撰文:深潮 TechFlow

还记得上一轮 DePIN 叙事中的明星项目 Grass 吗?

11月16日,GRASS 刚刚跌至$0.26的历史新低。不过一周后,代币反弹超过45%,同期跑赢大盘。

社区有一种声音认为,之前 GRASS 代币价格的剧烈变化,是在炒作项目首次 Token Holder Call(持币者会议) 的预期,期待这个面向所有持币者的会议里,官方能够透露出更为强劲的基本面信息。

今天 Grass 也开完了这次 Token Holder Call,笔者在听完内容后发现这不太像是加密项目常见的那种“如听一席话”的 AMA ,而是一次接近财报性质的信息披露;

Grass 的收入数据、客户构成、回购计划、空投时间线,全部都是首次公开。

如果你错过了这场会议,我们也快速针对会议视频和官方回顾,对这次会议中透露的数据和关键信息做了总结,帮助你判断哪些信号值得关注。

会议回放链接:点击此处

收入从0干到千万美金,只用了3个季度?

这是Grass首次公开披露收入数据:

-

Q1 2025:接近零

-

Q2 2025:约275万美元

-

Q3 2025:约430万美元

-

Q4 2025(预测):约1280万美元

官方表示,仅10月和11月两个月,预计收入就达到1000万美元。需要指出的是,Q4数据目前仍是预测值,实际情况有待验证。

Grass怎么赚钱?

在谈收入时,你得搞清楚Grass的生意是什么。

Grass是一个分布式带宽网络。用户安装插件或App后,Grass会借用你的闲置网络带宽去抓取公开网页上的内容,文字、图片、视频都有可能。

因为请求来自全球各地的普通家庭IP,不容易被网站屏蔽,这对需要大规模采集数据的客户来说很有价值。

谁是客户?主要是AI公司。训练大模型需要海量数据,而Grass能帮它们以较低成本获取这些素材。简单说,Grass向用户“借”带宽,打包成数据采集服务卖给AI公司,赚的是中间的差价。

收入从哪来?

会上提到,90%的收入来自"多模态数据":也就是视频、音频、图像这类非文本内容的采集服务;98%的收入与AI模型训练相关。

这说明Grass目前的客户群体非常集中:基本都是AI公司,买的基本都是训练素材。

业务聚焦是一方面,但反过来也意味着,如果AI训练数据市场出现变化,Grass的收入会直接受到影响。

关于客户

Grass不公开客户名单,理由是AI公司将训练数据视为商业机密。会议中提到的信息包括:

-

Q4新签了一家 hyperscaler ,这个词你可以理解成大型云计算厂商;和一家视频生成领域的头部实验室

-

几乎所有合作过的AI客户都有复购

不过这些表述均来自官方,外部几乎不太能验证数据的真实性。

代币回购了,但不多

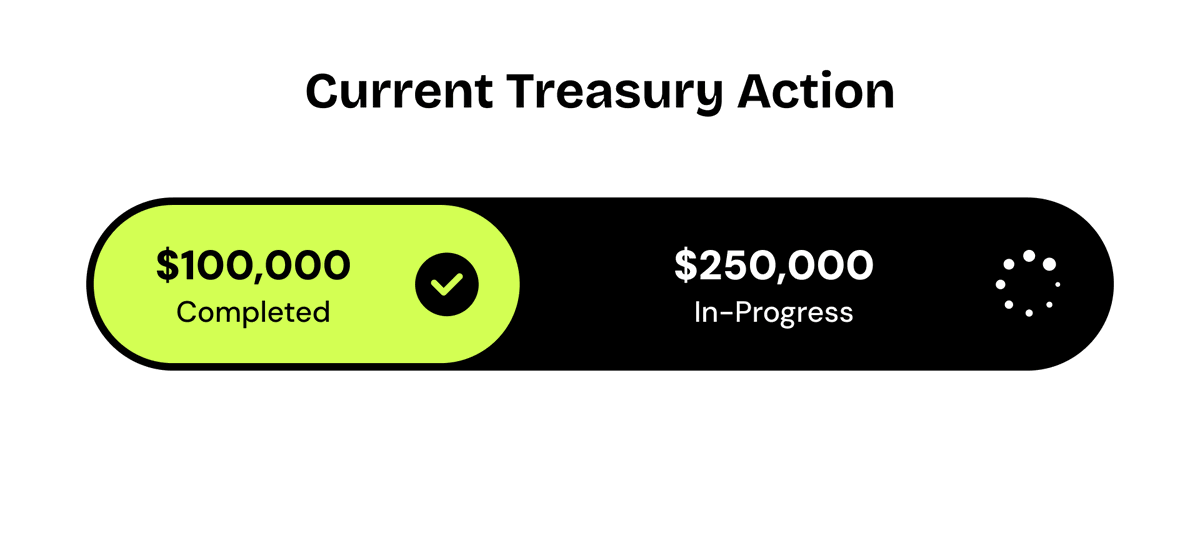

会上披露,Grass已经动用业务收入从公开市场买入GRASS代币,其中上周完成约10万美元的回购,本周正在执行约25万美元的回购。

而回购的资金,来自今年前三季度的收入。为了防止大家不相信回购正在执行,官方表示之后会公布存放这些代币的钱包地址。

目前回购金额合计约35万美元。对比Q2和Q3合计约700万美元的收入,也就是说这笔回购的钱,占比约5%,不算特别大的数目,更像是一种态度的体现。

官方提到,未来回购会从人工决定转向程序化执行,但没有给出具体规则。

不过需要注意的是,回购并不是百试百灵的催化剂,HYPE 和 PUMP 都有回购,也有真实收入,但阶段性的代币价格仍有可能出现大跌。

官方同时说了两件事:一是会回购代币,二是会把大部分收入投入增长。这两者怎么分,目前没有明确比例。回购能持续多久、规模能不能放大,最终还是要看收入能不能继续涨。

第二轮空投,定在明年上半年

Grass在去年进行过一次空投,向早期参与者发放了GRASS代币。这次会议确认了第二轮空投的时间窗口:

2026年上半年。

领取方式会变

和第一次空投不同,Airdrop 2不会通过外部钱包领取,而是通过Grass官方即将上线的内置钱包发放。这个钱包基于账户抽象技术,会嵌入Grass的产品界面中。

翻译一下:以后领空投不用连MetaMask之类的第三方钱包,直接在Grass后台就能收到。

规则会变

官方说法是,新一轮空投会"更强调长期网络贡献"。但具体怎么算贡献、跑了多久才算长期、不同设备和行为怎么加权,这些细节都没有公布,要等钱包上线后才会明确。

对现有用户意味着什么

如果你现在在跑Grass节点,这次会议没有给出明确的行动指引。唯一确定的是:规则会变,时间在明年上半年,届时会有新的计算方式。至于现在的积分、等级、设备数量能不能延续权重,目前不知道。

当前的市场处于熊市,明年上半年整体加密情况是否好转仍存在不确定性,GRASS 目前给的空投计划时间点很模糊,笔者认为某种程度上也是应对当前熊市的一种缓兵之计。

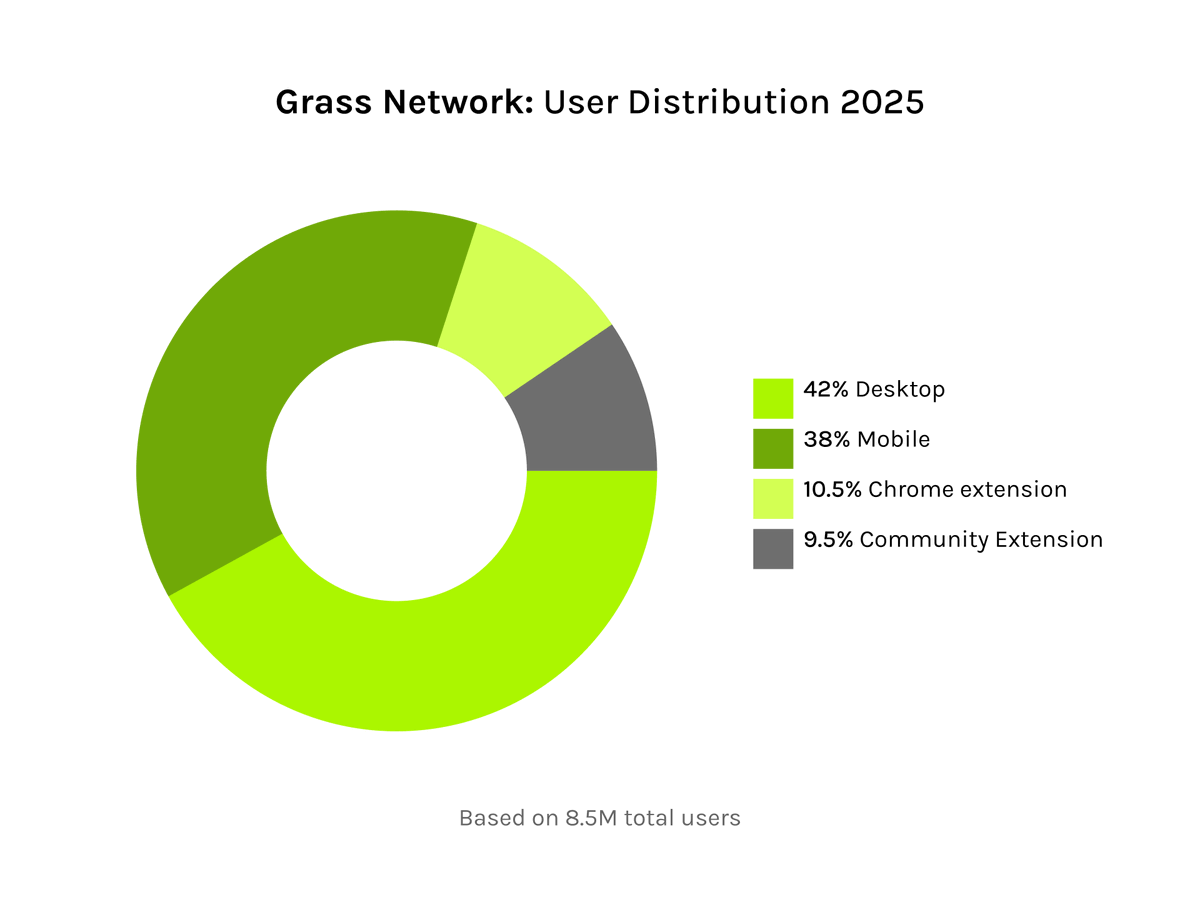

月活从300万涨到850万,下一步想做AI的实时数据源

Grass的网络规模在过去一年增长明显。官方数据显示,月活跃参与者从第一次空投时的约300万增长到现在的约850万。移动端用户占比约38%,超过三分之一的人是通过手机App而不是电脑插件来贡献带宽。

官方称,Grass积累的多模态数据(视频、音频、图像)总量超过250PB。1PB大约等于100万GB。按官方说法,这个量级“足够训练一个前沿级别的视频生成模型”。

新方向:从卖训练数据到提供实时查询

Grass正在开发一个叫Live Context Retrieval(LCR)的新产品线,直译是“实时上下文检索”。

现有业务是帮AI公司采集数据用于训练模型,一次性、大批量。LCR的定位不同,是为AI模型运行过程中提供实时数据。比如模型需要查询某个网页的当前内容,Grass可以即时抓取并返回。

目前LCR还在早期,官方把它叫"V0版本",正在和三家SEO公司以及一家AI实验室测试。

官方的解释是:训练数据是大单生意,金额高但频次低,不太适合链上结算。LCR是高频小额场景,每次查询可以对应一笔小额支付,更适合用代币完成。

如果LCR能跑通,GRASS代币在实际业务中会有更多用武之地。但这目前还是规划,LCR本身还没产生收入。

同时,原计划今年发布的硬件设备Grasshopper,因为关税引发的供应链问题推迟了,具体时间另行公布。

一句被官方纪要删掉的话

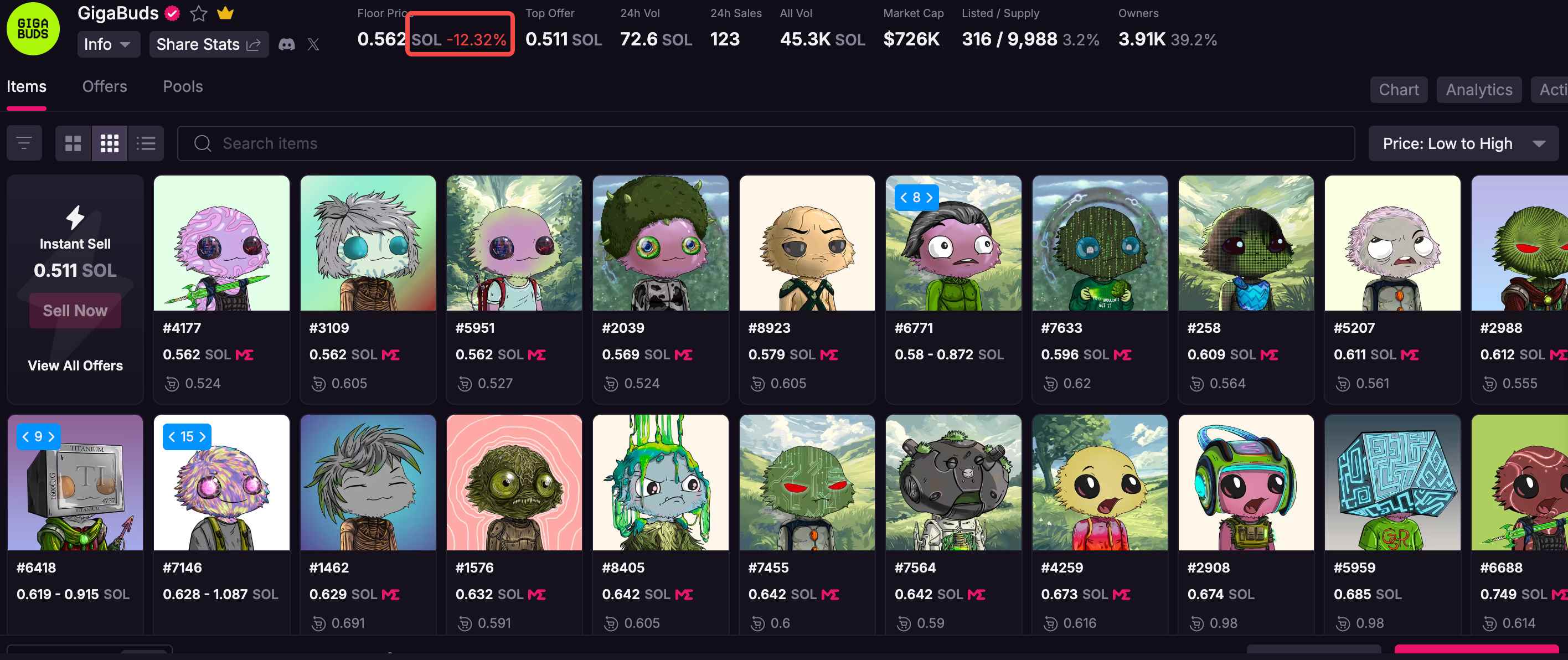

在会议进行到代币功能部分时,Grass CEO Andre说了一句:「Gigabuds have no utility」,意思是 Gigabuds没有任何功能性用途。

但在会后官方发布的书面纪要里,这句话没有出现。

Gigabuds是什么

Gigabuds是Grass推出的NFT系列。一些持有者可能期待它在未来的空投或网络权益中有加成作用,但这次会议上官方明确否定了这个预期。

地板价的下跌或许也是对这个表态的回应。

至于官方纪要里为何没出现,官方没有解释。可能的原因不外乎避免引发NFT持有者的负面情绪,或者认为这不属于核心业务信息。

这句话确实在会上说过,字幕记录里有。

如果你持有Gigabuds并且是基于「未来可能有用」的预期买入的,这句话是一个明确的官方表态。至于NFT本身是否还有收藏价值或二级市场价值,那是另一回事,但功能性用途这条路,官方已经堵死了。

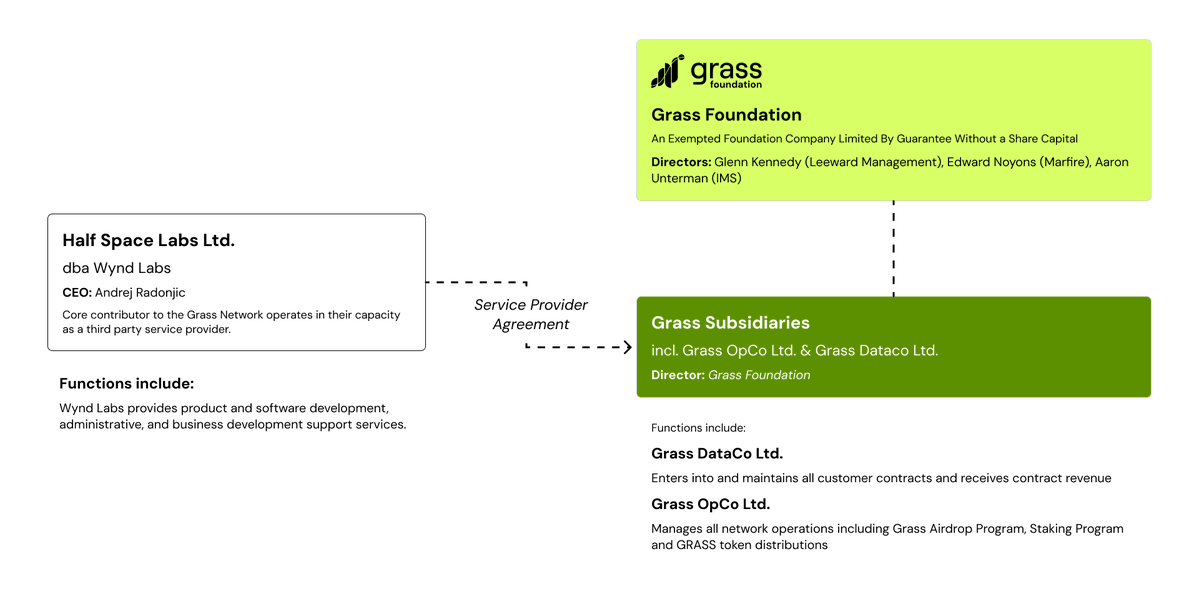

收入归基金会,开发团队拿服务费

很多加密项目的公司架构不透明,用户搞不清楚收入归谁、代币归谁管、开发团队和项目方是什么关系。这次会议上,Grass把自己的架构讲得比较清楚。

三个实体,各管一摊

Grass Foundation是一个注册在开曼群岛的基金会,没有股东。它下面有两家子公司:

-

Grass OpCo:负责网络运营,管空投和质押这些事

-

Grass DataCo:负责B2B业务,所有客户合同都是这家公司签的,收入也进这家公司

开发团队是外包的

负责产品开发的团队叫Wynd Labs,它不是Grass的子公司,而是第三方服务商。Wynd Labs按服务费收钱,不参与Grass的收入分成。

会上特别强调了一点:就算客户是Wynd Labs谈下来的,合同也是Grass DataCo签,收入也归Grass DataCo。

服务费具体多少?

官方没有披露。所以开发团队实际拿走多少钱,外界无从判断。

总结一下:

这场会议讲了收入数据、回购进展、空投时间线、产品方向、公司架构。对于一个DePIN项目,这个信息密度不常见。

再说没讲什么:客户具体是谁、回购会持续多大规模、Airdrop 2的具体规则、新业务什么时候能产生收入。这些问题官方要么说不能透露,要么说等后续公布。

这是Grass第一次开这种会,官方说以后还会有。对持币者来说,比起价格波动,这些业务层面的进展可能更值得跟踪。

也希望更多加密项目能够像这样公开自己的业务收入情况;在比谁烂的市场里,这已经很难得了。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。