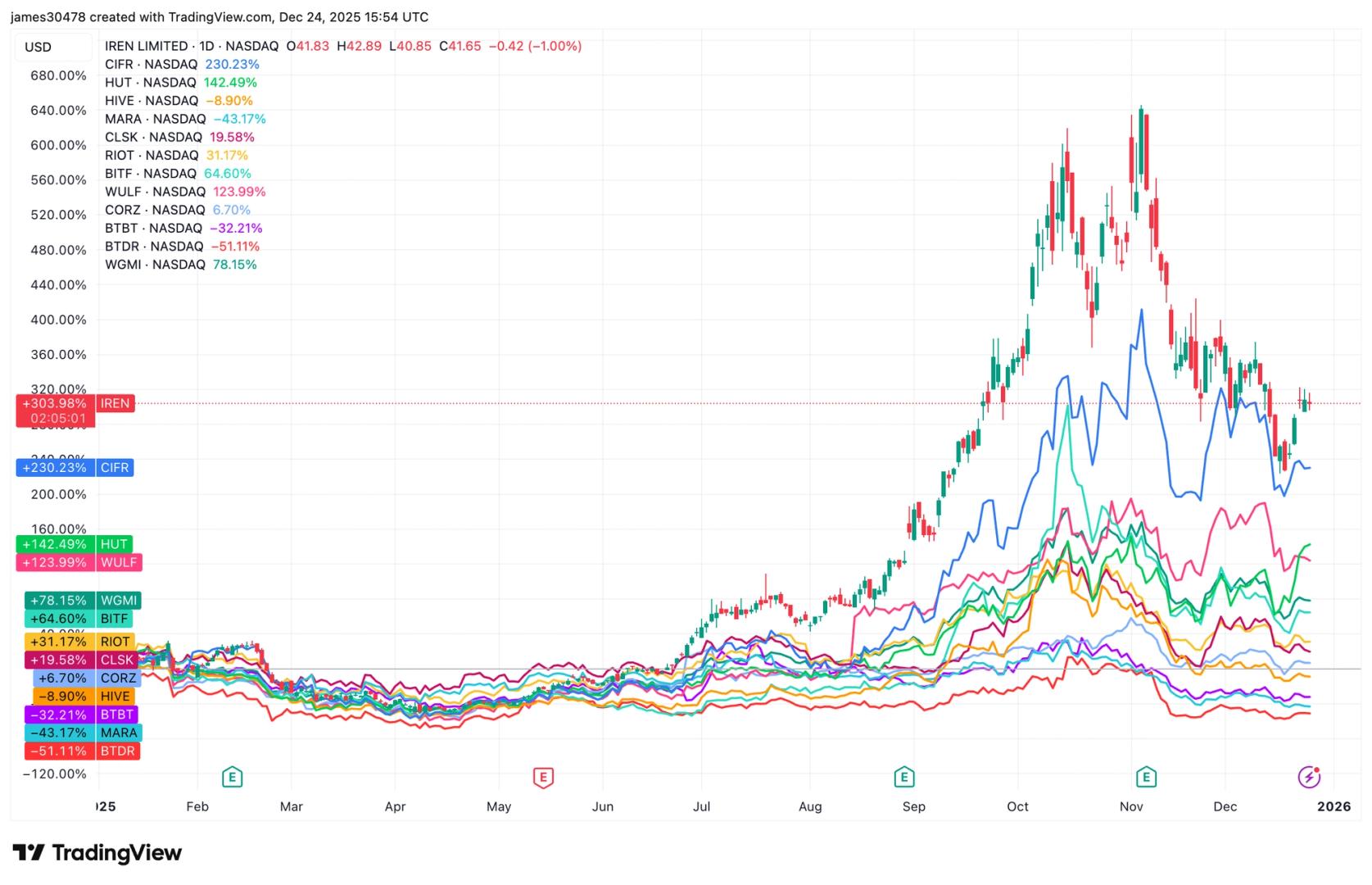

需要了解的事项:IREN以约300%的年初至今收益脱颖而出,而Bitdeer则是该行业最大的滞后者。专注于人工智能的矿工如IREN、Cipher和Hut 8实现了三位数的收益,得益于GPU云交易、超大规模合作伙伴关系和长期数据中心租赁。专注于比特币的矿工如Marathon、CleanSpark、Riot和Bitdeer表现不佳,突显出仅靠BTC持有并不足以抵消较弱的收益、执行问题和延迟的AI战略。

随着2025年接近尾声,比特币BTC$87,095.04面临艰难的一年,年初至今下跌约7%,而黄金、标准普尔500指数和科技股则继续创下历史新高。

因此,公共比特币矿业股票表现出明显的差异,主要受到向人工智能(AI)和高性能计算(HPC)基础设施多元化的推动。表现突出的公司是那些积极转向AI的企业。

IREN(IREN)以巨大的300%的年初至今(YTD)收益领先,得益于主要的GPU云交易和微软的支持。

Cipher Mining(CIFR)紧随其后,增长230%,特别与Fluidstack扩展AI托管合作伙伴关系。

Hut 8(HUT)也大幅上涨,约139%,受其最近的AI公告的推动:在路易斯安那州的River Bend地点签署了一项价值70亿美元、为期15年的245 MW AI数据中心租赁。

相比之下,公共矿工中四大比特币持有者中的三家表现不佳,未能赶上AI/HPC矿工。

Marathon Digital(MARA),在矿工中持有53,250 BTC的顶级BTC持有者,年初至今下跌44%。CleanSpark(CLSK)(13,011 BTC)和Riot Platforms(RIOT)(19,324 BTC)分别小幅上涨16%和32%,直到年末才进行积极的AI多元化。

Core Scientific(CORZ)在股东拒绝了一项价值90亿美元的全股票收购要约后保持独立,押注于在AI需求中更高的独立价值。其股票年初至今仅上涨9%。

Bitdeer Technologies(BTDR),该行业表现最差的矿业公司,下降约50%。大部分损失发生在其第三季度收益公告后,当时公司报告了超出预期的净亏损,并披露了ASIC芯片的延迟,增加了其AI扩展计划的不确定性。

今年突显出一个明显的趋势:矿工将场地重新用于AI数据中心,表现优于纯比特币运营商。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。