作者:Eric,Foresight News

2022 年年末,笔者曾经盘点了当年发生的离奇事件。时隔三年,我又来以同样的方式总结一下 2025 年的 Web3。

时过境迁,2025 年的 Web3 和三年前相比已经改头换面,类似转错地址,设置错参数的低级错误已经很少发生。虽然今年发生的事已经不如当年那么「搞笑」,但离谱程度有过之而无不及,只能说人性这个最伟大的编剧仍在不断发力。

神秘团队操控总统概念 Meme 币,收割超 1 亿美元

事件经过

年初美国新任总统特朗普发行 Meme 币 TRUMP 的事情可谓人尽皆知,之后特朗普夫人梅拉尼娅与阿根廷总统米莱也先后于北京时间 2025 年 1 月 20 日和 2 月 15 日在个人社媒上宣传与他们有关的 MELANIA 与 LIBRA 代币(米莱发布的推文已删除)。

特朗普夫人发币的事儿没啥好说的,发行方抛售在 PvP 的 Meme 币圈子里不是新鲜事儿,大家亏了也自认倒霉。

米莱这里就出了点问题, LIBRA 代币上线后数小时内,项目方即从流动性池撤出 8700 万美元的 USDC 和 SOL,导致价格暴跌 80% 以上。这种撤池子的行为是 P 小将们不太能容忍的行为,也引发了声讨。米莱在事件发酵后删除推文并启动反腐败调查。之后社区曝出了 LIBRA 背后的 KIP Protocol 和 Kelsier Ventures,但 KIP Protocol 声称仅负责技术监督,而做市商 Kelsier Ventures 的 Hayden Davis 则指责总统团队「临时反悔」引发恐慌。

之后,Bubblemaps 通过严谨的链上资金流分析,不仅发现 MELANIA 和 LIBRA 的部署地址都与同一个地址高度关联,且涉及到 TRUST、KACY、VIBES 等 Rug Pull 项目。LIBRA 做市商 Kelsier Ventures 也被被加密 KOL 称为「家族式犯罪集团」。

此外,之后米莱政府内部也被曝出有「内奸」,米莱的亲信就收取了 500 万美元促成了总统发推宣传 LIBRA 这件事。几百万美元换 1 个多亿,确实是笔划算的买卖。

入选理由

这可能是本篇中「字最少,事最大」的闹剧,当资本与政治联合上演「明抢」,我们还能相信谁?

离谱指数:★★★★★

Infini 员工为炒币监守自盗近 5000 万美元

事件经过

北京时间 2 月 24 日,稳定币数字银行 Infini 被盗,价值 4950 万美元的资金从 Morpho MEVCapital Usual USDC Vault 流出。事件发生之后,Infini 创始人 Christian 立刻站出来承认了被盗事实并且承诺即使出现最坏的情况也将全额赔付。

之后,Infini 团队在链上对黑客喊话,称已经掌握了大量黑客的信息,如果对方可以归还 80% 的资金(20% 作为白帽赏金),则将不对对方追责。随后的 2 月 26 日,Infini 团队在链上发出最后通牒,但黑客仍然没有任何动作。次日,Christian 表示就 Infini 黑客事件已在香港正式完成立案。

在仅不到一个月之后,Infini 就公布了诉讼文件,而作为被告的「黑客」,被证实实际是 Infini 团队中一名实力不俗的开发者,且颇受团队信任。

这名叫做 Chen Shanxuan 的技术工程师本来拥有用于管理公司及客户资金合约的最高权限,且在开发完成后本应转交权限的过程中,利用团队对其的信任,悄悄保留了自己控制的地址对合约的控制权限。所以所谓的黑客事件其实是一场监守自盗的闹剧

至于这名兄弟为什么要铤而走险,Infini 团队表示其在被盗事件发生后才发现 Chen Shanxuan 沉迷赌博,虽然年入百万仍然四处借钱开合约,随着网贷欠款越来越多,最终走向了不归路。据 Colin Wu 透露,Chen Shanxuan 此前可以说是一个分享技术知识的典范,最后沦落至此令人唏嘘。

入选理由

创业与投资不同,当从高大上的「认知变现」到「下地干活」,Web3 的创业者仍需磨练。还有一点:除非你天赋异禀,否则别碰合约。

离谱指数:★

UMA 大户操纵预言机结果强行「修改现实」

事件经过

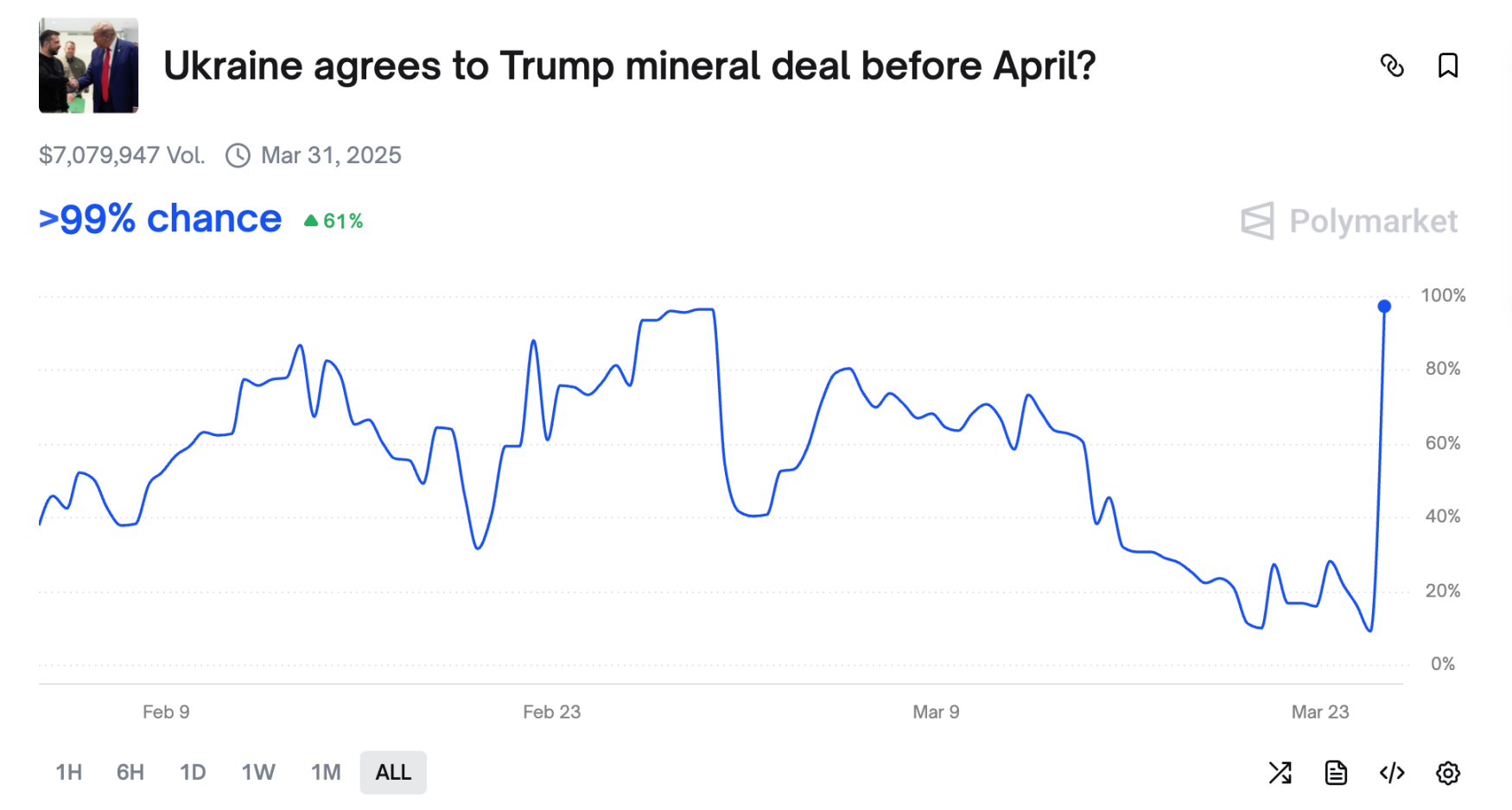

北京时间 2025 年 3 月 25 日,因美国总统大选红极一时的 Polymarket 上出现了一起预言机攻击事件。在「乌克兰是否会在 4 月之前同意特朗普的矿产协议」市场中,随着时间越来越接近截止日期,「Yes」的概率已经接近于 0,但却在 3 月 25 日晚突然反转,「Yes」的概率直接升至 100%。

至于反转的原因并不是泽连斯基服软了,而是一名参与这个 700 万美元市场的 UMA 大户利用自己持有的大量 UMA 强行修改了事实。X 用户 DeFiGuyLuke 解释(https://x.com/DeFiGuyLuke/status/1904804207452184622)了详细情况:

Polymarket 在需要事件结果时,会先提出数据请求,提议者会提交数据并缴纳保证金 750 USDC。提交请求后存在一段时间的争议期,如果其他人对结果有异议,提出异议、缴纳相等的保证金。最后由所有的 UMA 持有者共同投票,来决断是非。

在乌克兰矿产协议这个市场中,某个眼见自己要输钱的,手握 500 万枚 UMA 巨鲸向错误结果的一方投票。同时这种投票形成了示范效应,普通用户会担心无法与巨鲸对抗而同流合污,最终造成了这种局面。

Polymarket 官方在事后承认这是一个错误,但认为这是游戏规则一部分,拒绝修改结果。2025 年 8 月,UMA 引入白名单机制,仅允许 Polymarket 批准的实体提出解决提案,以减少恶意操纵,但这并未改变核心预言机,而是优化了治理流程。

入选理由

Polymarket 的做法可以被认为是去中心化的体现吗?作为新一代的真相机器,对预言机结果错误的无视更应被视为产品设计的缺陷。

离谱指数:★★★

TUSD 资金挪用迷案:是乌龙还是刻意为之?

事件经过

北京时间 2025 年 4 月 3 日,孙宇晨在香港举办了一个发布会,控诉香港信托机构 First Digital Trust 通过非法手段转移了 TUSD 的储备资金 4.56 亿美元,要求相关执法部门彻查此事,但香港法院驳回了孙宇晨的请求。而就在一个月前迪拜国际金融中心法院(DIFC)发布全球冻结令,冻结与 TrueUSD 稳定币发行方 Techteryx 相关的 4.56 亿美元资产。法院认为其存在违反信托的证据,并下令进行全球冻结以保护资产。

有关这件事情的真相众说纷纭,目前还没有完全的定论,笔者在此提供一些公开消息。

Techteryx Ltd.(一家注册于英属维京群岛的投资公司)于 2020 年底收购了 TrueUSD 稳定币业务,此后负责其运营和管理。基于历史业务延续性,原位于美国加州的运营方 TrueCoin 被保留继续负责储备金管理以及银行层面的执行与协调工作,TrueCoin 也选定了香港信托机构 First Digital Trust 为储备资金的托管方。公开信息显示,孙宇晨是 Techteryx 的「亚洲市场顾问」,但在 DIFC 2025 年的文件和听证会中,孙宇晨被描述为 Techteryx 的「ultimate beneficial owner(最终受益人)」。从某种程度上说,孙宇晨拥有对 Techteryx 的控制权,但并非明面上的法定代表人。

但就是这种表里不一的身份为之后所发生的事埋下了伏笔。从孙宇晨的视角,这件事情是这样的:

2021 至 2022 年,TrueCoin 以受托人身份与其选定的中国香港信托机构 FDT 及 Legacy Trust 的部分管理层形成紧密关系,并与开曼群岛注册基金 Aria Commodity Finance Fund(下称「ACFF」)形成了资金外流的隐秘通道。孙宇晨表示,「在掌握储备金指令与资金路径的情况下,未经授权伪造文件、捏造投资指令,并多次向银行提交带有虚假陈述的材料。」

法庭证据显示,双方并未按照约定将储备金存入合规的开曼群岛注册基金 ACFF,而是违规将高达 4.56 亿美元的法币储备,分批次秘密转移至迪拜 Aria DMCC 公司。Aria DMCC 为 ACFF 实际控制人英国公民 Matthew Brittain 的妻子在迪拜成立的私人全资控股公司,而 Aria DMCC 并非 Techteryx 授权的投资对象。

简单来说,孙宇晨认为 Techteryx 要求 FDT 将储备资金转入 ACFF,但 FDT 却把钱转到了 Aria DMCC,涉嫌挪用资金。

但从 FDT 的视角,事情是这样的:

Techteryx 的一名「授权代表」Lorraine 要求 FDT 将储备资金转到 ACFF,之后 FDT 认为其没有收到 Techteryx 真正实际控制人的要求,出于对于这名代表的不信任,其没有将资金转入 ACFF,而是转入了 Aria DMCC(这个逻辑我也没想明白,两家公司实际上是有千丝万缕联系的,但 FDT 没有多做解释),并且表示现在的资金配置方式也能获得收益。

重点是,FDT 认为他们从来没有侵吞这些资金,只要 Techteryx 的实际控制人发话,就能把这些钱拿回去。关键是,你得证明你是 Techteryx 的实际控制人。

想要拿回这 4.56 亿美元的方法有二,要么 Techteryx 明面上的通过 KYC 的实际控制人出面要求 FDT 取回资金,如果没有这样一个人,那就需要证明 FDT 的行为违法违规,从而让法院要求 FDT 撤回资金。但鉴于孙宇晨的特殊身份,只能采用后者的方式进行。

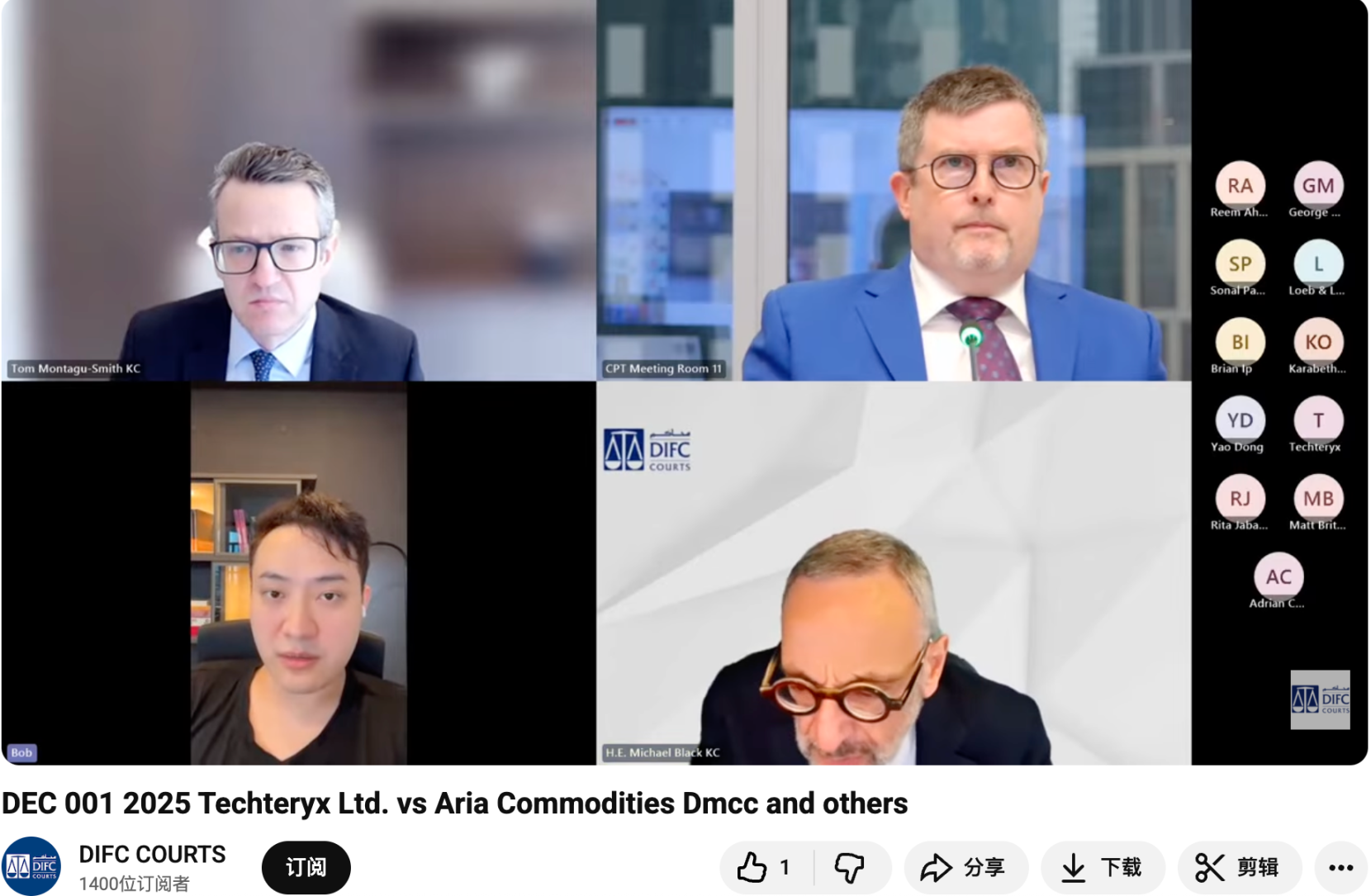

这个事件中最有意思的事情是,在一次孙宇晨因自称不是 Techteryx 法人而没有参加的,有关 Techteryx 的线上法院听证会上,突然出现了一位叫 Bob 的人,然后法官要求他打开摄像头,结果摄像头一打开,Bob 居然就是孙宇晨。

这样的行为就引发了社区的猜测:即使 FDT 确实没有按照规定转钱,但孙宇晨就是不愿意担任 Techteryx 明面上的法人,也就是不想承担法律上的责任的行为也让很多人开始质疑是否真的有挪用资金这件事。也有很多人调侃称,终于轮到孙哥维权了。

入选理由

可能 FDT 也是利用了不清不楚的关系挪用资金,也或许就如他们所说这么做反而是为了资金安全,我们只能等待最终的结果。世事无常,有时候聪明反被聪明误。

离谱指数:★★★★

Zerebro 联创 Jeffy「假死」风波

事件经过

北京时间 2025 年 5 月 4 日,22 岁的 Zerebro 联创 Jeffy Yu 在 pump.fun 平台进行了一场直播,但之后多名社区用户声称,「Jeffy Yu 在直播中自杀,Jeffy 抽完一支烟后,用枪对准颈部扣动扳机,随后画面陷入死寂」。

相关视频迅速在推特上传播,很多社区用户表达了惋惜之情,但由于视频真实性一直没有得到证实,所以也有部分用户开始质疑这是否是营销噱头。

质疑的原因之一,就是 Jeffy Yu 在直播之前发布了一篇关于「Legacoin」的文章。Jeffy 在文章中提出「遗产模因币」Legacoin(源自 legacy memecoin)概念,核心在于开发者承诺仅买入、不卖出相关资产,并在离世后将其永久锁定于区块链,以此实现「数字遗产的永恒存续」。而就在直播当日,名为 LLJEFFY 的代币于 pump.fun 平台上线。

5 月 5 日,讣告平台 Legacy 发布了一则关于 Jeffy Yu 去世的消息,虽然没有指名道姓,但社区基本默认这个 Jeffy Yu 就是 Zerebro 联创。次日,Jeffy Yu 的 Mirror 账号也出现了一篇被某些条件「触发」而自动发布的文章,内容则是经典的「如果你看到这篇文章,证明我已经死了……」云云。

除了这个经典的开头之外,文章内容还包括了被 Jeffy Yu 称为其最后的艺术品的,代号为 LLJEFFY 的「Legacoin」,以及 Jeffy 表达的其对金钱的厌恶:「一旦我在网上变得有点富有、有点出名,一切有意义的东西都崩塌了——朋友、家人、恋爱关系、联合创始人。一切都变得不再纯粹。」

唏嘘之下,反转悄然降临,KOL Irene Zhao 和 DeFi 开发者 Daniele 先后曝光了 Jeffy 的「假死计划」。据一封泄漏的信件,Jeffy 称其长期遭受一名前合伙人(ex-partner)的骚扰和电信诈骗,之后又被另一人盯上并实施勒索。Jeffy 在信中表示其个人住址和电话号码频繁被公开,严重危及人身安全。而这些恶劣行为中还夹杂着针对其种族、性别认同及个人成就的各类仇恨言论。

Jeffy 虽然想直接退出,但担心公开宣布导致币价暴跌之后会招致更严重的后果,所以选择演一出「假死」的戏码淡出公共视野。事后,Lookonchain 发现在 5 月 7 号时,一个可能与 Jeffy Yu 相关的钱包出售了 3555 万枚 ZEREBRO,获得 8572 枚 SOL(约 127 万美元),随后将其中 7100 枚 SOL(约 106 万美元)转移至 LLJEFFY 开发者钱包(G5sjgj 开头地址)。所以这个事儿究竟是 Jeffy 真的被搞怕了从而想通过假死离场,还是说只是想套现后更安全地消失还真的不好说。

入选理由

背叛、威胁,这些事情在商业世界并不是新闻。当你参与了一个没有任何保障的赌局的时候,你应该知道这是一个生死有命,富贵在天的游戏。

离谱指数:★★★

Sui「冻结」黑客资金引发「中心化问题」讨论

事件经过

北京时间 2025 年 5 月 22 日,Sui 上最大的 DEX Cetus 因数值精度的代码问题被攻击者虚构流动性盗走了 2.23 亿美元。被盗后仅两小时,Cetus 就发文称冻结了 1.62 亿美元被盗资金。

至于资金怎么「冻结」的,Sui 官方中文账号做出了解释:Sui 需要 2/3 的节点投票同意交易,交易才可以被执行。所以这一次 Sui 网络中 2/3 的节点选择性忽略了黑客地址的交易,使得黑客无法将这些资金转出。除了跨链到以太坊价值约 6000 万美元的资金,黑客留在 Sui 上的资产直接被节点硬生生截留在了网络上。

那被盗的资金要怎么拿回来呢?Solayer 的工程师 Chaofan 表示 Sui 团队已经在要求每一个 Sui 上的验证者部署一段修复代码,以便让他们可以在攻击者不签名的情况下「追回」这笔钱。但 Sui 验证者反馈表示并没有收到「要求」,Chaofan 后续也表示 Sui 验证者目前没有部署相关代码。

入选理由

在此讨论中心化与去中心化意义不大,我们真正想问的是,如果我在 Sui 上转错了资金,Sui 也会如此帮我找回吗?这或许是「破例」之后更值得思考的问题。

离谱指数:☆

Conflux 「反向借壳上市」失败

事件经过

北京时间 2025 年 7 月 1 日,香港上市公司领航医药生物科技有限公司发布公告称,其已与 Northwestern 基金会(卖方)及 Conflux 签订谅解备忘录,内容有关收购目标公司全部股权的潜在收购事项,前提为目标公司按照与公司的协议完成收购 Conflux 资产。Conflux 资产为有关 Conflux 区块链及相关技术的若干资产及 / 或 Conflux 业务,将由领航医药生物科技有限公司厘定。

看着有点绕,简单点说就是 Conflux 想要反向借壳上市。为什么说是反向呢?是因为借壳上市一般是想要上市的公司收购上市公司,而到了 Conflux 这儿操作反了过来。

或许有人会问,为什么你会认为这是借壳上市不是单纯的收购呢?因为早在 4 月初,领航医药就发布公告称龙凡博士和伍鸣博士成为了该公司的执行董事,而这两位就是 Conflux 的创始人。8 月 21 日领航医药公告称拟发行 1.45 亿股配售股份净筹 5882.5 万港元。公司拟将配售事项所得款项净额全数用作集团发展区块链技术业务资金。之后 9 月底,领航医药生物科技又改名为星太链集团。

理论上说,乘上了 Web3 的东风,股价应该会原地起飞。好消息是确实飞了一段时间,坏消息是之后跌的更多。9 月 12 日,之前融资近 6000 万的计划因为没能在 9 月 11 日前满足某些条件而告吹,股价大跌。9 月底的改名之后,股价跌得更狠……

2025 年 11 月 17 日开市前,星太链公告称遭香港联交所勒令于 11 月 26 日停牌,原因是联交所质疑该公司未能满足持续上市资格。

入选理由

港交所用「未能满足持续上市资格」为由要求停牌已经算是给足了面子,虽然香港确实大力支持 Web3 的发展,但如此行为确实有种把别人都当傻子的味道了。

离谱指数:★★★★

「下周回国」贾会计来币圈圈钱了

事件经过

北京时间 2025 年 8 月 17 日,贾跃亭旗下一个季度收入十几万美元,净亏上亿的电动车公司法拉第未来(Faraday Future,以下简称 FF)宣布推出「C10 指数」和基于该指数的「C10 财库」产品,正式进军加密资产领域。

C10 指数追踪全球前十大加密货币(不含稳定币),包括比特币、以太坊、Solana 等主流资产。C10 财库采用 80% 被动 +20% 主动的投资模式,确保可持续回报。据其官网显示,FF 将会使用专项融资资金来专门购买加密资产,即 FF 要向市场募资并使用该资金购买加密资产。第一阶段目标是在获得必要资金后,购买 5-10 亿美元加密资产,首批 3000 万美元配置最早预计本周启动。长期愿景是扩展至 100 亿美元规模,通过质押收益实现复利增长。

在官宣了之后,贾老板不出意外真的融到了钱,甚至还通过法拉第投资了 Qualigen Therapeutics, Inc. 3000 万美元帮助其向加密资产转型,贾老板亲自担任顾问。

就在不久前,贾老板甚至宣布与特斯拉达成合作,法拉第未来的新车型可直接接入特斯拉超充网络,之后甚至发文称愿与特斯拉在 FSD 技术上展开全面合作。

入选理由

只能说贾会计确实有点东西,一般人学不来,这事儿不给五星单纯是为了给米莱一个面子。

离谱指数:★★★★☆

USDX 项目方「借钱套现」,创始人「战绩斐然」

事件经过

北京时间 2025 年 11 月 5 日,在 xUSD 因为第三方「策展人」遭受巨额损失之后,X 名为 0xLoki 的用户发现,原本只需要等待一天即可赎回铸造 sUSDX 用的稳定币,但有地址无视年化 30% 以上的利率,把 Euler 上所有能用 USDX 和 sUSDX 作为抵押品借其他稳定币的池子都抽干了。

USDX 由 usdx.money 发行,该项目于去年年底宣布以 2.75 亿美元估值完成了 4500 万美元融资。USDX 的机制与 USDe 几乎无异,唯一的区别就是,USDX 也会在山寨币上执行 Delta 中性策略,用项目方的原话说,是为了获得更高的收益。

经过笔者的调查,有两个可疑地址从 10 月下旬就开始接收大量的 USDX 与 sUSDX 并通过借贷、DEX 交易等方式把链上所有能变现渠道的流动性一扫而空,给很多借贷平台留下了坏账。问题正如上一段所说,这个稳定币明明只需要等待一天即可赎回原本投入的 USDT。

更可怕的是,两个可疑地址中有一个与 USDX 发行方 usdx.money 创始人 Flex Yang 直接相关,创始人都在着急套现,除了项目已经出现问题,还有其他解释吗?就在笔者文章发出后的当晚,USDX 开始出现严重的脱锚,验证了项目确实出现了问题的论断。之后的 11 月 8 日,Stables Labs 发推称将根据现有资源情况帮助受损失的用户,并开放了登记渠道,但这也是 Stables Labs 至今为止的最后一条推文,实质进展如何,我们不得而知。

继续深挖,Flex Yang 同样也是贝宝金融与 HOPE 的创始人。贝宝在 2022 年的熊市中也遇到了与很多机构同样的资不抵债的问题,之后陷入漫长的重组过程,时至今日仍然前途未卜;至于 HOPE 则是在旗下借贷产品遭到攻击之后一蹶不振,虽然并没有说真正意义上的跑路,但也慢慢淡出了市场。

入选理由

人们从历史中得到的最大的教训就是,人们从来不会从历史中吸取教训。创业者屡败屡战,但多次出现风控方面的问题,究竟是真的被盯上了,还是监守自盗?

离谱指数:★★★

Berachain 给了风投「原价退出」条款

事件经过

北京时间 11 月 25 日,据 Unchained 报道,其所披露的文件显示,Layer1 项目 Berachain 在 B 轮融资中向 Brevan Howard 旗下的 Nova Digital 基金提供了一项特殊的退款权条款,使得后者 2500 万美元的投资近乎「零风险」。

Berachain 联合创始人 Smokey the Bera 在随后的回应中否认报道的准确性,强调 Brevan Howard 仍是项目最大投资者之一,其投资涉及多项复杂商业协议,且 Nova Digital 的条款是为防范代币未能成功上线而设。Berachain 方面提及,Nova 基金在融资前主动接洽并提议领投该轮次,其投资基于统一条款。此外,引发争议的附带协议是为了满足 Nova 合规团队的要求,而非为确保投资本金不受市场损失。Brevan Howard 目前仍是 Berachain 最大的代币持有人之一,并且在市场波动中持续增持 BERA,而非如报道所暗示的已退出。

根据披露的文件,Nova Digital 在 2024 年 3 月向 Berachain 投资 2500 万美元,以每枚 3 美元的价格购买 BERA 代币。作为 B 轮融资的联合领投方,该基金通过一份签署于 2024 年 3 月 5 日的侧边协议,获得了在 TGE 后一年内要求全额退款的权利。这意味着,若 BERA 代币价格表现不佳,Nova Digital 可在 2026 年 2 月 6 日前要求 Berachain 返还全部投资本金。

争议的另一个焦点在于,Berachain 是否应向其他 B 轮投资者披露这一特殊条款。两位匿名 B 轮投资者表示,项目方未告知他们 Nova Digital 拥有退款权。律师指出,这可能违反证券法中对「重大信息」的披露要求。

入选理由

如果 Berachain 的这个骚操作如果是真实的,那基本可以认定为利用 Nova Digital 的名气炒作,与诈骗无异。所以你还天真的认为 Web3 不应该接受强监管吗?

离谱指数:★★★

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。