作者:BlockWeeks

在加密货币的世界里,注意力即货币,而 X(原 Twitter)一直是全球最大的注意力批发市场。

长期以来,这里的用户习惯了一种割裂的生存状态:在 X 上寻找“Alpha”(超额收益信息),然后迅速切换到 TradingView 看K线,再跳转到交易所下单。这种因应用切换产生的“摩擦成本”,往往是决定一笔高频交易盈亏的关键。

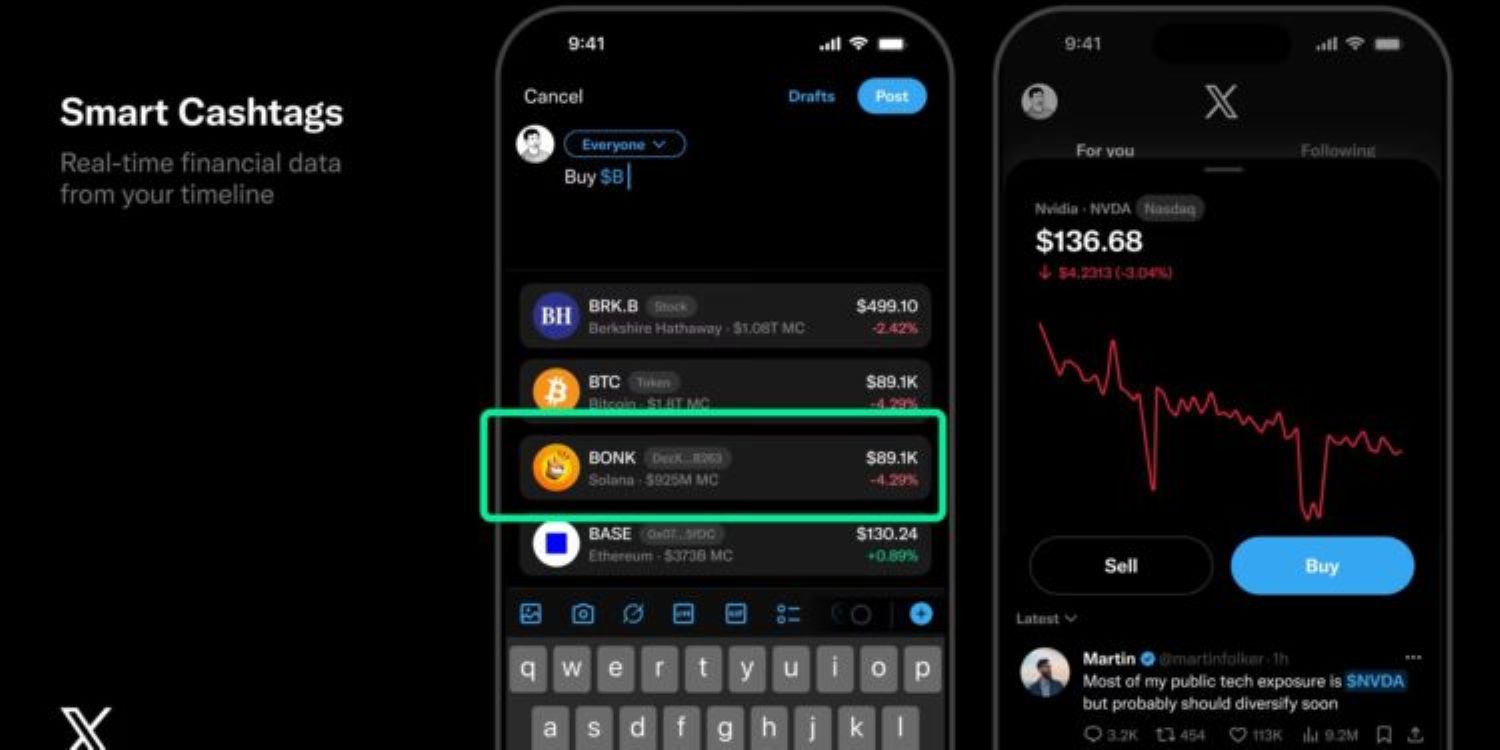

然而,随着 2026 年初 X 产品负责人 Nikita Bier 正式预告 Smart-Cashtags(智能金融标签) 的即将上线,这种割裂的状态或许将成为历史。这不仅仅是一个 UI 组件的更新,它标志着马斯克构建“万能应用(The Everything App)”的拼图中最关键的一块——金融信息流的闭环——终于落位。

告别“李鬼”:代币身份的链上确权

对于任何经历过“土狗季”的投资者来说,Smart-Cashtags 解决的第一个,也是最痛的痛点,就是“身份确认”。

在旧版系统中,Cashtag(如 $ABC)仅仅是一个带蓝色的搜索超链接。而在去中心化的世界里,任何人都可以发行一个名为 $ABC 的代币。这导致当某个大 V 喊单时,骗子往往会在几分钟内部署同名代币,并在搜索结果中通过刷量混淆视听,导致大量散户买入错误的合约地址(Contract Address)。

Smart-Cashtags 的核心变革在于它引入了“语义与合约的硬绑定”。根据目前披露的信息,新功能将允许发帖者或社区在输入 $ 符号时,直接关联特定的智能合约地址。

这意味着,未来的 $SOL 不再是一个模糊的标签,它将直接指向 Solana 链上的原生资产。对于那些流动性极强、生命周期极短的 Meme 币而言,这相当于在社交层面上引入了“防伪水印”。X 正在试图通过技术手段,清洗掉其平台上泛滥的诈骗噪音,为后续的合规金融铺路。

社交界面的“彭博化”:当信息流直接变成交易流

如果说“防伪”是基础,那么将 X 打造为“散户的彭博终端”才是其野心所在。

在传统金融中,彭博终端之所以昂贵,是因为它将新闻、数据和交易整合在了一个屏幕里。Smart-Cashtags 正在对散户做同样的事情。一旦功能上线,用户点击标签将不再跳转至推文搜索流,而是直接唤起一个悬浮的金融看板(Dashboard)。

试想这样一个场景: 你刷到一条关于某 DeFi 协议遭遇黑客攻击的突发新闻。在过去,你需要退出 X,打开看盘软件确认跌幅,再决定是否抄底或止损。而未来,你只需点击推文中的标签,实时价格、交易量变化、链上资金流向便会即刻展现在当前页面。

这种“零跳转”体验,将极大地缩短从“获取信息”到“做出决策”的时间窗口。对于市场而言,这意味着情绪传导的速度将进一步加快,X 对资产定价的即时影响力将达到前所未有的高度。

Social-Fi 的终局:向 Telegram 的正面宣战

我们不能孤立地看待这次更新。在 Smart-Cashtags 背后,是 X 与 Telegram 之间关于“Web3 流量入口”的隐形战争。

过去两年,Telegram 凭借 Unibot、Banana Gun 等交易机器人(Trading Bots),成功截流了大量的移动端交易需求。用户在电报群里看到消息,直接通过机器人一键买入,这种体验一度让 X 望尘莫及。

Smart-Cashtags 是 X 的有力反击。虽然初期功能侧重于行情展示,但结合马斯克在全美多州拿下的支付牌照,以及 X 正在测试的“应用内钱包”功能,我们有理由推测:在标签页面直接集成“Buy/Sell”按钮,只是时间问题。

一旦打通支付层,X 将瞬间从一个“吵架广场”升级为全球最大的“社交交易所”。它拥有比 Telegram 更公开的舆论场,更完善的算法推荐,以及更庞大的机构用户群。

结语

2026 年注定是 Social-Fi(社交金融)去伪存真的一年。

Smart-Cashtags 的出现,意味着 X 不再甘心只做流量的“导购”,它要亲自下场做“收银台”。对于普通投资者而言,这或许意味着更便捷的工具;但对于专业的加密从业者来说,这预示着一个新的战场:谁能最先利用这个新工具捕获情绪价值,谁就能在新的流量分配机制中占据高地。

据悉,该功能预计将于 2 月份面向全球用户推送。届时,我们每一次点击 $ 符号,或许都在参与一次金融历史的微小改写。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。