Author: Bootly

The Bitcoin treasury companies are undergoing a brutal selection process.

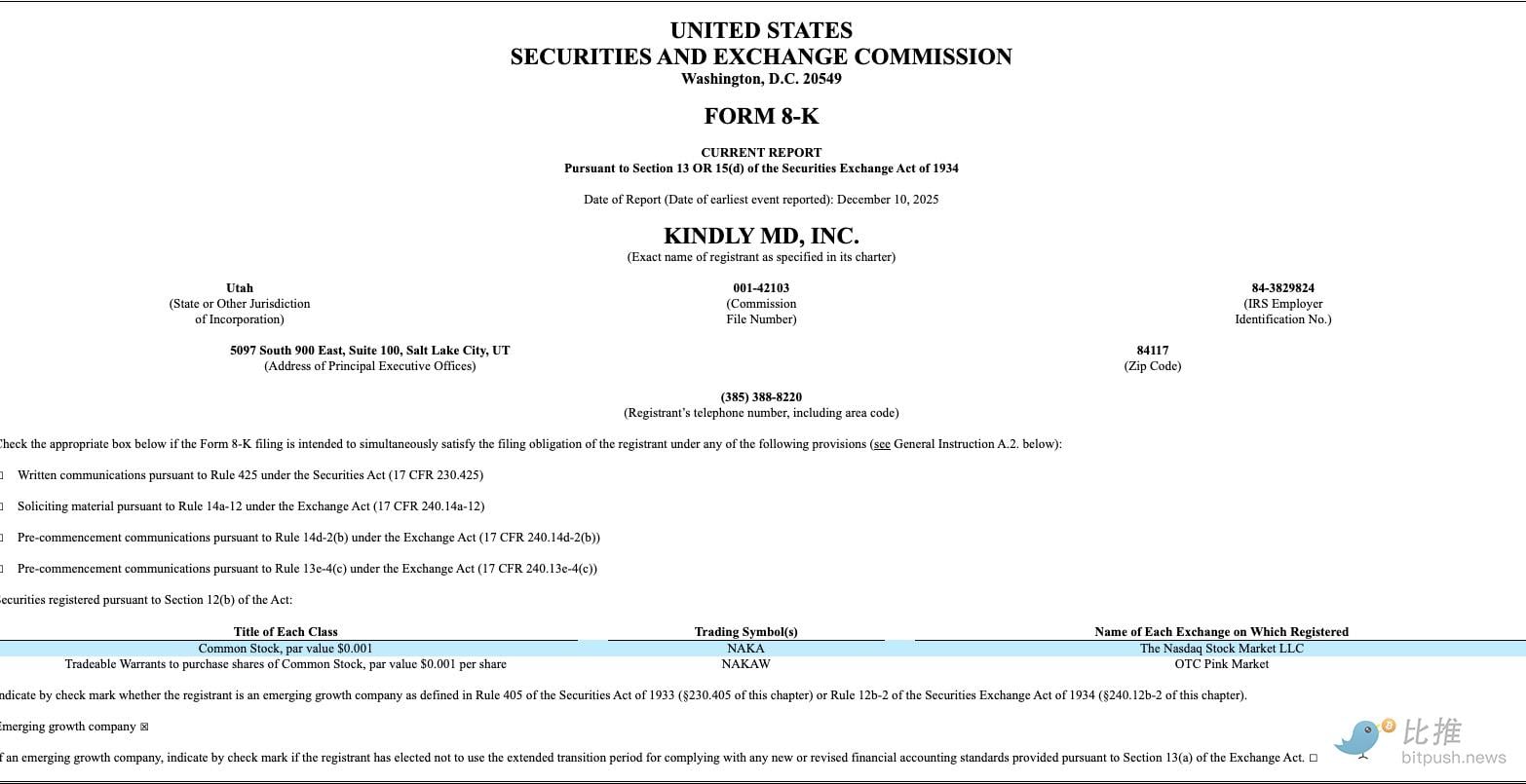

Not long ago, Nasdaq issued a minimum stock price compliance notice to KindlyMD (NAKA), pushing the "Bitcoin treasury companies" sector into a harsher and more realistic phase: from storytelling and premium pricing to being forced to answer hard questions like "Where does the cash flow come from? Can financing continue? Will extreme market conditions lead to selling coins?"

According to Nasdaq rules, the company needs to have its stock price close at least $1 or above for 10 consecutive trading days before June 8, 2026, to regain compliance.

For "treasury companies," whose lifeline is their ability to raise capital in the market, such notifications often trigger a chain reaction of financing discounts, liquidity contraction, and valuation repricing.

The market's patience seems to be running out.

Imitators Under Pressure: The Market is "Voting with Their Feet"

If Strategy (MSTR) is the source of this model, then over the past year, a whole batch of followers attempting to replicate its path has emerged in the market. However, recent stock price performances show that investors are giving these "imitators" harsher pricing.

In the past month, KindlyMD (NAKA) stock price has dropped about 39%;

American Bitcoin (ABTC), associated with Eric Trump, has seen a decline of nearly 68%;

ProCap Financial (BRR), in which Anthony Pompliano is involved, has dropped nearly 70%.

This loss of momentum is not an isolated case but a sector-wide phenomenon. Even among Ethereum treasury companies, the situation has not improved. Take Bitmine Immersion Technologies (BMNR) as an example; this company, which holds ETH as its core asset, has seen its stock price drop by over 30% since the significant correction in the crypto market last October, while Ethereum's price has dropped about 25% during the same period.

This means that during a downturn, these companies not only fail to provide a "buffer" but often exhibit higher volatility than the underlying assets.

Who is Priced at a Premium, Who is Discounted

If we further break down the situations of different companies, the differences are particularly clear in two indicators: the size of holdings and mNAV (market cap/net asset value). The former determines the company's scale in the crypto asset narrative, while the latter reflects whether the market is still willing to pay a premium for its continued financing ability.

From public data such as Bitcoin Treasuries, the differentiation among companies has become very apparent.

Core Data Comparison of Major Bitcoin Treasury Companies

| Company | Main Asset | Holdings Size | Holdings Market Value (Estimated) | Current Market Value | mNAV | |----------------------|------------|-------------------|----------------------------------|----------------------|-------| | Strategy (MSTR) | BTC | 671,268 BTC | ≈ $57.7 billion | ≈ $46 billion | ≈ 0.8x| | KindlyMD (NAKA) | BTC | 5,398 BTC | ≈ $465 million | ≈ $161 million | ≈ 0.35x| | American Bitcoin (ABTC)| BTC | 5,098 BTC | ≈ $439 million | ≈ $2 billion | ≈ 3.5x| | ProCap Financial (BRR)| BTC | 4,951 BTC | ≈ $435 million | Below holdings value | < 1x |

Note: Holdings and valuation data are based on public tracking metrics such as Bitcoin Treasuries, and market cap is a periodic range estimate.

The signals conveyed by this data are not complex:

The market is no longer pricing based on "whether to hold Bitcoin" itself but is reassessing the company's capital structure, financing flexibility, and ongoing operational capability.

KindlyMD's mNAV has dropped below 0.4 times, indicating that its stock is viewed by the market as a "high-risk vehicle below book asset value"; while American Bitcoin still maintains a high premium, the sharp stock price pullback indicates that this premium itself is extremely unstable.

Among all companies, Strategy (MSTR) shows the most representative changes. This year, its mNAV once exceeded 1.5 times, but as Bitcoin entered a high volatility range in the fourth quarter, this indicator quickly aligned with asset-based metrics and recently fell back to around 0.8 times.

This change is not merely a "valuation correction" but a shift in market focus:

From "how many more coins can be bought" to "will there be forced selling during volatility."

In this context, Strategy announced the establishment of approximately $1.44 billion in cash reserves to cover about 21 months of dividend and debt interest expenses, clearly reducing the likelihood of selling Bitcoin during extreme market conditions.

The Reality Behind: Most Companies Actually Bought at High Prices

If we zoom out, the overall fragility of the industry is more directly reflected in the statistical data.

According to the summary from Bitcoin Treasuries, among the approximately 100 Bitcoin treasury companies with measurable cost bases, 65 have purchased Bitcoin above the current price, meaning the industry as a whole is bearing large-scale unrealized losses.

More notably, during the recent phase of accelerated market decline, at least five companies collectively sold 1,883 Bitcoins. This behavior itself creates a clear tension with the narrative of "long-term holding and riding out cycles."

As Hivemind Capital founder Matt Zhang stated, this phase resembles an "industry cleansing." In an interview with Yahoo Finance, he revealed that his team evaluated over 100 digital asset treasury companies this year, ultimately investing in only a dozen, candidly stating that a significant portion of them may gradually become "irrelevant."

In his view, even if more traditional companies incorporate Bitcoin or Ethereum into their balance sheets in the future, this alone is insufficient to constitute long-term competitiveness. The real dividing line lies in whether they have stable operating cash flow and whether they can maintain treasury structures without relying on continuous financing.

Analysts at Galaxy Digital pointed out that this industry shakeout is essentially a "Darwinian selection period." As risk appetite weakens and financing costs rise, those companies without business support, relying solely on asset appreciation to tell their stories, will be forced to consolidate, sell, or exit the market entirely.

This judgment aligns closely with the conclusions of some institutional research: the treasury strategy has not been denied but has upgraded from "concept arbitrage" to a comprehensive competition around capital structure, cash management, and risk control.

Conclusion

The Nasdaq notice received by KindlyMD may just be the beginning. It serves as a reminder to the market and these companies:

During a phase of loose liquidity and one-sided asset appreciation, "buying coins" itself was enough to support valuations; but when the cycle reverses, what the market truly cares about is whether you can survive the turbulence.

This round of adjustments will not make all Bitcoin treasury companies disappear, but it will certainly redefine who can still stand on the stage.

Looking back at the end of the year, this may very well be the moment when the first batch of "Bitcoin treasury companies" is tested by the market, as well as the starting point for the next phase of industry differentiation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。