编译:深潮TechFlow

“如果比特币倒下,加密货币也会随之覆灭。”

比特币支持者对这句话简直爱得深沉。

我的朋友尼克·卡特(Nic Carter)最近又复活了这个老生常谈的观点——认为比特币是加密货币宇宙的中心,其余的一切不过是围绕它旋转的星体。

这种说法似乎是比特币支持者讨论中的一种顽固基调,时不时就会有某位比特币支持者发推重申这一观点,以回应某些新兴的热门话题。随后,其他比特币支持者便蜂拥而至为这条推文点赞,直到它的热度达到“逃逸速度”。

然而,这种笼统的观点是错误的,它只能出自那些认为比特币是加密货币宇宙中心的人之口。

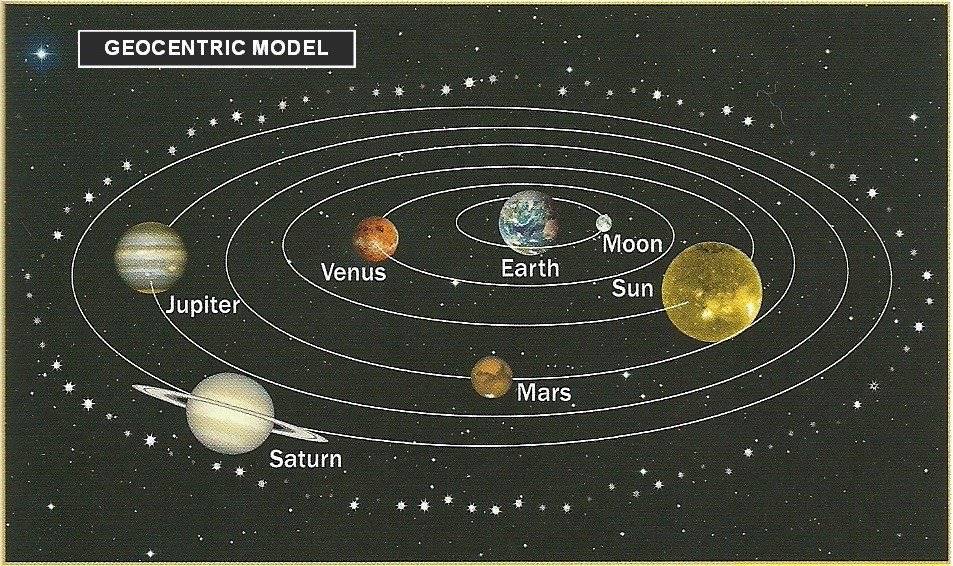

这种以比特币为中心的视角,就像地心说一样原始落后。需要明确的是,在我们的太阳系中,其他行星确实并不是围绕地球旋转的。

从基本原理出发,以太坊与比特币在技术上没有任何依赖关系。作为一种协议,以太坊对比特币的存在完全无感。

即便比特币停止出块,对以太坊来说,字面意义上的“什么都不会发生”。

价值1650亿美元的稳定币市场、650亿美元的去中心化金融(DeFi)生态、每年烧毁价值5500万美元的以太坊(ETH),以及无数初创公司、风险投资行业和开发者市场——这一切都是以太坊独特孕育的成果,它们会在第二天照常运转。

这正是以太坊的初衷。

量子计算的威胁

过去一周,关于量子计算对比特币构成风险的讨论再次升温。被视为顶尖量子研究者的斯科特·阿伦森(Scott Aaronson)在他的博客 Shtetl-Optimized 中写道:

鉴于当前硬件进步的惊人速度,我现在认为,在下一次美国总统大选之前,我们可能会拥有一台能够运行 Shor 算法的容错量子计算机。

自比特币诞生以来,这一直是一个讨论话题——人们早就知道,大多数早期比特币钱包使用的 ECDSA 签名无法抵御量子攻击,比特币的私钥迟早会被量子计算机攻破,其比特币也将被攻击者窃取。

在他最近的播客中,尼克甚至提到,比特币价格的一些负面表现可能与市场已经将量子风险定价进去了有关。

这里需要记住的关键点是,这完全是比特币需要解决的问题。以太坊早已对这一类比特币目前正焦虑的攻击方式进行了防护。

从一开始,以太坊就通过地址(keccak-256 哈希)隐藏了公钥,这意味着在你花费之前,你的公钥不会被暴露,从而大幅缩小了量子攻击者的攻击面。

此外,自合并(The Merge)以来,以太坊已转向验证者模型,提现密钥同样被隐藏在哈希之后。更重要的是,以太坊的路线图明确规划了通过未来升级(如 Verkle 树和 EOF 层重构)用量子安全的签名方案(如 BLS 变体或后量子密码学替代方案)替代 ECDSA 签名。

以太坊的文化一直极具前瞻性——甚至有时可能显得过于超前,因为其他生态系统经常通过捷径利用以太坊的短期弱点。但在应对量子威胁这一问题上,以太坊绝不是如此!

面对区块链安全的量子威胁,以太坊选择了直面挑战,深知量子计算终有一天会变得无处不在。

默认的互联网货币

“如果比特币消亡,人们将再也不会信任互联网货币。”

事实并非如此。

比特币的消亡无疑会在短期内造成信任的真空,但以太坊所满足的需求和价值并不会因此消失。这一事件反而可能为以太坊提供展示其长期韧性的机会。

我确实希望比特币能够克服量子威胁,但我也认为,加密货币领域的“头号货币”消亡,可能会极大地有利于“二号货币”。

比特币拥有巨大的货币溢价,而以太坊也有一定的货币溢价。如果比特币退出这个等式,那么以太坊将拥有一条畅通无阻的道路,成为互联网的原生货币。从一个只关注 ETH 价值的人角度来看,比特币因量子威胁而消亡,可能是对 ETH 最为利好的事件。

以太坊仍将继续出块,转移数万亿美元的稳定币,托管世界上最具韧性的 DeFi 生态系统,并通过燃烧 ETH 持续优化其经济模型。

因此,尽管比特币面临着“难以想象的巨大任务”,这是“比特币历史上最大的基础设施变革”(引自尼克·卡特在他最近的播客中的话),但以太坊早在十年前就已经在思考这些问题,并为未来做好了解决方案的准备。

所以,比特币的技术短板并不是我的问题。

感谢你对这一问题的关注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。