Written by: danny

"All functions must be accessed via API calls, and any form of backdoor access is prohibited. Those who do not comply will be fired. Have a nice day.

In 2002, Amazon's Jeff Bezos issued the famous "Bezos API mandate." At that time, Wall Street mocked Amazon as a distracted retailer, but Bezos was methodically dismantling his monolithic architecture. He firmly believed that if a service could support Amazon's peak traffic, it should become a utility for the entire industry.

In August 2025, OKX also experienced its own "AWS moment." By burning ten million OKB and permanently locking the total supply at 21 million, Lao Xu (Xu Mingxing) completed a decisive "decluttering"—cutting off OKB's dependence on exchange profit buybacks and pushing it into the deep sea of protocol sovereignty.

Reading Guide: Analyzing OKB from four dimensions:

- (1) The narrative of scarcity with a constant supply of 21 million;

- (2) The shadow cash flow of OKB;

- (3) Gas demand and deflationary mechanisms of X Layer;

- (4) The infrastructural value of OKX Web3 Wallet and the growth curve of OKB.

1. Introduction: From "Amazon's Servers" to "Web3's Utilities"

On a deep night in 2002, Amazon's Jeff Bezos felt a strong sense of frustration in his Seattle office. Despite the rapid growth of Amazon's e-commerce business, the internal tech team seemed stuck in a quagmire: every time a new feature was developed, engineers had to start from scratch to build servers, configure databases, and handle network bandwidth. This inefficient repetitive work made Amazon look more like a heavy, outdated machine rather than a tech company.

That night, Bezos wrote a brief memo that would propel the entire internet forward: "All functions must be accessed via API calls, and any form of backdoor access or direct linking is prohibited." He concluded with the famous ultimatum: "Those who do not comply will be fired. Have a nice day." (aka Bezos API mandate memo)

Initially, this system, known as AWS (Amazon Web Services), was only meant to make it easier for Amazon to sell books. Wall Street was puzzled for a long time: "Why would a retailer spend huge amounts on server rentals?" It wasn't until years later that people realized: Netflix was using AWS, Uber was using AWS, and even the Pentagon was using AWS.

At that moment, Amazon's valuation logic completely changed. It was no longer just a retailer valued based on "gross profit from sales," but a tech infrastructure company that collected "digital taxes" from the internet's foundation.

2026: OKB's "AWS Moment"

Today, as we look back from 2026, OKB is undergoing the exact same identity reconstruction.

For a long time, the market's perception of OKB remained stuck in the "book-selling era of Amazon"—it was seen as an "internal discount coupon" or "supermarket giveaway coupon" for the OKX exchange, with its value tightly anchored to the trading volume of centralized matching services. As long as the CEX industry slowed down, OKB's valuation would hit a ceiling.

However, a series of "major surgeries" in 2025 broke this shackling. By permanently locking the supply at 21 million and shifting the value focus of OKB entirely to the X Layer (public chain) and OKX Web3 Wallet (entry point), Lao Xu effectively completed a "decentralized version of API restructuring":

Separation: He extracted "OK" from OKB. OKB is no longer a profit certificate of a company but has become an indispensable native resource in the on-chain world, akin to AWS's computing power.

Reconstruction: Just as AWS transformed Amazon from a "seller" to a "definer of internet rules," the binding of X Layer and Web3 Wallet has transformed OKB from a "fee collector" to a "definer of on-chain traffic rules."

This leap from 'internal support tool' to 'global infrastructure' is precisely the path OKB is currently on.

In 2026, OKB's AWS moment has arrived.

2. Supply-Side Revolution: The Narrative of Scarcity with a Constant Supply of 21 Million

On August 13, 2025, OKX executed a rare monetary policy adjustment in cryptocurrency history: it burned 65.26 million OKB in one go and permanently locked the total supply at 21 million—aiming to align OKB's scarcity with BTC and capture the minds of both new and old OGs.

2.1 Supply Shock and Completely Inelastic Supply Curve

In traditional token economics, project teams usually retain the right to issue more tokens or hold a large reserve of tokens to meet future ecological incentive demands. This potential inflationary pressure often suppresses the long-term price performance of tokens. OKX, through upgrades at the smart contract level, permanently removed the minting and burning functions, establishing an upper limit on the total supply of OKB, shaping a 1/21,000,000 mind share.

In the supply-demand model P = D / S, the denominator S is locked at 21,000,000. This means that any incremental demand D within the ecosystem—whether from Jumpstart, airdrop earn, staking demand for lending, or gas consumption of X Layer—cannot be alleviated by increasing supply but must be fully reflected through a rise in price P.

2.2 Evolution of the Burning Mechanism: From "Buyback" to "Non-Dilution"

Before August 2025, the burning of OKB relied on the exchange's quarterly profit buybacks. This was essentially a centralized profit distribution behavior, constrained by the exchange's operational status and the transparency of its buyback strategy. (Is this a response from Lao Xu to competitors?)

More importantly, the burning of a large number of uncirculated tokens pledged the team's "non-dilution commitment" to holders, serving as a de facto fair launch model for old coins. Especially in the market environment of 2025, characterized by a large number of High FDV and Low Float, it can only be said that the founder's dedication and persistence towards a decentralized world.

Due to the capped supply, the number of tokens in the team's hands decreased, forcing the OKX team to generate revenue by enhancing the liquidity premium and use cases of the token (rather than selling tokens). This binding mechanism aligned the interests of the team and holders: only with ecological prosperity and rising token prices could everyone profit.

2.3 Will the Market Buy the Narrative of 21 Million?

Early August: OKB trading prices remained in the $45 - $49 range, showing stable performance.

August 13: With the announcement of the burn and on-chain confirmation, the price surged over 160% in a single day, quickly breaking the $100 mark.

August 22: Driven by both FOMO sentiment and fundamental reconstruction, OKB reached an all-time high of $255.50.

In the following months, as profit-taking occurred and the macro market adjusted, OKB's price entered a correction phase. By early January 2026, the price stabilized in the $113 - $115 range, reflecting a 150% increase from early August.

3. The "Shadow Interest" Economics of OKB

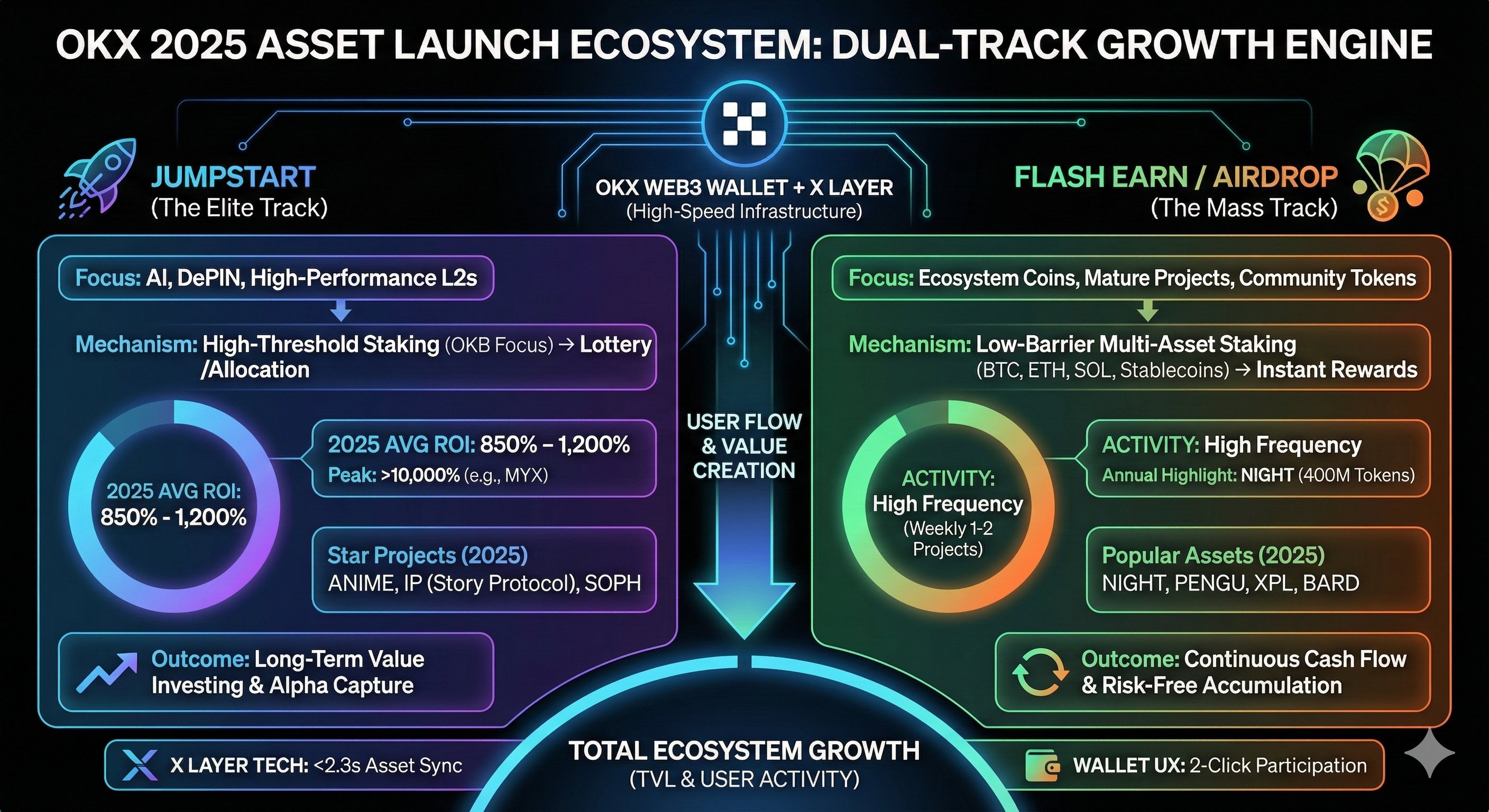

Although traditional Simple Earn products provide basic low-risk returns for OKB, the real alpha comes from high-frequency Flash Earn activities and Jumpstart new projects. OKB's "shadow interest" has effectively evolved into a non-dilutive dividend mechanism for fixed equity.

The annualized yield (APY) for popular Jumpstart projects during the mining period often reaches as high as 300% - 500%. This is particularly attractive for activities that only require locking funds for 3 days.

Flash Earn (formerly Airdrop Earn) is another high-frequency, stable "weekly salary" for OKB holders in 2025. According to OKX's official announcements and market data, a large number of Flash Earn activities were intensively launched in the second half of 2025, especially in Q4. This dense scheduling transformed OKB into a continuously operating money-printing machine.

We compiled the Jumpstart and Flash Earn activities for 2025, totaling 11 events. Assuming a user actively participated in every Jumpstart and Flash Earn, with OKB priced at an average of $95 (considering the low of $45 in the first half and the high of $135-$255 after the burn in the second half, taking a weighted average). The median return was approximately $812 (taking the median), with an annualized yield of 8.5%.

By simply participating in ecological activities, OKB holders earned about 8.5% in additional token returns in 2025. This figure is significantly higher than the on-chain staking returns of ETH or SOL (usually between 3%-5%).

4. Gas Demand of X Layer? Or Asset Locking?

4.1 Network Effects of the Aggregation Layer

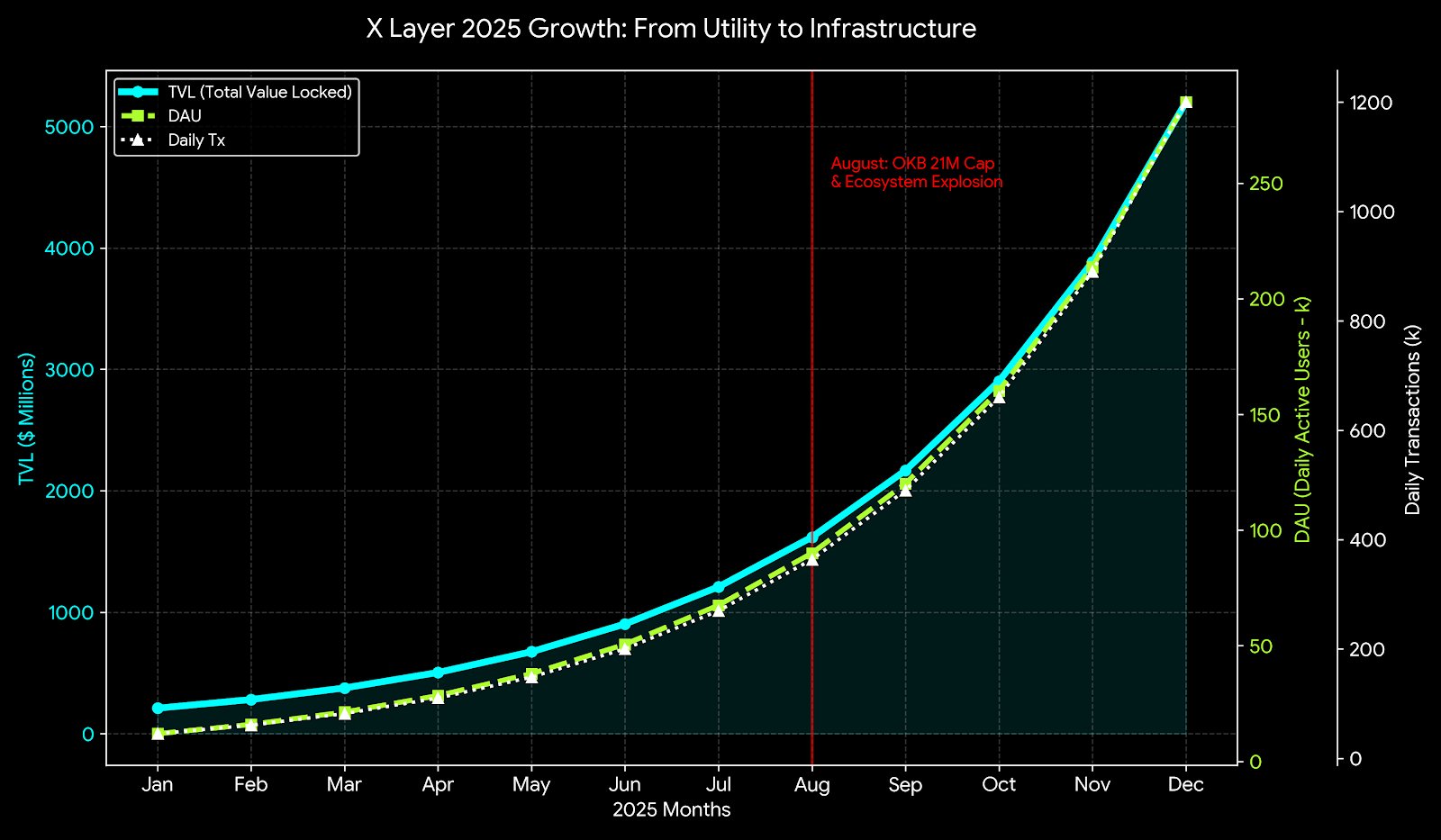

On August 5, 2025, OKX completed the "PP Upgrade" of X Layer—a zkEVM Layer 2 network built on Polygon CDK.

As a zkEVM, X Layer can seamlessly integrate with Ethereum's smart contracts and developer tools. This means that the vast DeFi applications on Ethereum can migrate to X Layer at almost zero cost. Additionally, the upgraded TPS has reached 5,000, and gas fees have dropped to nearly zero ($0.01). This clears technical barriers for high-frequency trading, GameFi, and payment applications.

By the end of 2025, the cumulative number of independent addresses on X Layer exceeded 2 million. Among them, the daily active DAU addresses remained high at around 280,000 in November and December, with TVL maintaining at $5 billion, primarily due to year-end exchange marketing activities and the launch of new meme coins.

2025 saw the deployment of over 15,000 new contracts.

Contract type distribution:

Token contracts (ERC-20): Approximately 60%. This reflects the surge in meme coin issuance and project token migrations.

NFT contracts (ERC-721/1155): Approximately 25%. Mainly focused on game items and community badge NFTs.

DeFi contracts: Approximately 15%. Although the number is small, this is the core that supports TVL.

4.2 The Economics of OKB as Native Gas

In the X Layer network, OKB is the only native gas token. This means that every transfer on the chain, every DEX transaction, and every NFT minting requires the consumption of OKB.

Average single transaction gas fee: Stabilized between $0.005 - $0.01.

Daily average gas consumption: Approximately $5,000 - $10,000.

Despite the massive transaction volume, the on-chain revenue generated by X Layer is pitiful due to the extremely low fee structure.

This low-income state is intentional on OKX's part. The current strategic goal of X Layer is not to profit from gas fees but to serve as infrastructure for OKX's overall ecosystem. For OKX, X Layer is a strategic investment that transforms from a "cost center" to an "ecological moat."

4.3 Locking OKB as a Native Pairing Asset

If gas fees can't earn much, then what is X Layer aiming for?

The real value lies in DeFi locked TVL and liquidity pairing.

In the DEX of X Layer, OKB is the core trading pair asset (e.g., OKB/USDT, OKB/ETH). To provide liquidity, market makers and liquidity providers (LPs) need to lock a large amount of OKB.

If X Layer's TVL reaches $5 billion, and 30% of that is in the form of OKB assets, then $1.5 billion worth of OKB will be locked in smart contracts. At a valuation of $120, that means 12.5 million OKB will be locked in the ecosystem, which is nearly 60% of the total supply.

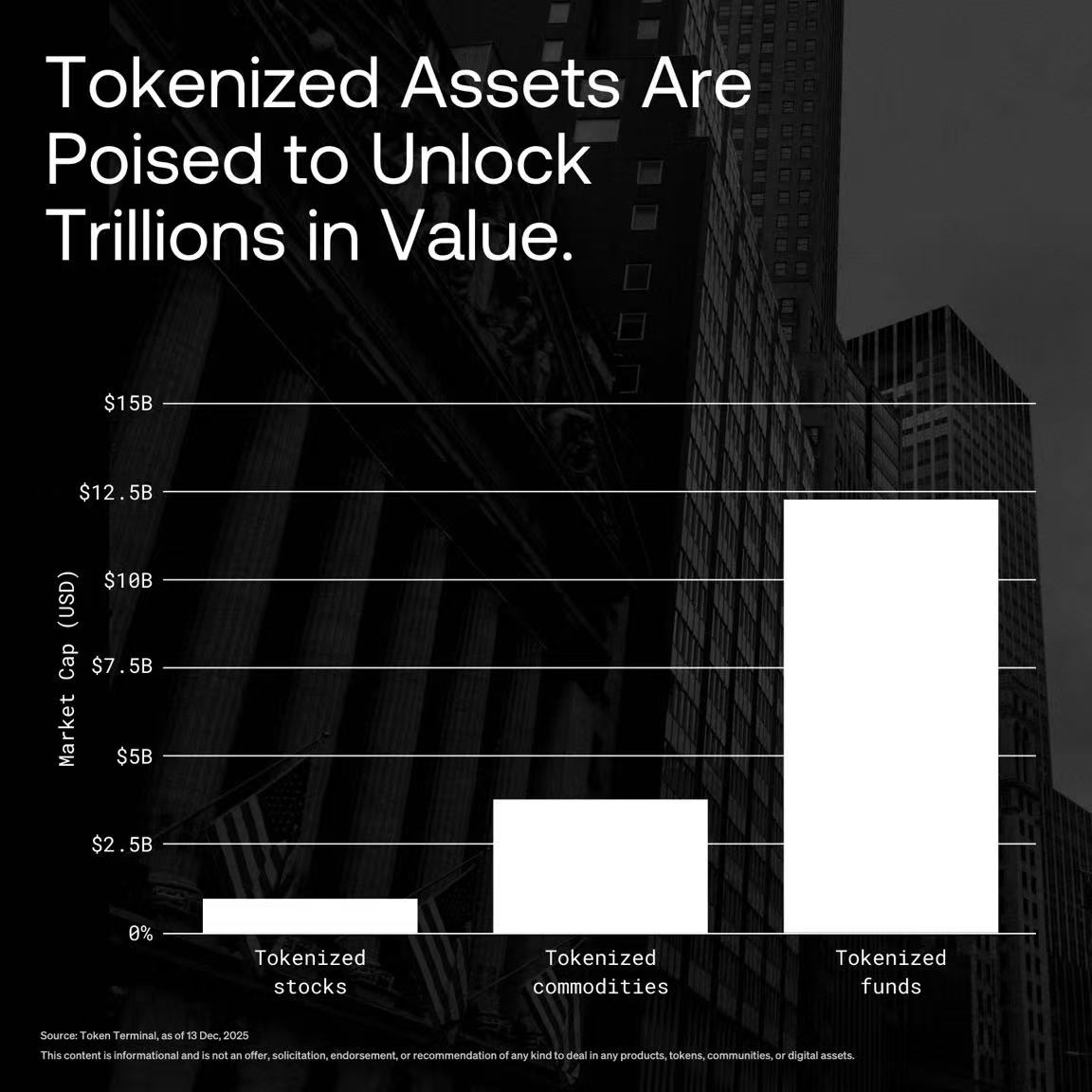

This locking effect built by DeFi Lego blocks and launchpads passively reduces the circulation of OKB, which is the most direct contribution of X Layer to OKB's valuation. As for the anchoring effect of locking in 2026, based on information from OKX's official Twitter, it is likely to bet on tokenized assets.

Images from OKX's official Twitter

5. The Infrastructural Value of OKX Web3 Wallet as a Traffic Entry Point

Extracting "OK" from OKB is Lao Xu's bold move in 2025 to "put everything on-chain," which means that the growth of OKB will no longer be anchored to exchange trading volume; instead, it will be anchored to the user growth of OKX Web3 Wallet.

Wallets are the Super Apps of the Web3 era, serving as the primary entry point for traffic, and OKX Web3 Wallet's advantages in technology, brand, and market position are evident.

5.1 The Landscape of the Wallet Sector and OKX's Advantages

In 2024-2025, OKX Web3 Wallet demonstrated astonishing growth potential. Data shows that the OKX App reached 17.5 million downloads in 2024, a year-on-year increase of 182%, with a significant proportion of active users utilizing the Web3 wallet feature.

Compared to MetaMask, Rabby, and Phantom, OKX Wallet's advantages lie in the integrated experience of "CEX + DEX" and early comprehensive support for heterogeneous chains (such as Bitcoin Ordinals/Runes).

5.2 The Network Effect Value of Wallets

Wallets are the entry points for public chains, not exchanges. Wallet users are high-frequency (asset management, DApp interaction, payments) and have high migration costs (private key management, asset habits).

Therefore, an active wallet user contributes far more to the network value of a blockchain than an exchange user.

The binding mechanism of OKB and wallets:

Default carrier of gas fees: OKX Wallet is deeply integrated with X Layer. To achieve the best cross-chain experience and low fees, the wallet guides users to use X Layer as the primary asset settlement layer. This makes OKB an "essential asset" for tens of millions of wallet users.

Payment and x402 payment integration: Pay is one of OKX's main focuses. In addition to fee-free stablecoin transfers, OKX Wallet has natively integrated x402. When AI Agents encounter payment walls (e.g., API calls), the OKX Wallet infrastructure can instantly sign and settle micro-payments. To interact effectively with OKX Wallet, these AI Agents will need to configure OKB.

Cross-chain aggregation tolls: Although the wallet itself claims to be decentralized, OKX actually earns "tolls" through cross-chain bridges and DEX aggregators provided by X Layer, indirectly empowering OKB.

Identity and rights certificates: With the development of Web3 social, the amount of OKB held may become an important weight for on-chain identity (DID), determining the user's rights level in the wallet ecosystem (e.g., gas fee exemptions, priority experience rights, etc.).

5.3 Migration of Valuation Logic: From P/E to P/S and P/U

Old model (exchange): Focus on P/E (price-to-earnings ratio), i.e., token price / exchange profit buyback amount.

New model (wallet infrastructure): Focus on P/S (price-to-sales ratio) and P/U (market value per user).

P/S: Market value / on-chain protocol revenue (X Layer revenue + aggregator fees).

P/U: Market value / monthly active wallet users (MAU) + AI Agents.

Referring to the valuation logic of Trust Wallet Token (TWT), the market is willing to give higher valuation premiums to wallet projects incubated by exchanges because they occupy the Web3 entry point + exchange linkage. As "TWT with exchange liquidity support," OKB should have a higher P/U multiple. If OKX Wallet can maintain its current growth rate, the market value of OKB will show a nonlinear increase with the growth of MAU.

6. Summary

Some say that extracting "OK" from OKB is a necessary path for OKX's IPO, and the reason is simple: compliance. After all, you cannot adequately explain to the SEC why the non-equity of OKB can receive benefits from OKX. Thus, a path has emerged where exchange equity belongs to the exchange, and OKB is the token of the public chain.

Of course, this does not mean that OKB cannot find its own path away from the exchange. No, OKB focuses on the chain and bets on the youth.

A very important premise here is the growth trend of DEX — the proportion of DEX trading volume is increasing year by year, while the growth of centralized exchange trading volume may slow down. On-chain interactions (Swap, NFT, DeFi) are in an explosive period. OKX Wallet is a capture of this trend. OKB becomes the underlying pricing unit of this trend through X Layer.

For the new generation of Web3 users, their first contact is OKX Wallet (as the entry point), followed by OKX exchange. As the "native asset" within the wallet, the brand recognition of OKB will be deeply tied to the wallet.

Moreover, the profit buyback of the exchange is indirect, lagging, and opaque; while wallet users consume OKB using X Layer, locking up OKB is direct, real-time, and transparent. This is the essence of decentralization.

Isn't it ironic if the economic system of a decentralized token heavily relies on a centralized mechanism?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。