MicroStrategy announced the establishment of a $1.44 billion cash reserve to "weather the winter" and for the first time acknowledged the possibility of selling Bitcoin under certain conditions.

Written by: Long Yue

Source: Wall Street Watch

As the publicly traded company with the largest Bitcoin holdings globally, MicroStrategy announced on Monday, December 1, that it has raised funds by selling stock to establish a "dollar reserve" worth $1.44 billion.

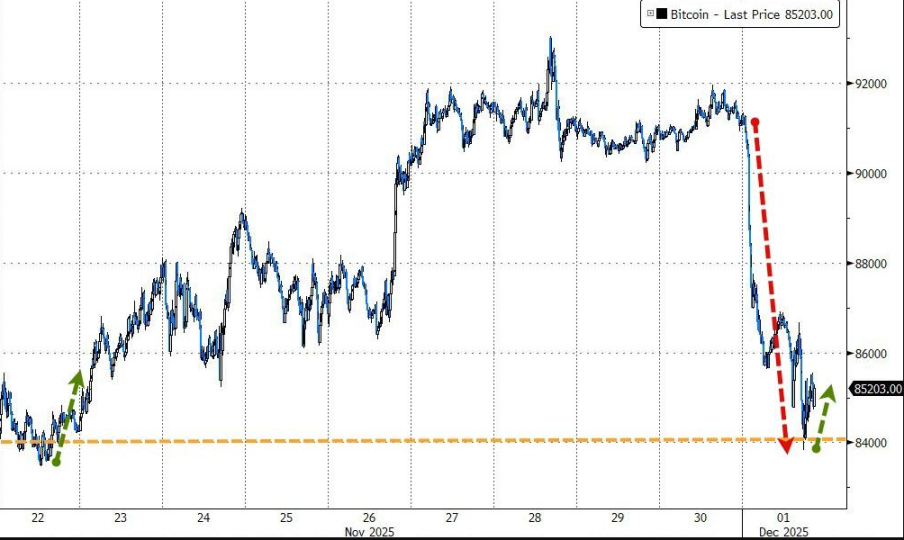

This move aims to address the severe volatility in the cryptocurrency market and ensure the payment of its dividends and debt interest. Previously, the price of Bitcoin had dropped from a peak of over $126,000 in early October to about $85,000 within a month.

Company executives stated that if its metric for measuring the relationship between enterprise value and cryptocurrency holdings, "mNAV," falls below 1, and the company cannot secure financing through other means, it will sell Bitcoin to replenish its dollar reserves. This statement is seen as a significant turning point in the company's strategy, breaking away from its founder Michael Saylor's long-standing advocacy of "always buy and hold."

Due to the company's first indication of the possibility of selling Bitcoin, its stock price plummeted by as much as 12.2% during Monday's trading session, ultimately closing down 3.3%. The sell-off by investors reflects deep concerns about the sustainability of its business model during the "Bitcoin winter."

Dollar Reserve: Insurance Against the "Bitcoin Winter"

In the face of headwinds in the crypto market, MicroStrategy is taking steps to strengthen its financial position. According to reports from the Financial Times and other media, the $1.44 billion reserve is funded by the proceeds from the company's stock sale. The company's goal is to maintain a dollar reserve sufficient to cover "at least 12 months of dividends" and eventually expand to cover "24 months or more."

It is reported that the funds were raised through the issuance of 8.2 million shares last week, enough to cover the company's total interest expenses for the next 21 months. Currently, MicroStrategy's annual interest and preferred stock dividend expenses are about $800 million. This move aims to ensure that even if the capital markets lose interest in its stock and bonds, the company will not be forced to sell Bitcoin in the short term.

Company CEO Phong Le candidly stated in a recent podcast "What Bitcoin Did" that this move is to prepare for the "Bitcoin winter." Founder Michael Saylor also mentioned that the reserve will "help us better navigate short-term market fluctuations."

The Myth of "Never Sell" Shattered?

The core change in this strategic adjustment is that MicroStrategy has for the first time acknowledged the possibility of selling Bitcoin. This potential selling condition is linked to the company's self-created "mNAV" metric, which compares the company's enterprise value (market capitalization plus debt minus cash) with the value of its cryptocurrency assets.

CEO Phong Le clearly stated: "I hope our mNAV does not fall below 1. But if we really get to that point and have no other financing options, we will sell Bitcoin."

This statement is significant. For a long time, Michael Saylor has presented himself as a staunch advocate for Bitcoin, transforming MicroStrategy from a small software company into the world's largest corporate holder of Bitcoin, with the core strategy of continuously buying and holding for the long term.

Currently, the company holds about 650,000 Bitcoins, valued at approximately $56 billion, accounting for 3.1% of the total global Bitcoin supply. Its enterprise value is about $67 billion. If mNAV falls below 1, it means the company's market valuation (after excluding debt) is less than the value of its Bitcoin holdings, which would severely undermine the foundation of its business model.

Imminent Debt Pressure

Behind the establishment of the dollar reserve is the immense debt pressure facing MicroStrategy. The company has financed its Bitcoin purchases through various means, including issuing stock, convertible bonds, and preferred stock, and currently carries $8.2 billion in convertible bonds.

If the company's stock price continues to languish, holders of these bonds may choose to demand cash repayment of the principal rather than converting them into stock, which would create significant cash flow pressure for the company. Credit rating agency S&P Global specifically pointed out the "liquidity risk" posed by its convertible bonds when it assigned MicroStrategy a "B-" credit rating on October 27.

S&P warned: "We see a risk that the company's convertible bonds could mature while Bitcoin prices are under severe pressure, which could lead the company to liquidate its Bitcoin at depressed prices or undertake a debt restructuring that we might view as a default."

The specific pressure is already imminent. Data shows that holders of a $1.01 billion bond can demand repayment of the principal on September 15, 2027. Additionally, over $5.6 billion in "out-of-the-money" convertible bonds may need to be redeemed in cash by 2028, posing a long-term financial stability risk for the company.

Traders Interpret: Cautious Hedging or Prelude to Sell-off?

Although the CEO of MicroStrategy emphasized that Bitcoin would only be sold under extreme conditions, traders have clearly begun to "overinterpret" in the sensitive market environment.

Despite the company insisting that its long-term accumulation strategy remains unchanged, traders are concerned that the latest comments introduce a potential path for selling. This concern quickly translated into action, leading to heightened risk-averse sentiment.

Regarding CEO Phong Le's mention that "selling Bitcoin is mathematically reasonable when the stock price is below the value of the underlying asset and financing is constrained," market reactions were polarized:

Pessimists read between the lines: Many cryptocurrency traders speculate that these seemingly understated comments could signal that the world's largest corporate holder is preparing to sell some Bitcoin. One user sarcastically remarked on social media platform X: "Can't wait to see them sell at the bottom." Another commenter stated: "Sounds like typical corporate PR talk, but they better not sell at the wrong time."

Rationalists see it as a necessary move: There are also views that CEO Phong Le is simply acknowledging the constraints any publicly traded company faces when its market value is below its asset value. One investor pointed out: "The focus is not on whether they might sell, but on how firm their commitment is before that option becomes a reality."

To reassure the market, MicroStrategy later stated on the X platform that even if Bitcoin prices fall back to around $74,000, the value of its holdings would still cover its outstanding convertible debt several times over; it even claimed that even if it dropped to $25,000, its asset coverage would still be more than double its liabilities. Founder Michael Saylor also continued to show confidence, announcing on Monday that the company had purchased another 130 BTC for $11.7 million.

Market Reaction and Performance Warning

MicroStrategy's latest moves and the concerns over its strategic shift quickly triggered negative reactions in the market. On Monday, its stock price hit a low of $156 during trading, and although it rebounded by the close, it was still down 64% from its 52-week high in mid-July. The stock has fallen nearly 41% year-to-date. Meanwhile, Bitcoin prices also suffered, dropping over 4% to around $86,370.

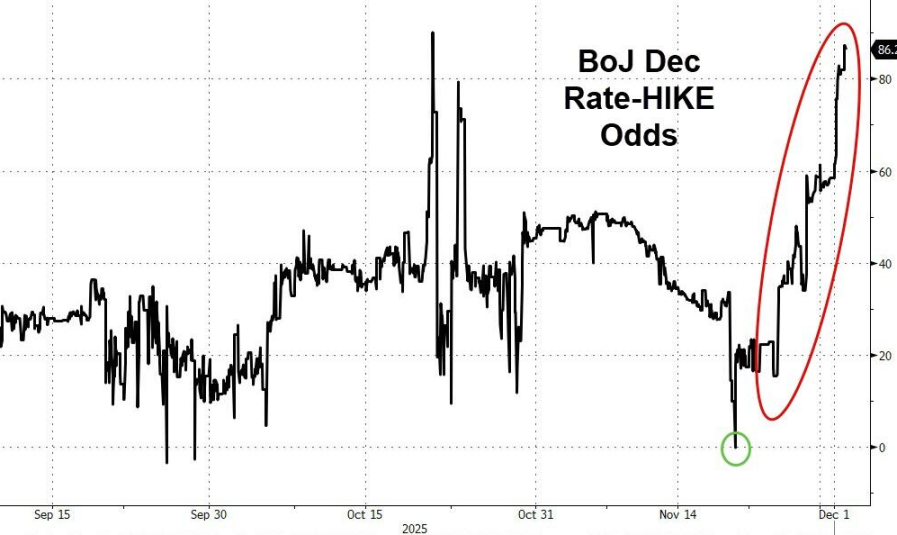

In addition to the company's own strategic adjustments, the severe volatility in the macro market has also become the "last straw" for the stock price. On Monday, the market exhibited a clear risk-averse tone, partly due to the hawkish stance of the Bank of Japan leading to a squeeze on yen financing, and partly due to the turmoil within the cryptocurrency sector itself.

Relevant charts show the current extreme market sentiment:

Bitcoin purchasing power has shrunk: A year ago, one Bitcoin could purchase 3,500 ounces of silver; now, the same unit of Bitcoin can only buy 1,450 ounces of silver, marking the lowest point since October 2023. This sharp drop in ratio visually reflects the weakness of crypto assets compared to traditional safe-haven assets (like silver).

Options market targeting: Data from SpotGamma indicates that MicroStrategy (MSTR) is facing a typical situation of "over-leveraged targets being attacked." A large number of put options are concentrated below $170. This negative gamma effect means that if Bitcoin prices fall further, market makers' hedging actions could accelerate the decline of MSTR, Coinbase, and other crypto-related stocks, potentially dragging down major indices.

Macro headwinds: As expectations for interest rate hikes by the Bank of Japan rise, carry trades face liquidation pressure, with cryptocurrencies being the most speculative asset class taking the brunt. Bitcoin briefly sought support around $84,000 during the day, experiencing its worst single-day performance since March 3; Ethereum even fell below the $3,000 mark.

In addition to the pressure on stock prices, the company's performance expectations have also raised red flags. MicroStrategy expects that if Bitcoin prices close between $85,000 and $110,000 by the end of this year, the company's annual performance could range from a net loss of $5.5 billion to a net profit of $6.3 billion. This sharply contrasts with the company's forecast of "achieving a net profit of $24 billion by 2025" released in its financial report on October 30.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。