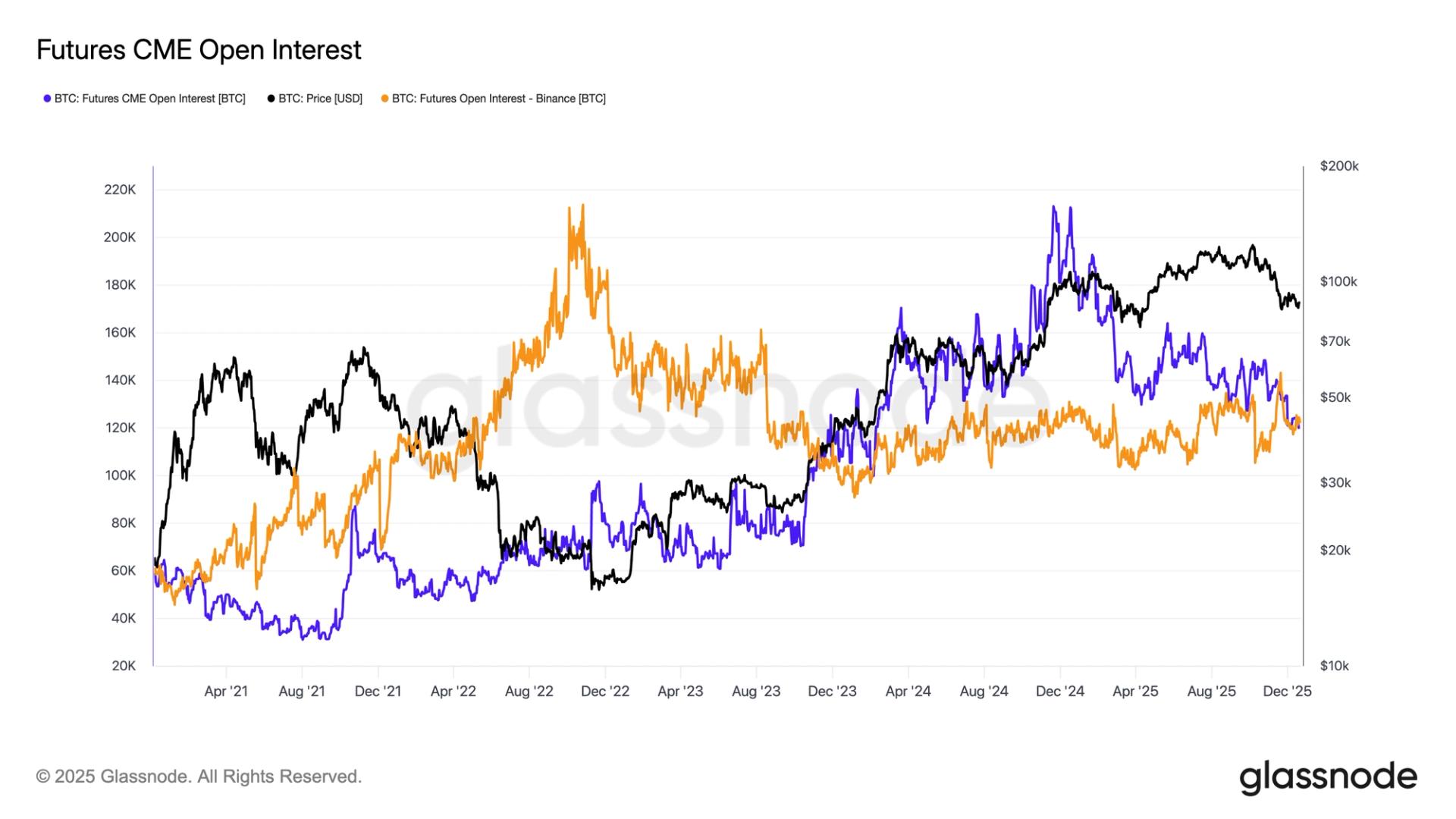

What to know : Binance has now become the largest venue for bitcoin futures open interest with roughly 125,000 BTC, or about $11.2 billion in notional value. CME bitcoin futures open interest has fallen to around 123,000 BTC, its lowest level since February 2024. Tightening spot futures spreads triggered basis trade unwinds and reduced institutional demand on CME.

The CME has lost its place as the number one exchange for bitcoin futures open interest (OI). Binance has now overtaken CME as the largest venue by OI according to CoinGlass data, with Binance holding roughly 125,000 BTC ($11.2 billion in notional value) against the CME's of 123,000 BTC ($11 billion).

CME OI started the year at 175,000 BTC, but that level has steadily fallen as the profitability of the basis trade — in which traders buy spot bitcoin while simultaneously selling futures to capture the price premium between the two markets — has declined.

Open interest on Binance, however, has remained steady throughout the year as it's the exchange more likely to be favored by retail punters betting on directional price movements.

Just more than a year ago, CME OI reached a record 200,000 BTC as prices rallied toward $100,000 following President Trump’s election victory. At that time, the annualized basis rate surged to around 15%.

Today, the CME that basis rate has compressed to roughly 5%, according to Velo data, reflecting diminishing returns for institutional basis traders.

As spot and futures prices converge and market efficiency improves, arbitrage opportunities continue to shrink. CME had been the largest exchange for bitcoin futures OI since November 2023, driven by institutional positioning ahead of the launch of spot bitcoin ETFs in January 2024. That advantage, for the moment, appears to have faded.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。