撰文:Gino Matos

编译:Luffy,Foresight News

2024 年 1 月以来,加密货币与股票的表现对比表明,所谓的新型 「山寨币交易」,本质上不过是股票交易的替代品。

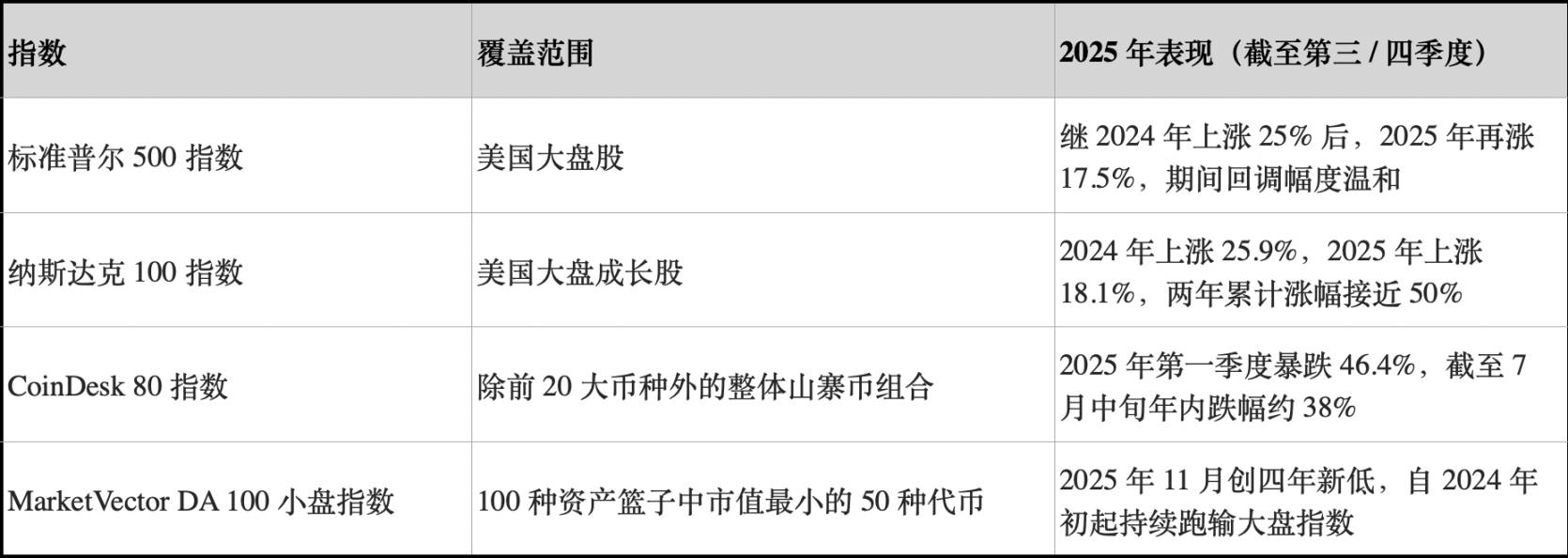

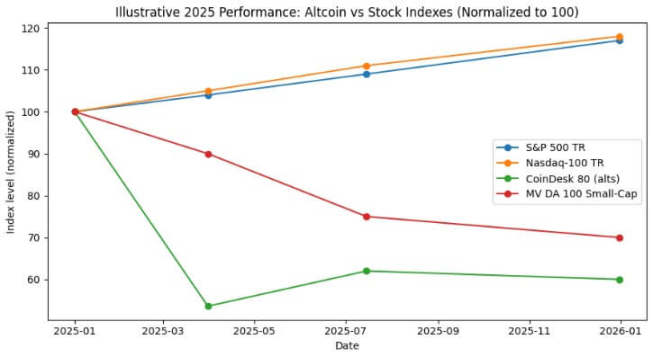

2024 年,标准普尔 500 指数回报率约为 25%,2025 年达 17.5%,两年累计涨幅约 47%。同期纳斯达克 100 指数涨幅分别为 25.9% 和 18.1%,累计涨幅接近 49%。

追踪加密货币市值前 20 名之外的 80 种资产的 CoinDesk 80 指数,仅 2025 年第一季度就暴跌 46.4%,截至 7 月中旬,年内跌幅约 38%。

到 2025 年底,MarketVector Digital Assets 100 小盘指数跌至 2020 年 11 月以来的最低水平,导致加密货币总市值蒸发超 1 万亿美元。

这种走势分化绝非统计误差。整体山寨币资产组合不仅回报率为负,波动性还与股票相当甚至更高;反观美股大盘指数,在回撤可控的前提下实现了两位数增长。

对于比特币投资者而言,核心问题在于:配置小盘代币究竟能否带来风险调整后的收益?或者说,这种配置是否只是在保持与股票相似相关性的同时,额外承担了负夏普比率的风险敞口?(注:夏普比率是衡量投资组合风险调整后收益的核心指标,其计算公式为:投资组合年化收益率 - 年化无风险利率 / 投资组合年化波动率。)

选择一个可靠的山寨币指数

为了进行分析,CryptoSlate 追踪了三个山寨币指数。

其一为 2025 年 1 月推出的 CoinDesk 80 指数,该指数覆盖 CoinDesk 20 指数之外的 80 种资产,提供了比特币、以太坊及其他头部代币之外的多元化投资组合标的。

其二是 MarketVector Digital Assets 100 小盘指数,该指数选取 100 种资产篮子中市值最小的 50 种代币,堪称衡量市场 「垃圾资产」 的风向标。

其三是 Kaiko 推出的小盘指数,这是一款研究型产品,而非可交易基准,为分析小盘资产群体提供了清晰的卖方量化视角。

这三者从不同维度描绘市场图景:整体山寨币组合、高 beta 小盘代币以及量化研究视角,而三者指向的结论却高度一致。

反观股票市场的基准表现,则呈现出截然相反的态势。

2024 年,美国大盘指数实现 25% 左右的涨幅,2025 年涨幅也达到两位数,期间回撤幅度相对有限。在此期间,标准普尔 500 指数年内最大回撤幅度仅为中高个位数,纳斯达克 100 指数则始终保持强劲上涨趋势。

两大股指均实现了年度收益复利增长,并未出现显著的收益回吐。

而整体山寨币指数的走势则大相径庭。CoinDesk 指数公司的报告显示,CoinDesk 80 指数仅第一季度就暴跌 46.4%,而同期追踪大盘的 CoinDesk 20 指数跌幅为 23.2%。

截至 2025 年 7 月中旬,CoinDesk 80 指数年内跌幅达 38%,而追踪比特币、以太坊及另外三种主流币种的 CoinDesk 5 指数同期涨幅却达到 12% 至 13%。

CoinDesk 指数公司的 Andrew Baehr 在接受 ETF.com 采访时,将这种现象描述为 「相关性完全相同,盈亏表现天差地别」。

CoinDesk 5 指数与 CoinDesk 80 指数的相关性高达 0.9,意味着二者走势方向完全一致,但前者实现了两位数的小幅增长,后者却暴跌近 40%。

事实证明,持有小盘山寨币带来的多元化收益微乎其微,而付出的业绩代价却极为惨重。

小盘资产板块的表现则更为糟糕。据彭博社报道,截至 2025 年 11 月,MarketVector Digital Assets 100 小盘指数已跌至 2020 年 11 月以来的最低水平。

过去五年间,该小盘指数回报率约为 - 8%,而对应的大盘指数涨幅却高达 380% 左右。机构资金明显青睐大盘资产,对尾部风险则避之不及。

从 2024 年山寨币的表现来看,Kaiko 小盘指数全年跌幅超 30%,中盘代币也难以跟上比特币的涨幅。

市场赢家高度集中在少数头部币种,如 SOL 和瑞波币。尽管 2024 年山寨币交易总量占比一度回升至 2021 年的高点,但 64% 的交易规模都集中在前十大山寨币身上。

加密货币市场的流动性并未消失,而是向高价值资产转移。

夏普比率与回撤幅度

如果从风险调整后收益的角度对比,差距则进一步拉大。CoinDesk 80 指数及各类小盘山寨币指数不仅回报率深陷负值区间,波动性也与股票相当甚至更高。

CoinDesk 80 指数单季度就暴跌 46.4%;MarketVector 小盘指数在经历又一轮下跌后,于 11 月跌至疫情时期的低位。

整体山寨币指数多次出现指数级别的腰斩式回撤:2024 年 Kaiko 小盘指数跌幅超 30%、2025 年第一季度 CoinDesk 80 指数暴跌 46%、2025 年末小盘指数再度跌至 2020 年低位。

相比之下,标准普尔 500 指数和纳斯达克 100 指数在两年间实现了 25% 与 17% 的累计回报,最大回撤幅度仅为中高个位数。美股市场虽有波动,但整体可控;而加密货币指数的波动则极具破坏性。

即便将山寨币的高波动性视为结构性特征,其 2024 至 2025 年的单位风险回报率,仍远低于持有美股大盘指数的水平。

2024 至 2025 年间,整体山寨币指数夏普比率为负;而标准普尔和纳斯达克指数在未调整波动性的情况下,夏普比率就已表现强劲。经波动性调整后,二者的差距进一步扩大。

比特币投资者与加密货币流动性

上述数据带来的首个启示,是流动性集中化与向高价值资产迁移的趋势。彭博社与 Whalebook 对 MarketVector 小盘指数的报道均指出,自 2024 年初以来,小盘山寨币表现持续落后,机构资金转而涌入比特币和以太坊 ETF。

结合 Kaiko 的观察结论,尽管山寨币交易总量占比回升至 2021 年水平,但资金集中于前十大山寨币。市场趋势已十分明确:流动性并未完全撤离加密货币市场,而是向高价值资产转移。

曾经的山寨币牛市,本质上只是一种基差交易策略,并非资产的结构性跑赢。2024 年 12 月,CryptoRank 山寨币牛市指数一度飙升至 88 点,随后在 2025 年 4 月暴跌至 16 点,涨幅完全回吐。

2024 年的山寨币牛市最终沦为一场典型的泡沫破裂行情;到 2025 年年中,整体山寨币组合几乎回吐了全部涨幅,而标准普尔和纳斯达克指数则持续复利增长。

对于那些考虑在比特币和以太坊之外进行多元化配置的理财顾问与资产配置者而言,CoinDesk 的数据提供了明确的案例参考。

截至 2025 年 7 月中旬,追踪大盘的 CoinDesk 5 指数年内实现两位数小幅增长,而多元化的山寨币指数 CoinDesk 80 却暴跌近 40%,二者相关性却高达 0.9。

投资者配置小盘山寨币,并未获得实质性的多元化收益,反而承受了远高于比特币、以太坊及美股的回报率损失与回撤风险,同时仍暴露于相同的宏观驱动因素之下。

当前资本将大多数山寨币视为战术性交易标的,而非战略性配置资产。2024 至 2025 年,比特币和以太坊现货 ETF 的风险调整后收益显著更优,美股同样表现亮眼。

山寨币市场的流动性正不断向少数 「机构级币种」 集中,如 SOL、瑞波币,以及其他少数具备独立利好因素或明确监管前景的代币。指数层面的资产多样性正遭受市场挤压。

2025 年,标普 500 指数和纳斯达克 100 指数上涨了约 17%,而 CoinDesk 80 加密货币指数下跌了 40%,小市值加密货币下跌了 30%

这对下一轮市场周期的流动性意味着什么?

2024 至 2025 年的市场表现,检验了在宏观风险偏好上行的环境中,山寨币能否实现多元化价值或跑赢大盘。在此期间,美股连续两年实现两位数增长,且回撤幅度可控。

比特币和以太坊则通过现货 ETF 获得了机构认可,并受益于监管环境的缓和。

反观整体山寨币指数,不仅回报率为负、回撤幅度更大,还与加密大盘代币及股票保持高相关性,却未能为投资者承担的额外风险提供相应补偿。

机构资金向来追逐业绩表现。MarketVector 小盘指数五年回报率为 - 8%,而对应大盘指数涨幅达 380%,这一差距反映出资本正不断向监管明确、衍生品市场流动性充足且具备完善托管基础设施的资产迁移。

CoinDesk 80 指数第一季度暴跌 46%,并在 7 月中旬录得 38% 的年内跌幅,这一走势表明,资本向高价值资产迁移的趋势非但没有逆转,反而在加速。

对于正在评估是否要配置小盘加密代币的比特币和以太坊投资者而言,2024 至 2025 年的数据给出了明确答案:整体山寨币组合的绝对收益跑输美股,风险调整后收益不及比特币和以太坊;尽管与加密大盘代币的相关性高达 0.9,却未能提供任何多元化价值。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。