作者:Alex Krüger

编译:深潮TechFlow

美联储刚刚承诺每月购买400亿美元的美国国债,市场已开始高呼“量化宽松(QE)!”

虽然从表面上看,这一数字似乎是刺激经济的信号,但其背后的机制却讲述了不同的故事。鲍威尔此举并非为了刺激经济,而是为了防止金融系统的运转出现问题。

以下是美联储的储备管理购买计划(Reserve Management Purchases,RMP)在结构上与量化宽松(QE)的区别,以及其潜在影响的分析。

什么是量化宽松(QE)?

为了严格定义量化宽松,并将其与标准的公开市场操作区分开来,需要满足以下条件:

三大机械条件

-

机制(资产购买):央行通过创造新的储备资金购买资产,通常是政府债券。

-

规模(大规模):购买量相对于市场总规模而言是显著的,其目的是向系统注入大量流动性,而不是进行精细调整。

-

目标(数量优先于价格):标准政策通过调整供给以实现特定利率(价格)目标,而量化宽松则承诺购买特定数量的资产(数量),无论最终的利率如何变化。

功能性条件

-

正净流动性(QE):资产购买的速度必须超过非储备负债(如货币和财政部普通账户)的增长速度。其目标是将过剩流动性强制注入系统,而不仅仅是提供所需的流动性。

什么是储备管理购买(RMP)?

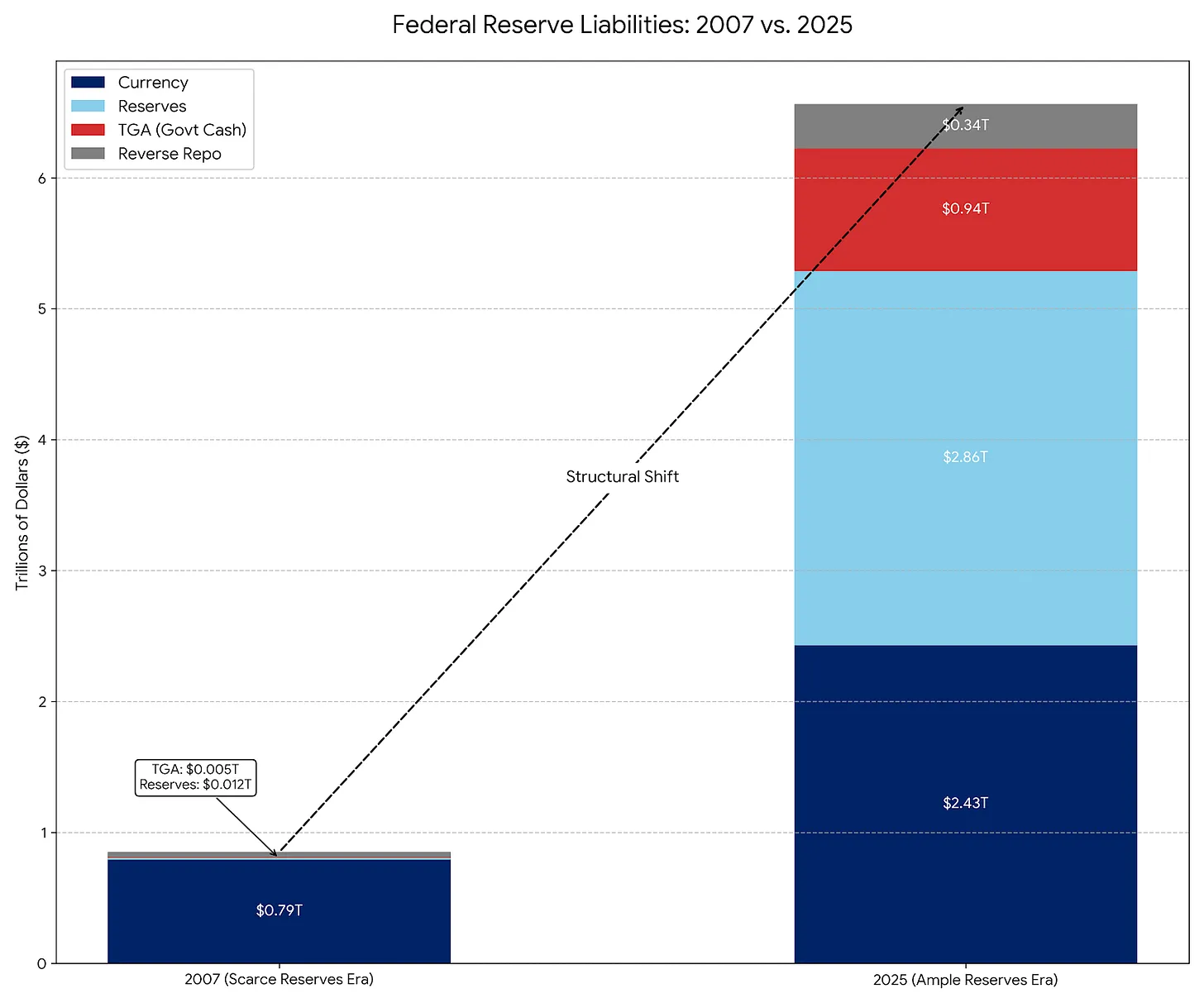

RMP实际上是永久公开市场操作(Permanent Open Market Operations,POMO)的现代继承者,POMO是从20世纪20年代到2007年的标准操作程序。然而,自2007年以来,美联储负债的构成发生了巨大变化,这需要调整操作范围。

POMO(稀缺储备时代)

在2008年之前,美联储的主要负债是流通中的实物货币;其他负债较少且可预测。在POMO下,美联储购买证券仅仅是为了满足公众对实物现金的逐步需求。这些操作被校准为流动性中性,并且规模较小,不会扭曲市场价格或压低收益率。

RMP(充足储备时代)

如今,实物货币仅占美联储负债的一小部分,其负债主要由财政部普通账户(TGA)和银行储备等大额且波动性较强的账户主导。在RMP下,美联储购买短期国债(T-Bills)以缓冲这些波动,并“持续维持充足的储备供给”。与POMO类似,RMP的设计也是流动性中性的。

为什么选择此时启动RMP:TGA与税收季的影响

鲍威尔之所以实施储备管理购买计划(RMP),是为了解决一个特定的金融系统问题——TGA(财政部普通账户)流动性抽离(TGA Drain)。

操作原理:当个人和企业缴纳税款时(特别是在12月和4月的主要税收截止日期),现金(储备金)从他们的银行账户转移到美联储的政府支票账户(TGA),而TGA位于商业银行系统之外。

影响:这种资金转移会从银行系统中抽走流动性。如果储备金下降过低,银行之间将停止互相放贷,可能引发回购市场(Repo Market)危机(类似于2019年9月的情况)。

解决方案:美联储现在启动RMP,以抵消这种流动性抽离。他们通过创造400亿美元的新储备金,来替代即将被锁定在TGA中的流动性。

如果没有RMP:税收支付会收紧金融环境(利空)。 如果有RMP:税收支付的影响被中和(中性)。

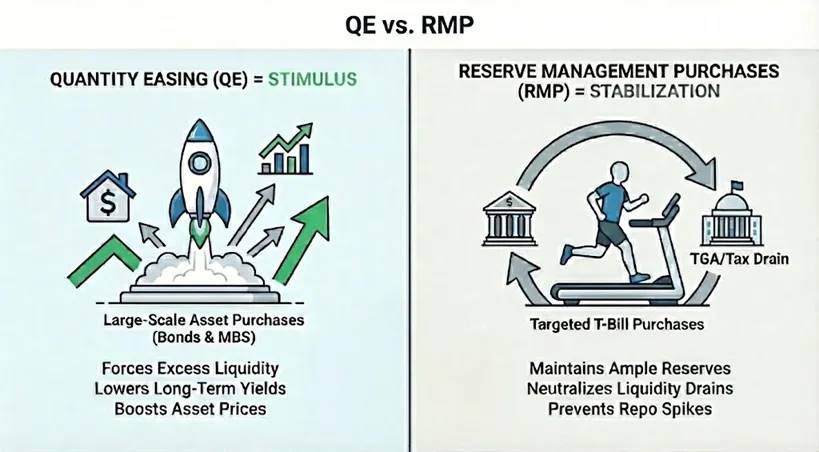

RMP究竟是QE吗?

从技术上看:是的。如果你是严格的货币主义者,RMP符合QE的定义。它满足了三大机械条件:通过新储备金进行的大规模资产购买(每月400亿美元),并且目标是数量而非价格。

从功能上看:不是。RMP的作用是稳定,而QE的作用是刺激。RMP并不会显著放松金融环境,而是防止在TGA补充等事件期间金融环境进一步收紧。由于经济本身会自然抽离流动性,RMP必须持续运行才能维持现状。

RMP何时会转变为真正的QE?

RMP转变为全面QE需要以下两个变量之一发生变化:

A. 持续期的变化:如果RMP开始购买长期国债或抵押贷款支持证券(MBS),它就会成为QE。通过这样做,美联储将市场中的利率(持续期)风险移除,压低收益率,迫使投资者转向更高风险资产,从而推高资产价格。

B. 数量的变化:如果对储备金的自然需求放缓(例如TGA停止增长),但美联储仍然每月购买400亿美元,RMP就会成为QE。此时,美联储向金融系统注入了超出需求的流动性,这些流动性不可避免地会流入金融资产市场。

结论:市场影响

RMP旨在防止税收季的流动性抽离对资产价格造成影响。尽管从技术上看是中性的,但其重新引入向市场传递了一个心理信号:“美联储保护伞”(Fed Put)已经启动。 这一宣布对风险资产是净利好的,提供了“温和的顺风”。通过承诺每月400亿美元的购买,美联储实际上为银行系统的流动性提供了一个底线。这消除了回购危机的尾部风险,增强了市场的杠杆信心。

需要注意的是,RMP是稳定器,而非刺激器。由于RMP只是替代被TGA抽离的流动性,而不是扩展净货币基础,因此它不应被误认为是真正QE的系统性宽松。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。