作者:imToken

如果你经常在 Base、Arbitrum 或 Optimism 之间跨链穿梭,你一定感受过一种微妙的「割裂感」。

虽然单条 L2 交易已经几乎是秒出结果,但当你试图将资产从链 A 跨到链 B 时,却往往需要经历数分钟甚至更长的等待,这并不是 L2 本身不够快,而是因为在传统流程中,一笔涉及跨层、跨链的交易,必须经历一条冗长而严谨的路径:

L2 排序器排序 → 提交到 L1 → L1 达成共识并最终确定(Finality),总而言之,在当前的以太坊架构下,L1 的最终确定通常需要两个 Epoch(约 13 分钟),这对于安全无疑是必要的,但对于互操作(Interop)来说,却显得过于迟缓。

毕竟如果按照以太坊的宏大愿景中,未来将存在成百上千条 L2,它们不应是彼此隔绝的执行孤岛,而应像一个整体那样协同工作,那么问题的关键就在于能不能尽量缩短这个等待时间。

也正是在这一背景下,以太坊 Interop 路线图在加速(Acceleration)阶段,明确提出了三项高度协同的改进方向:快速确认规则(Fast L1 Confirmation Rule)、缩短 L1 Slot 时间(Shorter L1 Slots)、压缩二层网络结算周期(Shorter L2 Settlement)。

可以说,这并不是零散的优化,而是一场围绕「确认、节拍与结算」的系统性重构。

一、快速确认规则:在 Finality 之前,先给系统一个「可信答案」

众所周知,在现在的以太坊架构下,主网的出块间隔约 12 秒,验证节点会在每一个 slot 对当前链状态进行投票,而最终确定(Finality)则滞后于多个 slot 之后。

简言之,即便交易已经被打包进区块,系统仍需等待较长时间,才能确信它不会被重组或回滚,且目前交易最终被认为是不可被回滚之前大概需两个 Epoch(约 13 分钟),而对绝大部分链上金融场景来说,13 分钟无疑太长了。

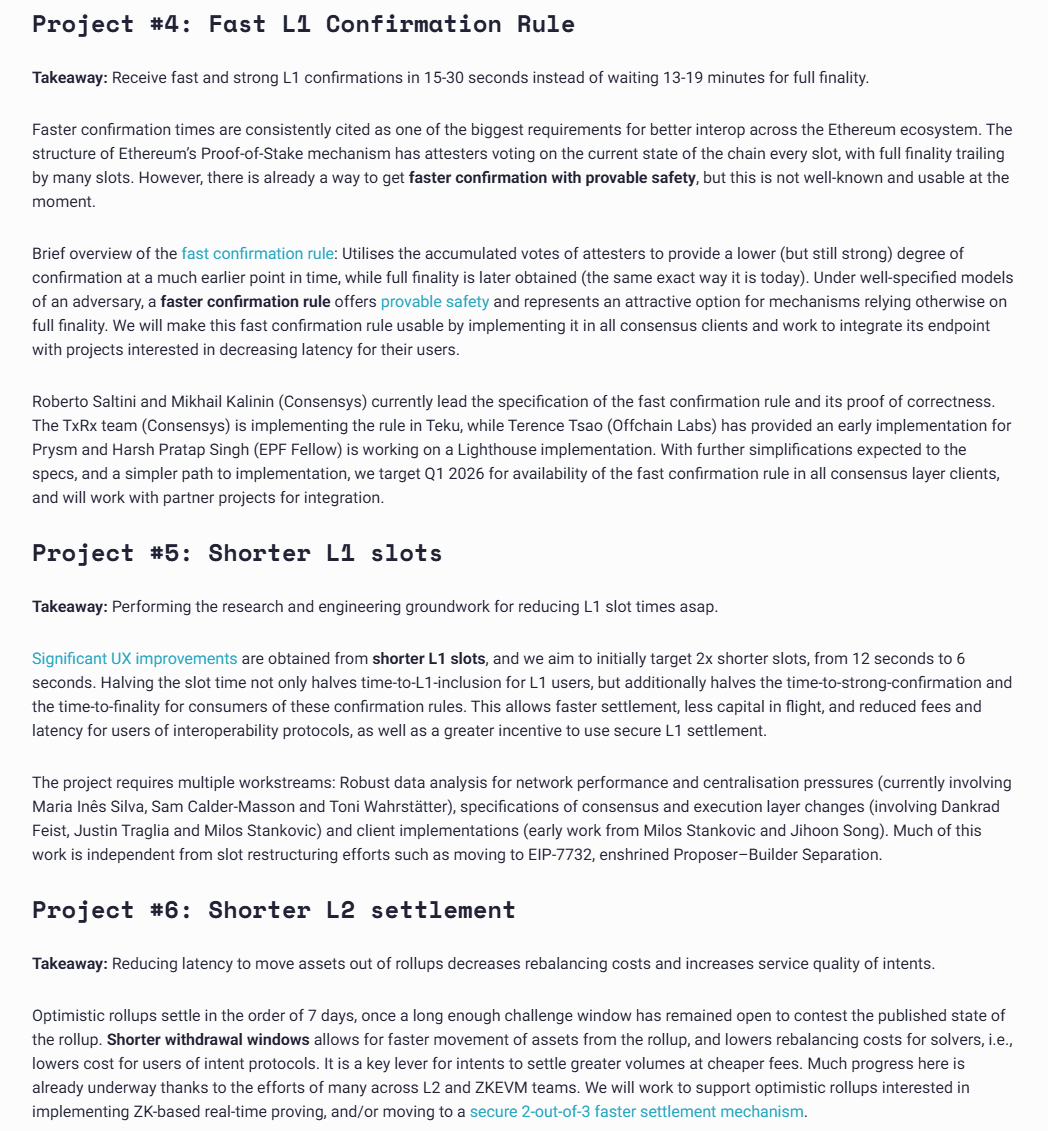

那我们能不能在 Finality 到来之前,能不能给应用和跨链系统一个「足够快、且足够可信」的确认信号?这也是以太坊在 Interop 路线图中明确提出的 Project #4:Fast L1 Confirmation Rule(快速确认规则)要做的事。

其核心目标非常直接,就是让应用与跨链系统在 15–30 秒内,获得一个「强而可验证」的 L1 确认信号,而不必等待完整 Finality 所需的 13 分钟。

从机制上看,快速确认规则并不是引入新的共识流程,而是重新利用以太坊 PoS 体系中每个 slot 都在发生的 attester 投票,当某个区块在早期 slot 中已经累积了足够多、足够分散的验证者投票时,即便尚未进入最终确定阶段,也可以被视为「在合理攻击模型下,极不可能被回滚」。

说白了,这种确认等级并不取代 Finality,而是在 Finality 之前,提供一个被协议明确承认的强确认,对 Interop 而言,这一点尤为关键:跨链系统、Intent Solver 与钱包不再需要盲等最终性确定,而是可以在 15–30 秒内,基于协议级确认信号安全地推进下一步逻辑。

目前像 Based Rollup 叙事所大力推动的预确认(Preconfirmation)就算是这一方向现阶段承担重要的工程过渡角色,它的逻辑也很简单,恰如字面之意,想象一下:

当我们在 12306 购买火车票时,一旦选定行程下单(进行签名交易),订票系统会先给到一份预确认信息,告诉你购票行为(对应每笔交易)已经被接受并且正在进入后续的确认流程,此时我们就可以开始规划行程、准备行李等,而只有当车票最终确认车厢及座位(交易发布至 L1)后,我们才算正式完成了购票订座的交易。

简言之,在 Based Rollup 中,预确认就是在交易被正式提交到 L1 进行确认之前,就承诺将交易包含在区块中,等于先给用户一个初步的确认信号,让用户知晓交易已经被接受并且正在处理中。

「我先给你一个强烈的口头承诺,最终确定稍后补票」,通过这种分层确认的逻辑,以太坊 Interop 路线图实际上是在「安全」与「速度」之间精细地切分出了不同的信任等级,构建出尽量丝滑的互操作体验。

二、缩短 L1 Slot:加速以太坊的「心跳」周期

与快速确认规则这种「共识层面的逻辑重构」相配套的,是一项更底层、更具物理意义的改动——缩短 Slot 的大小。

如果说快速确认是在共识最终达成前先「打欠条」,那么缩短 L1 Slot 时间则是直接缩短账本的「清算周期」。在 Interop 路线图中,Project #5 的阶段性目标非常明确:将以太坊主网的 Slot 时间从现有的 12 秒压缩至 6 秒。

这看似简单的「减半」,实则会引发整条链的连锁反应,这也很容易理解,slot 越短,意味着交易被纳入区块、被分发验证、被观测确认的节奏都更快,从而带来整体协议层更低的延迟。

而对用户现实体验的影响也很直接,包括 L1 交互(如 ETH 转账)感知确认更快、L2 的状态提交到 L1 的节奏更紧凑,甚至于更短 slot 与快速确认规则结合,基本形成「近乎实时的链上反馈」,这也意味着生态中的 DApp、钱包和跨链协议能更好地构建「秒级确认体验」。

对于跨链互操作协议而言,时间的缩短也意味着资金利用率的飞跃, 目前跨链桥或做市商在处理不同链间的资产调度时,必须承担数分钟甚至更长的「资金在途」风险。为了对冲这段时间的波动风险,他们不得不收取更高的手续费。

而当 L1 结算周期缩短、资金周转速度翻倍时,这种在途资本的占用将显著减少。结果是显而易见的,即更低的摩擦成本、更低的用户手续费,以及更短的到账延迟,这将极大地激励开发者和用户重新回归安全的 L1 结算层,而非依赖脆弱的第三方中继。

当然,将「心跳」频率提高一倍绝非易事。以太坊基金会的多个工作组正同步推进这项复杂的工程:

- 网络分析: 研究团队(包括 Maria Silva 等研究员)正在进行严密的数据分析,以确保更短的 Slot 不会因为网络延迟导致严重的重组(Reorg)风险,或给带宽较差的家庭节点带来中心化压力;

- 客户端实现: 这是一个涉及共识层与执行层全方位的底层重构。值得注意的是,这项工作独立于 EIP-7732(原生质押者 - 构建者分离 ePBS),这意味着无论 ePBS 的进度如何,心跳加速计划都能独立推进;

总的来看,当 6 秒 Slot 与快速确认规则结合,以太坊有望真正拥有「近乎实时的链上反馈」,让生态中的 dApp 和钱包能够构建出前所未有的秒级确认体验。

三、缩短 L2 结算周期:让资产「即提即走」

在 Interop 路线图中,Project #6:Shorter L2 Settlement 是最具争议、但也最具想象空间的一环。

在当前架构下,Optimistic Rollup 通常依赖长达 7 天 的挑战期,而即便是 ZK Rollup,也受限于证明生成与验证节奏,实事求是地讲,这种设计在安全上无可挑剔,但在互操作层面,却带来了一个现实问题:

资产与状态被“时间锁”在链与链之间。这不仅抬高了跨链成本,也显著增加了 Solver 的再平衡负担,最终反映为更高的用户费用。因此缩短结算周期被视为 Interop 能否规模化落地的关键杠杆之一,当前主要的工程方向包括:

- ZK 实时证明:随着硬件加速与递归证明成熟,证明生成时间正在从分钟级压缩到秒级;

- 更快的结算机制:例如引入安全的 2-out-of-3 结算模型;

- 共享结算层:让多条 L2 在统一结算语义下完成状态变更,而不是「提币—等待—充值」;

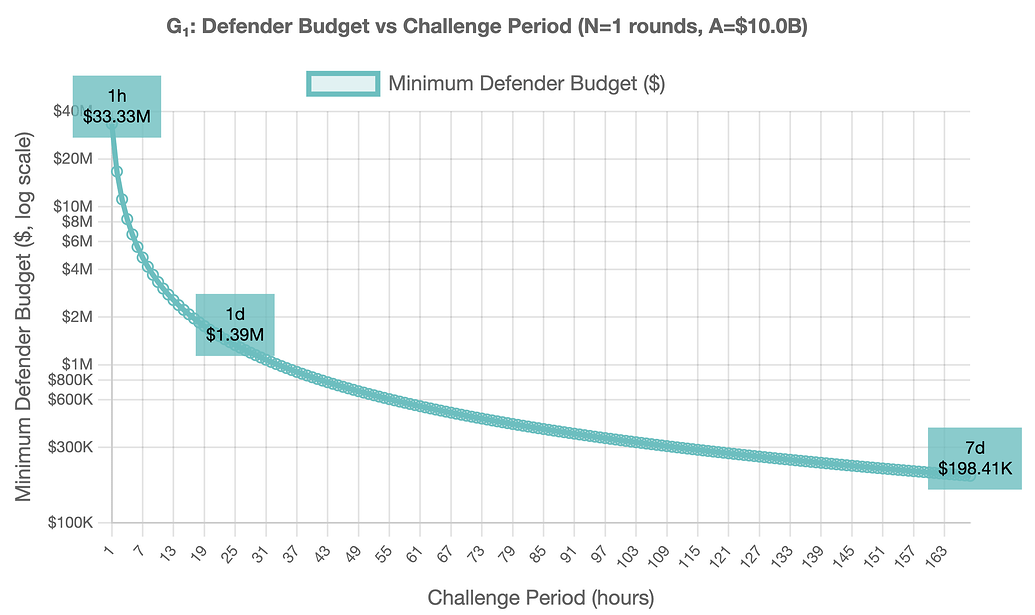

当然,在 Interop 的讨论中,一个绕不开的核心疑问在于,如果为了实现更快的跨链确认,将结算挑战期从传统的 7 天压缩到 1 小时,是否会给攻击者留下作恶的空间?

理论上讲,这里的担忧并非空穴来风,与「强审查」(验证节点集体作恶)不同,现实中更值得警惕的,恰恰是这种由区块构建者主导的软审查攻击:攻击者并不需要控制共识,只需在出价上持续压制防御者,让关键交易无法上链。

有趣的是,目前唯一关于此类情景的系统性经济学分析来自 Offchain Labs 在 2025 年 2 月发表的论文《Economic Censorship Games in Fraud Proofs》,该论文构建了三种模型,从最悲观到相对乐观,分别假设:

- G¹ 模型:区块内容完全由出价最高的一方决定;

- G¹ₖ 模型:部分验证者始终本地构建区块;

- Gᵐ 模型:多个验证者共同决定区块内容,只要其中一方选择防御者交易即可。

在现实工程中,由于验证者可能选择空槽(miss slots),某些设计甚至会退化为更悲观的 G¹ 情形,因此论文选择从最坏情况出发进行分析。

基于这一前提,研究者提出了一种极具现实意义的防御思路——「以小博大」的延时防御机制,其核心逻辑在于防御者拥有「一键延时」的权利,即防御者并不需要在短时间内完成全部复杂的查错流程,而只需要成功提交一笔关键交易。

这笔关键交易的作用非常明确,一旦上链,便会自动将挑战期从 1 小时延长回传统的 7 天。譬如当防御者发现 L2 状态异常时,他不需要在 1 小时内完成所有复杂的查错流程,他只需要成功向 L1 提交一笔特殊的交易,这笔交易就像拉响了防空警报,能瞬间将挑战期自动延长回传统的 7 天。

这也意味着攻击者将被迫进入一场极不对称的消耗战,为了阻止这笔交易上链,攻击者必须在每一个区块中持续支付高于防御者的优先费,并且这种对抗需要维持完整个挑战期。

论文给出的量化结果也非常直观,根据测算,如果一个实力雄厚的攻击者准备花 100 亿美元进行持续审查攻击,那么:

- 在 1 小时的窗口期,防御者只需备好 3300 万美元的 Gas 预算即可反击;

- 如果成功触发延时机制,将挑战期拉长至 7 天,防御者的反击成本甚至会骤降至 20 万美元左右;

换言之,这是一个极为关键的结构性优势:攻击者的成本是线性叠加的,而防御者只需要完成一次成功上链。

正是这种悬殊的攻击成本 / 防御成本比(Cost to Attack vs. Cost to Defend),确保了即便结算周期被大幅压缩,以太坊在经济安全性上依然具备强鲁棒性。

而对于 Interop 而言,这一点也至关重要,相当于快速确认与更短结算周期,并不必然以牺牲安全为代价,也意味着在合理的制度设计下,秒级跨链与经济安全未必不可以同时成立,至少为 Interop 实现秒级跨链提供了最坚实的底层信心。

写在最后

可能有人会觉得,为什么要费尽心思去优化这几秒钟、几分钟的延迟?

在 Web3 的极客时代,我们习惯了等待,甚至认为「等待」是去中心化必须支付的溢价。但在 Web3 走向大众的路上,用户不应该、也不需要去关心自己是在哪条链上操作,更不应该去计算 L1 的最终性逻辑。

快速确认、6 秒心跳、以及不对称的防御机制,本质上是在做一件事情——将「时间」这一变量从用户的感知中抹去。

还是近期笔者老生常谈的一句话:技术最好的形态,就是让复杂性在极速的确认中彻底消失。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。