今天是2025年11月26日,距离日历重置大约还有35天。在过去的330天里,加密货币经历了多次复兴——从表情符号代币的喧嚣回归到老旧“恐龙币”的意外复苏。然而,最新一波浪潮属于以隐私为中心的资产,这是市场上很久没有享受这种重新关注的角落。

不久前,隐私币的势头稳步减弱——不仅在市场表现上,而且在主要交易平台上的可用性上,它们经常被下架。那些坚持不懈的人——以及相信未来将由隐私增强资产塑造的人——在过去11个月中享受了可观的收益。

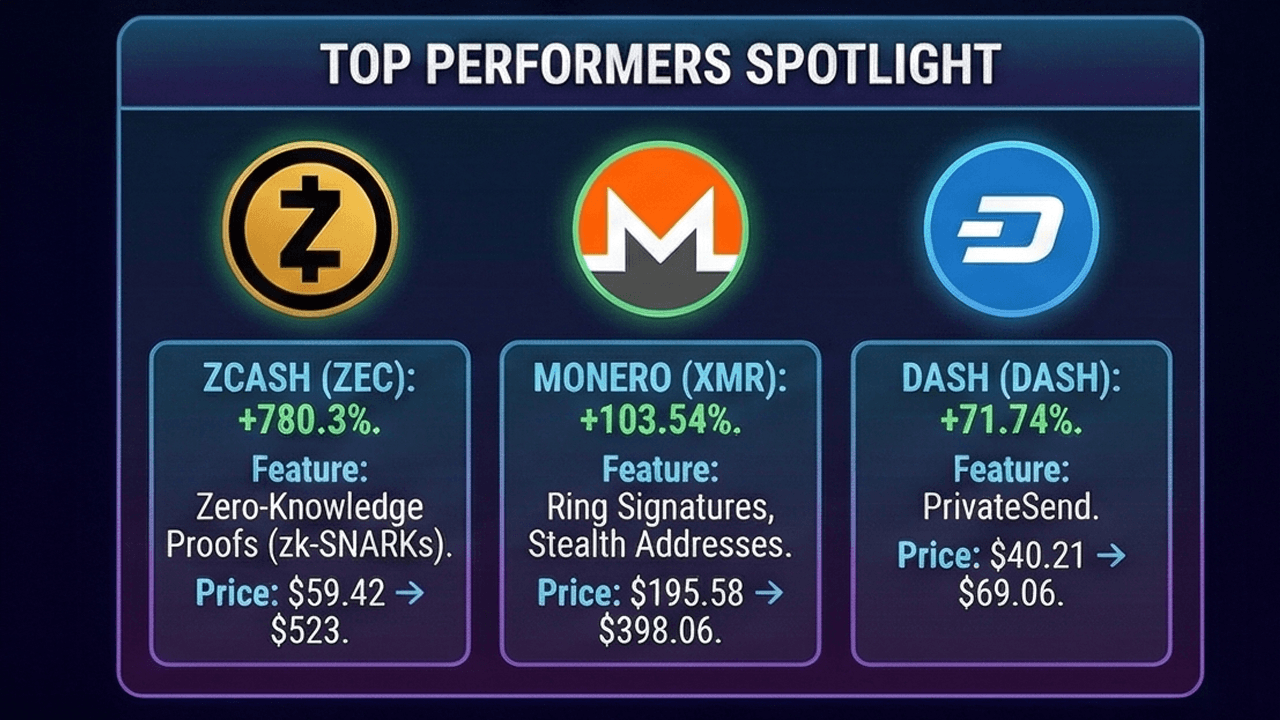

考虑到这一点,我们仔细查看了数据,看看按市值计算的前十种隐私币在与美元的年初至今市场表现中表现如何。榜单第一的是zcash(ZEC),这是一种利用零知识证明来促进完全私密交易的加密货币。1月1日,ZEC的交易价格为59.42美元,到11月26日达到了523美元每枚——上涨了780.3%。Zcash已成为这一领域的市场领军者。

本文的市场指标记录于2025年11月26日。

Monero(XMR),这款依赖环签名、环保密交易和隐秘地址的隐私驱动加密货币,今年上涨了103.54%,从195.58美元涨至398.06美元每单位。与此同时,dash(DASH)——以其privatesend功能而闻名——年初开盘价为40.21美元,目前上涨71.74%,达到了69.06美元。

Beldex(BDX),基于Cryptonote协议并采用环签名,自1月1日以来仅小幅上涨3.27%。Decred(DCR)年初开盘价为15.15美元,经过66.14%的上涨,目前交易价格为25.17美元每枚。Mimblewimblecoin上涨了19.89%,从24.53美元涨至29.41美元。

阅读更多:Vitalik Buterin呼吁全面开放和可验证性以确保数字未来

Horizen(ZEN),一个通过其侧链框架支持隐私的区块链平台,在2025年未能获得市场关注。它在1月份的交易价格为31.05美元,截至今天每个ZEN的价格为12.72美元,标志着该期间的59%下降。隐私币zano(ZANO)年初开盘价为15.83美元,目前交易价格为13.94美元,反映出大约11.94%的温和下降。Verge(XVG),在Coingecko.com的隐私币列表中排名第九,年初至今下降了45.58%。

XVG从每枚0.014美元下滑至当前价格0.0076187美元。在第十位,COTI下跌超过75%,从0.1255美元降至当前水平0.0304美元。大多数隐私币今年都录得了显著的上涨。然而,仍有少数落后,证明即使在复兴的细分市场中,并非每种资产都同样受益于这种势头。

在一个由不断变化的叙事和市场宠儿定义的年份,隐私币重新夺回了一定的相关性,这让一些人感到惊讶。它们的表现参差不齐——从三位数的上涨到一些修正——揭示了一个仍在与自身身份挣扎的领域,但无可否认的是,它们由一个重视隐私的忠实基础所支撑,在一个日益受到监控的金融世界中。

- 是什么引发了2025年对隐私币的重新关注?一些人表示,对监管监控和数据收集的日益担忧促使更多用户转向以隐私为中心的资产。

- 哪种隐私币在年初至今的涨幅最大?Zcash(ZEC)以超过780%的年初至今涨幅领跑该领域。

- 所有隐私币在2025年表现都好吗?不,一些币种尽管整体领域复苏,但仍出现了下跌。

- 为什么隐私币再次引起关注?对金融隐私的需求上升使这些资产对寻求更大交易隐私的用户具有吸引力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。