The spot liquidity of mainstream cryptocurrencies and altcoins has yet to recover, and the market remains in a fragile state, making it more susceptible to extreme price fluctuations.

Written by: Tanay Ved

Translated by: Luffy, Foresight News

TL;DR

Major funding channels such as ETFs and DAT have recently seen weak demand, and the deleveraging process in October, along with a macro risk-averse backdrop, continues to exert pressure on the cryptocurrency market.

The futures and DeFi lending markets have completed a comprehensive leverage reset, with a cleaner position structure and reduced systemic risk.

The spot liquidity of mainstream cryptocurrencies and altcoins has yet to recover, and the market remains in a fragile state, making it more susceptible to extreme price fluctuations.

In early Uptober, Bitcoin surged to an all-time high, but the optimistic sentiment quickly reversed, and the flash crash on "10.11" severely impacted market confidence (Note: Uptober refers to the typical rise in the cryptocurrency market during October). Subsequently, Bitcoin's price fell by about $40,000 (a drop of over 33%), with altcoins suffering even greater impacts, causing the total market capitalization of the entire cryptocurrency market to retreat to nearly $3 trillion. Even with several positive fundamental developments expected throughout 2025, the price trends and market sentiment have shown significant divergence.

Currently, crypto assets are at the intersection of multiple external and internal factors. On a macro level, the uncertainty surrounding interest rate cuts in December and the recent weak performance of tech stocks have further intensified market risk-averse behavior; internally, the ETF and crypto asset treasury (DAT), which once served as stable funding channels, are experiencing capital outflows; meanwhile, the liquidation wave on "10.11" triggered one of the most severe deleveraging events in history, and its subsequent effects are still ongoing, with market liquidity remaining sluggish.

This article will delve into the core driving factors behind the recent weakening of the cryptocurrency market, focusing on ETF capital flows, the leverage situation in perpetual futures and DeFi markets, and order book liquidity, exploring the current market landscape revealed by these changes.

Macro Shift to Risk Aversion

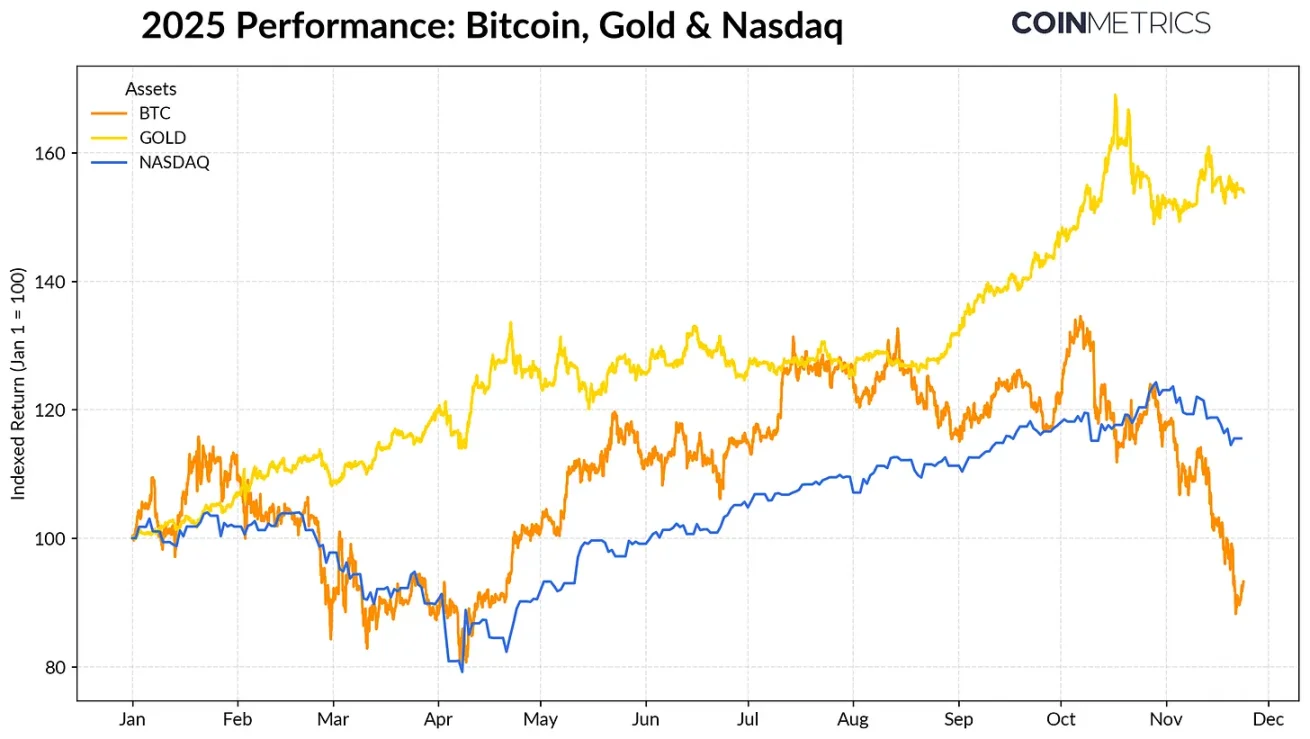

Bitcoin's performance has increasingly diverged from major asset classes. Against the backdrop of record gold purchases by central banks and ongoing trade tensions, gold has seen a return of over 50% this year; meanwhile, tech stocks (Nasdaq index) have lost momentum in the fourth quarter as the market reassesses the Federal Reserve's upcoming interest rate cut probabilities and the sustainability of the AI-driven bull market.

As our previous research has shown, Bitcoin's relationship with "risk-on" tech stocks and "safe-haven" gold exhibits cyclical fluctuations and adjusts with changes in the macro landscape. This makes Bitcoin particularly sensitive to market shocks or catalytic events (such as the October flash crash and recent risk-averse sentiment).

Performance of Bitcoin, Gold, and Nasdaq Index in 2025, data source: Coin Metrics and Google Finance

As the "anchor asset" of the entire cryptocurrency market, Bitcoin's pullback has spread to other assets. Although thematic sectors like privacy coins briefly performed well, most cryptocurrencies remain highly correlated with Bitcoin.

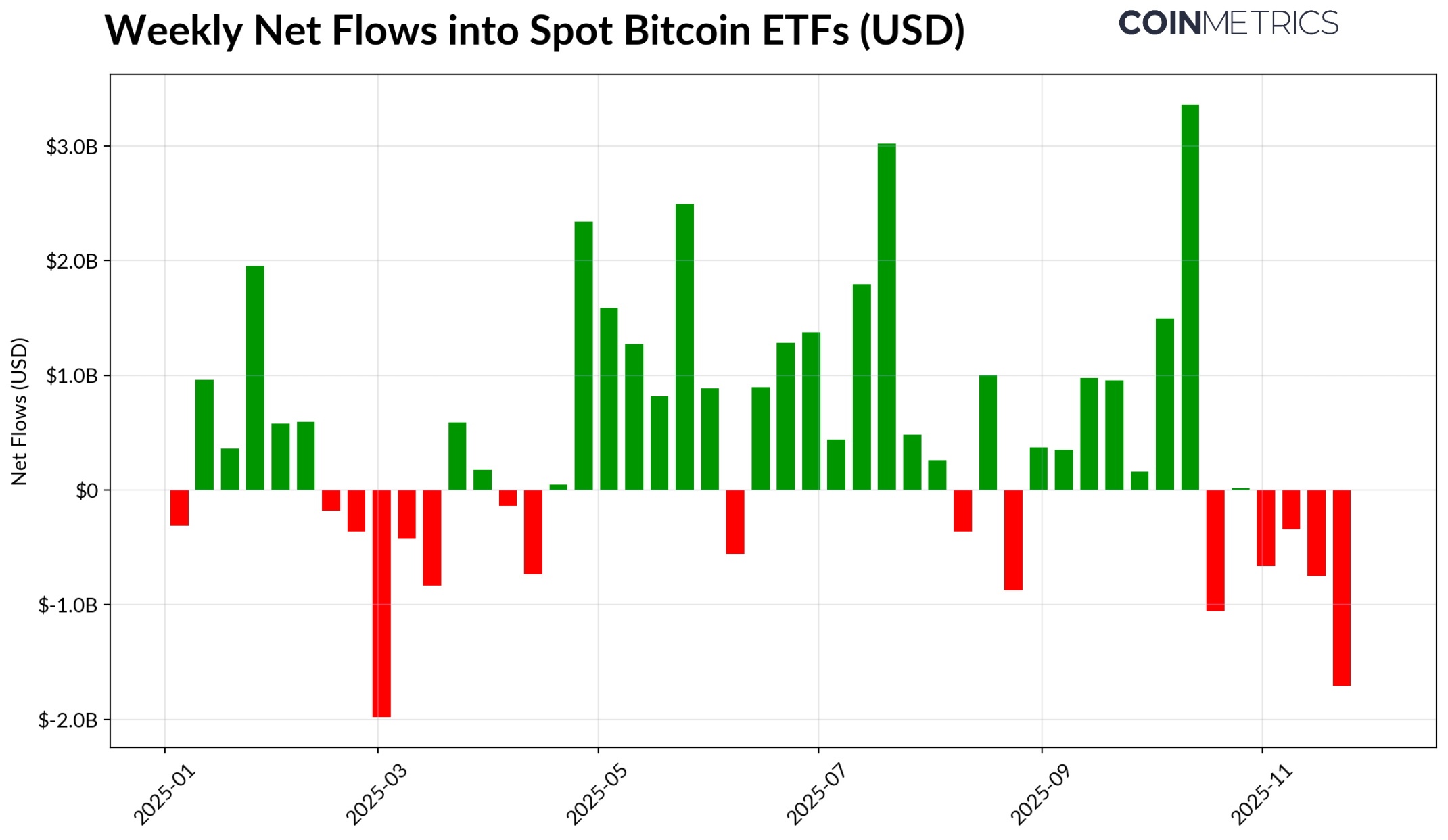

Weakened ETF and DAT Capital Absorption

Bitcoin's recent weakness partly stems from a decline in demand from core funding channels that support its trajectory for 2024-2025. Since mid-October, ETFs have seen several weeks of net outflows, totaling $4.9 billion, marking the largest redemption wave since Bitcoin fell to $75,000 before the "Liberation Day" tariff announcement in April 2025. Despite the short-term capital outflow, on-chain holdings continue to trend upward, with BlackRock's IBIT ETF alone holding 780,000 Bitcoins, accounting for about 60% of the current total holdings of spot Bitcoin ETFs.

If ETF capital inflows recover, it would indicate a stabilization of this channel. Historical data shows that when risk appetite rebounds, ETF demand has been a key force in absorbing Bitcoin supply.

Weekly net inflows of Bitcoin ETFs, data source: Coin Metrics

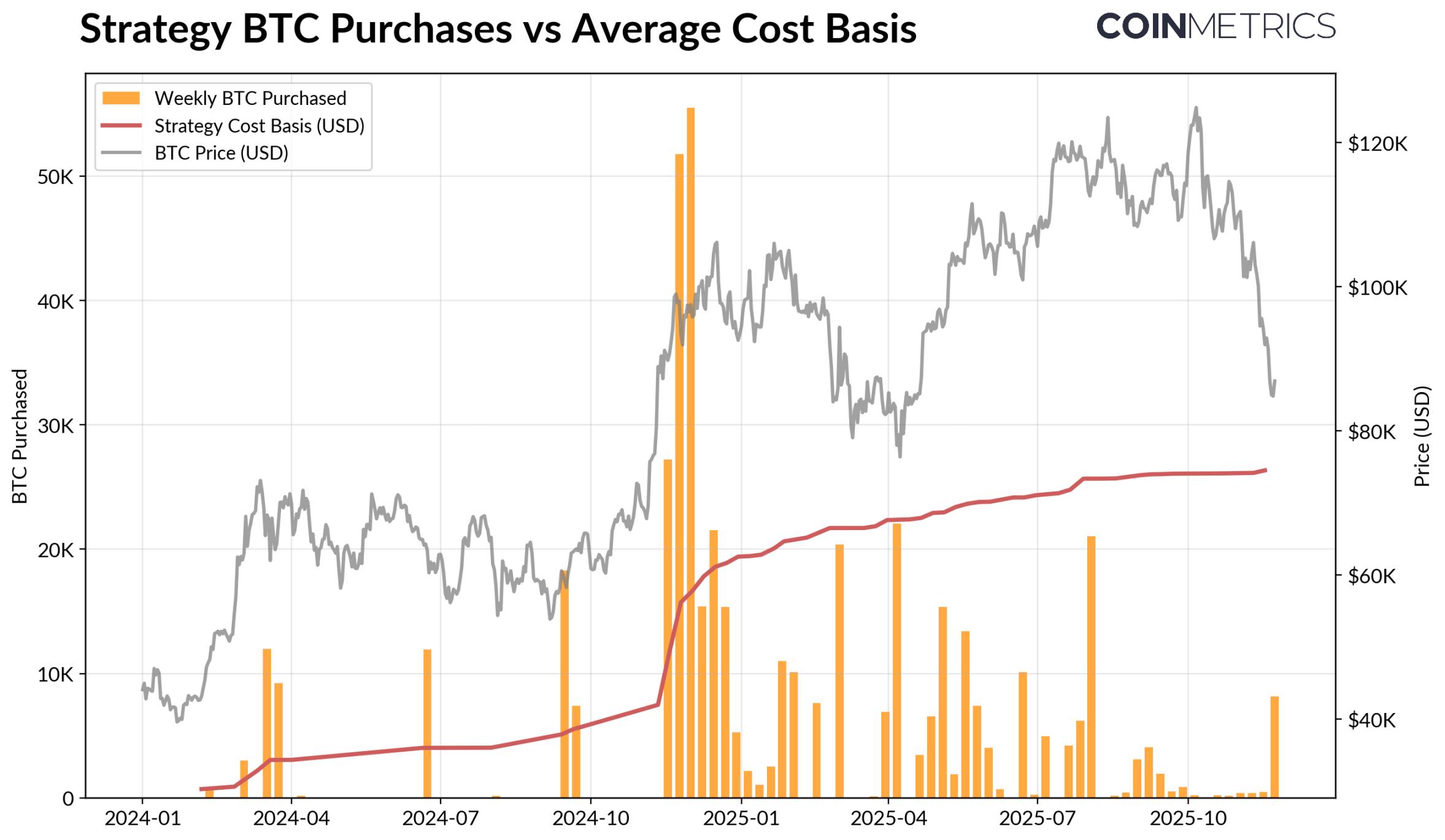

The crypto asset treasury (DAT) is also beginning to show signs of pressure. As prices pull back, the value of DAT company stocks and the scale of crypto asset holdings shrink, putting pressure on the net asset value premium that supports its growth flywheel. This weakens DAT's ability to raise new capital through equity issuance or debt financing, thereby limiting the growth of its per-share crypto asset holdings. Smaller emerging DATs are particularly sensitive to this, as changes in market conditions may render cost baselines and equity valuations unsuitable for further accumulation.

Currently, the largest DAT—Strategy—holds 649,870 Bitcoins at an average cost of $74,333 (approximately 3.2% of Bitcoin's current total supply). As shown in the chart below, when Bitcoin prices rise and equity valuations are strong, Strategy's accumulation speed significantly accelerates, while the recent pace of accumulation has slowed. Nevertheless, Strategy still holds unrealized profits, with its cost basis below the current market price.

If prices continue to decline or face risks of index exclusion, Strategy may encounter pressure; however, an improvement in market conditions is expected to enhance its balance sheet and valuation, creating a favorable environment for DAT accumulation.

Strategy's Bitcoin purchase volume and average cost basis, data source: Strategy and Bitbo Treasuries

This trend aligns with on-chain profit conditions. The realized profit and loss ratio (SOPR) for short-term holders (holding for 155 days) has dropped to about -23%, a level historically reflecting capitulation selling pressure from the most price-sensitive group. Long-term holders remain generally profitable, but SOPR data indicates a slight increase in profit-taking behavior. If the SOPR for short-term holders rebounds above 1.0 while the selling pace of long-term holders slows, it would indicate that the market is gradually stabilizing.

Deleveraging Process in Cryptocurrency: Perpetual Futures, DeFi Lending, and Liquidity

The liquidation wave on "10.11" initiated a multi-layered deleveraging cycle in futures, DeFi, and stablecoin collateral, with its subsequent effects still reverberating through the cryptocurrency market.

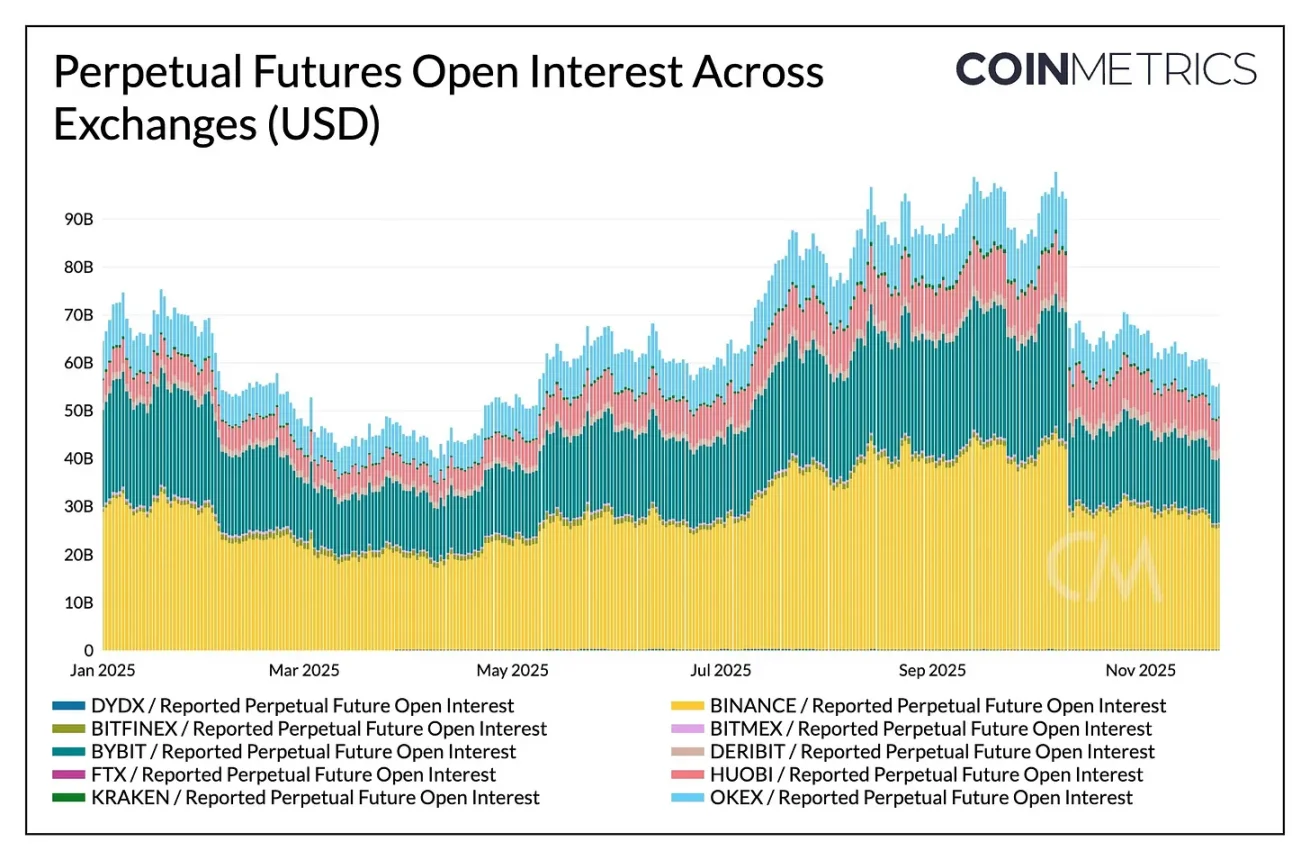

Deleveraging in the Perpetual Futures Market

In just a few hours, the perpetual futures market experienced the largest scale of forced liquidations in history, with over 30% of the months-long accumulated open interest (OI) wiped out. The decline in open interest was most pronounced in exchanges with high altcoin and retail trading volumes (such as Hyperliquid, Binance, and Bybit), consistent with areas of concentrated leverage before the deleveraging. As shown in the chart below, the current open interest remains far below the pre-crash peak of over $90 billion, and has slightly retreated afterward, indicating that leverage within the system has been effectively cleaned up as the market stabilizes and readjusts.

During the same period, funding rates also weakened, reflecting a reset in bullish risk appetite. Recently, Bitcoin funding rates have hovered around neutral or slightly negative levels, consistent with the state of the market not yet fully rebuilding directional confidence.

Changes in perpetual contract open interest across exchanges, data source: Coin Metrics

DeFi Deleveraging

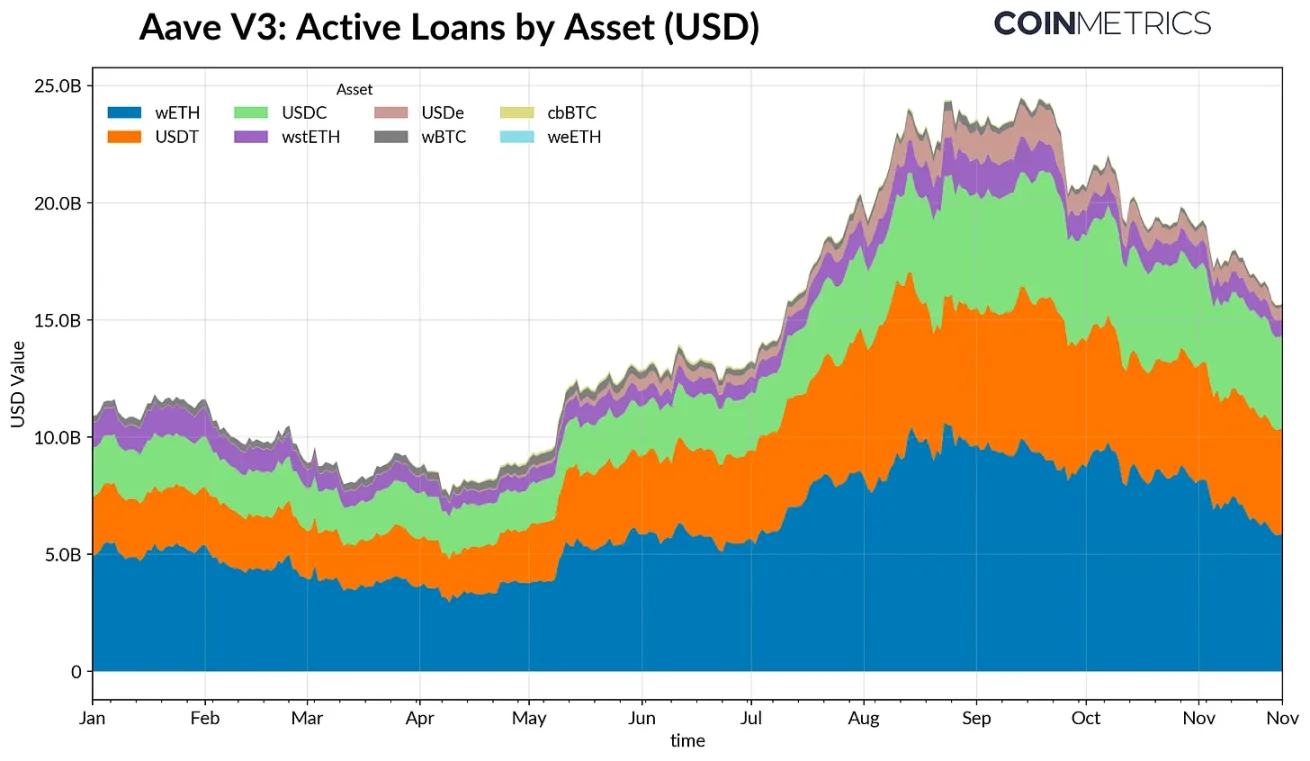

The DeFi lending market has also undergone a gradual deleveraging process. Since peaking at the end of September, the volume of active loans on Aave V3 has continued to decline. In the context of weak risk appetite and collateral repricing, borrowers have been reducing leverage and repaying debts. The contraction in stablecoin-denominated lending has been the most severe, with the USDe-related lending volume plummeting by 65% due to the Ethena USDe depegging event, triggering a comprehensive liquidation of synthetic dollar leverage.

Ethereum-related lending has also contracted: the volume of WETH and liquid staking tokens (LST) loans has decreased by about 35%-40%, reflecting a reduction in circular lending strategies and a contraction in yield-bearing collateral strategies.

Active loan volume on Aave V3, data source: Coin Metrics

Weak Spot Liquidity

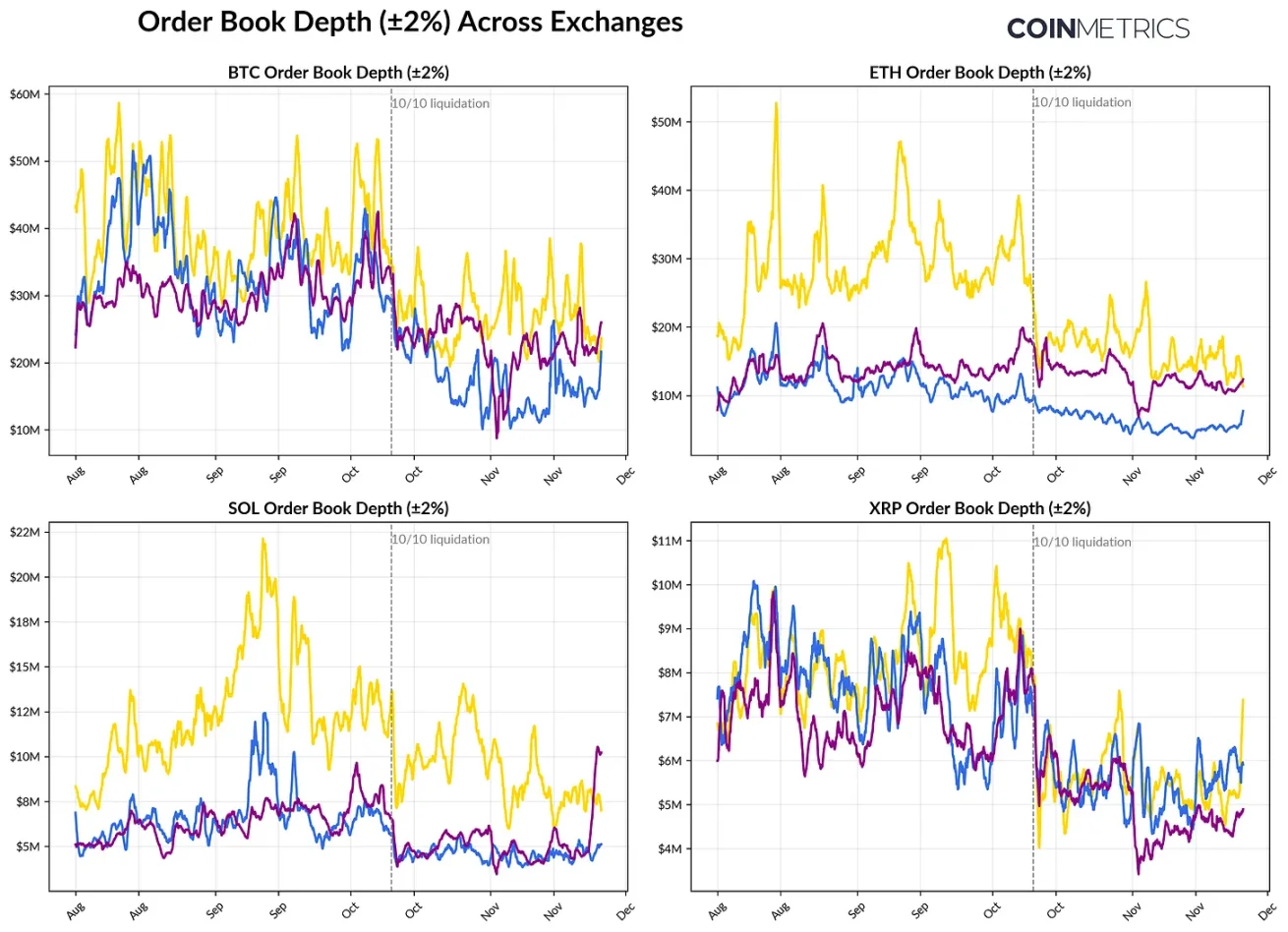

Following the liquidation wave on "10.11," spot market liquidity has remained tight. In major exchanges, the depth of trading volume for Bitcoin, Ethereum, Solana, and other cryptocurrencies is still 30%-40% lower than early October levels, indicating that liquidity has not recovered in sync with prices. Due to reduced order volumes, the market remains in a fragile state, where small trades can trigger disproportionate price fluctuations, exacerbating volatility and amplifying the effects of forced selling.

The liquidity situation for altcoins is even worse. The order book depth for assets outside of mainstream cryptocurrencies has seen a more severe and prolonged decline, reflecting the market's continued aversion to risk assets and reduced market maker activity. A comprehensive improvement in spot liquidity would help reduce price shocks and stabilize the market, but as of now, insufficient depth remains one of the most evident signals that systemic pressure has not fully eased.

Changes in exchange order book depth, data source: Coin Metrics

Conclusion

The cryptocurrency market is undergoing a comprehensive adjustment, influenced by weak demand for ETFs and DAT, the leverage reset in futures and DeFi markets, and low spot liquidity. While these dynamics exert pressure on prices, they also contribute to a healthier market system, lower leverage levels, and more neutral positions, increasingly returning to fundamentals-driven dynamics.

Meanwhile, the macro environment remains a major obstacle. Weakness in AI stocks, adjustments in interest rate cut expectations, and an overall risk-averse tone have suppressed market demand. If major funding channels (ETF capital inflows, DAT accumulation, and stablecoin supply growth) recover, and spot liquidity rebounds, it will lay the foundation for market stabilization and eventual reversal. Until then, the market will remain caught in the tension between macro risk aversion and the internal market structure of cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。