Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

According to the latest analysis from Wall Street, the global economy and financial markets are undergoing profound structural changes. The core risk facing the U.S. economy in 2026 may shift from a traditional economic recession to a recession directly caused by a stock market crash. The "excess retiree" group, approximately 2.5 million people who retired early due to the stock market boom post-pandemic, has consumption capacity closely tied to stock market performance, creating a demand side that is extremely sensitive to market fluctuations. The Federal Reserve is caught in a dilemma between tackling stubborn inflation and maintaining financial stability. Analysts believe that the Fed may prioritize avoiding a market crash, tolerating higher inflation, and adopting aggressive rate cuts in the face of economic weakness. Meanwhile, the divergence in global central bank policies is intensifying, with the Bank of Japan expected to raise interest rates by 25 basis points to 0.75% at its meeting on December 19, reaching a 30-year high, which may alter global capital flows. The European Central Bank is expected to keep interest rates unchanged, while the Bank of England may complete its final rate cut in the current cycle. Against this backdrop, the upcoming U.S. non-farm payroll and CPI data are highly anticipated, with U.S. stocks beginning to show divergence in their upward trends, and funds may rotate to undervalued European markets, adding complexity and uncertainty to global asset allocation for 2026.

In the field of artificial intelligence, the market's fervent enthusiasm is facing a harsh reality check. Recently, Oracle's stock price plummeted by 14.8% over two days due to disappointing earnings and rumors of project delays, leading to a significant reduction in market capitalization. Although the company denied any delays in the data center project developed for OpenAI, its earnings report showed a slowdown in core cloud revenue growth, while capital expenditures soared to $12 billion, raising its full-year guidance by 43% to $50 billion, and free cash flow deteriorated to negative $10 billion, shifting to a "high investment, slow return" model. Similarly, despite chip giant Broadcom reporting better-than-expected revenue and profit figures, its stock price fell sharply by 11.4% due to investor dissatisfaction with its $73 billion AI order scale, and the company did not provide a complete AI revenue guidance for 2026. This sentiment has spread throughout the semiconductor industry, with the Philadelphia Semiconductor Index closing down over 5%, and Nvidia dropping more than 3%. Additionally, AI infrastructure company Fermi, founded by former government officials, saw its stock price halve by 46% during trading after a major client withdrew a $150 million investment commitment. Concerns about the sustainability of AI computing power spending and the overvaluation bubble are becoming increasingly evident. In the future, industry attention will shift to the Moore Threads MUSA Developer Conference and the ByteDance Engine Conference, anticipating updates on the new generation GPU architecture and AI assistant "Doubao."

Amid macroeconomic uncertainty and internal industry adjustments, Bitcoin is undergoing a critical correction phase. Currently, Bitcoin's price has been trading below the key on-chain cost basis (approximately $102,000 to $105,000) for nearly two months, and the purchasing power of ETFs has also significantly weakened. Analysts point out that this is due to a decline in traditional capital risk appetite and the convergence of futures basis from a peak of 25% to less than 5%, leading to a dual impact of arbitrage funds exiting the market. External pressures are also evident, with market expectations that the Bank of Japan may raise interest rates to 0.75% on December 19. Some analysts, based on historical data, have noted that previous rate hikes by the Bank of Japan were accompanied by Bitcoin experiencing significant corrections of over 20%, thus warning of the risk of prices further dropping to $70,000. Although Strategy founder Michael Saylor hinted at continuing to buy during the downturn, market analysts have sharply divided opinions: pessimists believe a bear market may have begun, with technical patterns pointing to deep correction targets of $70,000 or even $50,000; while optimists believe the short-term target of $87,700 has been reached and have turned bullish, setting a long-term target of $112,000. In the short term, the market generally expects prices to oscillate between $87,000 and $93,000, awaiting clear breakout signals.

In contrast to Bitcoin's extreme volatility, Ethereum is showing a "lagging" weak consolidation trend, but this also provides a different perspective for long-term investors. Analyst EliZ points out that Ethereum typically underperforms Bitcoin in the early stages of a cycle, as capital tends to prioritize the "safer" Bitcoin, but this is not a true weakness; rather, it is building momentum for a subsequent breakout. Historically, when Bitcoin's upward momentum slows, capital rotates to Ethereum, which often leads to a rapid and fierce increase. Therefore, for investors with a long-term view, the current price pullback is seen as a good opportunity to accumulate positions gradually. From a technical perspective, analyst CyrilXBT observes that Ethereum is attempting to build a bottom around $3,050 but is still hindered by the key 50-day moving average (approximately $3,281). If it can successfully break through and stabilize above this resistance level, it is expected to open up upward space to above $3,500; conversely, if it is blocked here, it may retest the support areas of $3,000 or even $2,800. It is worth noting that despite cautious market sentiment, on-chain data shows that a whale wallet known as "Bitcoin OG" has recently significantly increased its long position in Ethereum, valued at approximately $555 million, indicating strong confidence from some smart money in Ethereum's future.

2. Key Data (as of December 15, 13:00 HKT)

(Data source: GMGN, CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $89,604 (YTD -4.24%), daily spot trading volume $35.43 billion

Ethereum: $3,128 (YTD -6.26%), daily spot trading volume $20.05 billion

Fear and Greed Index: 16 (Extreme Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market Share: BTC 58.5%, ETH 12.4%

Upbit 24-hour trading volume ranking: BTC, XRP, ETH, MOVE, SOL

24-hour BTC long-short ratio: 47.91% / 52.09%

Sector performance: The crypto market saw a general decline, with the Layer 2 sector leading down by 3.59%, and the RWA sector down by 3.41%

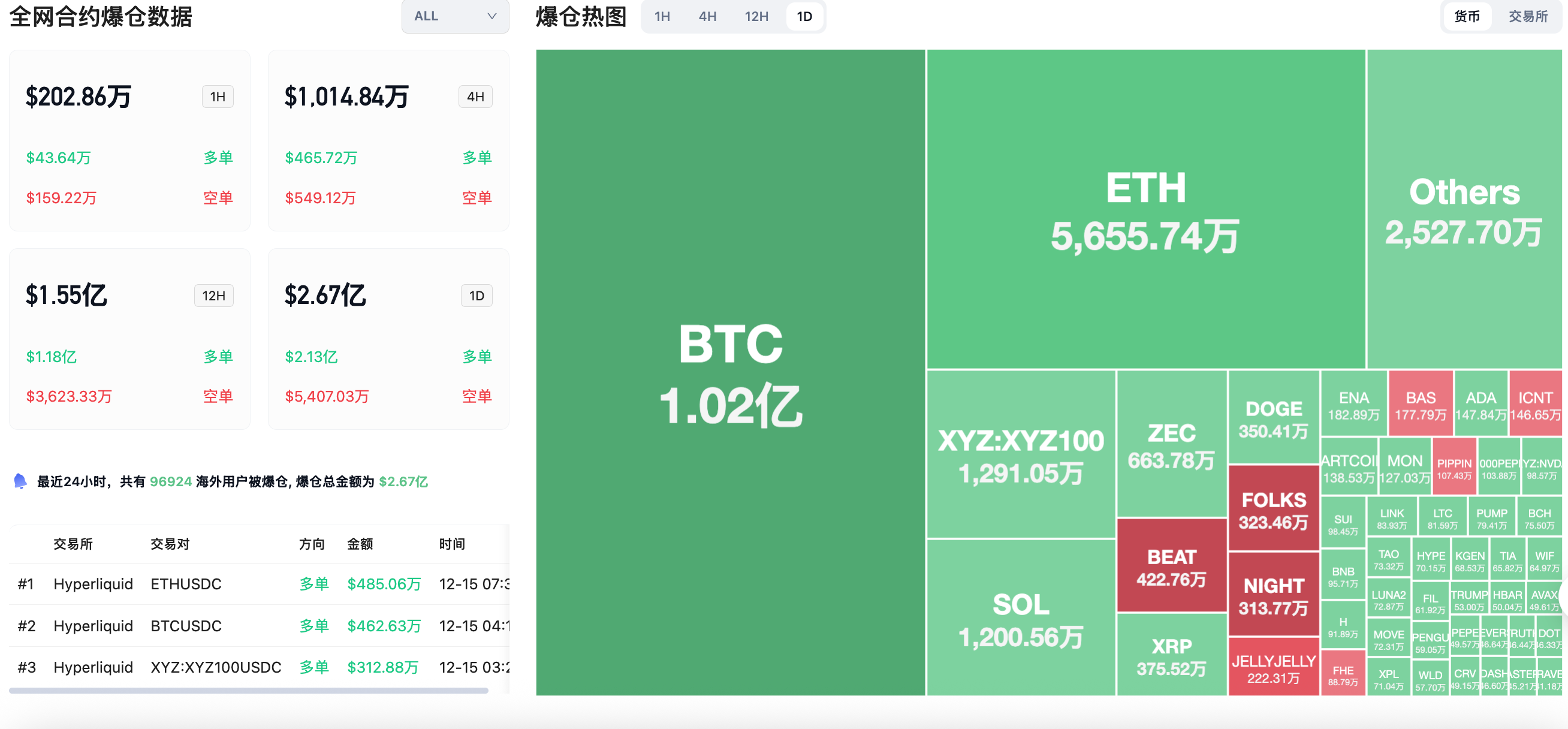

24-hour liquidation data: A total of 96,924 people were liquidated globally, with a total liquidation amount of $267 million, including $102 million in BTC liquidations, $56.55 million in ETH liquidations, and $12 million in SOL liquidations.

3. ETF Flows (as of December 12)

Bitcoin ETF: +$287 million

Ethereum ETF: +$209 million

Solana ETF: +$33.6 million

4. Today's Outlook

U.S. November unemployment rate: Expected value 4.4% (December 16, 21:30)

U.S. November non-farm payroll change (10,000): Expected value: 5 (December 16, 21:30)

Today, the top 100 cryptocurrencies by market capitalization saw the largest gains: MYX Finance up 12.6%, Rain up 6.4%, Ultima up 3.5%, Canton Network up 3.4%, TRON up 2.5%.

5. Hot News

Japanese and South Korean stock markets open lower, with the South Korean KOSPI index down 2.67%

A wallet marked as suspected Matrixport withdraws 3 million ASTER from Binance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。