Author: Anita @anitahityou

If you only look at technology news from 2025, you would think the world is thriving: AI investment continues, the construction of data centers in North America is accelerating, and crypto miners have finally "emerged from the cycle," successfully transforming their originally high-volatility mining business into stable AI computing power services.

But the atmosphere in the credit department on Wall Street is entirely different.

Credit investors are not discussing model performance, nor are they concerned about which generation of GPU is stronger. They are fixated on the core assumptions in their Excel spreadsheets and are beginning to feel a chill: it seems we are using a 10-year real estate financing model to purchase a perishable product with a shelf life of only 18 months.

Reuters and Bloomberg's consecutive reports in December revealed just the tip of the iceberg: AI infrastructure is rapidly becoming a "debt-intensive industry." But this is just the surface; the real crisis lies in the deep financial structural mismatch—when high-depreciation computing power assets and high-volatility miner collateral are forcibly bundled with rigid infrastructure debt, a hidden chain of defaults has already formed.

1. Deflation on the Asset Side: The Cruel Revenge of "Moore's Law"

The core logic of debt is the debt service coverage ratio (DSCR). Over the past 18 months, the market has assumed that AI computing power rents would be as stable as housing rents, or even as inflation-resistant as oil.

Data is ruthlessly shattering this assumption.

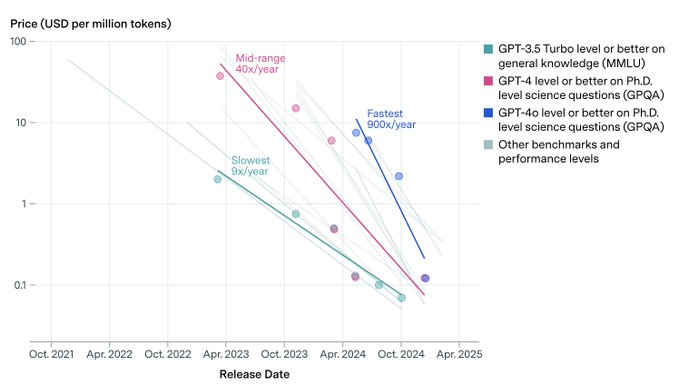

According to tracking data from SemiAnalysis and Epoch AI for the fourth quarter of 2025, the cost of AI inference per unit has decreased by 20-40% year-on-year over the past year.

- The proliferation of model quantization and distillation techniques, along with the efficiency improvements of application-specific integrated circuits (ASICs), has led to an exponential increase in the efficiency of computing power supply.

- This means that the so-called "computing power rent" has a natural deflationary attribute.

This constitutes the first duration mismatch: the issuer of the debt purchased GPUs at the peak price in 2024 (CapEx), but locked in a rental income curve that is destined to plummet after 2025.

If you are an equity investor, this is called technological progress; if you are a creditor, this is called collateral depreciation.

2. Alienation on the Financing Side: Packaging Venture Capital Risks as Infrastructure Returns

If the returns on the asset side are thinning, the rational liability side should be more conservative.

But the reality is quite the opposite.

According to the latest statistics from The Economic Times and Reuters, the total debt financing for AI data centers and related infrastructure in 2025 surged by 112%, reaching a scale of $25 billion. The main drivers of this surge are "Neo-Cloud" companies like CoreWeave and Crusoe, as well as transforming mining companies, which are massively adopting asset-backed lending (ABL) and project finance.

The essential change in this financing structure is extremely dangerous:

- In the past: AI was a game for tech VCs; failure meant equity went to zero.

- Now: AI has become a game of infrastructure; failure means debt default.

The market is mistakenly placing high-risk, high-depreciation tech assets (Venture-grade Assets) into a low-risk financing model (Utility-grade Leverage) that should belong to highways and hydropower stations.

3. The "False Transformation" and "True Leverage" of Miners

The most vulnerable link appears among crypto miners. The media likes to praise miners' transformation into AI as "de-risking," but from a balance sheet perspective, this is risk stacking.

Data from VanEck and TheMinerMag reveals a counterintuitive fact: the net debt ratio of leading publicly listed mining companies in 2025 has not substantially decreased compared to the peak in 2021. In fact, some aggressive mining companies have seen their debt levels surge by 500%.

How did they achieve this?

- Left hand (asset side): Still holding high-volatility BTC/ETH or using future computing power income as implicit collateral.

- Right hand (liability side): Issuing convertible notes or high-interest debt to borrow dollars to purchase H100/H200.

This is not deleveraging; this is rollover (debt extension).

This means miners are playing a "double leverage" game: using the volatility of crypto as collateral to bet on GPU cash flows. In favorable conditions, this yields double profits, but once the macro environment tightens, "falling coin prices" and "declining computing power rents" will occur simultaneously. In credit models, this is known as correlation convergence, the nightmare of all structured products.

4. The Missing Repo Market

What keeps credit managers awake at night is not the default itself, but the liquidation that follows a default.

In the subprime mortgage crisis, banks could at least auction off the houses they repossessed. But in AI computing power financing, if a miner defaults, who can the creditor sell those ten thousand H100 graphics cards to?

This is a severely overestimated liquidity secondary market:

- Physical dependency: High-end GPUs cannot just be plugged into a personal computer; they are heavily reliant on specific liquid cooling cabinets and power density (30-50kW/rack).

- Hardware obsolescence: With the release of NVIDIA's Blackwell and even Rubin architectures, the old cards in hand face nonlinear depreciation.

- Vacuum in buying: When systemic sell-offs occur, there are no "last lenders" in the market willing to take on outdated electronic waste.

We must be wary of this "collateral illusion"—the LTV on paper looks safe, but the secondary repo market capable of absorbing billions in sell pressure does not actually exist.

This is not just an AI bubble; it is a failure of credit pricing

It needs to be clarified that this article does not deny the technological prospects of AI, nor does it deny the real demand for computing power. What we question is the erroneous financial structure.

When deflationary assets driven by Moore's Law (GPUs) are priced as inflation-resistant real estate; when miners who have not truly deleveraged are financed as high-quality infrastructure operators—the market is actually conducting a credit experiment that has not been fully priced.

Historical experience repeatedly proves: credit cycles often peak earlier than technology cycles. For macro strategists and credit traders, the primary task before 2026 may not be to predict which large model will win, but to reassess the true credit spreads of those "AI Infra + Crypto Miners" combinations.

References>

1>https://epoch.ai/data-insights/llm-inference-price-trends

2>https://epochai.substack.com/p/the-epoch-ai-brief-april-2025

3>https://semianalysis.com/2025/

4>https://www.reuters.com/commentary/breakingviews/shaky-data-centre-tenants-could-choke-off-ai-boom-2025-12-10/

5>https://longbridge.com/en/news/269179463

6>https://economictimes.indiatimes.com/topic/data-center-capacity

7>https://www.webpronews.com/ais-debt-fueled-data-center-frenzy-risks-mounting-in-2025-boom/

8>https://www.alpha-matica.com/post/assessing-risks-in-ai-infrastructure-finance

9>https://www.blackstone.com/news/press/coreweave-secures-7-5-billion-debt-financing-facility-led-by-blackstone-and-magnetar/

10>https://www.prnewswire.com/news-releases/coreweave-secures-7-5-billion-debt-financing-facility-led-by-blackstone-and-magnetar-301848093.html

11>https://www.cnbc.com/2024/05/17/ai-startup-coreweave-raises-7point5-billion-in-debt-blackstone-leads.html

12>https://happycoin.club/en/vaneck-za-god-dolgi-bitkoin-majnerov-vyrosli-na-500-do-127-mlrd/

13>https://www.binance.bh/en-BH/square/post/10-23-2025-crypto-news-bitcoin-miner-debt-surges-500-as-industry-gears-up-for-hashrate-

14>https://www.aicerts.ai/wp-content/uploads/2025/02/Publications-Certification-Impact-Report-1.pdf

15>https://www.webpronews.com/ais-debt-fueled-data-center-frenzy-risks-mounting-in-2025-boom/

16>https://www.alpha-matica.com/post/assessing-risks-in-ai-infrastructure-finance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。