来源:金十

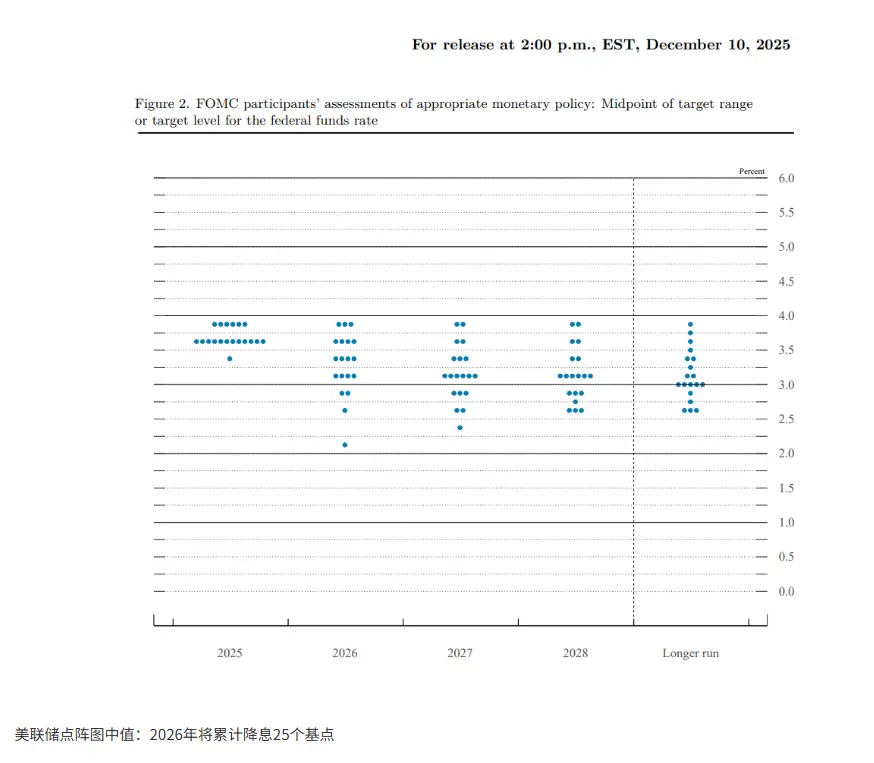

12月11日,美联储以9-3的投票比例将基准利率下调25个基点至3.50%-3.75%,为连续第三次会议降息。政策声明删除了对失业率“较低”的描述。最新点阵图维持2026年降息25个基点的预测。

另外,美联储将于12月12日开始的30天内购买400亿美元国库券,以维持充足的准备金供应。

利率决议全文

可用的数据表明,经济活动正以温和的步伐扩张。今年以来就业增长放缓,失业率截至9月有所上升。更近期的指标与上述情况一致。通胀较年初有所上升,仍处于偏高水平。

委员会的长期目标是实现最大就业和2%的通胀率。经济前景的不确定性依然处于高位。委员会密切关注其双重使命两端的风险,并认为近数月就业方面的下行风险有所上升。

为支持上述目标,并考虑到风险平衡的变化,委员会决定将联邦基金利率目标区间下调25个基点至3.50%至3.75%。在评估是否需要对联邦基金利率目标区间进行进一步调整的幅度和时机时,委员会将仔细评估最新数据、不断变化的经济前景以及风险平衡。委员会坚定致力于支持最大就业,并使通胀回到2%的目标。

在评估适当的货币政策立场时,委员会将继续监测最新信息对经济前景的影响。如果出现可能阻碍实现委员会目标的风险,委员会将准备适时调整货币政策立场。委员会的判断将考虑广泛的信息,包括劳动力市场状况、通胀压力与通胀预期,以及金融与国际形势的发展。

委员会认为,准备金余额已下降至充足水平,并将按需启动购买短期美国国债,以在持续基础上维持充足的准备金供应。

投票支持此次货币政策行动的有:主席杰罗姆·鲍威尔(Jerome H. Powell)、副主席约翰·威廉姆斯(John C. Williams)、迈克尔·巴尔(Michael S. Barr)、米歇尔·鲍曼(Michelle W. Bowman)、苏珊·柯林斯(Susan M. Collins)、丽莎·库克(Lisa D. Cook)、菲利普·杰斐逊(Philip N. Jefferson)、阿尔贝托·穆萨莱姆(Alberto G. Musalem)以及克里斯托弗·沃勒(Christopher J. Waller)。投票反对的有史蒂芬·米兰(Stephen I. Miran),其倾向于在本次会议上将联邦基金利率目标区间下调1/2个百分点;以及奥斯汀·古尔斯比(Austan D. Goolsbee)和杰弗里·施密德(Jeffrey R. Schmid),他们倾向于本次会议维持联邦基金利率目标区间不变。

关于货币政策操作的决定

为落实联邦公开市场委员会在2025年12月10日声明中宣布的货币政策立场,美联储作出以下决定:

美联储理事会一致投票决定,自2025年12月11日起,将准备金余额利率下调至3.65%。

作为政策决定的一部分,联邦公开市场委员会投票决定指示纽约联邦储备银行公开市场交易台,在另行通知前,按照以下国内政策指令执行系统公开市场账户中的交易:

“自2025年12月11日起,联邦公开市场委员会指示交易台:

为将联邦基金利率维持在3.50%至3.75%的目标区间内,按需开展公开市场操作。

以3.75%的利率开展常备隔夜回购协议操作。

以3.50%的操作利率开展常备隔夜逆回购协议操作,并对每家交易对手设定每日1600亿美元的限额。

通过购买国库券,并在必要时购买剩余期限不超过三年的其他美国国债,增加系统公开市场账户的证券持有量,以维持充足水平的准备金。

在拍卖中将美联储持有的美国国债的全部本金偿付进行再投资。将美联储持有的机构证券的全部本金偿付转投于国库券。”

在相关行动中,美联储理事会一致投票批准将一级信贷利率下调25个基点至3.75%,自2025年12月11日起生效。在采取这一行动时,理事会批准了纽约、费城、圣路易斯和旧金山联邦储备银行董事会提交的设定该利率的请求。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。