The mission of Zcash is more focused and more radical.

Author: Naly

Translation: Deep Tide TechFlow

Abstract

Zcash (ZEC) can be seen as the invisible version of Bitcoin.

It has the same supply cap, the same halving mechanism, and the same deflationary structure as Bitcoin, but it is invisible.

As institutions, governments, and native users of the crypto industry gradually view Bitcoin as a sovereign store of value, the world is beginning to realize the need for a second dimension of currency—one that is not only scarce and self-custodial but also permissionless and privacy-protecting.

In this rapidly advancing world of AI surveillance, programmable currencies, account freezes, and cashless control systems, Zcash offers a second dimension of monetary freedom—not only scarce but also protectable.

This report will delve into the core concept of Zcash as "invisible Bitcoin" and why it may be the most asymmetrically potential investment choice in today's crypto space.

Key Highlights:

A currency system with a fixed supply cap similar to Bitcoin, but its maturity still lags behind two halving cycles.

Originating from a deep-rooted cypherpunk background, including cryptographic setups involving Edward Snowden.

Easily understandable even without technical knowledge: the concept of invisible currency is intuitive enough.

Regaining attention from institutions and thought leaders, such as Naval Ravikant, whose support stems from the increasingly important reality of financial privacy rather than hype.

This report breaks down the investment logic of Zcash into eight key areas:

Ideology

Origin Story

Technical Advantages

Competitors

Token Economics

Macro Relevance

Risks and Challenges

Investment Logic

1. Ideology

Zcash was not created to compete with Bitcoin but to complement its shortcomings. Bitcoin grants monetary sovereignty, while Zcash grants monetary privacy. It extends Satoshi's design into the realm of invisibility that Bitcoin has always struggled to control.

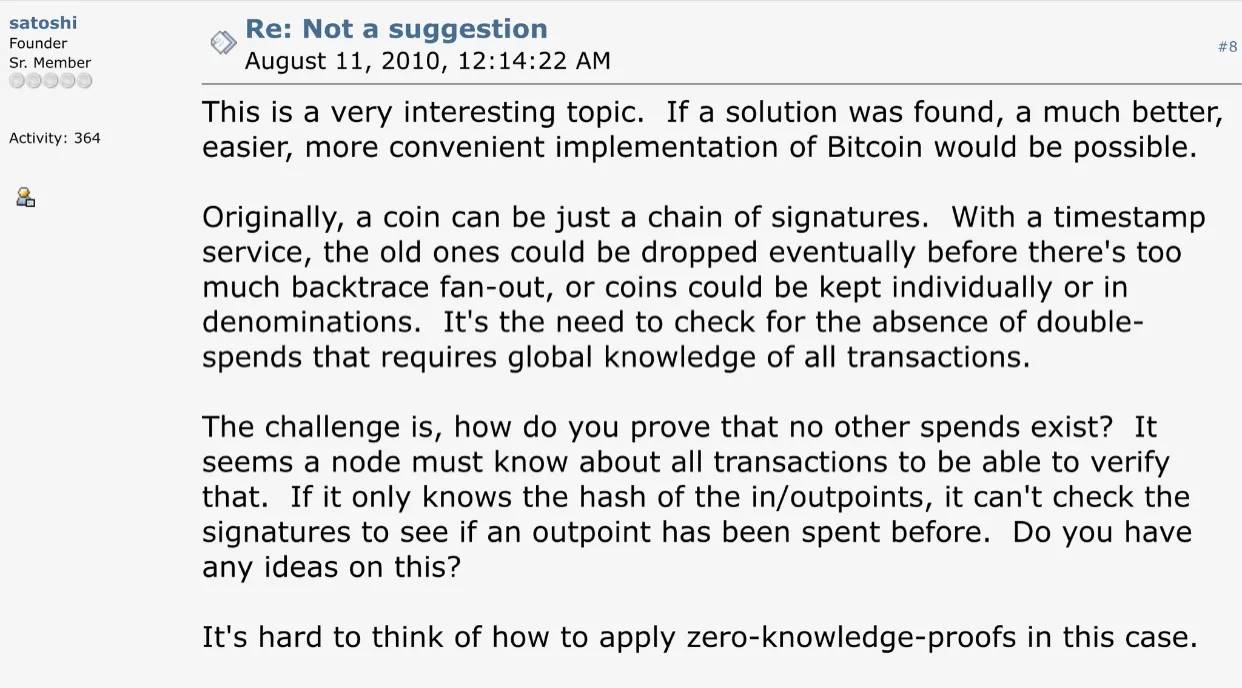

From the early development of Bitcoin, privacy has been seen as one of its fundamental weaknesses. Hal Finney—one of the first people to run Bitcoin and the recipient of the first transaction sent by Satoshi—had a clear understanding of this. He warned that while Bitcoin's transparent ledger has significant advantages in verification, it inevitably undermines its fungibility, as the history of coins can be traced and distinguished. For Finney and early cypherpunks, this undermined the core idea of digital cash.

Hal Finney was active in cypherpunk mailing lists in the 1990s, where the community first discussed concepts such as zero-knowledge proofs and cryptographic anonymity, viewing them as tools for achieving personal autonomy. He firmly believed that future digital currencies need to possess both verifiability and privacy.

Years later, Zooko Wilcox—another veteran cypherpunk and early contributor to Bitcoin—dedicated himself to solving this problem. He collaborated with a world-class cryptographic team to co-author the academic proposal Zerocoin, aimed at providing Bitcoin with complete transaction privacy features. However, when Bitcoin core developers refused to integrate this proposal, the team decided to start anew and create an entirely new protocol.

This protocol eventually evolved into Zcash, which officially launched in 2016. Its founding principle is simple yet radical: privacy is the norm. It is not a privilege or an optional feature, but a fundamental attribute of sound money.

For a long time, privacy has been misunderstood as secrecy or hidden behavior. In reality, privacy is about dignity, autonomy, and the freedom to choose whom to disclose information to. It is the silent cornerstone of self-sovereignty.

Bitcoin achieves censorship resistance through decentralization, while Zcash goes further by providing financial invisibility. By utilizing zero-knowledge proofs, Zcash allows users to verify transactions without disclosing the sender, receiver, or transaction amount. It has achieved the first-ever transfer of value on a public blockchain without exposing identities or activities.

This innovation makes Zcash the first project to actually deploy zk-SNARKs in a permissionless blockchain, a milestone that has shaped the broad field of zero-knowledge cryptography. Even today, Zcash remains one of the few first-layer protocols that treat privacy as a fundamental attribute rather than an overlay feature.

The origin story of Zcash connects two eras: the cypherpunk beginnings of Bitcoin and the cutting edge of modern cryptography. It represents the maturation of the ideas originally conceived by Satoshi, Hal Finney, and the early builders of the internet: privacy is not a vulnerability to be fixed, but a right to be protected.

2. Origin Story

At the inception of Zcash, generating cryptographic parameters was necessary to enable shielded transactions. However, if these parameters were compromised, it could theoretically lead to undetectable coin inflation issues. To mitigate this risk, the Zcash team designed one of the most captivating launch events in cryptocurrency history, called "The Ceremony."

"The Ceremony" is a globally distributed multiparty computation activity conducted under extremely high operational security standards. Each participant operates in a physically isolated environment, using devices that are disconnected from the network, and destroys all cryptographic materials after completing their tasks. The goal is to ensure that no single party, or even multiple parties colluding, can reconstruct the keys.

Participants included Edward Snowden, who took part under a pseudonym and only revealed his identity in 2022. Snowden, as a symbolic figure of the digital privacy movement, further solidified the significance of "The Ceremony" in the history of cryptocurrency.

Radiolab's coverage of this event reads like science fiction:

Wizard hats

Paper maps, no GPS

Hardware burned in a bonfire

Randomly chosen hotels, TVs disassembled

Laptops sleeping under pillows

Phone batteries removed mid-call

Bitcoin has its Genesis Block, while Zcash has "The Ceremony."

Bitcoin records history; Zcash encrypts history.

If you believe that privacy is a collective right, then Zcash is the starting point of that idea. This is particularly important in a narrative-driven market. Internet memes and origin stories are not distractions from the fundamentals but vessels of belief, and belief is the force that drives network effects.

3. Technology

Zcash is the first project to implement zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKs) in a permissionless blockchain environment. Although zk-rollups have gained popularity in recent years, Zcash applied zero-knowledge cryptography in a production environment as early as 2016.

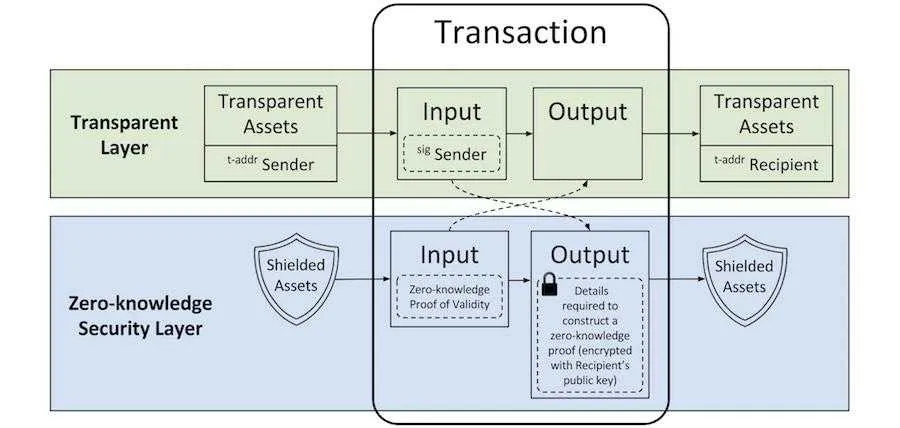

The core of zero-knowledge cryptography is that it allows one party to prove something is true without revealing any underlying data. In traditional blockchains (like Bitcoin and Ethereum), verifying transactions requires disclosing the sender, receiver, and transaction amount, all of which are permanently recorded on a transparent public ledger.

Zcash offers a radically different model. Through zk-SNARKs, users can prove the validity of transactions without disclosing any details. This is not an additional layer of obfuscation or an optional privacy tool, but a fundamental feature enforced by cryptography and built into the protocol.

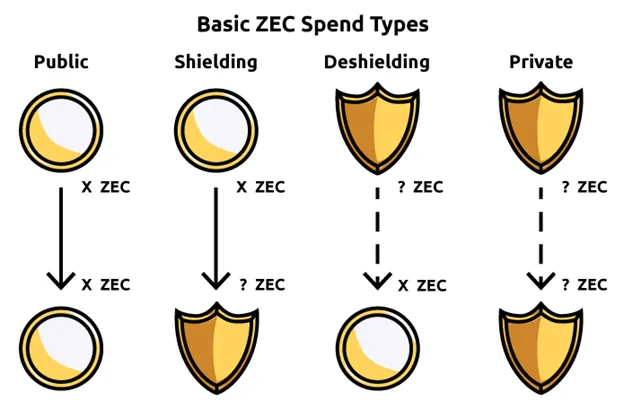

Zcash supports two types of addresses: transparent addresses (t-addresses), which function similarly to Bitcoin's model; and shielded addresses (z-addresses), which provide complete privacy protection. Funds can flow freely between these two pools. This flexibility and the integrated nature of the shielded pool make Zcash structurally distinct from almost all other blockchains.

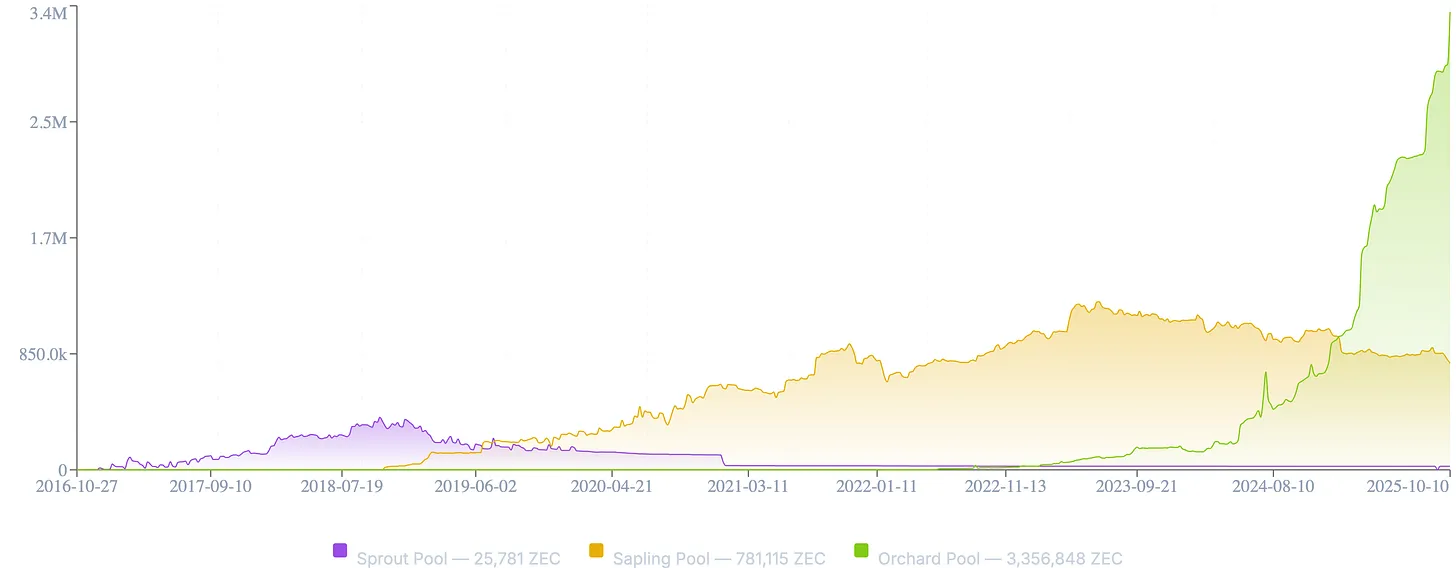

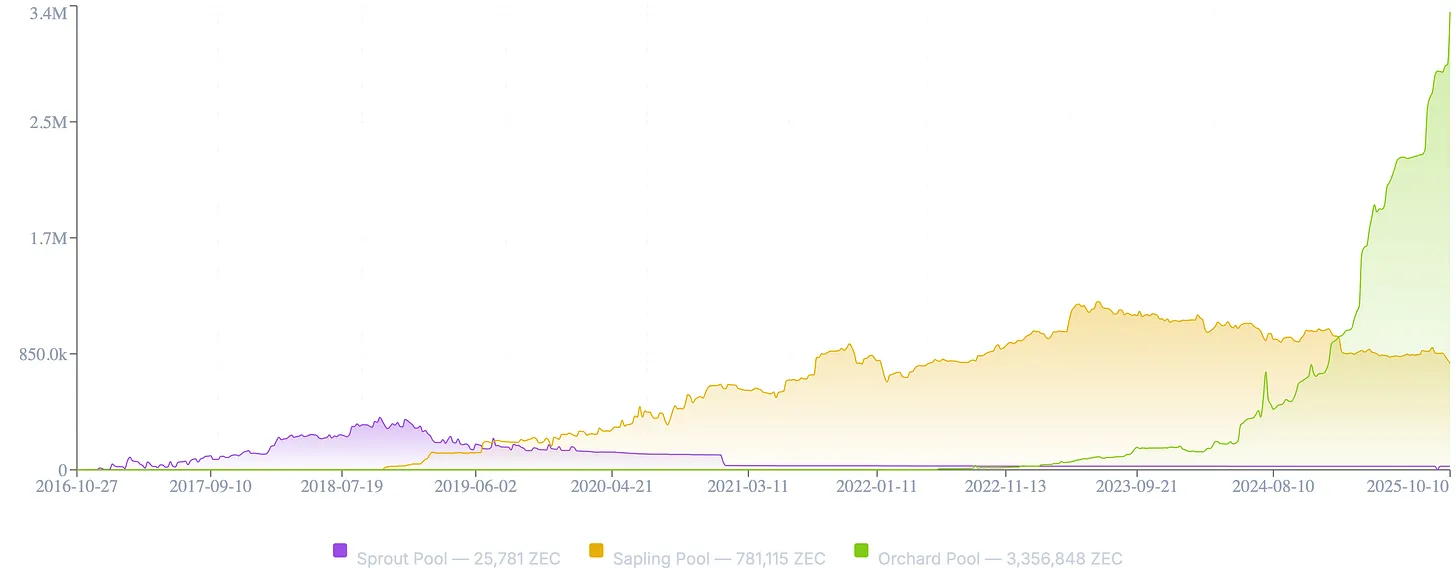

The privacy of the ZEC network is directly related to the liquidity in the shielded pool: just like a crowd, the more people there are, the harder it is to identify individuals.

Although the technology itself is very powerful, critics point out that shielded transactions have historically accounted for only a small portion of overall network activity, providing shielded users with a "smaller crowd to hide in." Part of the reason is the lack of wallet support, user experience barriers, and the relatively high computational resources required to generate zk-SNARK proofs.

At certain times, the proportion of fully shielded ZEC transfers was even below 5%. However, this trend is reversing. Recent updates to the proof system and the emergence of new tools like the Zashi wallet have made using shielded transactions more convenient. According to data from the Zcash Foundation, over 70% of active wallets currently support shielded transactions, and the volume of daily shielded activity is rapidly increasing.

Today, over 25% of circulating ZEC has entered the shielded pool, and this number is rapidly climbing. The distinction here is crucial: privacy alone is not enough. For widespread adoption, privacy must be usable. Zcash has spent the past decade building a cryptographic foundation, and it is only now beginning to create user interfaces that can drive its mainstream adoption.

4. Competitors

Before delving into the token economics of Zcash, it is essential to clarify its uniqueness within the broader digital asset privacy landscape. In today's market environment, Zcash faces very few true competitors.

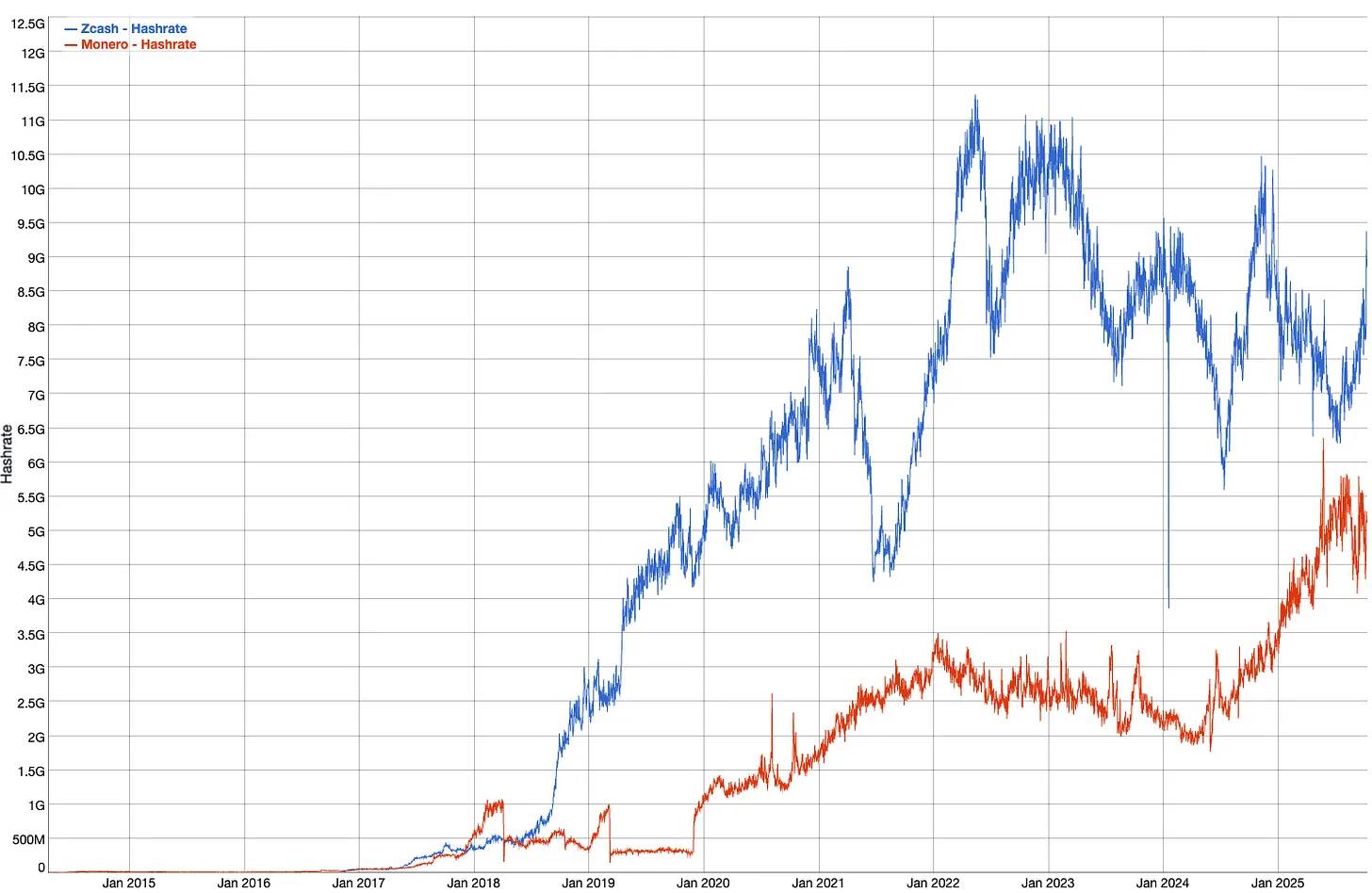

While Monero is widely used, it relies on ring signature technology—which, although powerful, has exposed some vulnerabilities in statistical and heuristic analyses. Even Monero's developers acknowledge these limitations and are exploring the integration of zero-knowledge systems to enhance privacy protection. Additionally, Monero's model carries a certain reputational burden, having long been closely associated with dark web markets and unregulated activities.

Moreover, Monero is no longer listed on mainstream exchanges like Coinbase, Binance, and Kraken, while Zcash can be freely traded on these platforms. The reason is that Monero's privacy is absolute and therefore cannot be regulated; whereas Zcash's privacy is optional, allowing users to choose between transparent and shielded transactions.

As Mert from Helius observed:

“Zcash is dual-mode—users can choose to shield or not shield their assets.

If you want privacy to be widely adopted, you need a system that can withstand real-world scrutiny.”

It is this balance between privacy and compliance that provides Zcash with a path for sustainable growth. Its architecture allows for selective disclosure through viewing keys, enabling users to share transaction data with auditors, regulators, or trusted third parties when necessary. In short, it offers a form of privacy that operates within the system rather than outside of it, which is a necessary prerequisite for widespread adoption.

However, it is not accurate to simply view Zcash and Monero as competitors. The real challenge is not which privacy asset prevails, but whether privacy can continue to serve as a vital pillar of the digital economy. Both ecosystems are advancing the development of this field. However, from the perspectives of design and adoption, Zcash's hybrid model of privacy and compliance makes it more likely to achieve mainstream and institutional integration.

The privacy protocol Tornado Cash on Ethereum was once a promising project, but it showcased the limitations of a system completely detached from regulatory adaptability. Following sanctions and dismantling by authorities, its developers faced prosecution, and its smart contracts came under strict scrutiny. This conveyed a clear message: privacy without resilience or adaptability cannot survive.

In contrast, Zcash achieves privacy at the protocol level through zero-knowledge proofs, a method that is cryptographically stronger than ring signatures or mixer-based approaches. It combines mathematical rigor with practical flexibility, providing privacy that can coexist with transparency when needed. This technical robustness and legal survivability are what make Zcash unique.

Additionally, the concept of Zcash is very easy to understand: it is the "invisible version of Bitcoin"—with the same supply cap, the same halving model, and the same deflationary structure, but with shielding capabilities. From the perspective of adoption and investment, the simplicity of this narrative is particularly important.

Zcash started as a cryptographic experiment and is now gradually maturing into a sovereign, private, and programmable financial system. In an era filled with surveillance, programmable currencies, and geopolitical instability, it occupies a unique position.

5. Token Economics

In the post-ETF era, institutions have become familiar with Bitcoin's halving cycles and fixed supply, while Zcash's design appears as an asymmetric gift.

As the Bitcoin model—fixed supply, halving every four years, and predictable scarcity—has become a consensus among institutional investors, an asset similar to it but introducing privacy features represents a logical evolution of this idea.

Zcash fully replicates Bitcoin's monetary structure:

Maximum supply of 21 million

Halving approximately every four years

Higher issuance in the early stages

No ICO, no pre-mining, no venture capital allocation

This is Bitcoin's scarcity model, just in an "invisible version."

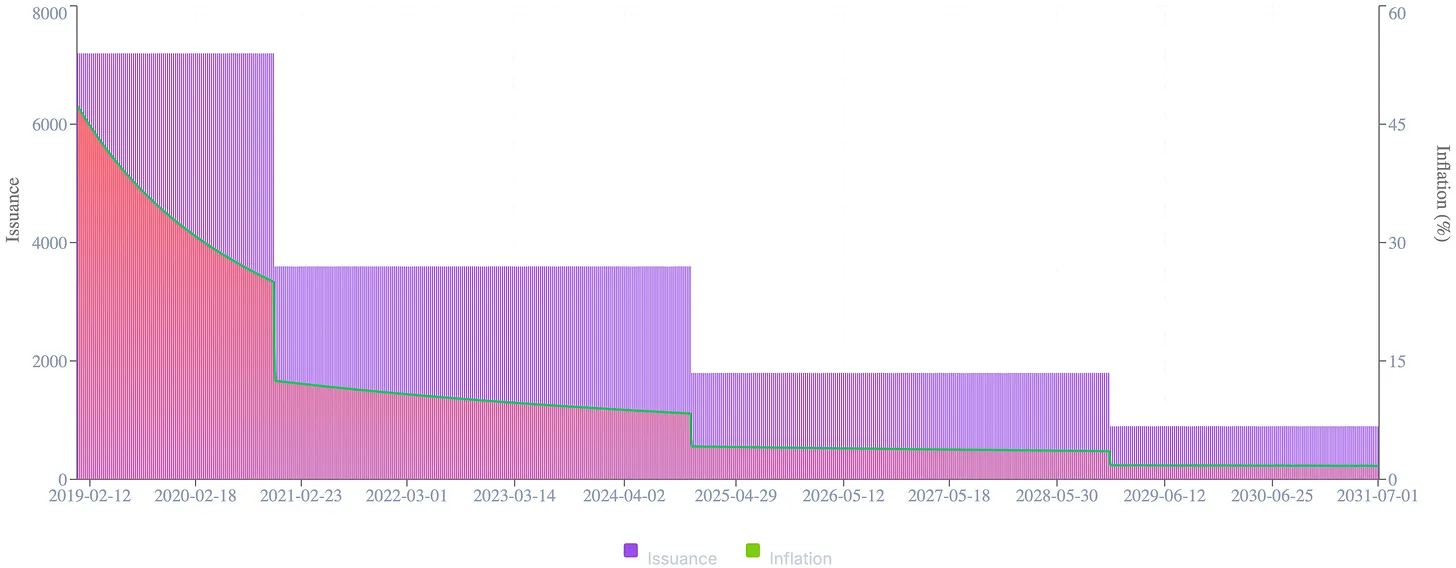

But the key difference is that ZEC's halving cycle lags behind by two cycles. This lag means it is progressing along the same monetary curve, but at an earlier stage of maturity.

What distinguishes this cycle from previous ones is the scale of capital entering the market. The participants accumulating Bitcoin today are no longer retail speculators or crypto-native funds, but managers of trillions of dollars in assets, pension allocators, and sovereign entities seeking exposure to hard digital assets. The emergence of spot ETFs has institutionalized the Bitcoin narrative, opening the floodgates for traditional capital, which now views programmable scarcity as a legitimate asset class.

Many asset allocators missed the early development phase of Bitcoin, and they are unlikely to make the same mistake again. As institutional investment gradually expands beyond Bitcoin, ZEC's Bitcoin-like supply mechanism, regulatory acceptability, and clear narrative logic make it a natural secondary allocation choice.

ZEC offers the same mathematical scarcity as Bitcoin while adding a dimension: invisibility. For large asset managers who recognize both the power of transparency and its risks, even a small allocation to ZEC represents their provision of more options for the next phase of the digital asset cycle.

Zcash was launched in 2016, and its early market dynamics were influenced by a steep issuance curve and the absence of pre-sales or venture capital allocations. With supply primarily concentrated in the hands of miners, there was significant selling pressure. Prices plummeted from the initial speculative peak, and the range of holders gradually expanded, leading the asset into a long accumulation phase.

Today, these market dynamics have reversed.

Circulating supply: approximately 16.3 million ZEC

Maximum supply: 21 million

Market cap: approximately $4.46 billion, reaching an all-time high, although the unit price ($272) remains below the peaks of 2017, 2018, and 2021.

This difference is crucial. The high inflation of ZEC in its early days kept the price chart flat for years, but as supply growth has significantly slowed, the market cap reveals the true trend—a stable structural rise, echoing the post-halving turning points in Bitcoin's history.

Chart: ZEC Market Cap (Log Scale)

Trading volume is surging (approximately $1.28 billion daily), and large players seem to be quietly positioning themselves. In the largest liquidation storm in crypto history—over $19 billion in forced liquidations—ZEC was one of the few assets to see price increases, which is clearly a signal of accumulation.

On-chain data confirms this potential shift:

The number of active addresses and privacy wallets is steadily increasing.

Over 70% of ZEC wallets now support z-address (privacy address) functionality.

The number of transactions in the privacy pool has begun to grow exponentially after years of stability.

The distribution of holders remains clean and natural: there has never been pre-mining, founder rewards have fully vested, and long-term believers hold the majority of the supply.

From an investment perspective, this situation is textbook asymmetric: fundamentals are strengthening, the supply curve is tightening, market cap is quietly reaching new highs, and the narrative—Bitcoin's "invisible twin"—is beginning to resonate again. This is not speculation but repricing. The market is starting to recognize the true value of Zcash.

6. Macro Relevance

Zcash cannot be evaluated in isolation. Its significance can only be revealed when placed against the backdrop of accelerating digitization, expanding surveillance, and deepening macroeconomic fragility.

In most developed countries, public trust in institutions is eroding. Sovereign debt has reached unsustainable levels, fiscal deficits have become structural issues, and central banks have fewer tools available due to political and leverage constraints. Inflation is no longer a transient shock but has become a policy.

In the current environment, Bitcoin has become one of the primary hedges against currency devaluation, serving as a modern reserve asset that provides protection for those seeking to avoid fiat dilution. However, every Bitcoin transaction, wallet balance, and sovereign purchase behavior is visible on-chain. While Bitcoin's transparency ensures the security of its supply, it also exposes the privacy of its holders.

In short, Bitcoin can hedge against inflation but cannot hedge against surveillance.

As physical cash gradually disappears and central bank digital currencies (CBDCs) approach deployment, the ability to conduct private transactions is increasingly shifting from a right to a privilege. Zcash restores this right—not through policy, lobbying, or permission, but through code.

The past decade has shown that financial infrastructure is no longer neutral. Payment systems have been weaponized, protesters have been deprived of banking services, foreign reserves have been frozen, and entire groups have been excluded from the global financial system due to a few keystrokes.

What was once considered a dystopian scenario has now become standard policy.

Zcash offers an alternative. It is not a platform for speculation or yield, nor is it the underlying foundation for NFTs or games. Its goal is simpler: to protect the privacy and fungibility of the currency itself. By implementing programmable privacy transactions at the protocol level, Zcash ensures that financial freedom does not disappear in the process of fully on-chain currency.

The macro trends are becoming evident: surveillance will intensify, censorship will expand, and the demand for escaping a fully transparent financial system will grow stronger. Individuals, businesses, and even institutions operating in adversarial jurisdictions will seek tools that allow value to flow discreetly. Zcash may not be the only answer, but it is one of the few trustworthy, technically mature, and ideologically consistent solutions.

As Bitcoin enters the institutional realm, absorbed by ETFs, custodians, and sovereign portfolios, Zcash holds the line on individual autonomy. It is a quiet complement to Bitcoin's public role, an invisible layer that protects the privacy that Bitcoin was never intended to provide.

In a world where every transaction leaves a trace, the right to financial invisibility may become the most valuable asset.

7. Risks and Resistance

Despite Zcash's strong cryptographic technology and clear philosophical principles, it still faces some real-world challenges. The very characteristics that make Zcash appealing—privacy protection, ideological purity, and technical ambition—also serve as barriers to its adoption, usability, and regulatory acceptance.

Regulatory pressure is the most persistent risk. Although Zcash has avoided the fate of being dismantled like Tornado Cash due to sanctions, it still exists in a legal gray area. Privacy assets are often portrayed as tools for illegal finance, despite a lack of sufficient evidence to support this claim. This perception has led to Zcash being delisted in some key markets, such as South Korea and the UK. If U.S. regulators take a stricter stance on privacy transactions or expand anti-money laundering (AML) enforcement, the accessibility of ZEC could significantly narrow.

Usability is another barrier. While Zcash's zero-knowledge architecture is advanced, it is not always user-friendly. Privacy wallets, viewing keys, and private transactions typically require a higher level of technical literacy than the average user possesses. Although tools like Zashi have significantly improved the user experience, achieving widespread adoption will require seamless integration of privacy features into mobile applications, multi-asset wallets, and payment systems. For privacy to scale, it must become effortless.

Internal ecosystem coordination issues also exist. The coexistence of the Electric Coin Company (ECC) and the Zcash Foundation sometimes leads to a fragmented roadmap and inconsistent communication. As the Crosslink upgrade approaches, close collaboration between these two entities will be key to maintaining trust and driving development.

Zcash's dual-pool model provides both transparent and privacy addresses, and this flexibility comes with certain trade-offs. Since privacy is an option rather than a default setting, only a portion of network activity can enjoy complete anonymity. If the adoption rate of privacy addresses does not increase alongside price (which is currently rising), this split could weaken the overall privacy protection of the network and diminish one of its core differentiating advantages.

Furthermore, Zcash operates in an increasingly competitive zero-knowledge technology space. Since its launch, zk-rollups, modular privacy layers, and other architectures integrated with the Ethereum ecosystem have attracted significant attention and funding that once focused on underlying privacy chains. While few of these alternatives can offer the same maturity or mission purity as Zcash, they are vying for developer attention and capital.

However, these risks are not fatal. Each represents an execution challenge rather than a structural flaw. The future of Zcash lies not in redefining its mission but in executing it precisely, clarifying its narrative, uniting the community, and continuously optimizing its product.

The battle for privacy will not be won solely through ideology. It will be won through usability, legality, and a sustained belief in the right to trade freely.

8. Investment Logic

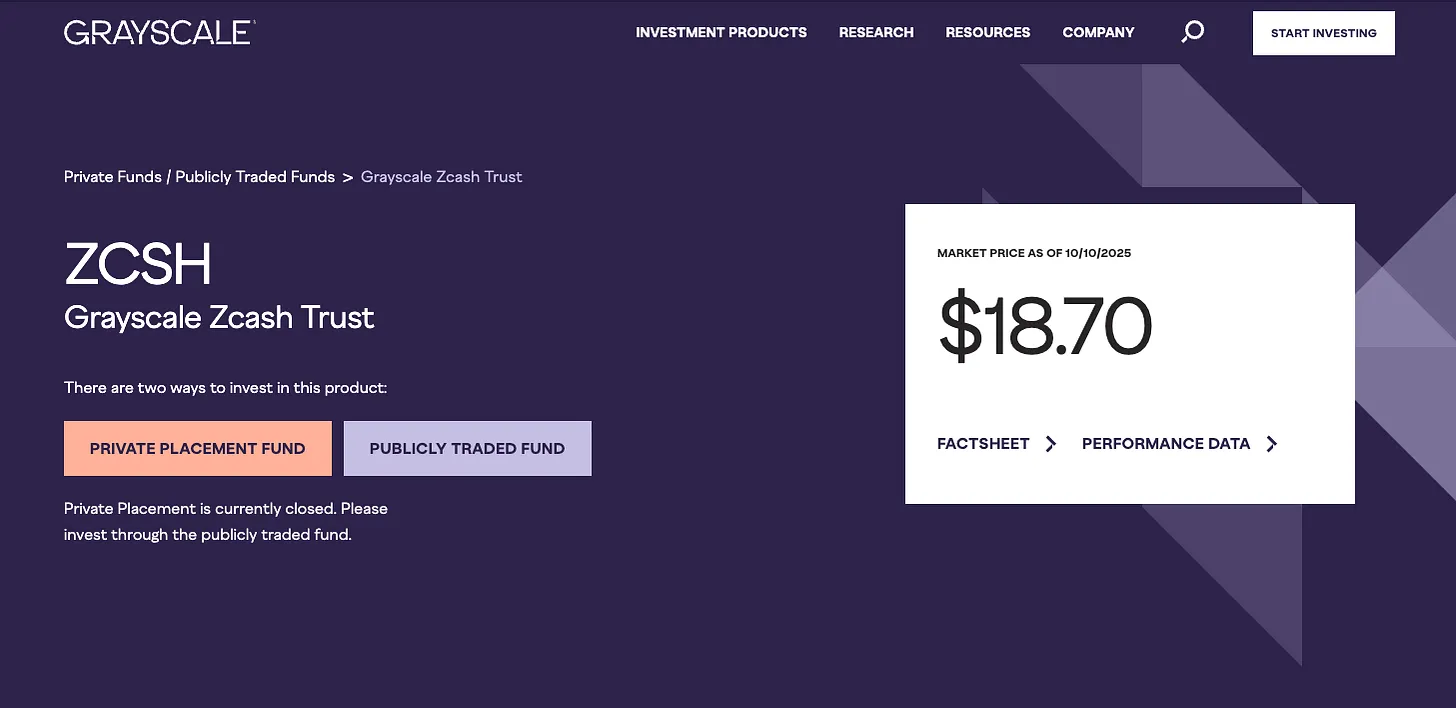

Chart: Greyscale ZEC Investment Thesis

Zcash represents a rare investment opportunity: a structurally scarce, cryptographically validated asset that has withstood market tests, currently trading at a price far below its intrinsic value.

Unlike most digital assets that rely on narrative-driven value, Zcash's worth stems from its design. It is based on scarcity, built on proven cryptographic technology, and is gradually being recognized for what it has always positioned itself as: a cornerstone in the realm of digital currency privacy.

The logic for investing in ZEC is based on three core pillars: timing, belief, and design.

Timing: Zcash's halving cycle lags behind Bitcoin by two cycles, and its monetary curve is similar to Bitcoin's but at an earlier stage of maturity. Its most recent halving occurred in November 2024, marking a significant turning point in its issuance schedule, with the annual inflation rate dropping from 12.5% to about 4.2%. This places ZEC on the same structural path as Bitcoin during its breakthrough phases. Bitcoin struggled to maintain a price of $1,000 before its second halving, but post-halving, programmed scarcity began to dominate market dynamics. Today, Zcash is at the same juncture. The next halving will reduce the issuance rate to about 2%, after which the inflation rate is expected to fall below 1%, gradually converging with Bitcoin's long-term monetary model.

This transition occurs in a macro environment increasingly favorable to hard assets and self-custodied assets. Against the backdrop of surveillance, capital controls, and the prevalence of programmable currencies, privacy protection and scarcity are becoming a unique asset class. Few assets can combine trustworthy monetary design, established history, and structural scarcity at such an early stage of recognition.

Belief: Zcash carries no burden of venture capital, no historical baggage from an ICO, and no speculative funds driving short-term narratives. Its issuance is transparent and limited, with a natural distribution method. Those who have held ZEC after years of neglect deeply understand the significance of the protocol. They are not chasing yields or participating in hype; they are builders, cryptographers, and early adopters of freedom technologies. This foundation makes Zcash more resilient during market downturns and more explosive during narrative shifts.

Design: Zcash is not an application chain, a layer-two network, or a DeFi toolkit. It is a currency—pure, privacy-protecting, and programmable. This simplicity gives it clarity and durability, allowing it to stand out in a market filled with complexity. It conveys a language that both institutions and individuals can understand: it is Bitcoin's architecture, but invisibilized.

Market Asymmetry and Portfolio Positioning

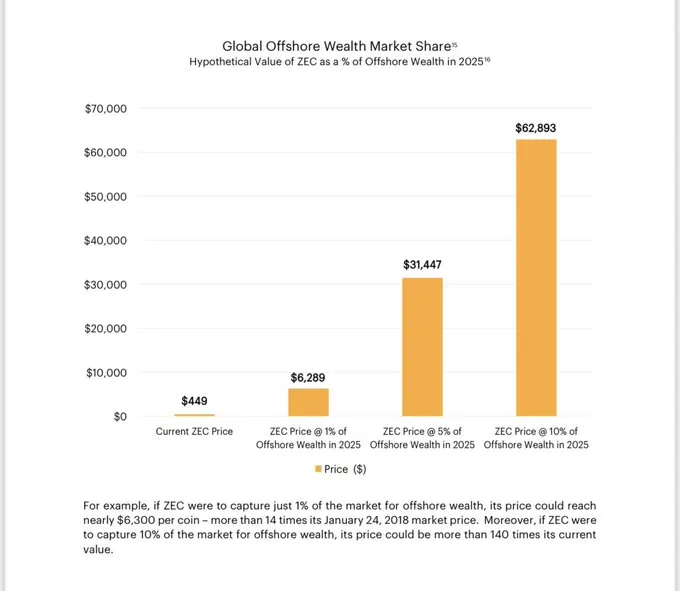

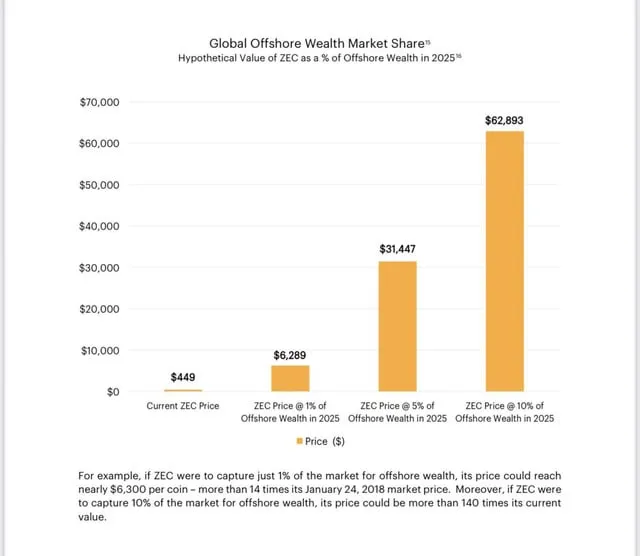

This section is based on the analysis of Frank Braun, whose research at the intersection of offshore wealth and digital privacy assets provides an excellent quantitative background for understanding Zcash's investment opportunities.

The total global asset value is estimated to be around $1,000 trillion. The market cap of gold is $27 trillion, while Bitcoin's market cap is $2.3 trillion—about 8.5% of gold's value, accounting for only about 0.2% of global assets. In contrast, the total market cap of the entire privacy coin sector is only $12.6 billion.

This gap is particularly striking when compared to the estimated $10 trillion in undeclared offshore wealth, which accounts for about 1% of global assets. The market value of all privacy coins is even less than 0.1% of this offshore wealth pool.

Historically, real estate has been the primary vehicle for storing hidden wealth, providing both opacity and yield. However, this channel is gradually closing. Global anti-money laundering (AML) regimes, stricter reporting standards, and digital regulation are making cross-border real estate and corporate structures increasingly transparent. As capital seeks new forms of self-custodied, censorship-resistant storage, programmable privacy networks like Zcash may become a digital alternative.

From a portfolio construction perspective, ZEC can play two unique roles. It serves as a hedge against central bank digital currencies (CBDCs), capital controls, and the pervasive data capture of the modern financial system, while also representing a high-beta asymmetric investment that returns to the founding principles of cryptocurrency—self-custody and privacy as the cornerstones of sovereignty.

The potential demand is enormous. If privacy assets can capture 1% of global offshore wealth, the implied valuation of ZEC could approach $6,000 per coin. If it reaches 5%, the valuation would exceed $30,000; if it reaches 10%, it would surpass $60,000. These are not predictions but frameworks—data that highlight structural asymmetries in a world where financial invisibility is gradually disappearing.

Institutional capital inflows are still in the early stages, but attention is gradually shifting. After years of being overlooked, Zcash is once again a topic of discussion among influential investors and developers. Notable figures like Naval Ravikant and Balaji Srinivasan have publicly emphasized its importance as "invisible Bitcoin"—a scarce crypto asset designed for the era of financial surveillance.

Zcash is not for everyone, but it does not need to be. Its goal is not to compete with Bitcoin but to complement it; to represent the invisible asset in a portfolio, while other assets are defined as visible.

In a digital world gradually moving toward total traceability, the most rebellious investment choice may no longer be leverage or yield, but privacy itself.

Conclusion

Zcash is not just another digital asset. It does not compete on transaction throughput, modular composability, or total value locked, nor does it attempt to position itself as a universal infrastructure layer for decentralized finance. Zcash's mission is more focused and more radical.

It is committed to defending financial autonomy in an era of total visibility.

In a world where data becomes currency, surveillance is embedded in infrastructure, and financial transparency is no longer a choice, Zcash offers an alternative. It brings encrypted cash to the digital age—an asset whose value transcends codebases, issuance curves, or cryptographic designs. Its true value lies in what it defends: individual autonomy in an increasingly transparent financial system.

For years, Zcash has been overlooked by the market. This is not because it has failed, but because it has refused to compromise. It has consistently adhered to an ideology that the market was not yet ready to accept. However, all of this is changing. The demand for private currency is rising, technological tools are maturing, and threat models are expanding.

Zcash's success does not rely on mass adoption. It only needs to be meaningful to those who value privacy. In a world where privacy is no longer the default option, these individuals include not only activists or dissenters but also an increasing number of ordinary citizens who recognize that financial surveillance has become a reality. For them, Zcash is not just a speculative asset; it is a safeguard against the future where every transaction, action, and association is recorded and analyzed.

Perhaps one day, invisible currency will become indispensable. And when that day comes, Zcash will not need to evolve to fit the times. It has already become what the world needs.

If you want to explore this topic further, the following resources provide excellent insights on Zcash, privacy technology, and the macro environment shaping digital sovereignty:

Disclaimer: The above content does not constitute any financial advice. It is merely my personal opinion and the way I choose to respond to these changes. Everyone's situation is different, so please be sure to conduct independent research, maintain critical thinking, and make decisions that are right for you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。