作者:Zen,PANews

韩国科技业与加密业迎来迄今最大规模的一次融合。11月26日,韩国互联网巨头Naver宣布已同意收购韩国最大虚拟资产交易所Upbit的运营商Dunamu公司。

消息公布后,Naver股价在盘后交易一度上涨7.7%。Naver方面表示,此举旨在“构建以数字资产为基础的未来增长引擎”。这起收购案在正式宣布前数周已在韩国媒体间传出风声,并一度推高Naver股价。双方高层据悉在幕后进行了多轮磋商,以弥合估值分歧和监管疑虑。

值得注意的是,就在市场对合并传闻热议之际,全球加密货币行情出现转弱,数字资产市值从高点回落逾1万亿美元。宏观环境的波动为这笔交易增添了不确定性,但双方最终仍选择携手。

Naver与Upbit合并,韩国超级金融平台呼之欲出

根据Naver当日提交的监管文件,收购将通过Naver的金融科技子公司Naver Financial进行,每1股Dunamu股票可交换为2.54股Naver Financial新发行股份。按此交换比例测算,Dunamu的股权估值约为15.1万亿韩元(约103亿美元),Naver Financial约为4.9万亿韩元(33.47亿美元)。

此次并购将使Dunamu通过换股方式成为Naver Financial的全资子公司。交易完成后,Naver对Naver Financial的持股比例将从当前的约70%大幅摊薄至17%左右。Dunamu创始人兼董事长Song Chi-hyung因持有Dunamu大量股权,届时名义上将成为Naver Financial最大股东,但他和副董事长将把手中超过半数的投票权委托给Naver行使,以确保Naver对合并后金融子公司的控制权(约46.5%的投票权)。

也就是说,虽然形式上是Dunamu作为大股东并入Naver Financial,但实际控制仍掌握在Naver公司手中。这种安排在保护Naver股东权益的同时,也让Dunamu管理层通过持股成为重要利益相关方,为后续整合奠定基础。

按照双方公布的初步时间表,Naver Financial和Dunamu计划分别于2026年5月22日召开股东大会,就换股合并方案进行表决。若股东批准,预计最终换股交割将在2026年6月30日完成。交易还需通过韩国公正交易委员会(FTC)的反垄断审查,以及金融监管机构对主要股东变更的批准。

为保护中小股东利益,方案设置了异议股东回购请求权——异议者可在2026年5月22日至6月11日期间按每股117,780韩元的价格要求公司回购其所持Naver Financial股票。如果行使回购权的金额总计超过1.1万亿韩元(约7.51亿美元)且双方不调整方案,交易可能告吹。

不过以当前市场反应和两公司前景来看,大规模股东异议的可能性不高。监管方面,由于Upbit在韩国加密交易市场占据主导地位,FTC可能会对合并后的市场集中度进行严格评估,尤其关注是否损害消费者利益。但也有观点指出,将Upbit纳入与政府关系良好的Naver旗下,反而可能降低监管阻力。总体而言,在韩国政府近年逐步完善加密货币监管、态度相对转暖的背景下,此桩并购的政策风险正逐步下降。

Naver与Dunamu的“联姻”被视为韩国科技与金融版图重塑的一大里程碑。作为韩国“网络巨头”兼国民级入口平台,Naver近年在支付、云计算、人工智能、内容等领域频频扩张。此次收购完成后,Naver将把加密资产交易这一新兴领域纳入版图,Upbit则可借助Naver庞大的用户生态赋能。双方计划打造集搜索、通讯、支付和虚拟资产交易于一体的综合性超级平台,将数字资产融入韩国人日常生活的方方面面。

具体来说,Naver目前拥有超过18万亿韩元年度交易额的Naver Pay支付平台,其有望与Upbit的加密交易功能打通,为用户提供从法币到加密货币的一站式金融服务。而在Naver金融部门长期研究的与韩元锚定的稳定币方面,收购完成后无疑将加速这一计划落地。此外,双方计划未来五年投资10万亿韩元(约68亿美元),构建基于AI与区块链融合的下一代金融基础设施。

值得一提的是,就在收购事宜官宣后,Upbit于当地时间2025年11月27日04:42左右,价值约3681万美元的Solana网络相关资产被转移至未知外部钱包。Upbit称已确认资产被盗事件的损失规模,并计划全额使用Upbit持有资产进行弥补,确保用户资产不受任何影响。

危机:加密市场疲软与唯一挑战者Bithumb

作为此次收购的主角,Upbit目前是韩国虚拟资产交易领域当之无愧的龙头。根据韩国金融监督院(FSS)的统计数据,2025年上半年Upbit平台累计交易额高达833万亿韩元(约合6420亿美元),占全国加密交易总量的71.6%。

这一市占率使Upbit几乎处于事实上的垄断地位,紧随其后的老牌交易所Bithumb同期交易额为300万亿韩元,市场占比25.8%,其余本土平台合计仅占不到3%。而放眼全球,凭借韩国用户的狂热投资,Upbit也常年跻身全球加密货币交易量排行榜前列。

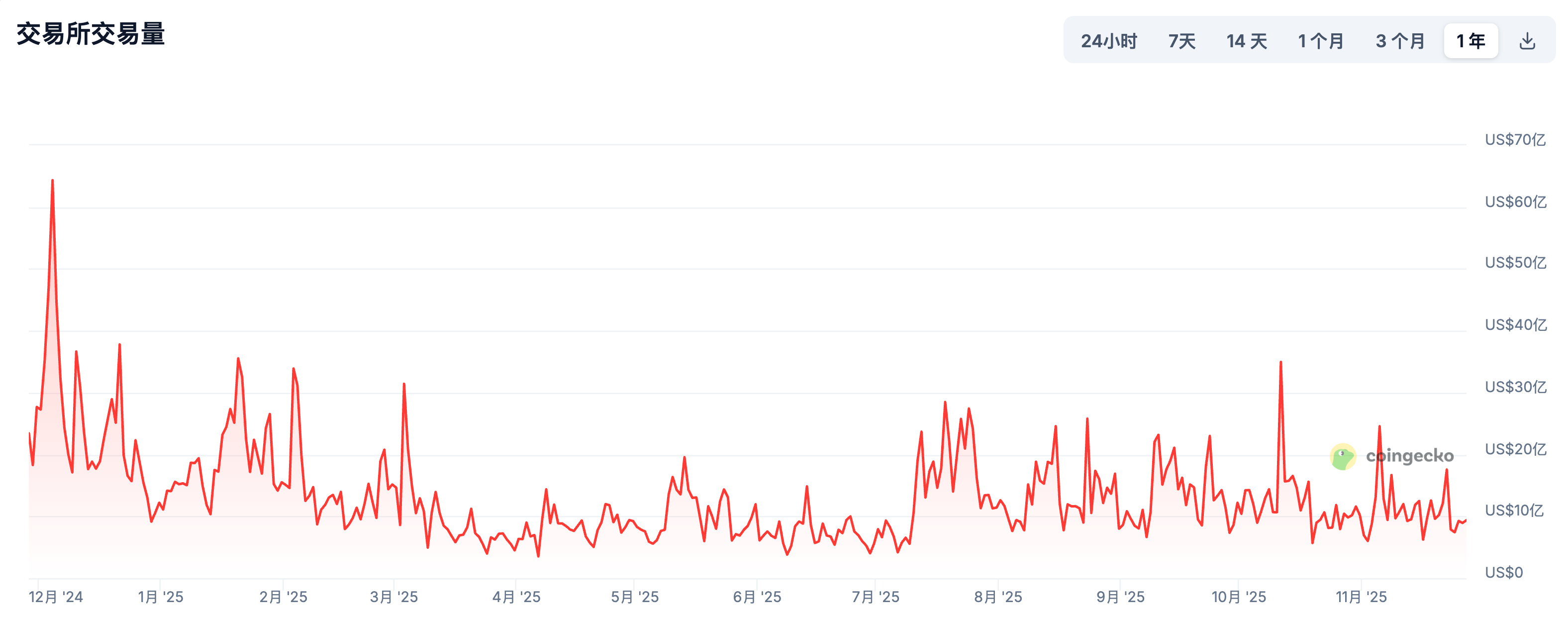

不过,与2024年相比,Upbit在本土市场的统治力出现了一定程度下滑。这一变化与主要竞争对手Bithumb的回升密切相关。Bithumb曾在2023年因经营和合规问题导致市占率跌至个位数,但自2024年起实施零手续费等激进策略吸引散户,市场占有率迅速攀升。韩媒体KoreaTechDesk引述The Block 数据称: 2025 年第三季度Upbit 总成交量约 2,864 亿美元,同比略有增多;然而 Bithumb 成交量从去年的 47 亿美元暴增至 128.1 亿美元。

有分析人士指出,Bithumb为筹备自身上市而在近年来积极争夺用户和交易量,韩国加密交易市场正从“一超多弱”向“两强并立”演变。但即便如此,Upbit领先Bithumb仍有约40个百分点的巨大差距。在Naver收购消息传出后,围绕两家公司估值的争论一度甚嚣尘上,显示市场认可Upbit相对更高的溢价和龙头地位。

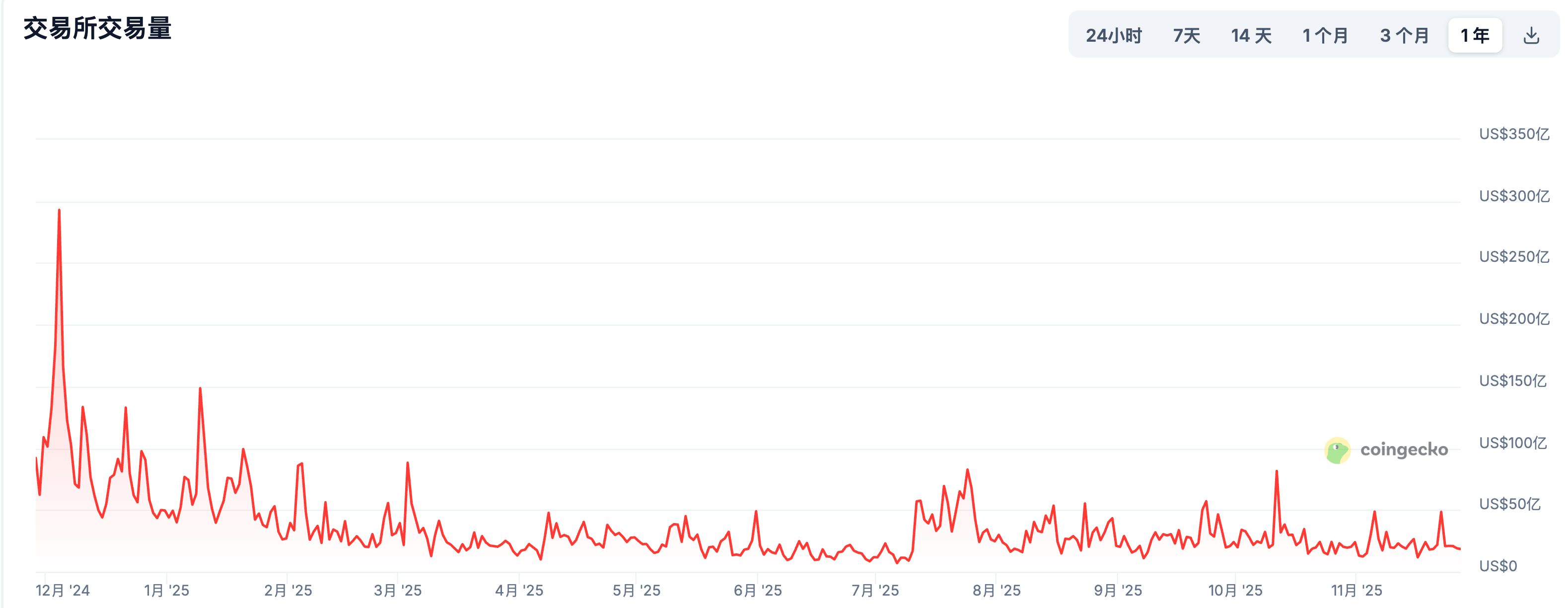

更值得关注的是整体市场热度的变化——交易量指标较去年大幅下滑。2024年底韩国加密市场曾出现一波疯狂行情:据统计,2024年12月3日Upbit单日成交额飙升至274.5亿美元,创下历史峰值,约为平日水平的十倍。然而,这一“疯狂之夜”过后,市场情绪急转直下,2025年进入降温通道。2025年11月Upbit日均交易额仅约17.8亿美元,较2024年末的高点暴跌了80%。其交易量已连续四个月下降,并趋于在20亿~40亿美元区间窄幅波动。

Upbit近期交易量和市占下滑,是多种因素共同作用的结果。除Bithumb发起有力挑战外,监管环境变化和投资偏好转移可能才是更重要的原因。

2025年下半年,韩国金融情报部门(FIU)对Dunamu开出约352亿韩元罚单,理由是Upbit在客户身份识别等反洗钱规定上存在违规,并对其部分业务处以三个月停业整顿的处分。这一事件对Upbit品牌形象和新增用户增长造成了一定影响。

此外,今年以来韩国股市出现罕见的大牛市,大批散户资金从币市回流股市,被戏称为“韭菜回归良田”。以AI概念股为代表的科技板块引爆行情,韩国KOSPI指数年内累计上涨逾70%,多次刷新历史高点。不少过去热衷讨论山寨币的年轻投资者,如今在Kakao Talk聊天群和Naver论坛上谈论的都是“AI/半导体概念股”。

股票市场分流投机资金和关注度,与加密货币行业全球行情趋冷也密不可分。在加密市场从2024年开启强力反弹后,今年夏季韩国散户投资热情达到高点。然而行至今年Q4,全球加密货币市场再度转弱,这一宏观背景无疑也拖累了以散户为主导的韩国币市情绪。

下一站,剑指纳斯达克上市?

在合并消息传出后,市场高度关注Upbit母公司的上市动向。事实上,Dunamu的IPO传闻由来已久。早在2021年加密牛市时期,Dunamu估值一度飙升,创始人Song Chi-hyung晋身韩国富豪榜前列,业内便猜测公司有上市计划。

但由于彼时监管环境不明朗,Dunamu并未有进一步举动。此后Dunamu通过定向增资引入了包括Kakao、HYBE等战略股东,暂时缓解了资本需求。而当Naver收购Dunamu的消息曝光后,其赴美上市被重新提上日程。

据彭博社报道,Upbit计划在与Naver Financial合并完成后,以纳斯达克为目标市场进行首次公开募股(IPO)。这一消息由彭博在11月24日率先披露,称合并完成后Upbit将着手筹备赴美上市事宜。

虽然Naver和Dunamu双方均未正式回应此计划,但多家主流媒体从不同渠道证实了这一战略意图。韩国《首尔经济日报》报道称,合并后的新公司可能寻求在纳斯达克挂牌,估值或高达340亿美元。若消息属实,这将使其有望成为亚洲首家登陆美国资本市场的大型加密交易所。

值得一提的是,Upbit的主要竞争对手Bithumb同样在谋划赴美上市。Cryptonews披露,Bithumb正力争抢在Upbit之前,计划最早于2026年登陆Nasdaq。两大韩国交易所的“上市竞赛”,也显现出韩国加密行业希望走出韩国,走向国际舞台并赢得全球投资者认可的野心。

从目前情况看,Naver对Dunamu的收购并未削弱后者的上市动力,反而为其IPO创造了更成熟的条件。通过合并,Dunamu将成为Naver金融板块的一部分,在公司治理和财务透明度上与上市公司接轨,为未来IPO扫清了一些障碍。Naver的背书,也有助于提升国际投资者对Upbit业务模式的信心。

此外,今年以来美国资本市场对大型加密公司的接受度逐渐提高,Circle、Bullish、Gemini和Galaxy Digital陆续上市,Coinbase更是被正式纳入标普 500 指数,成为首家进入 S&P 500 的加密交易所。

Upbit选择此时搭上这波行业东风,也正是顺利登上纳斯达克舞台的最佳时机。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。