作者:IcoBeast

编译:深潮TechFlow

在过去近十年的时间里,加密货币(不特指比特币)的一个显著特征就是,任何一个拥有互联网、一些空闲时间和大约六个正常运转脑细胞的普通人,都可以迅速将一小笔资金变成一大笔财富。

自 2016-2017 年以来,加密行业经历了三到四次广泛的“淘金热”周期。这些周期的共同特征是:某种链上的主流资产价格极低,但具备巨大的复利潜力,而这种资产的价值随后迅速飙升。

每一次,这个行业里你认识的“最笨的人”都能赚到令人咋舌的钱,然后他们会告诉朋友,朋友再把更多人拉进来。毕竟,“如果那个傻瓜能用 100 美元赚到 10 万美元,那我为什么不行?”

让我们一起回顾一下这些历史性的财富创造时刻吧……

回顾历史

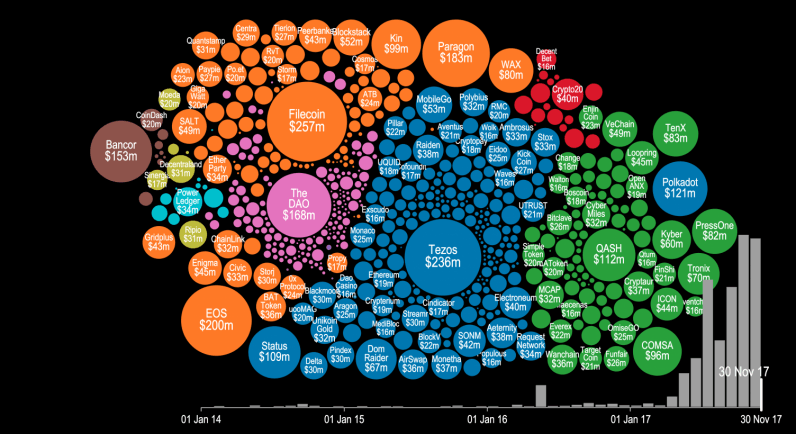

2017 年 - ICO 热潮(以太坊 ICO 之后)

在我看来,这基本上就是加密行业的“黄金时代”。几乎每天都会出现一个新的项目,附带一份白皮书和一个炫酷的渐变色标志,虽然这些项目几乎毫无实际功能,但大家仍然争相把自己的 ETH 投进去以获得分配。随后,这些代币上线交易所,市场上的人们蜂拥而至抢购新代币,价格迅速飙升。你可以赚到一大笔钱,然后再把收益换回 ETH。

ICO 热潮:图表说明一切

那真是太棒了。当时市面上只有大约 100-200 种代币存在,但实际上没有一个真正能用的,也没有什么实际意义。大家的操作就是简单粗暴地把 ETH 投进各种 ICO 项目,然后赚回大量资金——这简直就是“白送钱”。所有人都在交易那几个固定的代币,目标就是积累更多的 ETH……这过程非常简单。大家还会把这个“致富密码”告诉朋友,朋友们也纷纷加入进来。然而,最终我们都被市场教训了一顿,加密市场开始崩溃,随后经历了长达两年的熊市。

2020-2021 年:DeFi 的“收益挖矿+食品庞氏骗局”狂潮

这一波热潮我个人参与不多(因为现实生活中的事情),但它的本质是一些“真正的” DeFi 产品首次推出(由 Compound 的 COMP 代币分发拉开序幕)。这催生了各种流动性挖矿游戏和庞氏模式……大家又一次疯狂涌入少量精选的代币,目标依然是最大化他们的 ETH 持仓量。

许多早期的加密推特(Crypto Twitter)名人正是在这一阶段抓住机会崭露头角。当时,市场吸引了大量新资本,因为没人真正知道如何玩这个游戏,而且用于最大化收益的工具尚未广泛普及。此外, ETH 的价格也开始迅速上涨,这进一步推高了大家的利润表(PnL),同时吸引了更多“投机者”资金入场。

2021-2022 年:NFT 泡沫的疯狂时代

从前,疫情让世界停摆,人们收到政府发放的补贴支票,同时失去了工作(或生意被迫关停),于是他们整天泡在 Clubhouse 和 Twitter Spaces 上。

就在这时,一群人开始铸造 NFT。其中,Bored Apes(无聊猿)成为了行业的“造王者”(尽管它的铸造时间足够长,任何人都可以参与)。随着无聊猿的成功,市场的闸门被彻底打开。你可以用 1 ETH 铸造一张看起来最糟糕的图片,然后第二天醒来就能以 20 ETH 卖出……接着它的价格会飙到 50 ETH。这一切都毫无逻辑,没有人真正想要这些 JPEG 文件,也没有人真的相信它们值这些离谱的价格。但每个人都想赚钱,都想继续玩这个游戏。

这种疯狂的财富效应让人们能够用少量的 ETH 翻转几张图片,最终积累大量 ETH……几乎毫无技巧,仅仅因为“他们在场”。这显然吸引了巨大的关注,NFT 迅速走向主流。然而,泡沫终究破裂,大多数参与者最终惨遭市场淘汰。

这一财富效应在 2023 年初的 Ordinals 热潮中得到了短暂复制。当时比特币价格暴跌,早期的 Ordinals 成为一个疯狂的“烹饪”机会:你可以用极少量的 BTC 快速翻倍为大量 BTC。随后,比特币价格出现了抛物线式的暴涨。(而那些抱着 JPEG 不放的人最终还是被市场“清算”了。)

2023 年 1 月 25 日:Meme Season 的财富狂潮

可以说,这可能是加密货币“傻钱”周期中持续时间最长的财富创造期——ETH 和 Solana 的 Meme 币热潮。严格来说,这一切可以追溯到 2022 年底 FTX 崩盘后 BONK 的爆火,但我更倾向于将真正的起点视为 2023 年 4 月 PEPE(基于 ETH)和 2023 年 11 月 WIF(基于 SOL)的崛起,开启了超过一年时间的疯狂代币行情。

这些毫无实际用途、没有计划、只有“氛围感”的空气币,市值竟然飙升至数十亿美元。尤其是在早期,你只需要随便买上一千美元的某个随机代币,几乎可以保证第二天醒来就能获得 10 倍收益……而且这种操作可以持续数周。

随着时间推移,游戏变得越来越难:机器人变得更聪明,套利工具更加高效,开发者“跑路”时的套现能力也越来越强,整体的参与门槛逐渐提升。人们开始从“赌场”中取钱,而不是在看到朋友用“pepefartsockinu69420”这样的代币在 17 分钟内赚了 2 万美元后继续往里砸钱。同时,每一天都有新的交易对出现,你通过这些交易不断积累更多的 ETH 或 SOL。

然后,Meme 币的“9/11”事件发生了。TRUMP、MELANIA,再加上最后一根棺材钉——Hayden Davis 的 LIBRA。这一切改变了游戏规则。大家心里都隐隐明白,这场游戏已经“煮熟”了。当某一方可以在一秒钟内从“集体资金池”中窃取超过 1 亿美元时,这个游戏就不再值得玩下去了……毕竟,还有什么能比美国总统秘密发行一枚代币,并让其市值在一夜之间飙升至 700 亿美元 FDV(Fully Diluted Valuation,完全稀释估值)更疯狂的呢?

这就是我们今天所处的状况。从那场“致命一击”到现在,已经过去了大约 9 个月。虽然期间有一些表现突出的机会(尤其是从 4 月以来主流资产表现不错),但再也没有出现过那种能够快速倍增原生代币或主流资产,并且还能大幅升值的财富复利事件。

坦白说,我也不知道这种情况是否还会重现。NFT?已经被“破解”了——现在全世界大概只剩下 17 个人还在想要交易或倒腾 NFT。Meme 币?也已经“破解”了——成为一个 24/7 全天候的代币部署者显然更安全、更简单,你可以在没有任何风险的情况下获利。链上庞氏骗局?大家现在基本都懂了……只有那些“鲨鱼”还在玩,你必须非常精准地选择退出时机,否则就会被吞噬。也许 ICO 会卷土重来?Monad 表现不错。我们拭目以待。

过去一年里,我们几乎没有见到任何“傻钱”驱动的简单财富创造机会。这就是为什么大家都很愤怒。他们已经习惯了总能赶上一波这样的热潮,而过去 9 个月里,我们却只看到一片荒芜(除非你持有大量主流资产,尤其是比特币)。

最近,我在时间线上提到,当前链上可用的东西并没有让我感到特别有启发,很多内容都让人觉得有些陈旧。不过,一些正在构建有趣“新”事物的团队联系了我,我计划深入探索他们的原型,并记录我的测试和发现(当然,还会有大量关于 Kalshi 加密相关的更新)。

其中一个团队是 @zigchain,他们希望赞助我这篇文章——这其实是我几周前就打算写的内容。

他们正在构建一个被描述为链上版“华尔街”的平台,提供代币化的 RWA(真实世界资产,Real World Assets)收益产品。这些产品旨在让普通用户也能以更小的资金门槛,接触到更高收益的投资机会,而不再局限于传统上对散户不友好的高门槛投资。

虽然我长期看好 RWA(如权益永续合约、代币化股票等),但对目前市场上出现的 RWA 相关项目,我总体上持怀疑态度。不过,@zigchain 团队声称他们的首款应用(Zignaly)已经拥有超过 40 万真实用户,所以我打算亲自试用一下,看看他们的产品表现如何。

至于 RWA 产品是否能带来我们所缺失的那种极致财富创造机会,谁知道呢?但我已经准备好重新回到“理论上的战壕”中,再次尝试新的东西,并分享我的体验。太久没有这种探索性的内容了,我们需要更多激发兴趣和好奇心的内容出现在时间线上。

如果你读到了这里,谢谢你的耐心阅读。我真的很感激——我依然认为,世界上最酷的事情之一就是,有一群人在网上愿意抽出时间来看我写的东西。希望这篇文章能为你带来一些价值(无论是娱乐还是其他方面),很快会有更多内容分享给大家。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。