原创:Odaily 星球日报

作者:Azuma

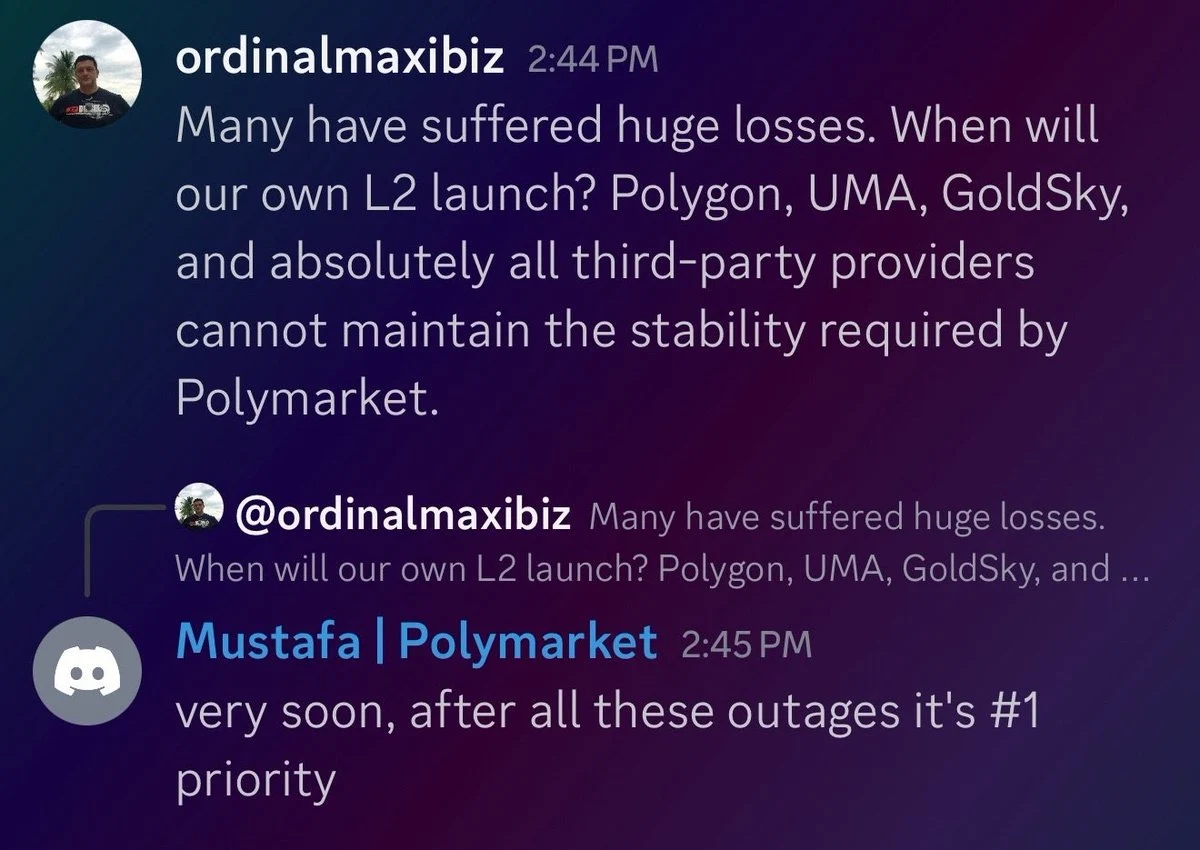

12 月 22 日,一则关于预测市场龙头 Polymarket 的动态引发了市场普遍关注 —— Polymarket 团队成员 Mustafa 于 Discord 社区内确认,Polymarket 计划从 Polygon 迁移,并推出名为 POLY 的以太坊 Layer2 网络,这是该项目当前的首要任务。

一场并不意外的“分手”

Polymarket 选择跳出 Polygon 并不算令人意外,一个是当红炸子鸡的应用层代表,一个是日渐式微的旧底层,二者之间的市场热度和价值预期本就有些错配。随着 Polymarket 逐渐成长为新的巨兽,Polygon 不够稳定的网络表现(最近一次故障出现于 12 月 18 日)以及相对贫弱的生态客观上已构成了对前者的限制。

对于 Polymarket 而言,自建门户意味着产品和经济两个维度上的双赢选择。

产品方面,除去寻求更稳定的运行环境外,自建 Layer2 网络可帮助 Polymarket 根据其平台需求去反向定制底层特性,从而更灵活地适配平台未来的升级与迭代。

而更重要的意义,则体现在经济层面。自建网络意味着 Polymarket 可以将围绕其平台所衍生的经济活动及周边服务一并收拢进自身体系,阻止相关价值外溢至外部网络,而是逐步沉淀为自身的系统性优势。

显性与隐性的经济贡献

作为应用层,Polymarket 的爆火曾经为 Polygon 带来了客观的直接经济贡献,数据分析师dash于 Dune 整理的数据历史显示:

- Polymarket 本月活跃用户数为 419309 人,历史总用户数为 1766193 人;

- 本月总交易笔数为 1963 万笔,历史总交易笔数为 1.15 亿笔;

- 本月总交易量为 15.38 亿美元,历史总交易量为 143 亿美元。

至于该如何去评估 Polymarket 对于 Polygon 生态经济的贡献占比,Odaily 星球日报在整理二者数据时发现了一个颇为巧合的比例。

- 首先是沉淀资金方面,Defillama数据显示当前 Polymarket 全平台头寸总值约为 3.26 亿美元,约占Polygon 全网锁仓总值 11.9 亿美元的四分之一;

- 其次是 gas 消耗状况,Coin Metrics去年十月曾统计称与Polymarket 相关的交易预计消耗了 Polygon 全网 25% 的 gas;

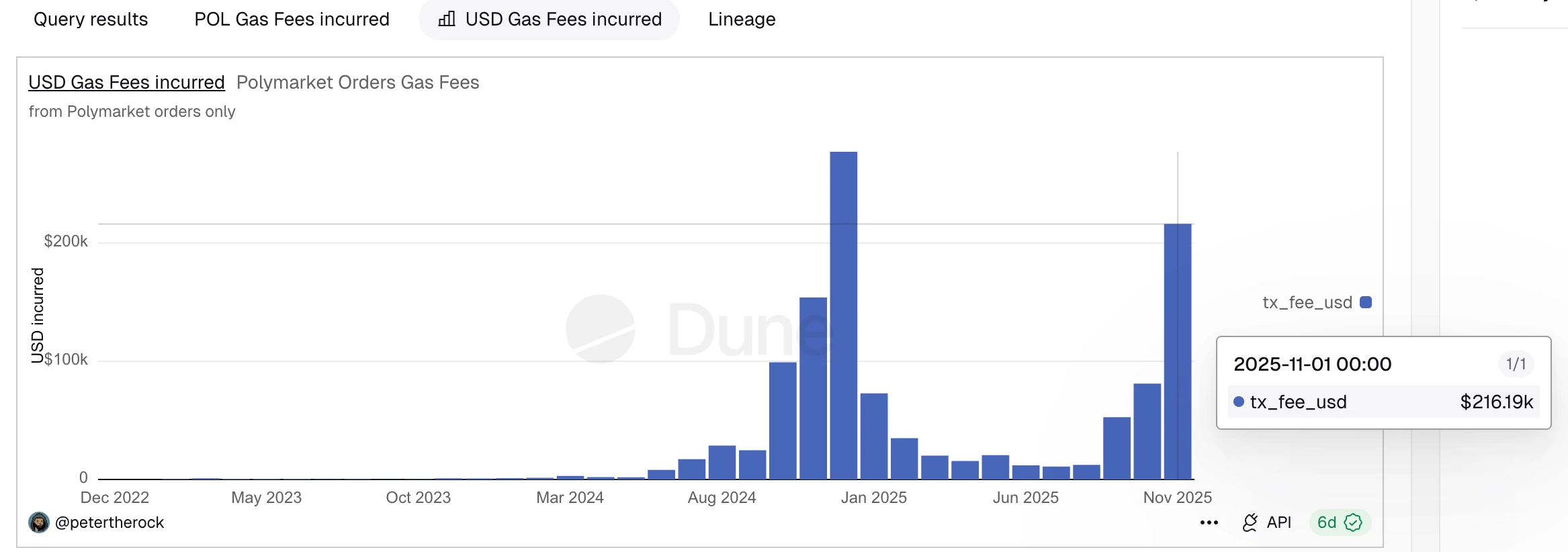

- 考虑到该数据偏久,我们又检查了近期的变化情况,数据分析师petertherock于 Dune 绘制的统计显示 11 月Polymarket 相关的交易合计消耗了约 21.6 万美元的 gas,而Token Terminal则统计显示当月 Polygon 全网 gas 总消耗量约为 93.9 万美元,比例同样接近四分之一(约 23%)。

这里固然可能存在因统计口径与时间窗口造成的巧合,但跨维度的相似结果在一定程度上也可作为衡量 Polymarket 对于 Polygon 经济意义的估算参考。

除了活跃用户、沉淀资金、交易流水、gas 贡献等可量化指标之外,Polymarket 对 Polygon 的经济意义,还体现在一系列更难被直接衡量、却同样真实存在的隐性贡献之中。

首先是对稳定币流动性的盘活。Polymarket 的所有交易均以 USDC 结算,其高频、持续的交易行为在客观上显著提升了 USDC 在 Polygon 网络上的流转需求与使用场景;其次是留存用户的附带行为价值,除去预测市场本身之外,这些用户也有可能出于便利而转向使用 Polygon 生态上的 DeFi 等其他产品,进而提升 Polygon 网络的整体生态价值。这些贡献很具体的数据去量化,却构成了底层网络最为看重、也最为稀缺的“真实需求”。

为什么是现在?答案并不难猜

事实上,仅从用户规模、数据表现及市场声量来看,Polymarket 已完全具备了自立门户的底气。这早已不是一个“该不该走”的问题,而是一个“什么时候走”的问题。

之所以选择在当下这个时间点着手迁移,核心原因或在于 PolymarketTGE 的临近。一方面,Polymarket 一旦完成发币,其治理结构、激励体系与经济模型都会相对固化,后续再进行底层迁移的成本与复杂度将显著上升;另一方面,从“单一应用”升级为“应用 + 底层”的全栈系统,本身就意味着估值逻辑的变更,自建 Layer2 无疑为 Polymarket 在叙事与资本层面打开了更高的天花板。

总而言之,Polymarket 出走 Polygon,本质上并不仅仅是一次简单的底层迁移,而是加密行业结构性变化的缩影。当顶级应用开始具备独立承载用户、流量与经济活动的能力,底层网络若无法提供额外价值,就不可避免地会被“背刺”。

无他,逐利而已。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。