Author: AJC, Messari Corporate Research Manager

Translation: Tim, PANews

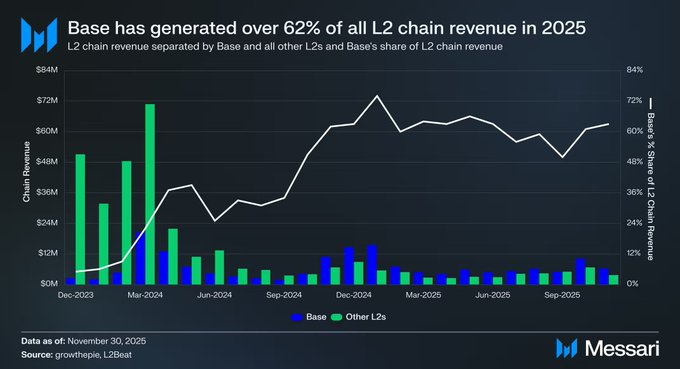

In 2025, Base further solidified its leading position in Ethereum L2 across various data metrics. Among these, revenue is the most indicative of its dominance within the entire L2 ecosystem.

Although total L2 revenue has significantly declined from its peak in 2024, Base continues to dominate the L2 market. In December 2023, Base's on-chain revenue was $2.5 million, accounting for only 5% of the total L2 revenue of $53.7 million. A year later, Base's on-chain revenue grew to $14.7 million, representing 63% of the total L2 revenue of $23.5 million in December 2024. This trend continued into 2025, with Base achieving $75.4 million in revenue so far this year, making up 62% of the total L2 revenue of $120.7 million.

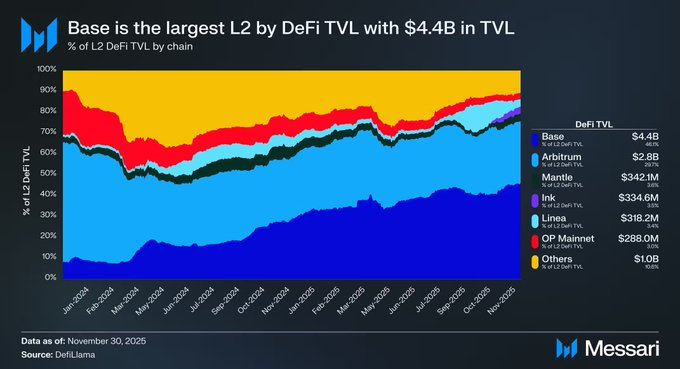

Base's competitive edge is not only reflected in revenue; its DeFi TVL has also become the leader in the L2 space. After surpassing Arbitrum One in January 2025, Base currently holds a DeFi TVL of $4.63 billion, accounting for 46% of the entire L2 market. Notably, Base's DeFi TVL share has steadily increased throughout 2025, rising from 33% at the beginning of the year to its current level.

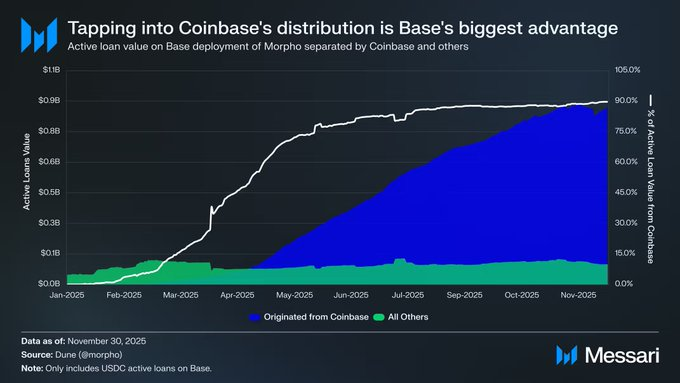

The biggest advantage of Base compared to other L2 solutions lies in its distribution channels, an advantage that speaks for itself. According to Coinbase's latest 10-Q filing, it had 9.3 million monthly active trading users in the third quarter, allowing Base to directly reach a large and onboarded user base that other L2 networks find hard to match. While most L2s must rely on incentives or third-party integrations to acquire users, Base benefits from its direct connection with the largest centralized exchange in the U.S., giving it a natural distribution advantage.

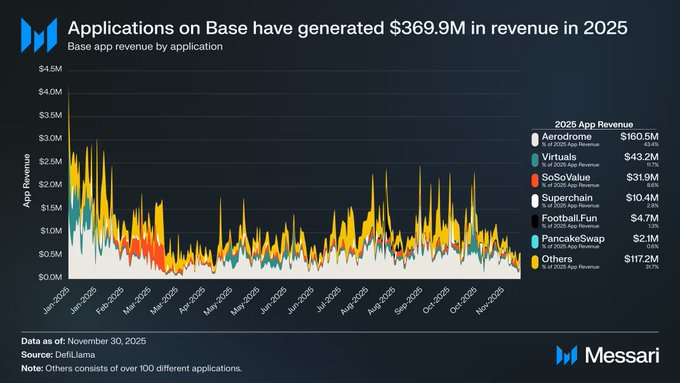

Base has also stood out due to the scaled development of applications within its ecosystem that create real value. So far this year, applications in the Base ecosystem have generated $369.9 million in revenue. Notably, application revenue is primarily concentrated in Aerodrome, which contributed $160.5 million, accounting for 43% of total application revenue. However, the leading DEX on Base is not the only successful application in 2025.

The AI agent launch platform Virtuals has achieved $43.2 million in revenue, accounting for 12% of total revenue from Base ecosystem applications; while the recently launched sports prediction application Football.Fun has also generated $4.7 million in revenue. These figures indicate that a diverse revenue-generating product portfolio has formed on Base, and ecosystem activity does not rely on a single application or use case.

This distribution advantage is best exemplified in the collaboration between Coinbase and Morpho. This partnership allows Coinbase users to borrow USDC directly on the platform using crypto assets as collateral. While the user experience is embedded within the Coinbase website, collateral management and loan execution are completed on-chain through Morpho's deployment on Base. This lending product has been launched for less than a year, but its adoption rate is already quite high.

Coinbase users have applied for $866.3 million in loans through Morpho, currently accounting for 90% of active loans on the Morpho network on Base. During the same period, Morpho's TVL on Base has grown by 1906% year-to-date, rising from $48.2 million to $966.4 million. Base's distribution advantage means that on-chain activity can become a byproduct of Coinbase product usage. This user acquisition channel is not available to other L2 networks, leading them to primarily rely on incentive programs to attract liquidity and users to their DeFi ecosystems.

Despite the continuous growth of Base's DeFi TVL and stable on-chain revenue since 2025, user behavior on-chain has begun to change. According to daily filtered user statistics (referring to independent addresses that conduct at least two transactions on specific contracts within a single day and consume more than 0.0001 units of gas fees), USDC has now become the most widely used application on the Base chain, with an average daily user count of 83,400 in November, a 233% increase from 25,100 users in the same period last year.

At the same time, retail interaction with DEXs has significantly decreased. The average daily filtered user counts for Uniswap and Aerodrome have dropped by 74% and 49%, respectively. However, more notably, DEX trading volume on the Base chain reached an all-time high in 2025, indicating that activity on Uniswap and Aerodrome is increasingly concentrated among larger traders with higher transaction volumes.

Key Layout for Base in 2026: Base App

Leveraging Coinbase's natural advantages, Base has established a luxurious condition that is hard for other chains to match. It has built a solid moat in terms of user base, liquidity, and application ecosystem. Base leads in revenue among L2 networks, possesses the deepest DeFi TVL in the field, and can continuously attract on-chain user traffic from Coinbase. In other words, unlike most L2 networks that are still struggling to establish themselves or attract users, Base has already crossed this developmental stage.

With this moat, Base's focus has shifted beyond core L2 network metrics to the creator economy. If this market opportunity can be seized, the potential total market size is expected to approach $500 billion. To capture this market direction, Base's core strategy focuses on the Base App. This "super app" aims to integrate asset custody, trading, social, and wallet core functions into one. Unlike most crypto wallets, the Base App features several innovative functions that go beyond basic asset management:

- Social information streams based on Farcaster and Zora;

- Direct messaging and group chat features via XMTP (supporting interactions with other users and AI agents like Bankr);

- Built-in mini-app discovery features, allowing users to access and use various mini-apps directly within the Base App.

The Base App launched its internal beta in July, initially limited to whitelisted users. Nevertheless, the Base App has still achieved significant growth. A total of 148,400 users have created accounts, with a 93% month-over-month increase in registrations in November. User retention rates are also strong, with weekly active users reaching 6,300 (a 74% month-over-month increase) and monthly active users reaching 10,500 (a 7% month-over-month increase). Although not explicitly confirmed, the Base App is likely to conclude its internal testing phase by the end of this month, paving the way for a full public launch before the new year.

The most important goal of the on-chain economy that Base aims to build is to enable creators to profit directly from the content they create. Content created within the Base App will be tokenized by default (though users can opt out of this feature), transforming each post into a tradable market. Creators can earn a share of the transaction fees generated from their content, which is 1% of each transaction.

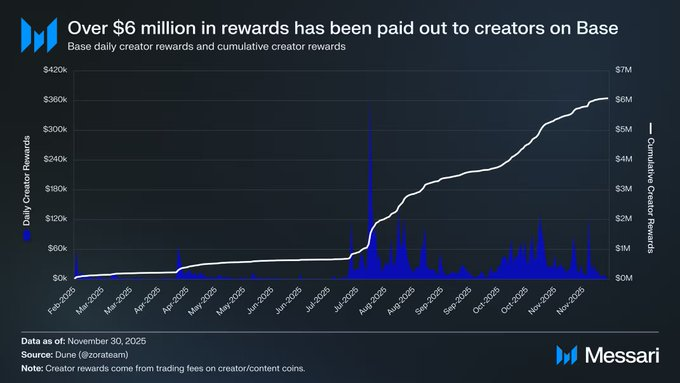

Looking ahead, users will also be able to directly issue creator tokens for their accounts within the Base App, opening up another monetization avenue (this feature is currently in early testing). At the technical level, both creator tokens and content tokens are tokenized based on the Zora protocol. So far, creators have earned a total of $6.1 million through Zora's tokenization model, with an average monthly payout of $1.1 million since July.

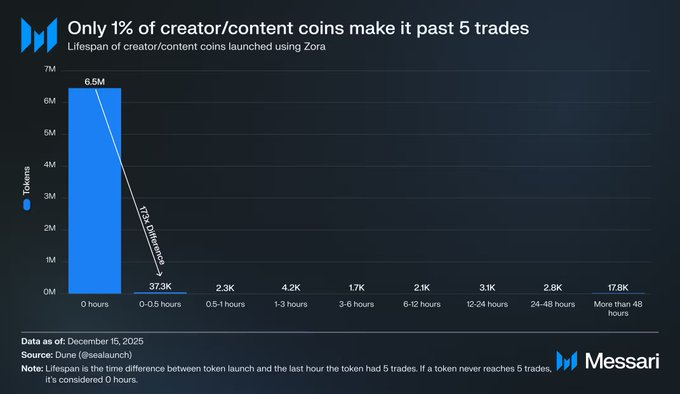

As of now, the total number of creators and content tokens tokenized through Zora has exceeded 6.52 million. Among them, 6.45 million (about 99% of the total) have not achieved five transactions. Only 17,800 tokens (0.3% of the total) have remained actively traded 48 hours after issuance.

Before interpreting these data, it is essential to understand a basic fact: the vast majority of content published on the internet has no inherent value. From this perspective, the fact that 99% of tokens have not garnered market attention may simply reflect the natural distribution of online content rather than a structural flaw in the Base model. What truly matters are those tokens that survive beyond 48 hours. We believe that the continued trading of creator or content tokens 48 hours after issuance signals that the creators or content itself possesses real value.

In other words, Base has yet to make significant waves in the creator economy. Only 17,800 creator and content tokens have shown sustained activity, which is a drop in the bucket compared to the vast amount of online content produced daily. Pessimists may feel that this model is fundamentally flawed, while optimists may argue that although Base's penetration into the creator economy is effectively close to zero, there is vast growth potential if optimizations can be made in content distribution, content discovery, and functional tools. Regardless, increasing the number of tokens that can survive beyond 48 hours should become a primary focus for Base in 2026.

Finally, Base may also possess the most effective incentive mechanism in the crypto market: tokens. In September of this year, Base confirmed that it is exploring the issuance of tokens, but has not yet disclosed specific details regarding distribution methods, utility functions, or potential launch dates. The most striking aspect of the Base token is not the token itself, but its application scenarios. Unlike most L2s, Base does not need to rely on tokens to attract liquidity. Instead, it can use tokens to incentivize on-chain creator participation, rewarding behaviors that drive user engagement, content creation, and social activity, rather than short-term trading behavior.

In summary, leveraging its established L2 core ecosystem, Base is advancing by utilizing distribution channels, product coverage, and potential token incentives, exploring consumer and creator application cases. If this strategy succeeds, Base will build a moat around the social and creator ecosystem. This moat is more sticky to users than DeFi TVL or stablecoin balances, which other L2s have yet to achieve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。