

From a low market share in 2020 to a rapid increase in trading volume this year, the presence of decentralized exchanges (DEX) is indeed becoming stronger.

Is the DEX comeback really just around the corner? But perhaps not so soon?

Don't rush to applaud the victory of decentralization, nor should you hastily dismiss it with old reasons like complex processes and poor experiences.

Read this report first, and the answers will become clear.

2025: The Year DEX Liquidity Takes Off

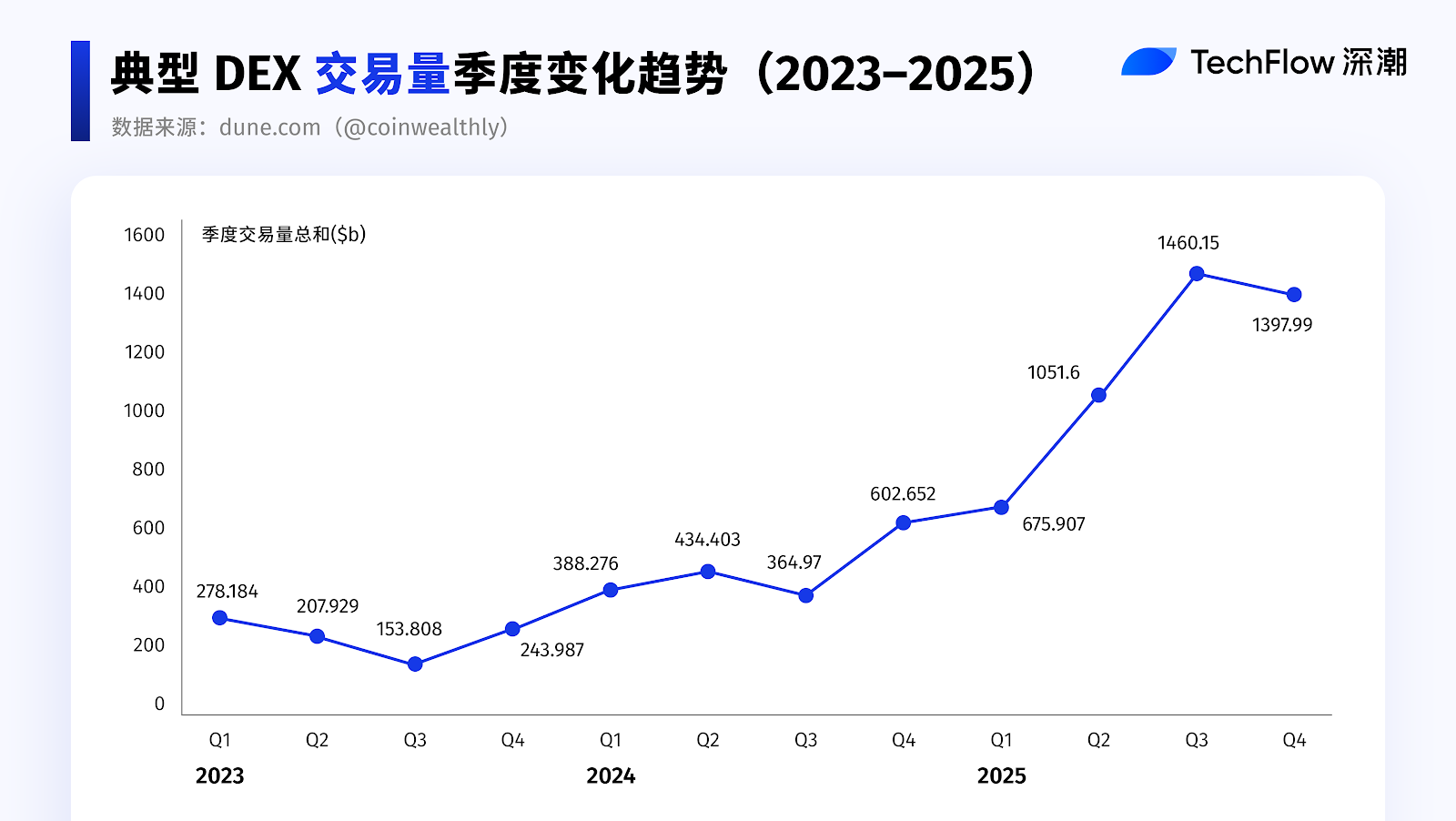

Compared to the slow rise of the previous two years, 2025 can be said to be the year when DEX liquidity truly takes off.

In terms of both scale and growth rate, DEX trading volume has shown a significant leap, with overall trading volume approaching four times that of before.

Data Source: dune.com (@coinwealthly)

If we break it down by quarter, this round of growth did not happen suddenly.

The takeoff in 2025 is essentially a continuation of the growth trend from Q4 2024.

It was in Q4 2024 that DEX trading activity and liquidity began to accelerate, which was then magnified in the following year.

It can be said that the turning point for DEX occurred in Q4 2024, while 2025 continued and amplified this trend.

Looking Back at the Turning Point: Acceleration in 2024Q4 and Amplification in 2025

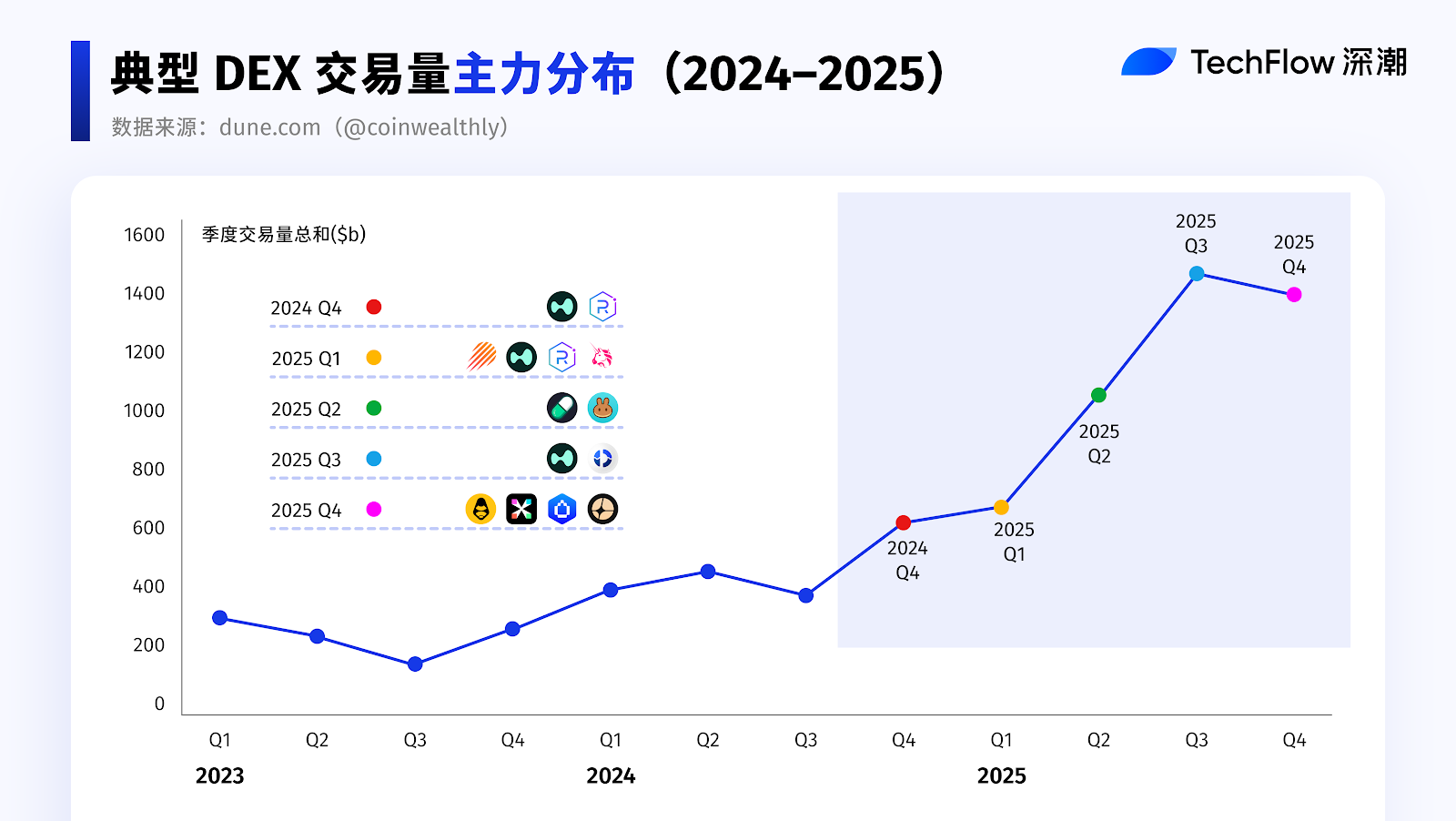

Quarterly Review: Who Led Each Quarter?

2024Q4: Trend Initiation

The trading volume of Solana ecosystem DEX surpassed Ethereum for the first time on a quarterly basis, with significantly increased activity, becoming the core of liquidity during this phase.

The AI narrative combined with new coin issuance platforms continuously created a large number of new trading pairs, significantly boosting DEX trading frequency and cumulative transaction volume.

Solana DEX: New coin trading mainly occurred on Solana DEX, relying on the "graduation" and "migration" processes of issuance platforms like Pump.fun, with Raydium accommodating a large amount of new coin liquidity and trading in Q4 2024, further solidifying its core position in Solana spot trading.

Hyperliquid: Hyperliquid rapidly expanded its share in the decentralized perpetual contract market, leveraging successful HYPE airdrops and product design advantages, with a market share exceeding 55%.

2025Q1: Ranking Changes and Hotspot Rotation

The competition for the top DEX entered a "musical chairs" game, with trading volume rankings among leading ecosystems repeatedly alternating, making it hard to distinguish.

During a phase of active trading in celebrity memes and AI memes, the trading volume of Solana ecosystem DEX rapidly expanded, temporarily dominating trading volume.

As the trading heat of meme coins gradually cooled in February and March, Ethereum successfully reclaimed the top spot in DEX trading volume in March, thanks to more robust liquidity and structural capital inflows.

CEX custody risk exposure: Some users began to try shifting to non-custodial, on-chain verifiable DEX, driving a migration of trading behavior.

2025Q2: Ecological Synergy Amplification and Capital Migration

PancakeSwap: Binance's Alpha project routed related trades to PancakeSwap, directly amplifying the trading activity of BSC ecosystem DEX. In this process, PancakeSwap became the biggest beneficiary of cross-ecosystem synergy, with quarterly trading volume skyrocketing by 539.2%.

Ethereum's Pectra upgrade was officially activated, triggering a strong market reaction. Ethereum surged nearly 44% during the Asian morning session, marking the largest single-day increase since 2021. The market narrative then shifted from Solana and meme trading to broader ecological allocations.

As liquidity migration accelerated, competition between Solana and BSC showed a clear siphoning effect, with capital and trading activity rapidly rotating between different ecosystems.

2025Q3: Intensified Competition and Product Integration

CEX trading volume growth was relatively more significant, driving overall market trading activity back up.

Uniswap: Uniswap regained some market share and tied with PancakeSwap as leaders in the DEX market.

Competition in the Perp DEX space intensified. Challengers like Aster, Lighter, and edgeX rapidly expanded in trading volume and user scale, directly competing with leading platform Hyperliquid, pushing the Perp DEX market into a high-intensity competition phase. Each platform competed for active trading users through airdrops, points, and zero-fee incentives, further amplifying on-chain derivatives trading demand.

DEX Ecosystem: DEX aggregators and infrastructure continued to improve, enhancing user trading experiences, retention rates, and trading stickiness.

Jupiter: After launching Jupiter Lend, it attracted over $1 billion in deposits within just ten days. The previously limited lending demand within the Solana ecosystem was rapidly activated. Supported by Fluid's underlying lending architecture, the explosion of Jupiter Lend further validated the strong appeal of the DEX + lending model for capital.

2025Q4: Extreme Market Disturbances and Track Differentiation

The extreme market conditions triggered by the 1011 liquidation event temporarily boosted market trading volume, leading to a phase of elevated data. This event exposed systemic risks at the CEX level, while chain loans and leveraged liquidations impacted DEX.

Lighter and edgeX: As market confidence gradually restored, the Perp DEX track returned to the growth mainline. Platforms like Lighter and edgeX rapidly expanded in trading volume and user scale, narrowing the competitive boundary with leading platform Hyperliquid, pushing the Perp DEX market into a high-intensity competition phase.

Aster: CZ publicly disclosed his personal holdings of ASTER, after which Aster successively gained support from mainstream trading platforms like Binance and Robinhood. As a leading Perp DEX in the BSC ecosystem, Aster has the strength to compete directly with leading platforms like Hyperliquid in the perpetual contract DEX space.

HumidiFi: In the spot DEX field, Uniswap's market share has been continuously declining since the end of the third quarter, with some trading volume being captured by emerging platforms like HumidiFi, reflecting a shift in the competitive landscape of spot DEX from a single leader to a more decentralized multi-platform structure.

After analyzing the best-performing dark horses of each quarter, let's further separate the views on Perp DEX and Spot DEX.

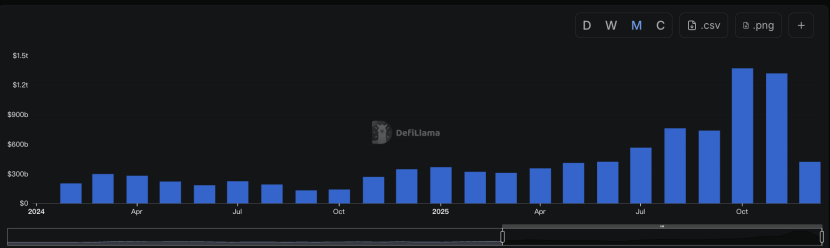

Perp DEX: The True Incremental Engine of 2025

Data Source: CoinGecko

Here, we specifically selected data from the past three years to observe the trading volume ratio of DEX/CEX in perpetual contracts.

It can be seen that this indicator rose sharply throughout 2025, while its overall performance in previous phases was relatively average.

2025 became the year of true takeoff for Perp DEX.

According to DeFiLlama data, the incremental trading volume of Perp DEX in 2025 reached $7.348 trillion.

In comparison, from the beginning of 2021 to the end of 2024, the cumulative trading volume of perpetual contract DEX was only $4.173 trillion.

This means that Perp DEX achieved approximately 176% net trading volume growth in 2025 alone. The newly added trading volume within a year has significantly exceeded the historical total of the previous four years.

Meanwhile, starting from the third quarter of this year, trading volume has shown a clear acceleration. As competition intensified and multiple innovative products gradually matured, the perpetual contract DEX track began to gain sustained attention from market capital, with liquidity levels rising in tandem.

Data Source: DeFiLlama

From an early stage of limited scale and dispersed participation to being ignited by market sentiment and capital structure, the market activity of Perp DEX is entering a whole new level.

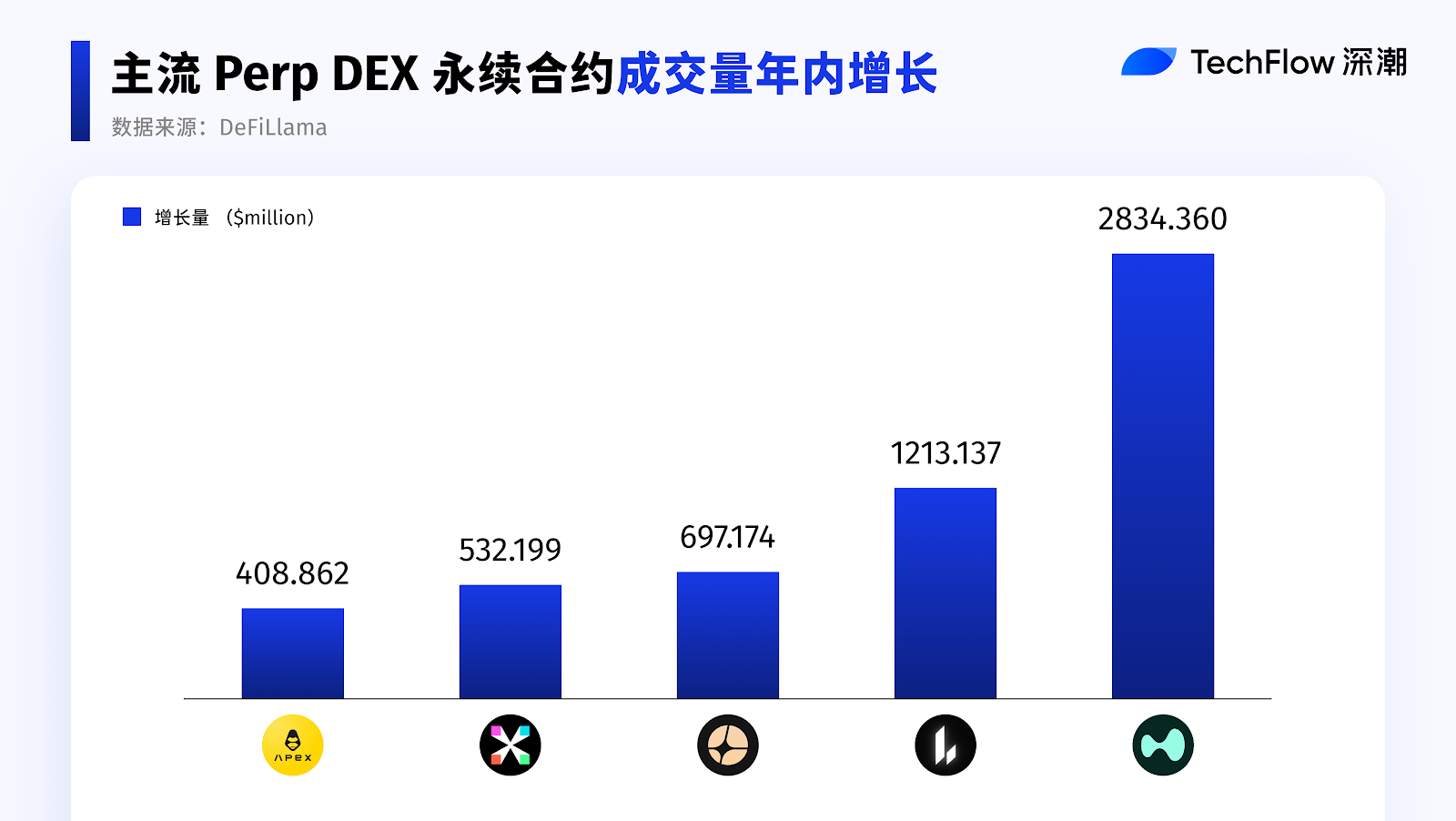

Perp Volume: The Core Indicator of Capital Turnover Intensity

Data Source: DeFiLlama

The strength of Perp DEX lies in how quickly it can turn capital.

From an indicator perspective, Perp Volume (perpetual contract trading volume) is an important metric for measuring perpetual contract DEX.

It reflects the intensity of capital turnover and usage frequency.

Looking at the Incremental Perp Volume for the Year:

Among them, Hyperliquid and Lighter have maintained rapid growth since 2025, with trading activity and capital turnover efficiency amplifying simultaneously.

Aster, on the other hand, made a strong comeback after the third quarter, becoming one of the fastest-growing platforms of the year.

In contrast, established players like dYdX and GMX did not make it to the top of the annual incremental list. Although both have considerable historical cumulative trading volumes, their new trading volumes in 2025 were below $100M, with overall growth rates significantly slower.

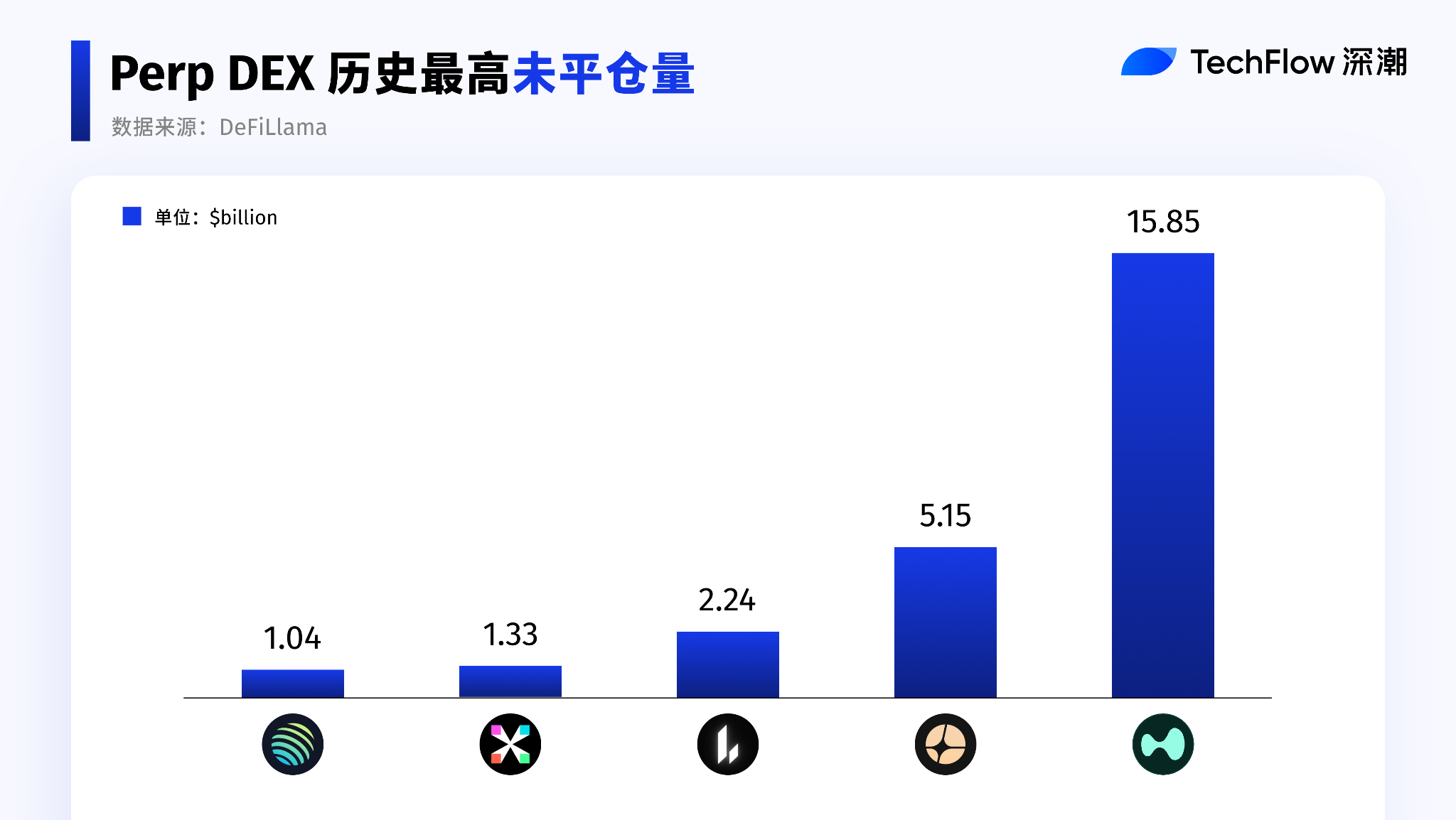

Open Interest: Risk Exposure and Concentration of Leading Players

For Perp DEX, Open Interest (the total nominal value of outstanding contracts) is an unavoidable core indicator.

In simple terms: if Perp Volume is the flow, OI is the stock.

Perp Volume represents trading activity, while OI indirectly reflects whether capital is willing to keep positions on the platform.

As a derivative, perpetual contracts' trading volume more reflects liquidity and matching activity; however, the actual amount of capital remaining in the market is determined by OI.

From the platform perspective, OI reflects the protocol's capacity to bear risk and manage capital scale;

From the user perspective, OI reflects trading demand and capital stickiness.

Therefore, under the premise that Perp Volume already possesses sufficient liquidity and trading activity, we further filter the top five protocols with outstanding OI performance.

Data Source: DeFiLlama

The concentration of OI is extremely high. The top five protocols absorb the vast majority of open interest, with a clear gap appearing. The OI scale of the sixth-ranked protocol is about one-third of the fifth, indicating a direct disparity. The capital in Perp DEX is highly sensitive to depth, stability, and liquidation mechanisms, with positions more likely to concentrate on a few mature platforms.

After the Impact of 10·11, Differences in the Recovery Performance of Perp DEX

As trading heat recedes and risk concentration is released, the differentiation of Perp DEX is no longer reflected in transaction scale but in the retention of capital and recovery resilience after the ATH OI retracement.

Aster:

- After creating market momentum in the third quarter, it demonstrated the strongest capital retention ability.

On October 5, after reaching the OI peak, even entering the fourth quarter, the retention rate relative to ATH OI remained above 72% for a long time; after the 1011 event, its ecological recovery speed was also at a leading level, showing the most robust recovery performance.

Lighter:

- The recovery pace is also relatively fast, with the current OI recovering to about 87% of ATH, indicating clear capital inflow.

Hyperliquid:

- Although it still has the largest overall scale, the open interest saw a retracement of over 60% from ATH OI at one point; as of now, OI has not returned to high levels, only recovering to about 61% of the average level before the 1011 event, showing a significant weakening in overall performance.

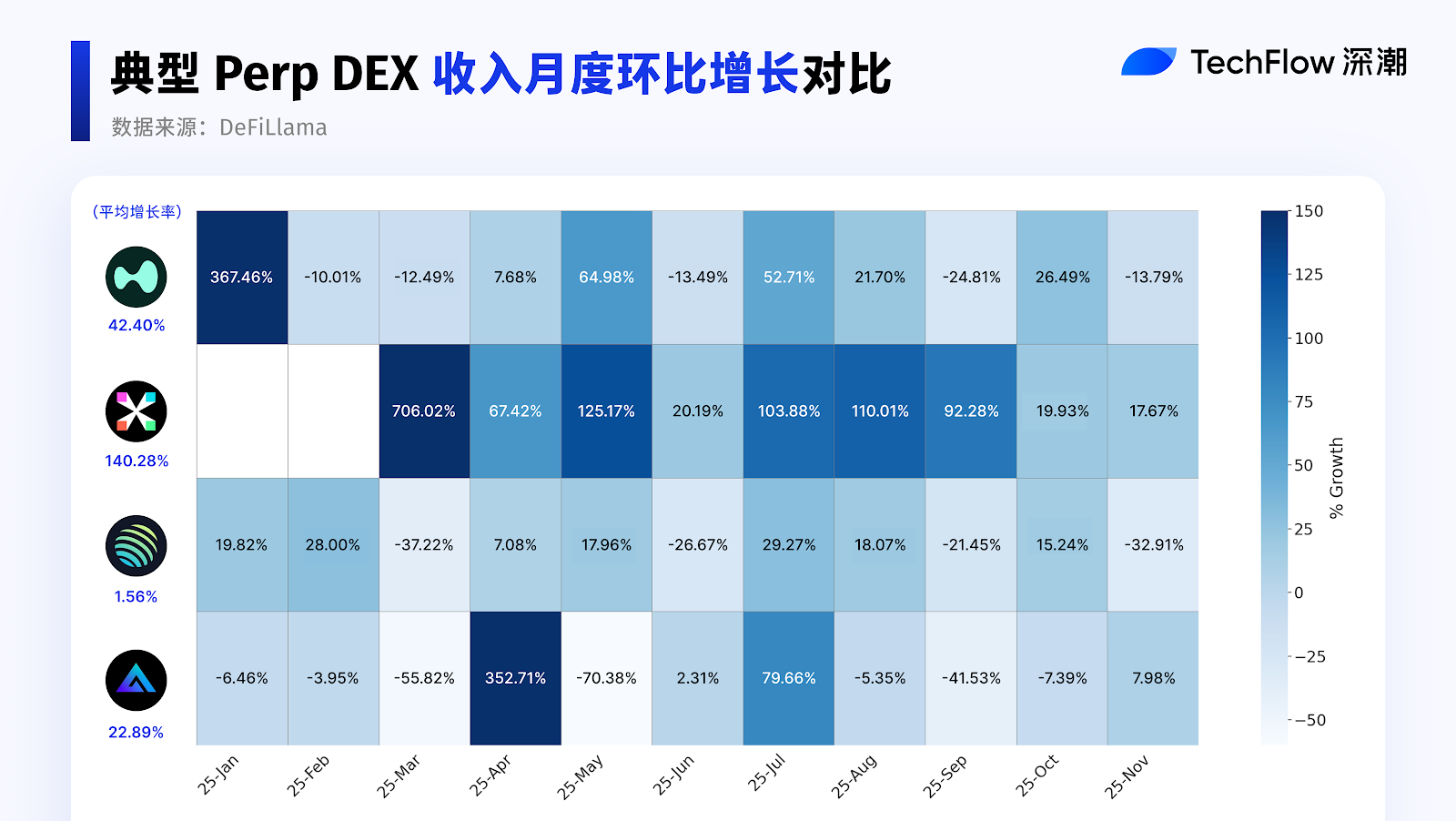

Perp Revenue Performance: Growth Differences Among Differently Positioned Protocols

Since the protocols can attract so much capital, a key question arises: are they actually profitable?

This brings us back to the revenue of the protocols.

Therefore, we select representative Perp DEX protocols to observe their performance in this cycle of 2025 based on revenue performance and change trends.

Here, we choose four types of differently positioned protocols for comparative analysis of their revenue performance:

Hyperliquid: As a leading representative of specialized Perp DEX

Jupiter: As a representative of multi-business platforms that include Perp DEX services

edgeX: As a representative of specialized new competitors

GMX: As a representative of established Perp DEX protocols

Before the analysis, let's segment the protocols in the market:

First, the degree of product focus:

Specialized Perp DEX

Multi-business platforms (Perp is just one of the business lines)

Second, the lifecycle stage:

New entrants

Mature protocols

Established protocols

The core purpose of this segmentation is to answer one question:

Under different positioning and stages, which protocol has the strongest revenue growth momentum?

It is important to emphasize that merely observing the absolute growth scale of revenue is not sufficient to depict the real change trend in 2025.

Therefore, we take December 2024 as the base period and further observe the month-on-month revenue growth to capture the speed and differences in protocol revenue growth more clearly.

Data Source: DeFiLlama

From the heatmap, it is clear that July became a time node when multiple protocols experienced rapid revenue growth simultaneously.

Specifically:

- edgeX showed the most outstanding growth performance in 2025.

Although the revenue growth rate slowed down after September, edgeX still ranks among the top in terms of average annual growth rate. As a successful emerging Perp DEX, its revenue performance remains impressive throughout the year.

Hyperliquid has entered a growth phase, with revenue growth showing stable expansion under a high base, maintaining a relatively high level, but the marginal growth rate is tending to flatten.

Since Jupiter primarily serves as a trading entry and routing layer, its transactions are often completed at the underlying protocol level, and the fee income needs to be shared with the execution layer. Revenue growth is significantly slower than the expansion of trading volume, showing a more stable overall trend.

GMX's average revenue growth rate is about 22%. As an established protocol, growth mainly comes from the retention of some users. If it can maintain this growth rate over the existing base scale, its business model still possesses long-term viability.

Spot DEX: Liquidity Depth and Ecological Competitive Landscape

Data Source: CoinGecko

Compared to the previous two years, the DEX/CEX spot trading volume ratio also significantly increased in 2025. It reached a peak in June and rebounded again in the fourth quarter.

TVL: Spot Liquidity Depth and Willingness to Invest Capital

In the Spot DEX system, TVL mainly comes from assets provided by LPs to the trading pool. A higher TVL indicates that more capital is willing to bear impermanent loss and contract risk, participate in market making, and earn fees or incentive returns. TVL better reflects capital's judgment on Spot DEX rules, risk structure, and long-term sustainability, making it a core reference dimension in the ranking of spot DEX.

Data Source: Tokenterminal

In terms of TVL, Uniswap still holds the top position with about $7.3 billion, maintaining a significant liquidity advantage in the spot DEX space and continuing to serve as the core trading hub of the Ethereum ecosystem.

Fluid and PancakeSwap form the second tier, with TVL both exceeding $2 billion, benefiting from cross-ecosystem expansion and increased trading activity on BSC, showing significant growth momentum throughout the year.

Curve and Raydium are in the mid-tier range, with the former primarily focused on stablecoin and low-volatility asset trading, maintaining stable TVL but with a relatively restrained expansion pace; the latter is deeply tied to the Solana ecosystem, reflecting liquidity changes within a single ecosystem.

Among the top ten protocols by average annual TVL in 2025, Fluid showed the most significant growth, reaching about $5 billion in TVL by the third quarter, while PancakeSwap also experienced notable expansion during the same period.

Trading Volume: The Rise of the Solana Ecosystem

Data Source: DeFiLlama

Here, we use the total annual trading volume excluding flash loans as the statistical basis. Since flash loans often leverage small, instantaneous capital exposures to create large nominal trading volumes, which can easily amplify trading volume metrics, they are excluded from the analysis to more accurately reflect real trading demand.

From the share distribution, Uniswap and PancakeSwap still dominate, together accounting for more than half, indicating that liquidity in mainstream spot DEX remains highly concentrated in a few leading protocols.

It is worth mentioning that the combined share of Solana ecosystem DEX is approaching the scale of the Uniswap single protocol, indicating a significant improvement in the overall competitiveness of the Solana ecosystem in spot DEX trading; however, it still presents a multi-protocol decentralized pattern internally.

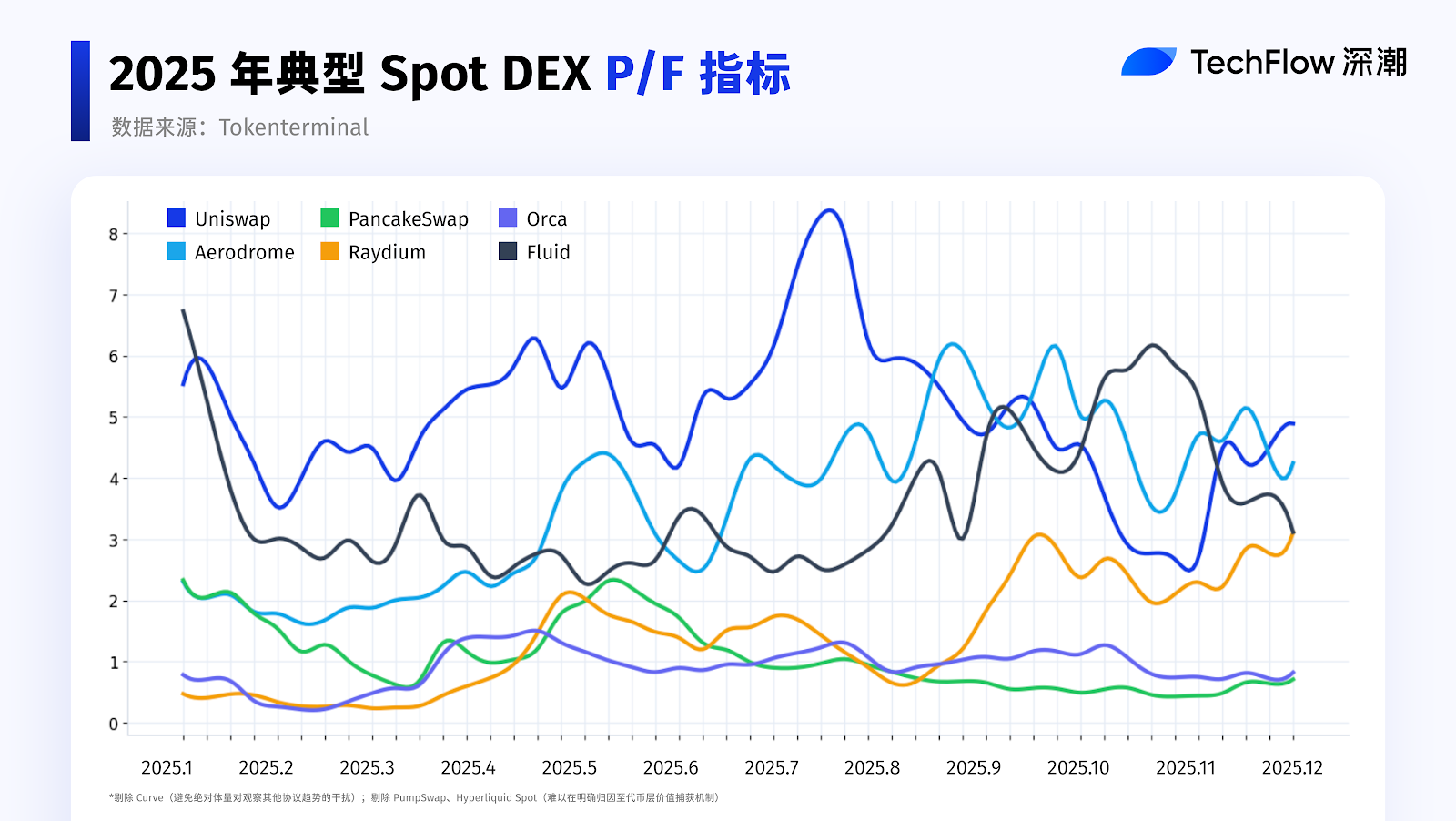

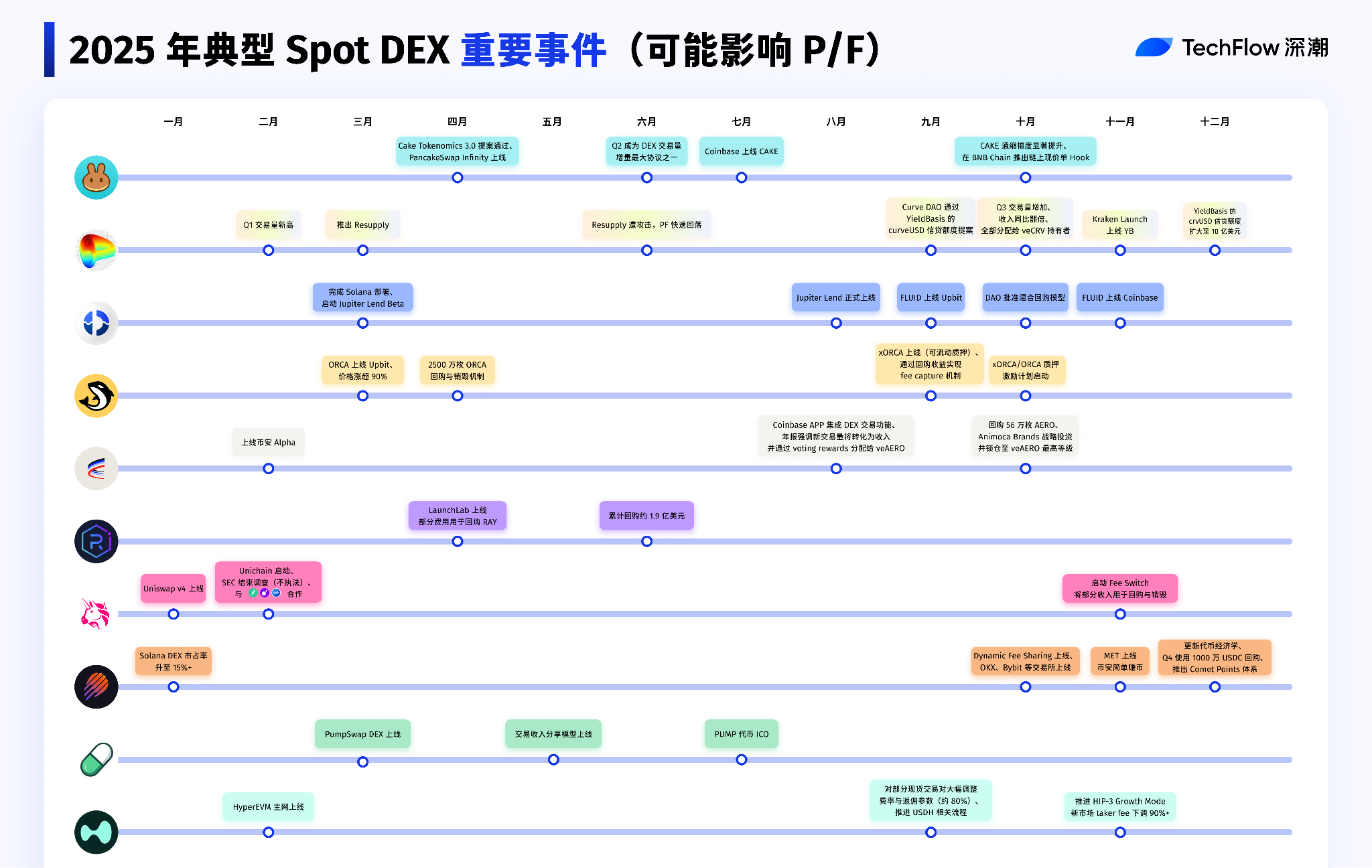

Clues Behind P/F Fluctuations: Major Events in Spot DEX in 2025

With such a large scale, does Spot DEX, as a key part of DeFi, actually make money? Let's take a look at the data together.

Given that this article focuses on performance within the year, only phase changes are discussed. Additionally, in 2025, multiple protocols successively introduced token buybacks or burns, fee distributions, and structural adjustments, which reduced the explanatory power of FDV.

Therefore, we use the P/F ratio of circulating market capitalization to measure how much valuation multiple the market is willing to pay for each unit of fee.

P/F does not directly reflect profit levels but characterizes the market's expectations of the potential monetization ability of Spot DEX under the current scale of economic activity.

Data Source: Tokenterminal

To avoid the absolute scale interfering with the observation of trends in other protocols, Curve is not displayed in the current chart and is only used for background analysis. Additionally, since PumpSwap and Hyperliquid Spot are difficult to clearly attribute to the token layer value capture mechanism, they are also not included in this round of comparison.

Curve's P/F level maintained a relatively high range throughout the year, peaking at about 28 in May, and then continuously declining to around 7 since July. Compared to the level of about 10 at the beginning of the year, there has been a slight overall decline.

It is important to emphasize that Curve's P/F is significantly higher than that of other protocols, mainly due to its long-term maintenance of extremely low fee levels. Curve's pricing curve is specifically designed to serve stablecoins and low-volatility assets (such as trading between stablecoins, stETH/ETH, etc.), achieving extremely low slippage and high capital efficiency through highly optimized AMM design.

Furthermore, the new YieldBasis mechanism launched by Curve in 2025 further focuses on reducing LP's impermanent loss and ensuring liquidity provider returns.

Regarding the changes in P/F for the protocols in the above chart in 2025, we have outlined important events that have had a certain impact on the P/F changes among the top ten Spot DEX, hoping to help you review this innovative and vibrant track in 2025.

So, back to the initial question, will DEX really replace CEX?

Whether it's the leap in trading volume or the increase in the DEX/CEX ratio throughout the year, these trends indicate a fact: DEX has become a major trading vehicle that cannot be ignored.

Especially in the perpetual contract sector, the trading scale of Perp DEX achieved a historic expansion in 2025, with capital turnover efficiency and the funding capacity of leading platforms bringing the market into a new magnitude.

However, this does not mean a simple replacement. The year 2025 seems more like the starting point of a "two-way evolution": on one hand, DEX is actively learning from CEX, continuously aligning in terms of matching efficiency, trading experience, risk control, and product completeness; on the other hand, CEX is also evolving towards DEX, placing greater emphasis on asset self-custody, on-chain transparency, and verifiable settlement and clearing mechanisms.

Ultimately, the relationship between DEX and CEX may not be a zero-sum game. A more likely scenario is that both will leverage their advantages at different levels and in different contexts, collaboratively building the trading and clearing infrastructure for the next generation of crypto finance.

Not to replace, but to stand side by side; not to compete, but to co-build.

In 2025, this trend is already approaching. How far can we be from the day when a new order truly takes shape?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。