Author: polar, Crypto KOL

Compiled by: Felix, PANews

Excessive financialization is an extreme stage of financialization, which itself refers to the process of financial markets dominating the economy. In economies characterized by excessive financialization, speculative trading and other financial activities overshadow more socially beneficial productive services, while household wealth and inequality increasingly become linked to asset prices. In short, wealth is no longer directly related to hard work and is decoupled from the means of production. This leads to more capital flowing into speculative activities, as Keynes said: "It is a bad thing when the development of a nation's capital becomes a byproduct of gambling activities."

At the same time, it is important to understand the role of the market. The market is crucial. The public lives in a (mostly) free market economy where buyers and sellers voluntarily match, prices are continuously updated to reflect new information, and profit-makers constantly replace losers (at least theoretically). The decisions of traders determine how scarce resources are allocated, thereby improving market allocation efficiency. Theoretically, the market is essentially elitist, which makes sense. If the power to allocate resources is in the hands of traders, it is natural to hope that the more skilled these traders are at capital allocation, the better.

Therefore, in an idealized free market system, excellent traders would allocate capital to the outcomes most needed by society and thus gain more capital; traders with poor allocation abilities would be punished and have less capital; capital would naturally flow to those best at allocating it. All of this should occur in sync with the real output created by manufacturing and service industries.

However, the current market can no longer fully achieve this. In the past, trading was a game that only a few could play. For most of the 19th and 20th centuries, only the wealthy and well-connected could participate; exchanges like the New York Stock Exchange were only open to licensed brokers and members, leaving ordinary people with almost no opportunity to access the market. There was also a severe information asymmetry, and market data was not publicly available.

All of this changed dramatically with digitization. From landlines to smartphones, and to zero-commission apps like Robinhood, the investment process has been thoroughly democratized. Today, anyone can easily trade 0DTE options, prediction markets, and cryptocurrencies. While this development has made investing fairer and more accessible, it has also dramatically increased the importance of the market in daily life.

Excessive Gambling and Excessive Financialization

Due to the rapid digitization from the late 20th century to the early 21st century, financial speculation (or excessive gambling) has become not only unprecedentedly easy to engage in but also has an unprecedented number of participants.

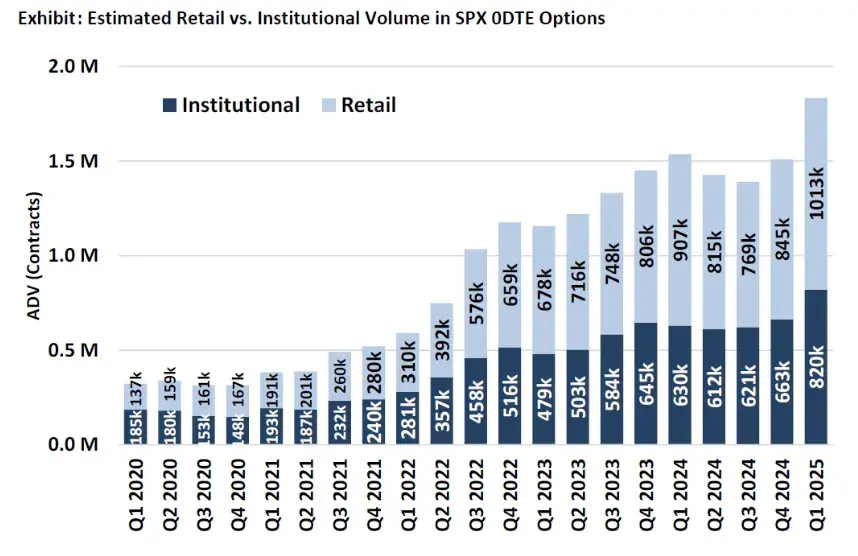

0DTE options trading volume can be seen as an indicator of retail gambling

Is the current level of (excessive) financialization a bad thing? It can be said with certainty: yes. Under excessive financialization, the market is no longer the "capital weighing machine" that Keynes described, but has simply become a "wealth extraction tool." However, what I want to explore here is not "good or bad," but the causal relationship: in a society where financialization and gambling are prevalent, which is the cause and which is the effect?

Jez describes excessive gambling as a process where "actual returns are compressed, and risks are increasing." I believe that excessive gambling is one of the two natural responses to excessive financialization. However, unlike the phenomenon of the millennial generation increasingly leaning towards socialist attitudes, excessive gambling has driven the process of excessive financialization, which in turn has exacerbated the degree of excessive gambling, forming a nearly self-consuming feedback loop.

Excessive financialization is a structural change—society increasingly relies on the market; excessive gambling is a behavioral response—an reaction after the complete decoupling of effort and reward. Excessive gambling itself is not a new phenomenon; a study from 1999 showed that in the United States, households with an annual income below $10,000 would spend 3% of their annual income on lottery tickets, motivated by a desire to change their income situation. However, in recent years, as financialization (and digitization) has intensified, the popularity of gambling has clearly risen.

Socialism as a Response

Due to social media and digitization, financialization has permeated many aspects of life. Public life increasingly revolves around the market, which now plays a larger role in capital allocation than ever before. As a result, it is nearly impossible for young people to buy homes early; the median age of first-time homebuyers in the U.S. has reached a record 39 years, while the median age of all homeowners is 56; asset prices are severely decoupled from real wages, partly due to inflation, making it nearly impossible for young people to accumulate capital. Peter Thiel has pointed out that this is a significant reason for the rise of socialist sentiment:

"When a person is burdened with massive student loans or exorbitant housing prices, they remain in a state of negative capital for a long time, unable to accumulate capital through real estate; if a person has no stake in the capitalist system, they are likely to oppose it."

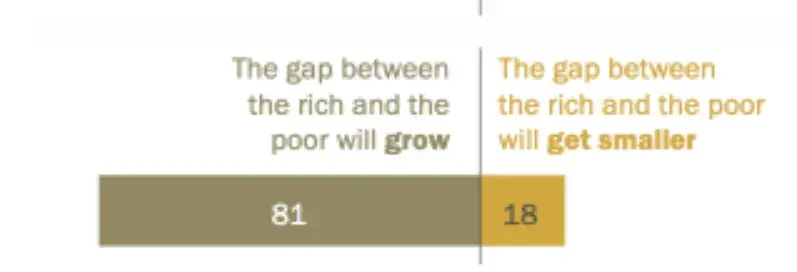

Asset inflation and high housing prices (I also believe that the desire for imitation and survivor bias brought about by social media are exacerbating factors) have significantly reduced perceived social mobility. A recent Wall Street Journal poll showed that only 31% of Americans still believe in the American dream of "working hard leads to success"; moreover, most Americans believe that by 2050, the wealth gap will only continue to widen.

This pessimistic sentiment only reinforces a perception: rising asset prices will leave those without capital far behind, and hard work cannot change that. When people no longer believe that effort can improve their lives, they lose the motivation to work hard in a "manipulated" system. This directly leads to the rise of socialist thought, which is a structural response to the increasing financialization of today's world, hoping to redistribute assets more fairly to reignite the connection between hard work and reward.

Socialism is an ideological response attempting to bridge the gap between the bourgeoisie and the proletariat. However, as of May 2024, public trust in the government stands at only 22%, leading to another natural response. Rather than relying on socialism to bridge the gap, people may prefer to directly enter the upper class through (excessive) speculation.

"Ouroboros"

As previously mentioned, the dream of climbing the social ladder through gambling is not new. However, the internet has fundamentally changed the mechanics of gambling. Today, almost anyone of any age can gamble anytime and anywhere. Behaviors once looked down upon have now deeply integrated into society due to the glamorization by social media and high accessibility.

The rise of gambling is an inevitable result of internet development. Nowadays, the public can gamble without going to physical casinos; gambling is ubiquitous. Anyone can register for a Robinhood account and start trading, and cryptocurrencies are equally accessible, with online casinos reaching historic revenue highs.

As the New York Times stated: "Today's gamblers are not just retirees at the card table. They are young people with smartphones. Moreover, due to a series of quasi-legal innovations in the online gambling industry, Americans can now bet on almost anything from their investment accounts."

Recently, Google and Polymarket announced a partnership to display betting odds in search results. The Wall Street Journal wrote: "Football and election betting are gradually becoming part of our lives, just like watching games and voting." While a large part of this is for social purposes, it is primarily attributed to excessive financialization; even social gambling is a result of the market increasingly integrating into life.

As household wealth becomes more linked to asset prices, while wage growth lags behind and perceived social mobility from hard work declines, a fatal question arises: "If hard work cannot improve my living standards, why should I bother?" A recent study found that as households perceive a decreasing likelihood of owning a home, their consumption relative to wealth increases, their work effort decreases, and they engage in riskier investments. The same is true for low-wealth renters; these behaviors accumulate, further exacerbating the wealth gap between the rich and the poor.

Then survivor bias begins to take effect. Social media is filled with success stories of "getting rich overnight," displays of wealth, and people shouting "quit your job, you can survive by gambling," all of which foster a broader "degeneracy" mindset. South Korea is a typical example: low social mobility, widening income gaps, high housing prices, and a general tendency towards gambling among Koreans. According to the Financial Times, retail speculation has accounted for half of the daily trading volume in South Korea's $20 trillion stock market. Due to youth unemployment, stagnant wages, mortgage pressures, and educational and workplace competition, they self-deprecatingly refer to themselves as the "sampo generation"—giving up on dating, marriage, and having children. Japan has the "satori generation," and China has the "lying flat generation," all essentially the same.

In the U.S., half of men aged 18-49 have sports betting accounts; 42% of Americans and 46% of Generation Z agree with the statement, "No matter how hard I work, I will never be able to afford the house I want." Rather than struggling in a job they hate for minimum wage, why not place a bet and potentially win back a week's, a month's, or even a year's salary in just a few minutes? As Thiccy pointed out: "Technology has made speculation easy, and social media spreads stories of getting rich overnight, enticing the public to participate in a massive negative-sum game like moths to a flame."

The dopamine effect brought about by this gambling should not be underestimated. In the long run, these gamblers are bound to lose money, but how can they comfortably return to work after realizing how easily they once made money? Of course, it is worth continuing to try; they just need to get lucky one more time, win one more jackpot, and then they will quit their jobs.

"You just need a dollar and a dream"—an old slogan from the New York State Lottery, now perfectly applicable to the new generation.

Thus, the "Ouroboros" truly closes the loop: excessive financialization leads people to feel nihilistic about the system, which in turn triggers a gambling craze, and gambling exacerbates excessive financialization. The media is filled with more survivor bias stories, more people start gambling and losing money, and resources are misallocated to non-productive activities. The market no longer invests in socially beneficial companies but rather in those that promote gambling. An intriguing fact is that Robinhood (HOOD) stock has risen 184% this year, while retail investors spend an average of only about 6 minutes researching a stock before trading, most of which occurs right before the trade.

I do not believe this is purely a case of "market failure." The market is merely an extension of human nature, which is itself full of flaws and selfishness, so the market allocates resources to what is "most profitable" rather than "most socially optimal," which cannot be entirely labeled as market failure. The market is not a moral arbiter. Nevertheless, I still find it sad: there exists an industry specifically designed to deceive people out of their money. But as Argentine President Milei said: "You know the nature of the casino, yet you go in and lose money; who can you blame?"—there are no tears in the casino. However, I do believe that excessive financialization distorts the market. While the market will never be perfect, excessive financialization makes it more like a casino, and when negative outcomes can also yield profits, there is clearly a larger problem than the market itself.

Regardless of whether this practice is ethical, it is accelerating excessive financialization. Stock prices rise faster, and unemployment rates increase. A trend of escapism is emerging, with platforms like TikTok, Instagram Reels, and the metaverse proliferating. The problem is that gambling is essentially a zero-sum game. From a technical perspective, due to the existence of fees, it resembles a negative-sum game. But even from the simplest perspective of a zero-sum game, it does not create new wealth or bring any benefits to society. The same money is merely redistributed to different people. There is increasingly less capital available for innovation, development, and the creation of positive returns. As Musk said, "The essence of civilization is to create far more than to consume," yet in a society characterized by excessive financialization, this statement is becoming increasingly difficult to uphold. What the public must face are the other negative impacts brought about by high financialization: escapism.

As people invest more and more time in the online world, the gap in leisure activities between the middle class and the upper class has never been smaller. This situation, combined with reduced social mobility, not only greatly weakens people's motivation to work hard but also diminishes their drive to create beautiful things.

After reading "Choose Good Quests," I increasingly feel that there are fewer and fewer good missions today. Robinhood has transformed from a good mission of "democratizing investment with zero fees" to a bad mission of "extracting the most money from retail investors." Comparing the "Request for Startups" from Y Combinator in 2014 and 2025 also reveals the same trend: good missions are becoming rarer (or are not receiving funding).

My personal conclusion is that in a highly financialized society, good missions are increasingly scarce; without good missions, people cannot achieve returns that far exceed consumption, and society cannot realize a positive-sum game.

Related reading: The Federal Reserve Announces the End of QT: Is Crypto Facing a "Starting Gun" or Does It Need to Endure Another Winter?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。