Author: Jae, PANews

As the year 2026 begins, Sui welcomes the "opening green" with a surge of 30% in just one week.

While most Layer 1 public chains are still battling for TPS and ecosystem numbers, Sui is waiting for its ticket to the Wall Street battleground. The world's largest crypto asset management firm, Grayscale, and Bitwise have recently submitted Sui spot ETF applications to the U.S. SEC. This means that the SUI token is about to be evaluated alongside BTC and ETH in the institutional asset basket.

However, beneath the glamorous narrative of the "Silicon Valley darling" transforming into the "new Wall Street aristocrat," Sui is also undergoing a severe test: can it become a trustworthy ecological foundation while embracing traditional capital?

Multiple Data Points Show Exponential Growth, New Users Flood In

Over the past two and a half years, the Sui ecosystem has shown exponential growth and strong user stickiness.

Since the mainnet launch in May 2023, its TVL has skyrocketed approximately 32 times, peaking at $2.6 billion in October 2025. However, due to the impact of the "October 11 flash crash," Sui's TVL has continued to decline, currently sitting at around $1 billion, having fallen below the halving line.

In terms of public chain fees, Sui has grown from an initial $2 million to approximately $23 million now, an increase of 11.5 times.

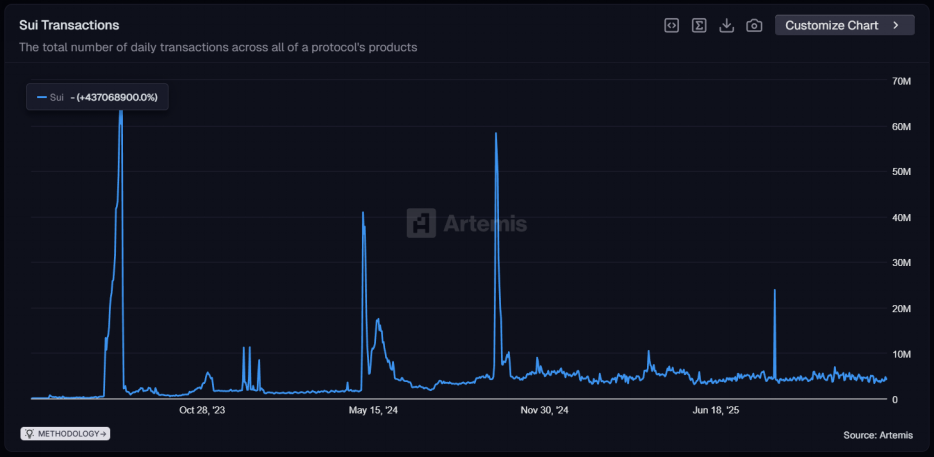

In terms of throughput, Sui's peak daily throughput reached 66.2 million transactions, with daily throughput remaining stable at over 4 million transactions for nearly a year. These massive throughput numbers confirm that Sui has achieved horizontal scaling, sufficient to support high-intensity, large-scale user and application requests.

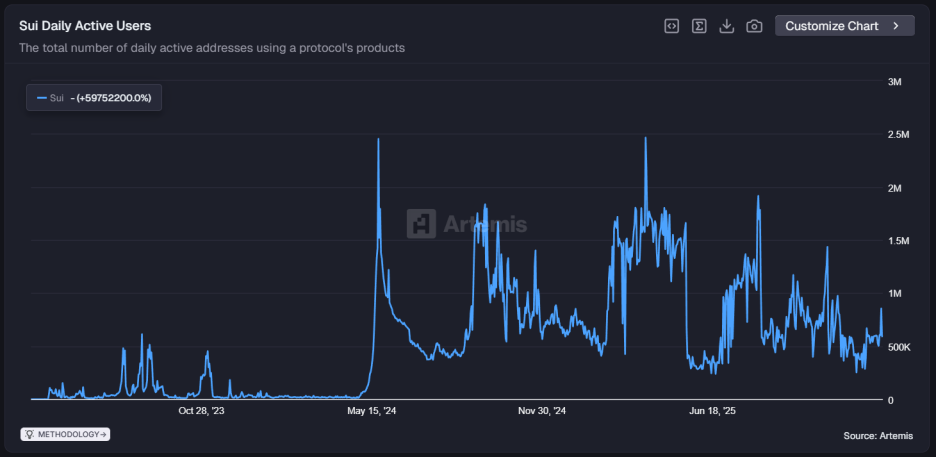

Regarding user activity, the number of daily active users on Sui was only tens of thousands at the initial launch, but it surged sharply, peaking at 2.5 million in April 2025. Although there has been a recent decline, the monthly average data remains at a healthy level. As of now, the average daily active user count is still around 600,000.

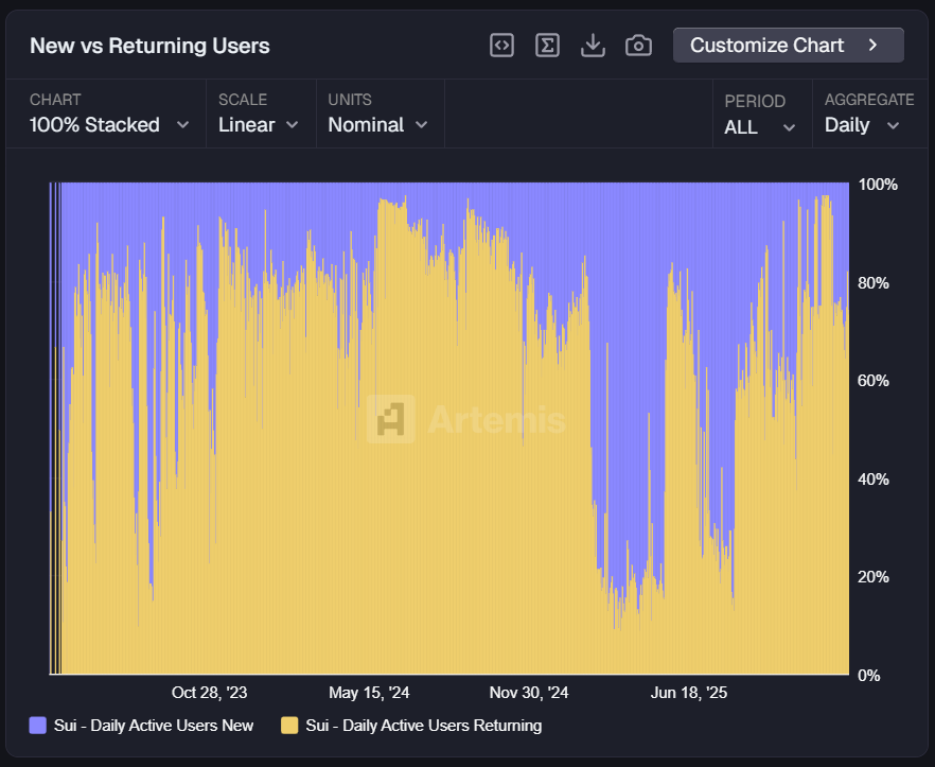

It is worth mentioning that the ratio of old users has remained stable at over 20%, reflecting a high level of user stickiness. Since 2025, a large number of new users have continuously flooded into the Sui ecosystem.

These data points provide Sui with the confidence to attract institutional capital; it is no longer just a public chain network with technology but a mature economy that carries real traffic and assets.

Opening the Door to Wall Street, Multiple SUI Spot ETF Applications Submitted

The application for the SUI spot ETF will further broaden the access path for compliant funds and strengthen institutional recognition.

On December 5, 2025, Grayscale officially submitted an S-1 registration statement to the SEC, applying to transform its Sui Trust Fund into a spot ETF. According to the disclosed documents, the Grayscale Sui Trust (SUI) ETF plans to be listed on the New York Stock Exchange (NYSE Arca), and the fund will directly hold SUI tokens, linking the net asset value to the market price of SUI. More importantly, this application includes a staking mechanism, meaning that this ETF can provide investors with price exposure while also generating additional endogenous returns through the rewards from the underlying validators of the public chain, which will be highly attractive to cash flow-seeking institutional investors.

Bitwise followed suit, submitting the registration statement for the Bitwise SUI ETF to the SEC on December 19, 2025, planning to list on Nasdaq and choosing Coinbase as the custodian. Bitwise had previously included SUI in its "Bitwise 10 Crypto Index ETF," and this independent application for a spot ETF marks SUI's official entry into the institutional asset basket alongside BTC, ETH, SOL, and others.

Unlike previous cautious stances, the recent changes in the SEC leadership have created a more relaxed regulatory environment for the approval of altcoin ETFs. This change has accelerated the approval of multiple altcoin ETFs and shifted the Sui ETF's landing from market vision to a substantive timeline.

The institutional favor for Sui is not coincidental; its core competitiveness lies in its rich application scenarios, especially in payment, gaming, and DeFi protocol scalability.

Moreover, the market consensus on the value of the SUI token is shifting from short-term speculation to long-term allocation. As of January 7, the market capitalization of the SUI token exceeds $7 billion, with a fully diluted valuation (FDV) of nearly $19 billion. Although about 62% of the tokens are still locked, the market has smoothly digested over $60 million worth of token unlocks at the beginning of 2026 without any severe price sell-off. The arrival of the Sui ETF will lower the entry barriers for traditional wealth management institutions, significantly improving the liquidity depth of the SUI token, thereby reshaping its valuation logic.

Upcoming Launch of Privacy Trading Function, Potentially Triggering Commercial Demand

As institutional capital enters the market, Sui is also attempting to address another barrier in the B2B payment field for public chains. While all public chains are promoting the transparency and traceability of their on-chain data, Sui is taking the opposite approach.

As the privacy track returns to the main stage of crypto, Adeniyi Abiodun, co-founder and Chief Product Officer of Mysten Labs, announced on December 30, 2025, that the Sui network will launch a native privacy trading function in 2026. This is not an optional plugin but an underlying capability integrated into the consensus layer and object model. The purpose of developing this function is to achieve privacy by default, meaning that when users make payments or transfers, the transaction amount and counterparty information will, by default, only be disclosed to the sender and receiver, remaining invisible to onlookers.

This function could generate significant commercial demand; while the transparency of traditional public chains ensures fairness, it severely hinders entities that need to protect business secrets and individuals who require privacy. Sui's privacy solution aims to maintain high throughput while providing end-to-end confidentiality through zero-knowledge proof technology.

The most notable feature of Sui's privacy trading function is its compliance-friendly design. Unlike privacy coins like Monero, Sui introduces a selective transparency mechanism.

- Audit Hooks: The protocol allows specific transaction details to be opened to regulatory agencies or authorized auditors under certain compliance processes;

- KYC/AML Integration: Allows financial institutions to conduct necessary anti-money laundering reviews while ensuring privacy protection;

- Quantum-resistant Primitives: Considering the potential threat of quantum computing to elliptic curve cryptography, Sui plans to introduce post-quantum cryptographic standards such as CRYSTALS-Dilithium and FALCON in its 2026 upgrade, ensuring that privacy data stored on the chain remains unbreakable for decades to come.

These technical components position Sui as a "regulated privacy financial network," attracting banks and commercial entities that are highly sensitive to data.

However, this positioning is a double-edged sword. It attempts to attract traditional financial institutions sensitive to data but may also provoke skepticism from pure crypto enthusiasts. A more severe challenge also lies in the technical aspect: integrating zero-knowledge proofs and even quantum-resistant encryption algorithms while maintaining high TPS.

Ecosystem Projects Undergoing Liquidity Infrastructure Upgrades

In the fierce competition among L1s, the depth of liquidity remains a core indicator determining the vitality of public chains. In recent months, Sui ecosystem projects have frequently made moves to enhance liquidity efficiency and architecture.

As a protocol that has long occupied the top of the TVL rankings in the Sui ecosystem, NAVI Protocol officially launched the Premium Exchange (PRE DEX) on December 29, 2025. This move marks NAVI's evolution from a single lending protocol to a full-stack DeFi infrastructure.

PRE DEX focuses on building a premium discovery mechanism. In the current crypto market, many protocol tokens exhibit significant price discrepancies at different stages. PRE DEX aims to provide a pricing platform for these assets through a market-driven algorithm.

For institutional investors and multi-wallet users, PRE DEX will greatly enhance management efficiency. The system allows users to efficiently configure and aggregate multi-chain and multi-protocol assets within the same interface, reducing friction costs associated with cross-protocol operations.

With the launch of PRE DEX, asset pricing within the Sui ecosystem is expected to become more efficient, especially when dealing with high-value or low-liquidity assets, PRE DEX may become a liquidity transfer hub.

The two financing events at the end of 2025 may indicate that liquidity management in the Sui ecosystem is entering a phase of AI-driven and dynamic management.

In December 2025, Magma Finance announced the completion of a $6 million strategic financing round, led by HashKey Capital. Magma aims to address the fragmentation of liquidity and low capital efficiency within the Sui ecosystem.

The protocol's technical architecture introduces an Adaptive Liquidity Market Maker (ALMM) model. Unlike traditional Centralized Liquidity Market Maker (CLMM) models, ALMM will utilize AI strategy layers to analyze market volatility in real-time. When the market experiences significant fluctuations, AI will automatically adjust the distribution of asset prices and rebalance the capital of liquidity providers (LPs) to active trading ranges.

In this way, Magma will not only provide traders with lower slippage but also create higher real returns for LPs. At the same time, AI will monitor the memory pool (Mempool) to prevent MEV attacks.

Ferra Protocol, on the other hand, completed a $2 million Pre-Seed round of financing in October 2025, led by Comma3 Ventures. Ferra launched the first Dynamic Liquidity Market Maker (DLMM) DEX on the Sui mainnet, with its innovation lying in high modularity and composability.

Ferra integrates both the CLMM model and the Dynamic Adjustment Market Maker (DAMM) model, and introduces dynamic joint curves, which will further empower the fair launch and liquidity guidance of new tokens. Ferra's vision is to become a dynamic liquidity layer on Sui, allowing funds to flow freely with market sentiment and demand, rather than being static deposits.

DeFi Ecosystem in Crisis, Leading Projects Face Governance and Trust Issues

However, Sui's public chain expansion is not without its challenges. Sui's largest lending protocol, SuiLend, was recently accused of buyback fraud, casting a shadow over its DeFi ecosystem and prompting the community to reflect on the misalignment of incentives within the public chain.

As the leading lending protocol on the Sui chain, SuiLend's TVL once approached $750 million, accounting for 25% of the total chain share. However, behind the impressive data, the performance of its token SEND has consistently been disappointing. Despite the protocol generating $7.65 million in annualized revenue in 2025 and claiming that 100% of protocol fees would be used for token buybacks, the price of SEND has dropped over 90% in the past year.

Although SuiLend executed a buyback of $3.47 million since February 2025 (approximately 9% of the circulating supply), this has not provided the expected price support for the small-cap asset SEND, which has a market capitalization just over $13 million.

According to KOL Crypto Fearless, SuiLend has been labeled as a "ST" (special treatment) by Bybit, and the community has questioned the buyback for potential insider trading, viewing it as a disguised way for the team to offload tokens. Particularly during the IKA liquidation incident, SuiLend did not activate its insurance fund but forcibly deducted 6% of the principal from users, further damaging community trust. Additionally, the protocol's continued operation relies heavily on monthly subsidies of several million dollars from the Sui Foundation.

This has led to accusations from the community of buyback fraud. The community generally believes that the buyback strategy is merely a drop in the bucket; while it superficially reduces token supply, it does not offset the high token emissions and the selling pressure from early VCs.

This case serves as a wake-up call for the Sui DeFi ecosystem: without real user growth and sustainable models, token buybacks may only mask a hollow house of cards. Beyond metrics like TVL and revenue, the market should also pay attention to dimensions such as community governance and incentive structures of the protocols.

For Sui, while the path to Wall Street is undoubtedly tempting, ensuring a solid and reliable foundation may be a longer journey. The explosive data has proven its technical potential, but trust is the foundation of survival. Sui needs to complete the difficult transformation from a technical experiment to a mature economy, maintaining innovative sharpness and reasonable valuation while making trust a core piece of the puzzle for value growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。