作者:Ignas, 加密 KOL

编译:Felix, PANews

近期 Aave Labs 与 Aave DAO 围绕 CoWSwap 集成引发的费用分配问题进行了一番争论,这场争论也被社区视为一场 DeFi 治理的潜在危机。本文作者对这场争论以力求中立的视角进行了解读,以下为内容详情。

12 月 4 日,借贷协议 Aave Labs 将其前端界面 aave.com 的默认兑换集成从ParaSwap 迁移到 CoWSwap。看似这只是产品的小更新,但实际上暴露了 Aave 内部长期存在的深层次矛盾。

这场冲突并非关于 CowSwap、费用甚至用户体验,而是关于所有权的问题。即谁掌控 Aave,谁来决定分配,以及谁来获取围绕该协议所创造的价值。

在旧的设置下,兑换功能主要发挥着用户留存的作用:

用户可以在不离开 Aave 界面的情况下进行资产重组或兑换。重要的是,所有推荐费或正滑点盈余费用都作为收入重新分配到 Aave DAO 金库。

CowSwap 的集成改变了这一局面。

根据 Aave 文档,现在兑换会收取约 15 到 25 个基点的费用。Orbit 代表 EzR3aL(注:Aave DAO 的资深治理参与者和独立委托人)调查了这些费用的去向,并得出结论:这些费用不再进入 DAO 金库,而是流入了 Aave Labs 控制的一个地址。

“假设每周仅转移 20 万美元,那么 DAO 一年至少损失 1000 万美元。”——EzR3aL

Aave Labs 是否单方面切断了 DAO 的收入来源并将其转移到一家私营公司?

Aave 多年来之所以能顺利运转,是因为虽然职责划分模糊,但各方利益却保持一致。

- DAO 治理协议

- Aave Labs 构建前端界面

资金大多流向同一方向,所以没人太在意界定问题。

而今这种默契的协调似乎已经破裂。

正如 Aave 创始人兼 CEO Stani.eth 所写:

- “当时 Aave Labs 决定在那些情况下向 Aave DAO 捐赠(这些资金本也可以返还给用户)”

Aave Labs 的回应:“协议和产品是不同的概念。”

来自 Aave Labs 在论坛的回应:

- “该前端界面由 Aave Labs 运营,完全独立于协议和 DAO 的管理之外。”

- “该前端界面是一个产品,而非协议组件。”

从他们的角度来讲,这很正常。运行前端需要资金、安全需要资金、支持也需要资金。

Paraswap 的盈余流向 DAO 并非永久性规则。没有先例可循。

ACI(为 Aave DAO 提供服务的服务提供商)及其创始人 Marc Zeller 认为这是一个受托责任的问题。

“Aave DAO 薪资名单上的每一家服务提供商都对 DAO 负有强制性受托义务,进而对 AAVE 代币持有者的最大利益负责。”——Marc Zeller 在论坛的评论。

他认为存在一种默契:DAO 借出品牌和知识产权,前端的盈利也应归 DAO 所有。“看来我们一直被蒙在鼓里,以为这是理所当然的”。

Marc Zeller 还声称,DAO 损失了收入,并且路由决策可能会将交易量推向竞争对手,导致 Aave DAO 损失约 10% 的潜在收入。

协议与产品

Aave Labs 在协议和产品之间划定了明确的界限。

DAO 管理协议及其链上经济。Aave Labs 则将前端界面作为独立且具有自身理念的单独产品来运营。

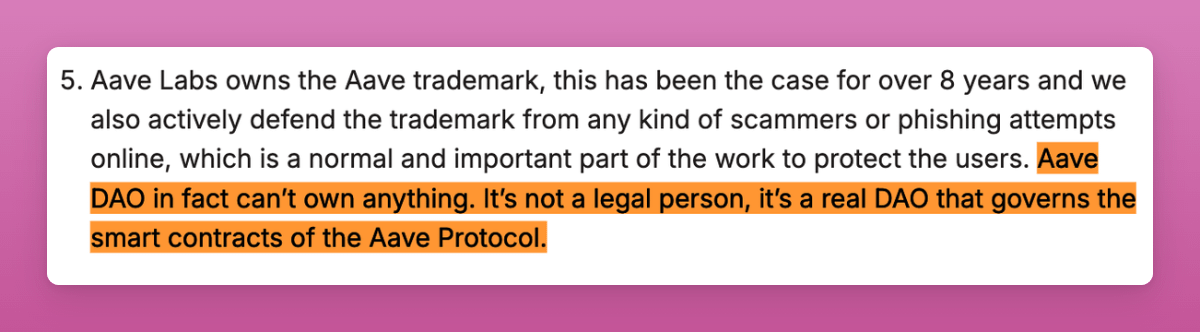

正如 Aave 创始人在此推文中解释的:

- Aave Labs 的前端界面是一个完全基于我们自身理念的产品,我们已经开发了 8 年多,类似于其他利用 Aave 协议的界面,如 DeFi Saver。

- Aave Labs 对其产品进行盈利也是完全合理的,尤其是因为其并不触及协议本身,而且鉴于 ByBit 安全漏洞事件,这确保了进入协议的安全访问。

Aave DAO 不拥有知识产权,因为 DAO 不是法律实体,不能持有商标或在法庭上强制执行商标权。

DAO 管理 Aave 协议的智能合约和链上参数,但不管理品牌本身。

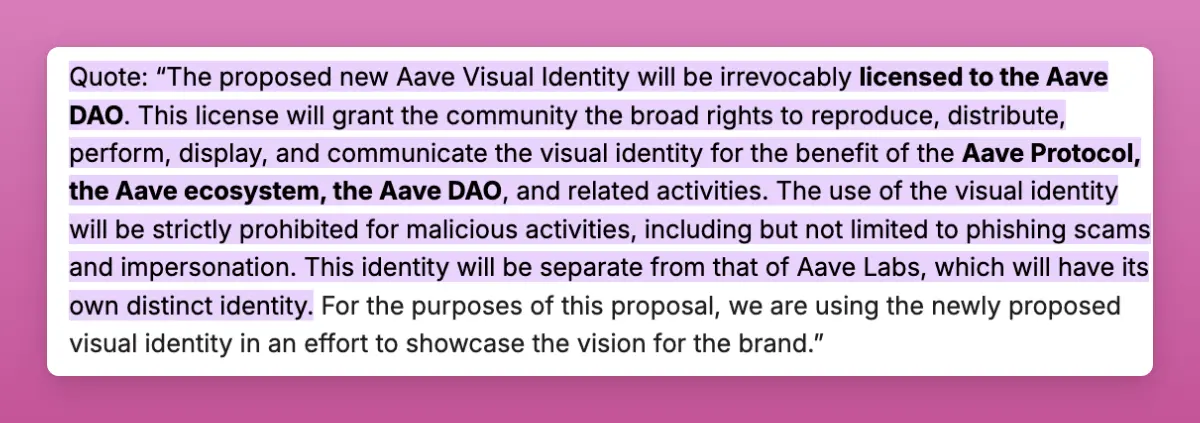

不过,DAO 获得了使用 Aave 品牌和视觉标识的许可权,用于与协议相关的用途。过去治理提案明确授予 DAO 广泛权利,可“为 Aave 协议、Aave 生态系统和 Aave DAO 的利益”使用视觉标识。

来源:Aave

正如 EzR3aL 所说:

- “收取这笔费用之所以可行,是因为 Aave 品牌在生态系统中广为人知且被接受。这是 Aave DAO 付出代价才换来的品牌。”

Aave 品牌的价值并非源于一个标志。

它的价值源于:

- DAO 谨慎地管控风险

- 代币持有者承担协议风险

- DAO 向服务提供商支付费用

- DAO 在多次危机中幸存下来而未崩溃

- 协议赢得了安全可靠的声誉

这就是 EzR3aL 所说的“DAO 付出代价才换来的品牌”。

并非法律意义上的付出,而是经济意义上的付出,投入了资金、治理、风险和时间。

这听起来是不是很耳熟?

又回到了 Uniswap Labs 和基金会关于 Uniswap 前端费用的类似问题。最终,Uniswap 重新调整了股权和代币持有者的权益,完全取消了前端费用。

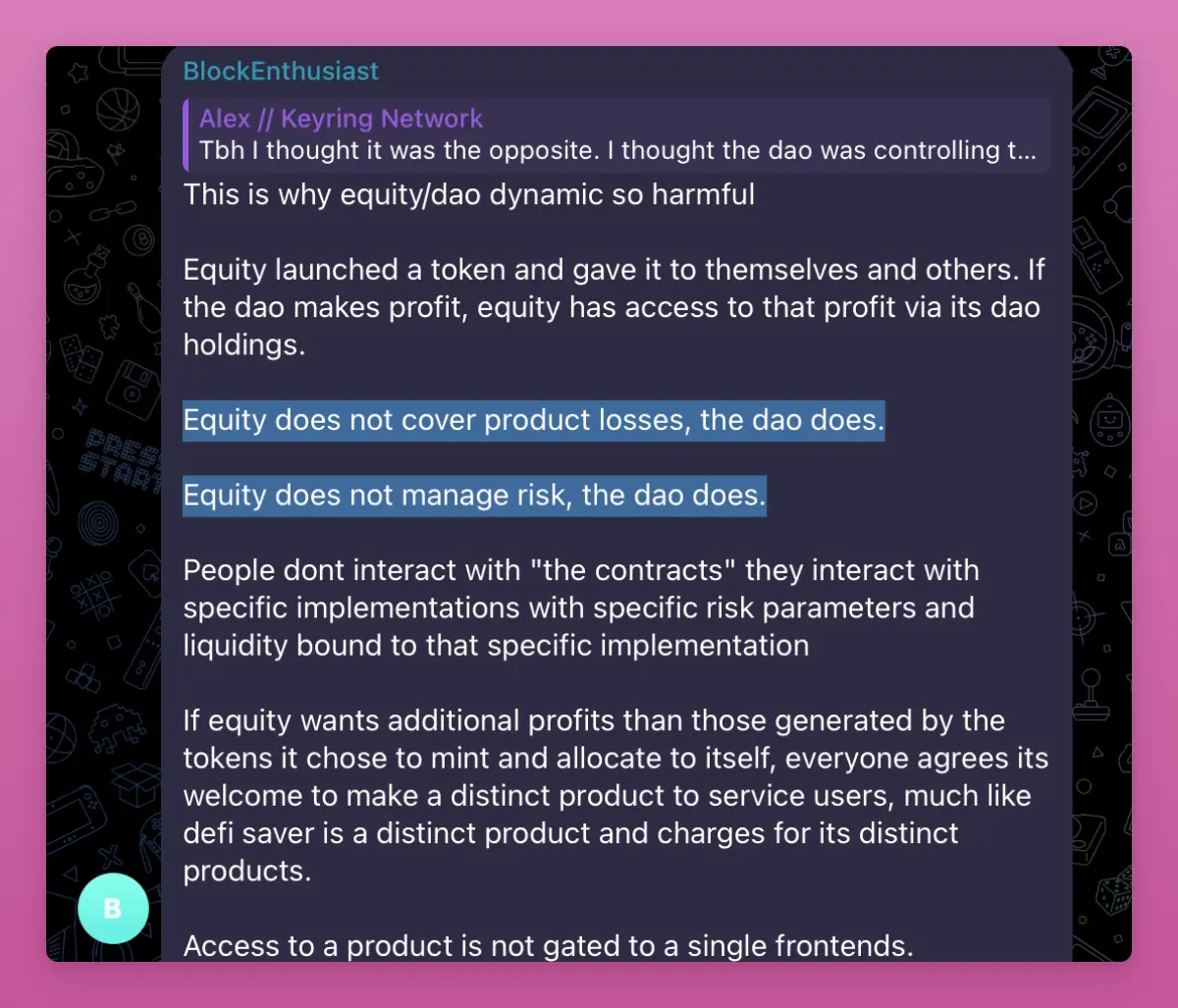

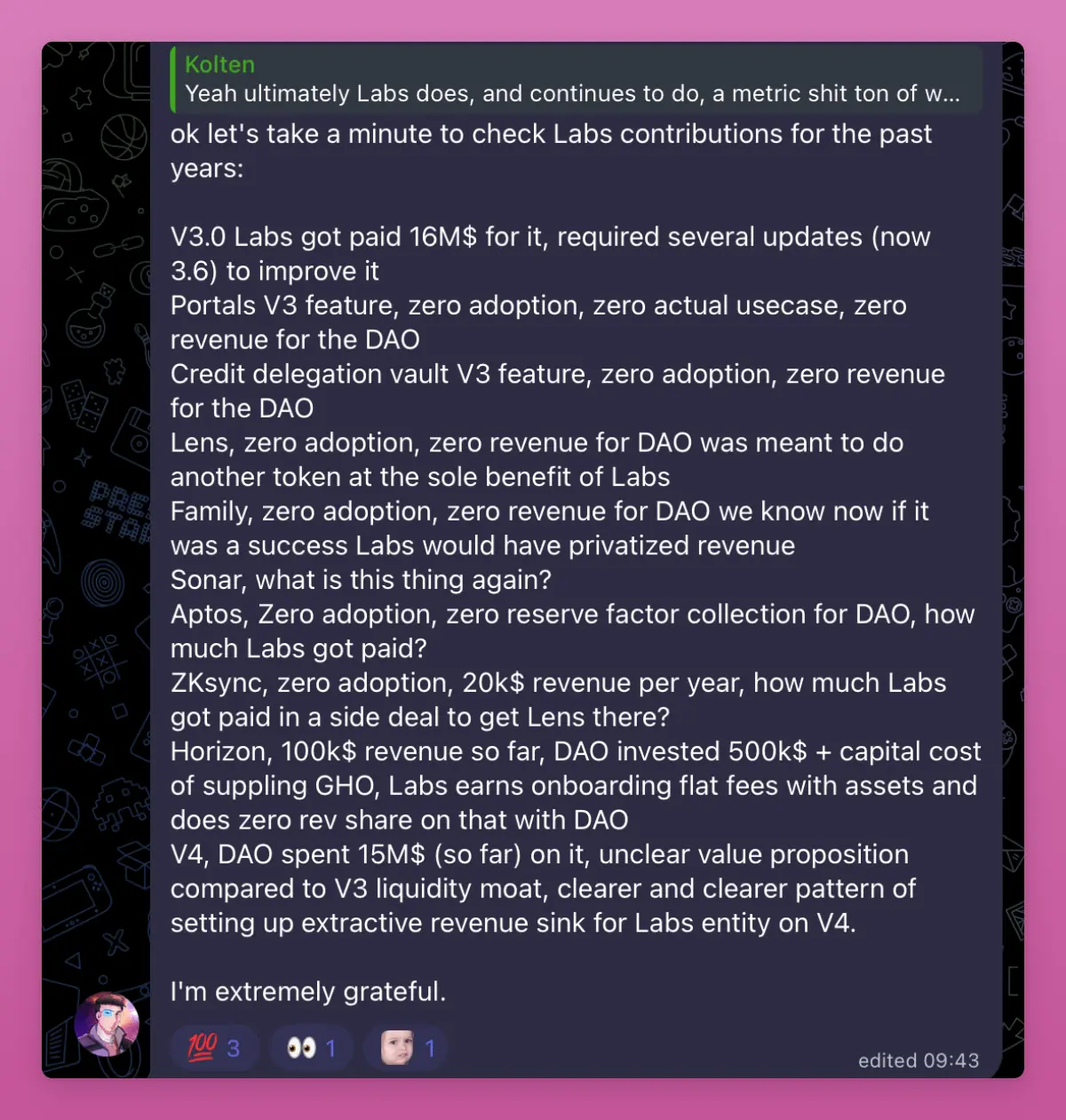

这就是为什么股权 / DAO 动态会造成伤害(这是我从 TG 群聊中发现的)。

上图内容如下:

“Equity(股权方)发行了一种代币,并把这些代币分配给了自己和他人。如果 DAO 产生利润,Equity 可以通过它在 DAO 中持有的代币份额获得利润。

- 但 Equity 不承担产品的损失,这些损失由 DAO 来承担。

- Equity 也不管理风险,风险管理由 DAO 负责。

用户并非直接与“合约”交互,而是与特定的实现版本交互,这些版本有特定的风险参数和与该特定实现绑定的流动性。

如果 Equity 想要获得超出它当初自行铸造并分配给自己的代币所产生利润之外的额外收益,大家都同意它完全可以去开发一个独立的产品来为用户提供服务,就像 DeFi Saver 是一个独立产品并为其独特服务收费一样。

对一个产品的访问权限,本来就不应该被限制在单一的前端上。”

截至撰稿时,Aave Labs 唯一认同批评者观点的是沟通方面。

- 这里真正合理批评的是沟通。或者说是缺乏沟通。

事情本来就够复杂了,现在更糟了。

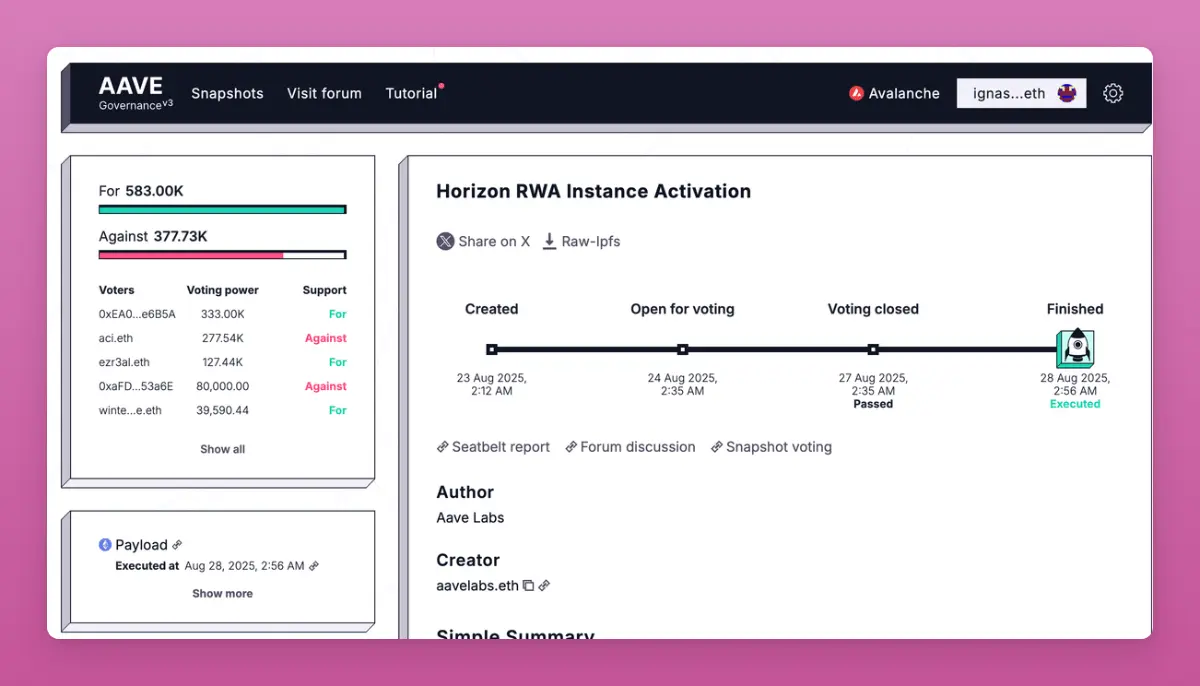

Aave Labs 提出了 Horizon 作为专属 RWA 实例。

最初,该提案包含了一个立即引起 DAO 警觉的内容:一种收益份额递减的新代币。

各派系的代表强烈反对(包括作者在内),认为引入独立的代币会稀释 AAVE 的价值主张,并破坏一致性。

DAO 最终获胜,Aave Labs 被迫让步。新代币计划被取消。

但这引发了更大的分歧。

尽管存在诸多担忧(其中一项明确指出 Aave Labs 与 DAO 的明确职责),Horizon 仍上线了。这是最具争议的一次投票获胜。

我投票反对部署,主张达成友好协议,以免未来冲突升级。而这正是目前的情况。经济问题迅速成为矛盾的焦点。

据 Marc Zeller 引用的数据,到目前为止,Horizon 已经产生了约 10 万美元的总收入,而 Aave DAO 则投入了 50 万美元的激励资金,这使得其账面上的净资产约为 -40 万美元。

而且这还没算上其他因素。

Marc 还指出,数千万枚 GHO 被投入 Horizon,但其收益低于维持 GHO 锚定价格所需的成本。

若将这些机会成本计算在内,DAO 的真实经济状况可能更糟。

这促使 ACI 提出了一个超越 Horizon 本身的问题:

如果一个由 DAO 资助的项目直接经济效益不佳,这是否就是事实的全部情况?

或者,是否存在代币持有者看不到的额外收益、集成费用或链下安排?

多年来,多个 Labs 提出的部署和计划最终都导致 DAO 的成本超过了其收益。

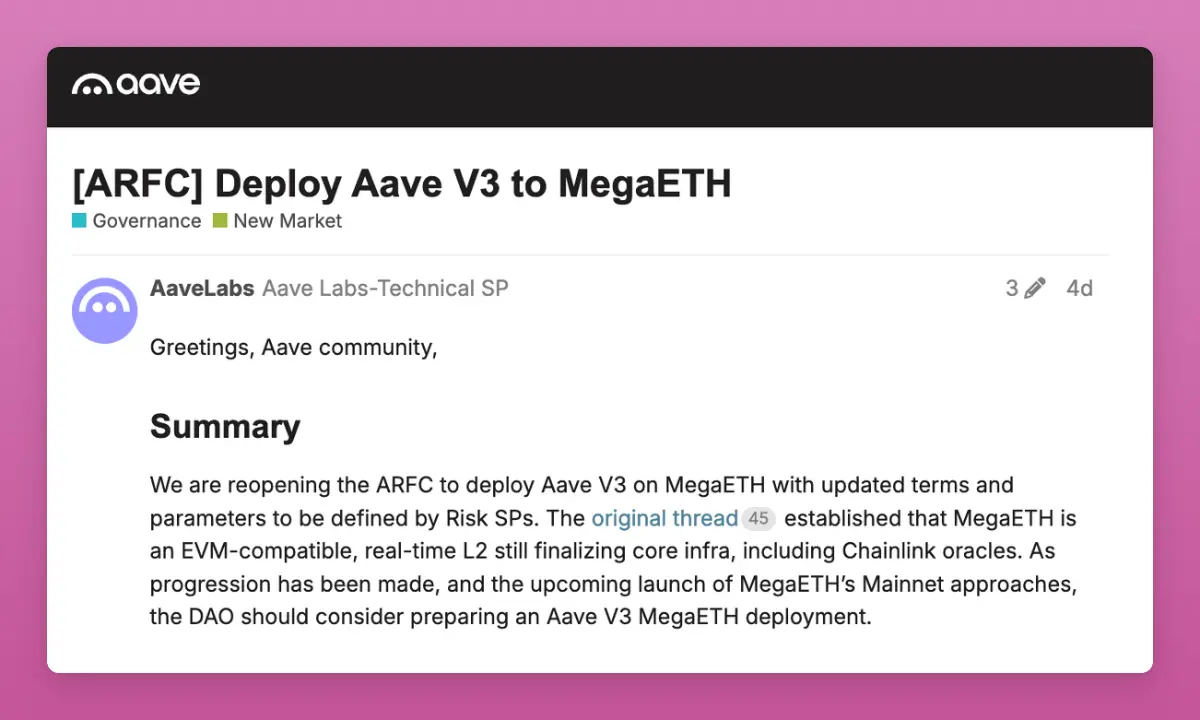

在 Aave Labs 提出一项在 MegaETH 上部署 Aave V3 的 DAO 提案的几天后,相关讨论随即展开。

作为回报,“Aave Labs 将从 MegaETH 获得 3000 万积分”。

然后,“这些积分可能会按照 Aave DAO 的 GTM 战略,在 Aave V3 MegaETH 市场上作为激励措施进行分配。”

问题在于,当一个产品由私人实体运营、使用 DAO 支持的资产时,透明度很重要,同时必须保证激励按约定分配。

来源:Aave

该提案令人意外的原因还有一个:

Aave DAO 与多个服务提供商合作,尤其是 ACI,早在 3 月就已提议在 MegaETH 上部署。相关讨论仍在进行中。

来源:Aave

正如 Marc 在论坛中评论的那样:

- “在讨论进行期间,我们非常惊讶地发现 Aave Labs 决定绕过所有先例,放弃所有正在进行的进展,直接与 MegaETH 联系。我们是在该提案发布在论坛上时才得知此事的。”

金库

这场争论的另一个部分与 Aave 金库有关。

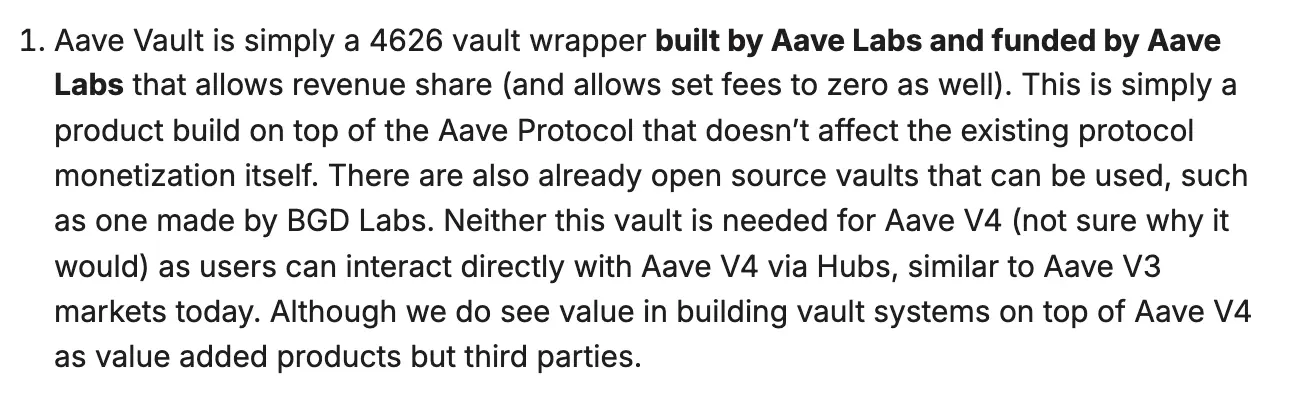

Aave 金库是由 Aave Labs 构建和资助的应用级产品。从技术上讲,它们是建立在 Aave 协议之上的 ERC-4626 金库包装器,为用户抽象化仓位管理。

Stani 对此解释得非常明确:

- “Aave 金库只是由 Aave Labs 构建并资助的 4626 金库包装器。”

从 Aave Labs 的角度来看,这不应引起争议。

金库并非协议组件。它们不会影响协议的盈利。

它们是可选的,用户始终可以直接与 Aave 市场互动或使用第三方金库。

- “对于 Aave V4 来说,这个金库并非必需……用户可以通过 Hubs 直接与 Aave V4 进行交互。”

而且由于金库是产品,Aave Labs 认为他们有权对其盈利。

- “Aave Labs 对其产品进行盈利是完全没问题的,尤其是因为它们并不涉及协议本身。”

那么为什么金库会被卷入这场争斗呢?

原因在于分发渠道。

如果金库成为 Aave V4 的默认用户体验,那么一个 Labs 拥有、带有 Aave 品牌的产品就可能成为用户与协议之间的桥梁,在依赖 DAO 积累的声誉、流动性和信任的情况下,收取交易费用。

尽管 Aave 产品的采用率增加,但 AAVE 代币仍会受到影响。

再次强调,作者认为这个问题与 Uniswap Labs 与基金会之间关于前端产品的争论属于同一范畴。

总而言之,CowSwap、Horizon、MegaETH 和 Aave Vaults 都面临着同一个问题。

Aave Labs 视自己为独立构建者,在中立协议之上运营一个带有主观意见的产品。

DAO 越来越认为协议价值正在其直接控制之外被变现。

Aave DAO 并不拥有知识产权,但它已获得授权,可以将 Aave 品牌和视觉标识用于与协议相关的用途。

这场争论至关重要,因为即将推出的 Aave v4 版本明确旨在将复杂性从用户端转移到抽象层。

更多的路由、更多的自动化,以及更多位于用户与核心协议之间的产品。

更多的抽象意味着更多的用户体验控制,而用户体验控制正是价值创造 / 提取的关键之处。

本文力求使本文保持中立。不过,还是希望在涉及 $AAVE 代币持有者的价值捕获方面能够达成共识。

作者希望达成的共识不仅对 Aave 本身有益,还因为 Aave 为股权和代币如何共存树立了一个重要的先例。

Uniswap Labs 已经完成了这一过程,并最终使结果有利于 $UNI 持有者。

Aave 也应如此。

相关阅读:Uniswap协议费用分配提案引爆市场,对DeFi的未来有何影响?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。