Author: Arthur Hayes

Translator: Liam

Editor’s Note: The views expressed in this article are solely those of the author and should not be taken as investment advice or recommendations. The article has been slightly edited.

If I had an online dating profile, it might read like this:

Language of Love:

The euphemisms and acronyms created by politicians and central bank governors for "printing money."

This article will discuss two of the most appropriate examples:

1. QE — Quantitative Easing

2. RMP — Reserve Management Purchases

RMP is a new acronym that entered my "language of love" on the day of the most recent Federal Reserve meeting on December 10. I instantly recognized it, understood its meaning, and cherished it like a long-lost love, QE. I love QE because QE means printing money; fortunately, I hold financial assets like gold, precious metal mining stocks, and Bitcoin, which have appreciated faster than the creation of fiat currency.

But this is not just for me. If various forms of money printing can drive up the prices and adoption of Bitcoin and decentralized public blockchains, then I hope that one day we can abandon this dirty fiat fractional reserve system in favor of a system driven by honest money.

We are not there yet. But with every unit of fiat currency created, this "redemption" accelerates.

Unfortunately, for most people today, money printing is destroying their dignity as producers. When the government deliberately devalues the currency, it severs the connection between energy input and economic output. Those hard-working "laborers," even if they do not understand complex economic theories, can intuitively feel like they are running in quicksand—they understand that money printing is not a good thing.

In a "one person, one vote" democracy, when inflation soars, the common people will vote the ruling party out of office. In an authoritarian regime, the common people will take to the streets to overthrow the government. Therefore, politicians know that governing in an inflationary environment is akin to career suicide. However, the only politically feasible way to repay massive global debt is to dilute it through inflation. Since inflation will destroy political careers and dynasties, the secret lies in: fooling the common people into believing that the inflation they feel is not inflation at all.

To this end, central bank governors and finance ministers throw out a pot of boiling, grotesque acronyms to obscure the inflation they impose on the public, thereby delaying the inevitable systemic deflationary collapse.

If you want to see what severe credit contraction and destruction look like, think back to the feelings during the period from April 2 to April 9—when President Trump announced the so-called "Liberation Day" and began to impose significant tariffs. That was unpleasant for the rich (the stock market plummeted), and for others as well, because if global trade slows to correct decades of accumulated imbalances, many people will lose their jobs. Allowing rapid deflation is a shortcut to revolution, ending political careers, and even lives.

As time passes and knowledge spreads, all these obfuscation tactics will eventually fail, and the common people will link the current acronyms to money printing. Like any clever drug dealer, when the "addicts" become familiar with the new lingo, the monetary bureaucrats must change their tricks. This linguistic game excites me because when they change tactics, it means the situation is dire, and they must press that "Brrrrr" (the sound of the money printer) button hard enough to elevate my portfolio to new dimensions.

Currently, those in power are trying to convince us that RMP ≠ QE because QE has been equated with money printing and inflation. To help readers fully understand why RMP = QE, I have created several annotated accounting T-account diagrams.

Why is this important?

Since the low point in March 2009 after the 2008 financial crisis, risk assets like the S&P 500, Nasdaq 100, gold, and Bitcoin have surged out of the river of deflation, recording astonishing returns.

This is the same chart, but standardized with the initial index value in March 2009 set to 100. The appreciation of Bitcoin, created by Satoshi Nakamoto, is so remarkable that it deserves a separate chart for comparison with other traditional inflation hedges (like stocks and gold).

If you want to get rich during the QE era of "Pax Americana," you must own financial assets. If we are entering another era of QE or RMP (whatever they choose to call it), hold tight to your assets and do everything you can to convert your meager salary into more assets.

Now that you are starting to pay attention to whether RMP equals QE, let’s do some monetary market accounting analysis.

Understanding QE and RMP

Now it’s time to look at the accounting T-charts. Assets are on the left side of the ledger, and liabilities are on the right. The simplest way to understand the flow of funds is to visualize it. I will explain how and why QE and RMP create money, leading to financial and goods/services inflation.

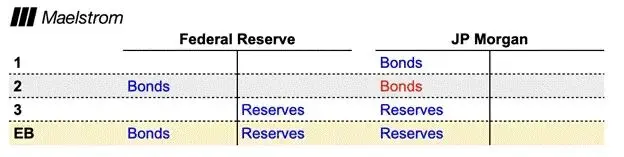

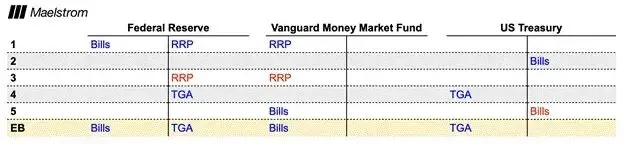

Step 1 of QE

1: JPMorgan Chase is a primary dealer with an account at the Federal Reserve and holds government bonds.

2: The Federal Reserve conducts a round of quantitative easing by purchasing bonds from JPMorgan Chase.

3: The Federal Reserve creates money out of thin air and pays for the bonds by injecting reserves into JPMorgan Chase's account.

Ending balance: The Federal Reserve has created reserves and purchased bonds from JPMorgan Chase. How will JPMorgan Chase handle these reserves?

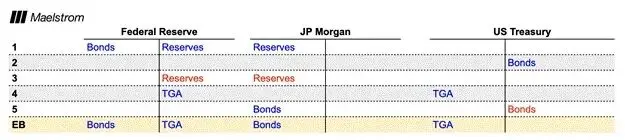

Step 2 of QE

1: The Federal Reserve creates money out of thin air, i.e., reserves. Once JPMorgan Chase uses these funds, they will have a stimulative effect. JPMorgan Chase will only purchase another bond to replace the one sold to the Federal Reserve if the new bond is attractive from the perspective of interest rates and credit risk.

2: The U.S. Treasury issues new bonds through auctions, and JPMorgan Chase purchases these bonds. Government bonds are risk-free, and in this case, the bond yield is higher than the reserve interest rate, so JPMorgan Chase will buy the newly issued bonds.

3: JPMorgan Chase uses reserves to pay for the bonds.

4: The Treasury deposits the reserves into its Treasury General Account (TGA), which is its checking account at the Federal Reserve.

5: JPMorgan Chase receives the bonds.

EB: The Federal Reserve's money printing funds the increase in the supply of bonds (the holdings of the Federal Reserve and JPMorgan Chase).

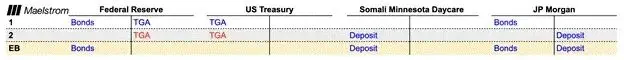

Step 3 of QE

1: Money printing allows the Treasury to issue more bonds at a lower price. This is purely financial asset inflation. Lower government bond yields will increase the net present value of assets with future cash flows (like stocks). Once the Treasury distributes benefits, goods/services inflation will occur.

2: The Tim Walz Somali Children's Daycare Center (serving children with poor reading skills who want to learn other skills) receives a federal grant. The Treasury deducts funds from the TGA account and deposits them into the center's account at JPMorgan Chase.

EB: The TGA account funds government spending, thereby creating demand for goods and services. This is how quantitative easing causes inflation in the real economy.

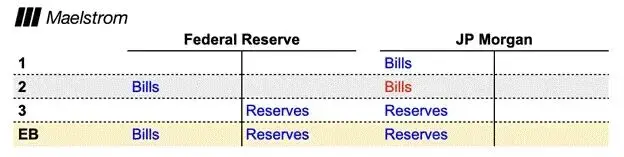

Short-term Treasury Bills vs. Long-term Government Bonds

Short-term Treasury bills have a maturity of less than one year. The most actively traded interest-bearing government bonds are 10-year government bonds, technically referred to as 10-year notes. The yield on short-term Treasury bills is slightly higher than the reserve interest rate at the Federal Reserve. Let’s return to the first step, replacing long-term government bonds with short-term Treasury bills.

EB: The only difference is that the Federal Reserve exchanged reserves for short-term Treasury bills. The flow of funds from quantitative easing stops here because JPMorgan Chase lacks the incentive to purchase more short-term Treasury bills, as the reserve interest rate is higher than the yield on short-term Treasury bills.

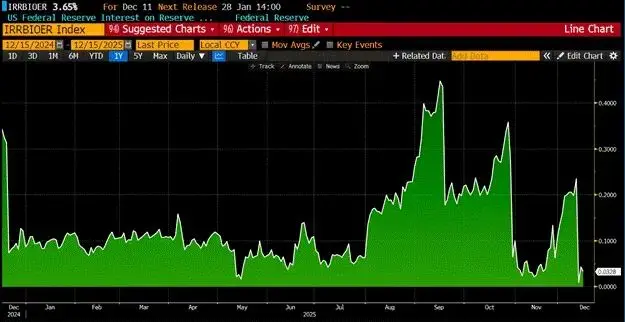

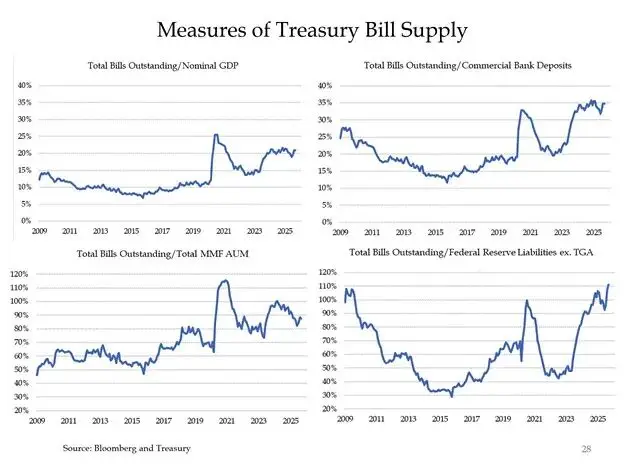

The above chart shows the reserve interest rate minus the yield on 3-month Treasury bills, resulting in a positive value. Profit-maximizing banks will keep their funds at the Federal Reserve rather than purchase lower-yielding short-term Treasury bills. Therefore, the type of debt securities purchased with reserves is important. If the interest rate risk or maturity is too small, the funds printed by the Federal Reserve will remain on its balance sheet without any effect. Analysts believe that technically, the stimulative effect of the Federal Reserve purchasing $1 of short-term Treasury bills is far less than the stimulative effect of purchasing $1 of bonds under quantitative easing.

But what if the holders of these short-term Treasury bills are not banks, but other financial institutions? Currently, money market funds hold 40% of outstanding short-term Treasury bills, while banks hold only 10%. Similarly, if banks can earn higher returns by depositing reserves at the Federal Reserve, why would they purchase short-term Treasury bills? To understand the potential impact of RMP, we must analyze what decisions money market funds will make when the Federal Reserve purchases short-term Treasury bills held by them. I will conduct the same analysis for RMP as I did for quantitative easing.

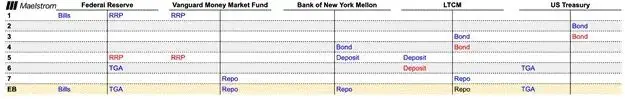

Step 1 of RMP

1: Vanguard is a licensed money market fund with an account at the Federal Reserve and holds short-term Treasury bills.

2: The Federal Reserve conducts a round of RMP operations by purchasing short-term Treasury bills from Vanguard.

3: The Federal Reserve creates money out of thin air and pays the bill by crediting Vanguard's account with funds from the reverse repurchase agreement (RRP). RRP is an overnight financing tool, with interest paid directly by the Federal Reserve daily.

EB: How else can Vanguard use the RRP balance?

Step 2 of RMP (Vanguard purchases more notes)

1: The Federal Reserve creates money out of thin air, which becomes the RRP balance. Once Vanguard uses these funds, they will have a stimulative effect. Vanguard will only purchase other short-term risk-free debt instruments if the yields are higher than the RRP. This means Vanguard will only buy newly issued Treasury bills. As a money market fund (MMF), Vanguard has various restrictions on the types and maturities of debt it can purchase with investor funds. Due to these restrictions, Vanguard typically only buys Treasury bills.

2: The U.S. Treasury issues new notes through auctions, which are ultimately purchased by Vanguard.

3: Vanguard pays for the notes using cash from the RRP.

4: The Treasury deposits the RRP cash into its Treasury General Account (TGA).

5: Vanguard receives the notes it purchased.

EB: The money created by the Federal Reserve funds the purchase of newly issued Treasury bills.

The yield on Treasury bills will never be lower than the yield on the RRP because, as the marginal buyer of Treasury bills, if the yield is the same as the Treasury bills, the money market fund will keep the funds in the RRP. Technically, since the Federal Reserve can unilaterally print money to pay the interest on the RRP balance, its credit risk is slightly better than that of the U.S. Treasury, which must obtain Congressional approval to issue debt. Therefore, unless the yield on Treasury bills is higher, money market funds are more inclined to keep cash in the RRP. This is important because Treasury bills lack duration characteristics, meaning that a few basis points drop in yield due to the implementation of RMP by the Federal Reserve will not have a significant impact on financial asset inflation. Inflation will only manifest in financial assets and goods and services when the Treasury uses the raised funds to purchase them.

Step 3 of RMP (Vanguard lends to the repo market)

If the yield on newly issued Treasury bills is less than or equal to the RRP yield, or if there is insufficient supply of newly issued Treasury bills, do money market funds (MMFs) have other investment options that could lead to financial asset or goods/services inflation? Yes. Money market funds can lend cash in the Treasury bill repo market.

A repurchase agreement is abbreviated as repo. In this example, the bond repo refers to the money market fund providing overnight cash loans secured by newly issued Treasury bills. Under normal market conditions, the repo yield should equal or be slightly lower than the upper limit of the federal funds rate. Currently, the RRP yield equals the federal funds rate, which is 3.50%. The yield on 3-month Treasury bills is currently 3.60%. However, the upper limit of the federal funds rate is 3.75%. If the repo transaction approaches the upper limit of the federal funds rate, money market funds can earn a yield nearly 0.25% higher (3.75% minus the RRP yield of 3.50%) by lending in the repo market.

1: The Federal Reserve creates the RRP balance by printing money and purchasing Treasury bills from Vanguard.

2: The U.S. Treasury issues bonds.

3: LTCM (a resurrected relative value hedge fund) purchases bonds at the auction, but they do not have enough funds to pay. They must borrow in the repo market to pay the Treasury.

4: Bank of New York Mellon (BONY) facilitates a tri-party repo transaction. They receive bonds from LTCM as collateral.

5: BONY receives cash withdrawn from Vanguard's RRP balance. This cash is deposited into BONY and then paid to LTCM.

6: LTCM uses its deposit to pay for the bonds. This deposit becomes the TGA balance held by the U.S. Treasury at the Federal Reserve.

7: Vanguard withdraws cash from the RRP and lends it in the repo market. Vanguard and LTCM will decide daily whether to roll over the repo agreement.

EB: The funds printed by the Federal Reserve purchased Treasury bills from Vanguard, thereby providing financing for LTCM's bond purchases. The Treasury can issue long-term or short-term bonds, and LTCM will buy these bonds at any price because the repo rate is predictable and affordable. Vanguard will always lend at a "proper" rate because the Federal Reserve prints money and buys the notes it issues. RMP is a roundabout way for the Federal Reserve to cash the checks of the government. This is highly inflationary from both financial and real goods/services perspectives.

RMP Politics

I have some questions, and the answers may surprise you.

Why was the announcement of RMP not included in the formal Federal Open Market Committee statement like all previous quantitative easing plans?

The Federal Reserve unilaterally decided that quantitative easing is a monetary policy tool that stimulates the economy by removing long-term bonds sensitive to interest rates from the market. The Federal Reserve views RMP as a technical implementation tool that does not stimulate the economy because it removes short-term Treasury bills, which are cash-like, from the market.

Does RMP require a formal vote from the FOMC?

Yes and no. The FOMC instructs the New York Federal Reserve Bank to implement RMP to keep reserves "ample." The New York Fed can unilaterally decide to increase or decrease the scale of RMP Treasury bill purchases until the Federal Open Market Committee (FOMC) votes to terminate the program.

What is "ample reserves"?

This is a vague concept with no fixed definition. The New York Fed decides when reserves are ample and when they are not. I will explain in the next section why Buffalo Bill Bessent controls the level of ample reserves. In reality, the Federal Reserve has handed over control of the short end of the yield curve to the Treasury.

Who is the president of the New York Fed? What are his views on quantitative easing and RMP?

John Williams is the president of the New York Fed. His next five-year term will begin in March 2026. He is not leaving. He has been an active advocate for the theory that the Federal Reserve must expand its balance sheet to ensure "ample reserves." His voting record on quantitative easing has been very supportive, and he has publicly stated that he fully endorses money printing. He believes RMP is not quantitative easing and therefore does not have a stimulative effect on the economy. This is good because when inflation inevitably rises, he will claim, "It's not my fault," and then continue to print money using RMP.

The unlimited and unrestrained money printing frenzy

The various sophistries surrounding the definition of quantitative easing (QE) and the level of reserves being "ample" allow the Federal Reserve to cash the checks of politicians. This is not quantitative easing (QE) at all; this is the money printer running wild! Every previous quantitative easing (QE) program set an end date and a monthly bond purchase cap. Extending the program requires public voting. In theory, as long as John Williams (the Federal Reserve chairman) is willing, RMP can expand indefinitely. And John Williams does not truly control the situation because his economic dogma does not allow him to consider that his bank is directly fueling inflation.

Ample reserves and RMP

The existence of RMP is due to the free market's inability to cope with the "Alabama Black Snake"-like enormous risks brought about by the surge in Treasury bill issuance. Reserves must grow. They must be synchronized with the issuance of government bonds; otherwise, the market will collapse. I discussed this in my article titled "Hallelujah."

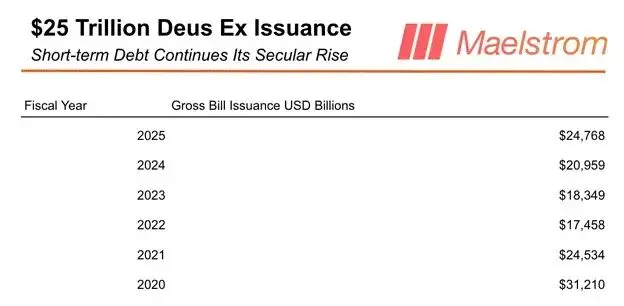

Here is a table of the total tradable Treasury bond issuance from fiscal years 2020 to 2025:

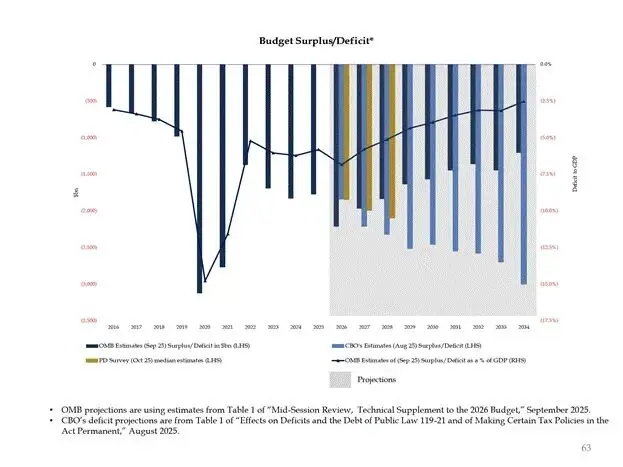

In short, although Bessent asserts that Yellen's refusal to extend the debt maturity is an epic policy mistake, the U.S. Treasury's reliance on cheap short-term financing continues to grow. Currently, the market must absorb about $500 billion in Treasury bonds weekly, up from about $400 billion weekly in 2024. Trump's rise to power, despite his campaign promise to cut the deficit, has not changed the trend of increasing total Treasury bond issuance. Moreover, it does not matter who is in power because even if Kamala Harris is elected, the issuance plan will not change.

What drives the growth in total Treasury bond issuance? The massive and continuously increasing issuance is because politicians will not stop distributing benefits.

The Congressional Budget Office (CBO) and primary dealers agree that the deficit will exceed $2 trillion in the next three years. This extravagant situation seems to show no signs of changing.

Before discussing why RMP ≠ QE, I would like to predict how Bessent will use RMP to stimulate the real estate market.

RMP-funded repos

I know this may be painful for some of you investors, but please recall what happened in early April this year. Just after Trump made his "TACO" (possibly referring to antitrust law) statement regarding tariffs, Bessent claimed in an interview with Bloomberg that he could use repos to stabilize the Treasury bond market. Since then, the nominal total of Treasury bond repos has been steadily increasing. Through the repo program, the Treasury uses the proceeds from issuing Treasury bonds to repurchase earlier inactive bonds. If the Federal Reserve prints money to buy these bonds, then short-term Treasury bills effectively provide financing directly to the Treasury, allowing the Treasury to increase the total issuance of short-term Treasury bills and use part of the proceeds to repurchase longer-term Treasury bonds. Specifically, I believe Bessent will use repos to buy 10-year Treasury bonds, thereby lowering yields. In this way, Bessent can magically eliminate interest rate risk in the market using interest rate market policy (RMP). In fact, this is exactly how quantitative easing operates!

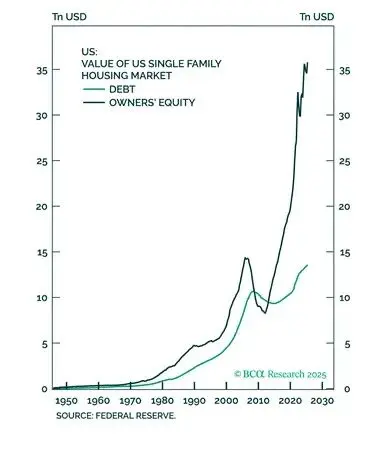

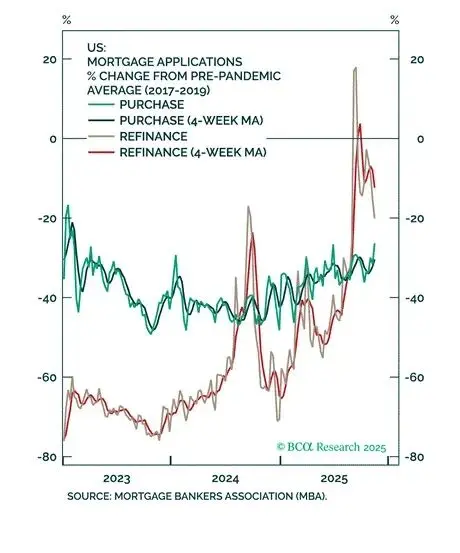

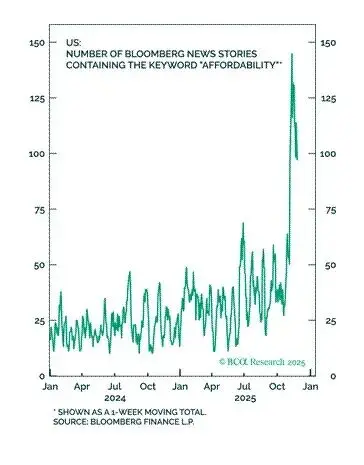

The yield on 10-year Treasury bonds is crucial for the 65% of U.S. households that are homeowners and for those struggling first-time homebuyers. Lower yields on 10-year Treasury bonds help American households access home equity loans, thereby increasing consumption. Additionally, mortgage rates will also decline, which will help improve housing affordability. Trump has openly stated that he believes mortgage rates are too high, and if he can achieve this, it will help the Republican Party remain in power. Therefore, Bessent will use interest rate market policy and repos to buy 10-year Treasury bonds. 10-year Treasury bonds and lower mortgage rates.

Let’s quickly review some charts of the U.S. real estate market.

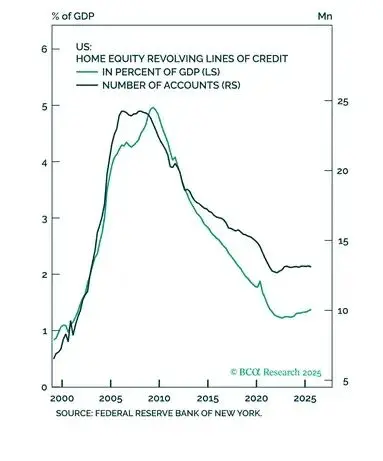

There is a large amount of home equity available for leveraged financing.

The refinancing wave is just beginning.

Current refinancing levels are far from the peak of the 2008 housing bubble.

If Trump can solve the housing affordability issue by lowering financing costs, Republicans may be able to turn the current situation around and maintain their majority in both legislative chambers.

Bessent has not publicly stated that he will use repos to stimulate the real estate market, but if I were him, I would use this new money-printing tool in the manner described above. Now let’s hear the argument for why RMP ≠ QE.

Opponents Will Always Oppose

Here are the criticisms from opponents of the RMP plan, questioning whether it can create financial and goods/services inflation:

The Federal Reserve buys short-term Treasury bills through RMP and long-term bonds through QE. Without long-term bonds, purchasing short-term Treasury bills has little impact on the financial market.

RMP will end in April, as that is the tax deadline, after which the repo market will return to normal due to reduced TGA volatility.

My accounting T-chart clearly shows how RMP's purchases of short-term Treasury bills directly fund new Treasury bond issuance. The debt will be used for spending, thereby triggering inflation, and may lower the yields on long-term debt through repos. Although the Rate Management Plan (RMP) transmits easing policy through Treasury bills rather than bonds, it is still effective. Nitpicking will only lead to underperformance in the market.

The growth in total Treasury bill issuance negates the claim that the Rate Management Plan will become ineffective in April. Out of necessity, the U.S. government's financing structure is shifting to rely more on Treasury bills.

This article refutes both criticisms, convincing me that the four-year cycle has ended. Bitcoin clearly disagrees with my view, gold thinks my perspective is "mediocre," but silver is set to make a big profit. To this, I can only say: be patient, my friend, be patient. After former Federal Reserve Chairman Ben Bernanke announced the first round of quantitative easing (QE1) at the end of November 2008, the market continued to plummet. It wasn't until March 2009 that the market bottomed out and rebounded. But if you had been waiting on the sidelines, you would have missed a great buying opportunity.

Since the introduction of RMP (Random Monetary Policy), Bitcoin (in white) has fallen by 6%, while gold has risen by 2%.

Another liquidity factor that RMP will change is that many of the world's major central banks (such as the European Central Bank and the Bank of Japan) are shrinking their balance sheets. Shrinking balance sheets does not align with the strategy of cryptocurrencies only going up. Over time, RMP will create billions of dollars in new liquidity, and the exchange rate of the dollar against other fiat currencies will plummet. While a weaker dollar benefits Trump's "America First" reindustrialization plan, it is disastrous for global exporters, who face not only tariffs but also the dilemma of their domestic currencies appreciating against the dollar. Germany and Japan will utilize the European Central Bank and the Bank of Japan to create more domestic credit to curb the appreciation of the euro and yen against the dollar. By 2026, the Federal Reserve, the European Central Bank, and the Bank of Japan will join forces to accelerate the demise of fiat currency. Long live!

Trading Outlook

A scale of $40 billion per month is indeed considerable, but the proportion of total outstanding debt is far lower than in 2009. Therefore, we cannot expect its credit stimulus effect at current financial asset price levels to be as significant as it was in 2009. For this reason, the current erroneous view that RMP is superior to QE in terms of credit creation, along with uncertainty about whether RMP will exist after April 2026, will lead to Bitcoin prices fluctuating between $80,000 and $100,000 until the New Year. As the market equates RMP with quantitative easing (QE), Bitcoin will quickly return to $124,000 and rapidly approach $200,000. March will be the peak of expectations for RMP driving asset prices, at which point Bitcoin will decline and form a local bottom well above $124,000, as John Williams remains firmly on the "Brrrr" button.

Altcoins are in dire straits. The crash on October 10 caused significant losses for many individual and hedge fund liquidity traders. I believe many liquidity fund providers looked at the net asset value reports for October and said, "Enough!" Redemption requests flooded in, leading to a continued bidding crash. The altcoin market needs time to recover, but for those who cherish their precious capital and read the rules of exchange operations carefully, now is the time to rummage through the trash heap.

Speaking of altcoins, my favorite is Ethena. Due to the Federal Reserve's interest rate cuts leading to a decline in currency prices, and the RMP policy increasing the money supply, Bitcoin prices have risen, creating demand for synthetic dollar leverage in the crypto capital market. This has pushed up cash hedging or basis yields, prompting the creation of USDe for borrowing at higher rates. More importantly, the spread between the basis yields of Treasury bills and cryptocurrencies has widened, with cryptocurrencies offering higher yields.

The increase in interest income from the Ethena protocol will flow back to the ENA Treasury, ultimately driving the repurchase of ENA tokens. I expect the circulating supply of USDe to increase, which will be a leading indicator of a significant rise in ENA prices. This is purely the result of the interplay between traditional finance and cryptocurrency dollar interest rates, a similar situation occurred when the Federal Reserve initiated an easing cycle in September 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。