When the market is dominated by grand narratives and fleeting FOMO emotions, the true Web3 trends and user behaviors often lie hidden beneath the surface data. The OKX Wallet 2025 Annual Report will focus on a core issue—uncovering the real preferences of on-chain users.

This report will clarify the on-chain funding behaviors of the year: what are the differences between small funds and whales; where does money truly explode in terms of chains, protocols, and activities; which products are genuinely used by users, and which are merely speculative concepts; how much of the yield from on-chain finance is actually realizable; which strategies can yield profits, and which are just traps? More importantly—who made money on-chain this year? Is it possible to replicate these profit-making methods? Which trends have already been "pre-positioned"?

DEX Trading Concentrated on Chains like Solana and Ethereum

Overall, the DEX aggregator market size in 2025 has surpassed one trillion dollars, with the OKX DEX aggregator continuously growing in trading volume due to its advantages in multi-chain asset routing and wallet-side entry; driven by the trading frenzy of MEME coins, the activity of DEX on-chain trading saw a significant concentration in February. From a temporal distribution perspective, February became one of the months with the densest DEX transactions of the year, with a peak daily transaction volume nearing 2 billion dollars, exhibiting typical "event-driven" explosive characteristics. As trading volumes rapidly increased, the structural differentiation of DEX transactions across different public chains also became clearer.

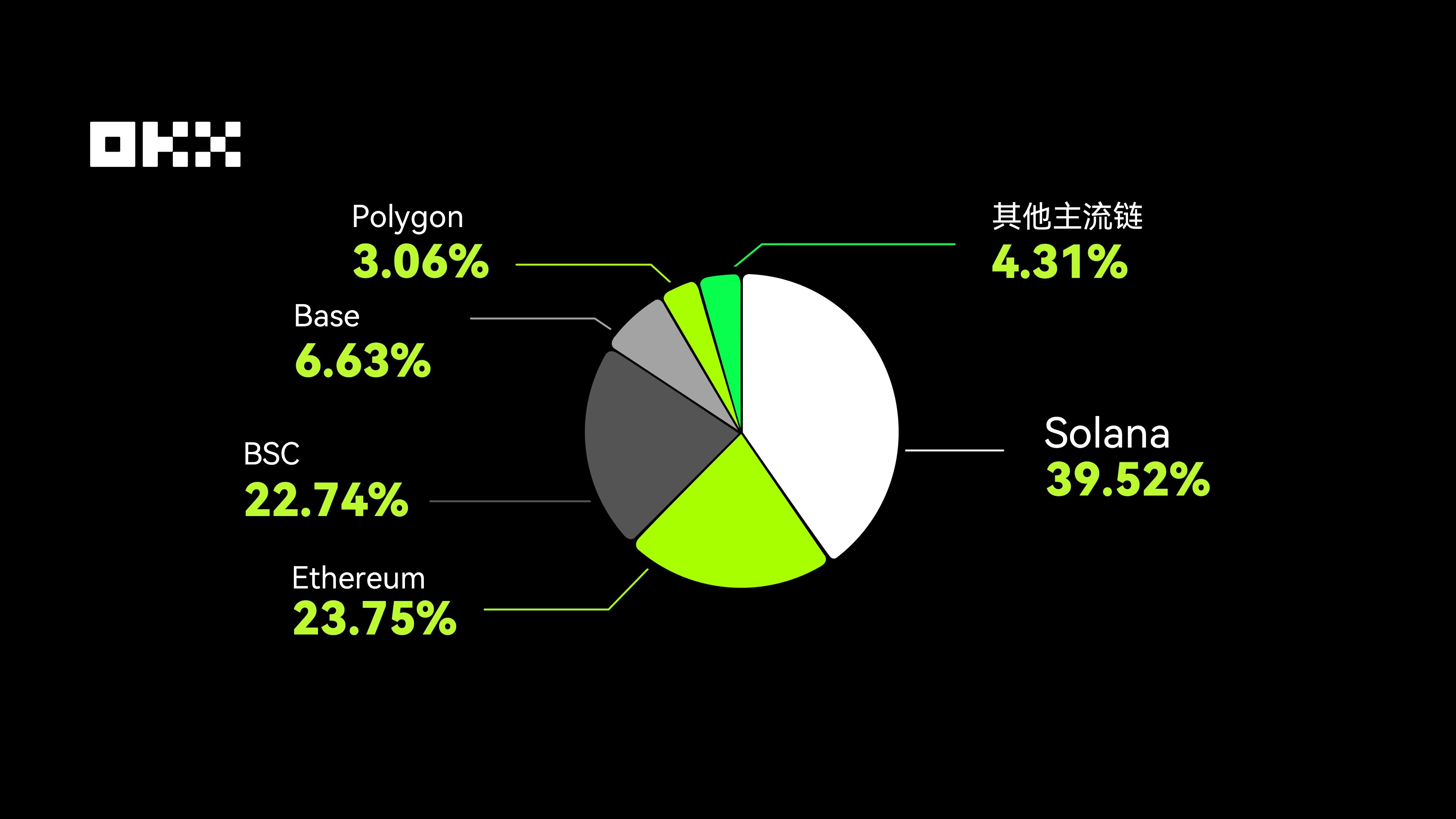

From the distribution of public chains, DEX trading volume is mainly concentrated on five mainstream public chains: Solana, Ethereum, BSC, Base, and Polygon. Among them, Solana stands out, with its DEX transaction volume for the year being approximately 1.6 times that of Ethereum, becoming the primary network for MEME coin trading. This phenomenon not only reflects a significant increase in user sensitivity to trading costs, confirmation speeds, and execution success rates in a high-frequency, emotion-driven trading environment, but is also closely related to Solana's advantages in asset issuance efficiency, transaction concurrency, and user interaction experience. A large number of MEME projects chose to launch on Solana, locking in trading behavior within the same network during the asset generation phase, further amplifying the aggregation effect of on-chain transactions.

Ethereum, as a mature ecosystem, still constitutes the core foundation of DEX trading due to its long-accumulated asset depth, mainstream projects, and stable liquidity, with its transaction structure leaning more towards diversified assets, stablecoin trading, and relatively rational allocation demands. In contrast, BSC does not rely on deep ecological sedimentation but attracts a large number of price-sensitive and new users to participate in trading through low thresholds, low costs, and strong traffic mobilization capabilities. During the highly concentrated phase of MEME markets, BSC was able to achieve transaction volumes close to Ethereum in a short period, indicating that in specific market environments, user scale and trading frequency can partially offset the gap in ecological maturity.

Base and Polygon are in the subsequent tier, with overall trading volumes relatively limited, and their growth paths more dependent on clear narrative drives, popular applications, or periodic incentive cycles. Compared to the aforementioned public chains, this tier still has significant shortcomings in user stickiness and liquidity depth, but during specific windows, they can quickly aggregate trading volumes by hosting single hot applications or thematic assets, contributing to incremental growth in the overall DEX market.

The public chain distribution structure of OKX DEX trading volume

Trading scenarios are gradually becoming a key factor influencing the evolution of the DEX landscape. Trading scenarios represented by MEME coins have accelerated the concentration of trading traffic towards a few public chains. Behind this lies the mechanisms of rapid asset issuance, social dissemination, and short-cycle gaming, which not only amplify single-chain trading volumes but also reshape cross-chain capital flows and DEX type selection. Subsequent chapters will focus on data disaggregation around MEME trading, further analyzing its impact on the phased evolution of the DEX landscape.

On this basis, the DEX trading landscape is transitioning from "single main chain dominance" to "multiple tiers coexisting with clear division of labor." High-performance public chains support high-frequency trading, mature ecosystems handle asset sedimentation and risk pricing, while traffic-oriented and emerging public chains play amplifying roles in specific market conditions. This differentiation requires trading platforms to possess cross-chain and scenario coordination capabilities. OKX DEX, relying on multi-chain coverage and an aggregated architecture, connects different tier public chains and trading scenarios under a unified entry point, helping users efficiently respond to short-term market conditions and long-term allocation needs.

Number of Active DEX Trading Addresses Increased 2.6 Times Year-on-Year

In 2025, decentralized exchanges (DEX) continued to serve as the core infrastructure for Web3 trading. With the maturation of public chain ecosystems, the improvement of trading infrastructure, and the timeliness of on-chain asset execution, DEX is gradually becoming the preferred choice for more users to conduct asset trading. The number of active DEX users throughout the year showed significant growth, with trading activities expanding from a few mainstream assets to more new project tokens, while activity levels and trading frequencies also increased significantly.

Compared to last year, the number of active DEX user addresses on OKX Wallet in 2025 increased 2.6 times year-on-year, with the growth primarily concentrated on a few hot public chains. As project launches and trading hotspots continuously emerge, user behavior exhibits a clear on-chain aggregation characteristic, with trading activities rapidly concentrating on specific networks and projects, forming new market structures and rhythms.

The MEME coin ecosystem is one of the most representative narratives in the DEX market. Despite a market correction at the end of the year, MEME trading remains highly speculative. The most active on-chain MEME users are highly sensitive to price fluctuations and market rhythms, seeking quick, popular trading opportunities, and are influenced by community activity and social media trends. Their trading demands focus on speed, flexibility, and on-chain information insights: trades need to be quick, with high success rates, and support continuous operations; at the same time, on-chain indicators such as whale tracking, developer holding dynamics, chip distribution, and K-line trend analysis can help users assess capital flows, concentration of interest, and potential manipulation behaviors, thereby assisting in short-term follow-ups and high-frequency speculation.

From the annual distribution of MEME coin trading, Solana and BSC are the two most concentrated public chains, but there are differences in trading scale and asset structure. The projects with the highest trading volume on Solana throughout the year include TRUMP, MELANIA, swarms, BUZZ, VINE, STONKS, ai16z, LIBRA, etc., with frequent project changes and fast trading rhythms, making it the core network for high-frequency MEME trading. The projects with the highest trading volume on BSC mainly include Broccoli, TST, NODE, Binance Life, KOGE, etc., relying more on community diffusion and traffic-driven strategies to quickly gather activity during specific windows. Although the continuous trading capacity of individual assets is limited, BSC can still form a stable participation base due to its low threshold and large user scale.

Under the structural differences, the mainstream MEME trading volume on Solana throughout the year is approximately 3.6 times that of BSC. Overall, the growth of MEME users is concentrated in a few hot networks, with Solana being more suitable for high-frequency, rapid rotation trading scenarios, while BSC has advantages in traffic-oriented participation and short-cycle gaming. Together, they constitute the important arenas for current MEME trading.

Trading situation of some mainstream MEME coins on Solana and BSC

It is worth noting that OKX launched a built-in DEX within the exchange in November 2025. Users can now directly purchase on-chain tokens such as Solana, Base, and X Layer using USDT/USDC from their trading accounts, without the need for cross-chain transfers, withdrawals, or managing mnemonic phrases or private keys. The built-in DEX adopts a self-custodial design, with OKX covering the Gas fees, providing a lighter and smoother experience.

Information asymmetry and time differences can directly translate into profits for MEME users, so Wallet has continued to listen to community feedback in 2025, enhancing user experience through hundreds of detail optimizations and core upgrades, such as reducing the new coin listing speed to under 1.5 seconds; simplifying one-click trade confirmations to speed up operations; significantly improving the loading speed of token pages, K-lines, trading functions, and overall performance to industry-leading levels; and adding AI narratives, among other enhancements.

Ethereum and TRON Remain Major Cross-Chain Scenarios

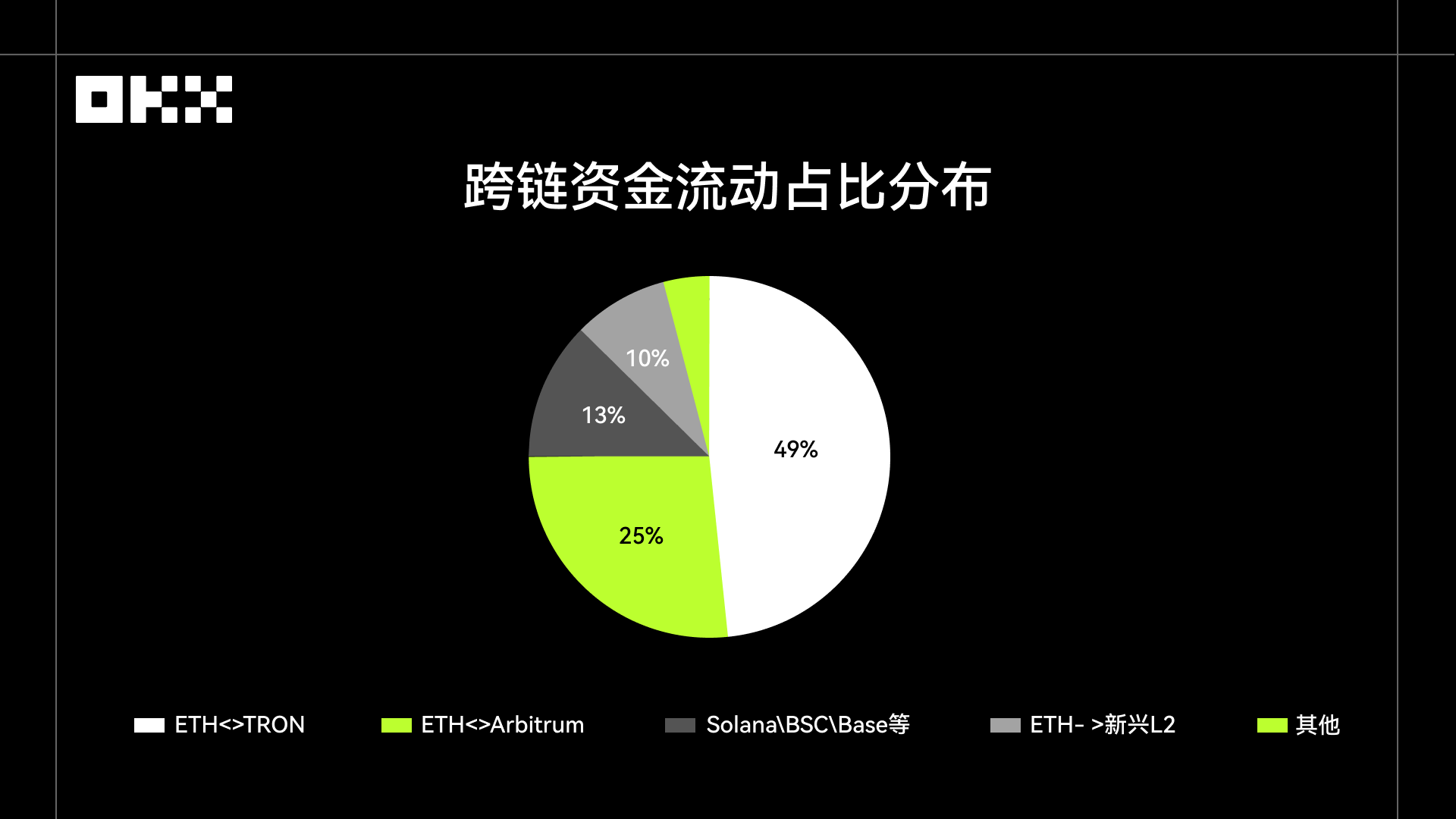

In 2025, the cross-chain capital of OKX DEX aggregator users is highly concentrated between a few high-liquidity public chains. Ethereum and TRON form the core funding channel, with bi-directional cross-chain transactions accounting for nearly half of the total liquidity for the year. This structure benefits from TRON's low fees, high throughput on-chain characteristics, and its efficiency in USDT transfer scenarios, while also relying on Ethereum's rich ecological resources, making TRON an important node for emerging market users to conduct small payments and capital turnover.

The bi-directional cross-chain transactions between Ethereum and Arbitrum account for over a quarter, forming a high-frequency cycle between the main chain and L2. Users often allocate funds on low-fee chains like Arbitrum to participate in short-term trading or DeFi activities, then flow back to the Ethereum mainnet for asset sedimentation and security assurance. Overall, the four major chains—Ethereum to TRON, TRON to Ethereum, Ethereum to Arbitrum, and Arbitrum to Ethereum—contribute approximately 70% of cross-chain capital flows, indicating that cross-chain activities are highly concentrated on a few core paths.

In terms of directionality, in most bi-directional chain pairs, the outflow of funds from Ethereum is higher than the inflow, reflecting its pivotal role as a source of funds; while between Ethereum and Arbitrum, the inflow slightly exceeds the outflow, indicating an active pattern of some L2 funds returning to the main chain. At the same time, the one-way flow of funds from Ethereum to emerging L2s accounts for over 10%, indicating that main chain funds continue to overflow into expanding ecosystems.

In contrast, the cross-chain proportion of high-performance public chains like Solana, BSC, and Base is relatively low, accounting for about 13% of total liquidity, primarily serving strategic allocation or short-term operational functions. However, there still exists a relatively independent bi-directional capital flow between Solana and BSC, with its scale approaching the cross-chain proportion between Ethereum and Solana, indicating that emerging public chains have begun to form certain independent capital allocation demands, not entirely relying on Ethereum as the sole hub.

Overall, cross-chain capital exhibits a structural characteristic of "high concentration on main paths and continuous overflow on expansion paths." On this basis, the OKX DEX aggregator covers over 25 cross-chains, 40 public chains, and 400 DEXs, utilizing X Routing smart routing to achieve optimal pricing across multiple DEXs, while also providing market data, limit orders, and KYT security checks, offering users a more efficient and controllable trading experience in a complex cross-chain environment.

DeFi Investment is Shifting Towards More Structured Portfolio Configurations

In the on-chain environment, lending and staking protocols remain relatively robust and sustainable sources of yield, with funds continuously concentrating on these leading protocols. This indirectly reflects that an increasing number of users are choosing OKX DeFi earning products as one of the main entry points for participating in on-chain DeFi. In terms of user investment amounts, funds are primarily concentrated in large, stable, and mature leading protocols. Among the top 10 protocols by investment amount, Aave V3 leads with over $200 million in investment, significantly ahead of other protocols, demonstrating its core position and high trust in the lending sector. The remaining top 10 protocols each have investment amounts exceeding $20 million, presenting an overall distribution structure of "stable leaders and orderly mid-tier."

The top 10 protocols cover multiple DeFi sub-directions, including traditional lending (Aave V3, Compound V3, Morpho, Fluid), staking and re-staking (Lido, Puffer Finance), DEX and liquidity protocols (Uniswap V3), as well as emerging chain-native lending protocols (NAVI Protocol, Echelon Market, Echo Protocol). This structure indicates that users are not solely betting on high-risk strategies but are making portfolio investments around mature protocols and certain yield paths.

Among them, emerging chain-native lending protocols like NAVI Protocol, Echelon Market, and Echo Protocol entering the top 10 indicate that users are actively allocating some funds to new ecosystems with stronger incentives and insufficient competition, making multi-chain allocation an important way to obtain incremental yields. Finally, the coexistence of Lido and Puffer Finance reflects the layered allocation characteristics of staking funds, where users choose mature and stable staking solutions for core funds while enhancing overall yield elasticity through new mechanisms like re-staking. These phenomena collectively indicate that DeFi investment is shifting from single strategies to more structured portfolio configurations.

Overall, higher investment amounts are flowing more towards protocols with higher security, sustainability, and maturity, reflecting users' emphasis on risk control and long-term availability in DeFi investments. Whether or not you have experience earning on-chain, OKX Wallet's DeFi earning products provide a one-stop on-chain subscription tool, allowing everyone to easily participate in various subscription activities for leading protocols like Aave and Morpho, while obtaining native rewards from the protocols and having the opportunity to enjoy additional rewards configured by DeFi earning for users. In terms of funds, all operations require user authorization, ensuring that funds only interact directly with the protocol parties for staking.

xBTC is the Fastest Growing DeFi Investment Product This Year

From the distribution of investment products by users, stablecoins remain the core underlying asset of DeFi investments. Among the top 10 investment products with the highest user investment, USDC and USDT rank at the top, continuing to play foundational roles in liquidity management, lending collateral, and strategy execution; at the same time, the emergence of yield-enhanced stablecoin products like USDS, Usual Boosted USDC, and Relend USDC indicates that users are gradually transitioning from "passive holding" to "yield optimization" in stablecoin allocation.

In non-stablecoin assets, ETH and SOL remain the primary underlying asset allocations, reflecting users' recognition of the long-term value and ecological participation of mainstream public chain assets. Notably, xBTC has become one of the fastest-growing DeFi investment products this year, making it into the top 10 assets with the highest user investment. This change indicates that users are participating in DeFi through on-chain BTC assets, retaining BTC value exposure while obtaining additional yield opportunities, reflecting the acceleration of the "DeFi-ization of Bitcoin" trend.

Additionally, emerging or re-staked assets like SUI and sAVAX entering the top 10 also show that users are beginning to experiment with assets that have potential for phased growth outside of core asset allocations to enhance overall yield elasticity.

From the perspective of participation behavior, the metric of "number of investors" emphasizes different aspects compared to capital scale. Currently, due to relatively low thresholds, clear logic, and high usage frequency, lending remains the main entry point for users participating in DeFi. Among lending protocols, NAVI Protocol, Aave V3, and Compound V3 rank in the top 3 for the number of investors, reflecting that users prefer to enter on-chain financial activities through mature or native lending protocols. Even if individual user investment scales are limited, a broader participation base forms considerable overall activity.

In liquidity protocols, Momentum, Uniswap V3, and Hyperion are the top 3 with the most investors. Compared to lending protocols, liquidity protocols emphasize trading participation and fee income, attracting a large number of small to medium-sized users. This further illustrates that the number dimension reflects participation breadth, while the amount dimension reflects capital depth, together forming a complete picture of DeFi usage structure.

DeFi Investment Still Favors Mainstream Public Chains like Ethereum

In the OKX Wallet DeFi earning ecosystem, users tend to allocate capital to public chains with high TVL, deep liquidity, and stable yields to achieve efficient earning and reduce slippage risk. Among the top 10 public chains where users invest the most in DeFi, Ethereum remains at the forefront, continuing to serve as the main battleground for core asset sedimentation and high-value DeFi activities. Its advantages in TVL, liquidity depth, and protocol maturity make it the preferred network for large funds engaging in lending, staking, and stable strategy allocations.

At the same time, high-performance or emerging public chains like AVAX, SUI, and SOL rank highly, reflecting that users are willing to allocate some funds to lower-cost, more incentivized on-chain environments in pursuit of yield and execution efficiency. BSC, Base, and Arbitrum have advantages in user scale and trading frequency, more often serving traffic support and strategy execution functions, forming periodic activity driven by hot events or ecological activities. Additionally, emerging networks like PLASMA, APTOS, and KATANA entering the top 10 show that users are gradually trying more differentiated ecosystems, reserving allocation space for future growth. Overall, users' DeFi investments are not concentrated in a single public chain but are forming a multi-chain parallel allocation structure around security, performance, and incentive mechanisms.

By integrating the three dimensions of protocols, assets, and public chains, it can be seen that DeFi behavior is evolving from early single-point speculation to more systematic asset and strategy allocations: at the protocol level, funds are concentrating on mature leaders; at the asset level, stablecoins provide a foundation, while BTC and mainstream public chain assets enhance yields; at the public chain level, there is multi-chain division of labor and collaborative operation. DeFi is gradually transitioning from an "opportunity-driven market" to a "structured asset management scenario," with users' focus on long-term sustainability and risk controllability continuing to increase.

OKX Boost Disburses Over $40 Million in Bonuses

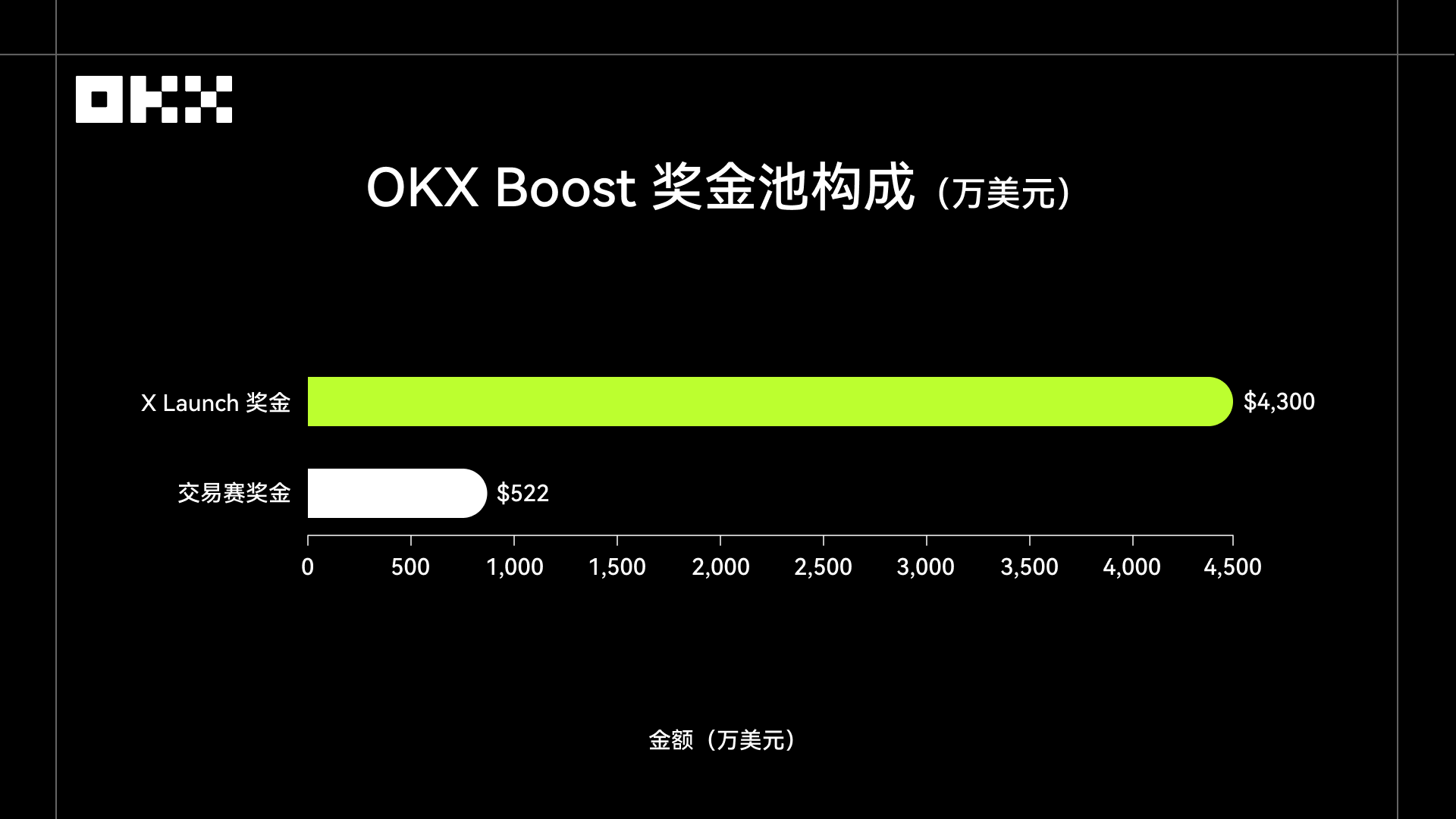

Since its launch in September this year, OKX Boost has completed 37 rounds of X Launch by the end of December, disbursing a total of over $43 million in bonuses, while also hosting 22 trading competitions with a total prize pool of $5.22 million. Among them, the average single yield of X Launch projects exceeds $520, with users' average total yield nearing $1,200, and an average yield of over $28 per user per round.

Thanks to the scoring mechanism of X Launch, users with low scores (1-2 points) typically achieve higher yields than high-scoring users (7-8 points), allowing ordinary trading users to realize substantial returns. Compared to traditional first-come-first-served models, X Launch allows all users who meet trading volume and holding thresholds to participate in rewards fairly. At the same time, strict risk control measures ensure the fairness of reward distribution, making it more user-friendly for genuine users.

OKX Boost is a product launched by OKX Wallet, simply put, it is a platform that allows users to participate in new on-chain projects preferentially while enabling project parties to gain genuine user attention and exposure. It integrates different activity formats, including X Launch, giveaways, and trading competitions, allowing users to earn rewards while experiencing new projects. The system determines eligibility for rewards based on users' trading volume and holdings, with all bonuses automatically distributed through decentralized contracts, ensuring transparency and security in fund flows and reward distributions. Additionally, the built-in DEX function of OKX Exchange and the OKX DEX aggregator have also supported OKX Boost, allowing users to participate by updating the app to version 6.149, increasing their chances of sharing rewards.

Conclusion: User Behavior Tends Towards Rationality and Pragmatism

The on-chain data of 2025 indicates that small funds are more inclined to participate in short-term hotspots and new projects, obtaining yields through OKX Boost's X Launch, trading competitions, or short-term arbitrage; while large funds concentrate on mature, liquid lending and staking protocols, reallocating funds between highly active chains to achieve stable returns. The operational trajectories of high-frequency MEME users and whales clearly reflect the annual preferences and actual behavioral patterns of on-chain capital, demonstrating strategic differences and market participation rules.

The flow of on-chain capital and trading behavior shows that stablecoin trading still dominates, with mainstream public chain assets and lending-staking protocols being the concentrated areas for yields, as users seek a balance between short-term opportunities and long-term stable layouts. Small users focus on fair participation and high yield rates, while large funds pay attention to liquidity and arbitrage efficiency, and DeFi earning, cross-chain trading, and MEME strategies reflect the potential for sustainable yields.

Overall, the on-chain behavior of users in 2025 exhibits characteristics of rationality and pragmatism, with funds flowing more towards mature, stable protocols and on-chain opportunities. Users who truly earn profits often combine cognitive differences, balancing stable layouts in leading protocols with the capture of short-term opportunities. These patterns are not entirely unreplicable but rely on an understanding of ecological logic and the rules of capital flow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。