撰文:YQ

编译:AididiaoJP,Foresight News

2025 年 11 月的前两周稳定币暴雷暴露了去中心化金融领域多年来被学者们反复警告的根本性缺陷。Stream Finance 的 xUSD 崩盘,以及随后引发的 Elixir 的 deUSD 和众多其他合成稳定币的连锁性失败,远非孤立的管理不善事件。这些事件揭示了 DeFi 生态系统在风险处理、透明度和信任方面存在的深层次结构性问题。

我在 Stream Finance 崩盘事件中观察到的,并非是对智能合约漏洞的精妙利用,也非传统意义上的预言机操纵攻击。相反它揭示了一个更令人不安的事实:在「去中心化」的华丽辞藻包裹下,基础的金融透明度已然缺失。当一名外部基金经理能在毫无有效监管的情况下亏损 9300 万美元,并引发高达 2.85 亿美元的跨协议连锁反应;当整个「稳定币」生态系统在一周内损失了 40% 至 50% 的总锁仓价值,尽管表面上仍维持着汇率挂钩,我们必须承认一个关于去中心化金融现状的基本事实:这个行业并未吸取任何教训。

更准确地说,当前的激励结构在奖励那些无视历史教训的人,惩罚那些行事谨慎保守的人,并在不可避免的崩溃发生时,将损失转嫁给整个市场。金融界有句老话在此显得格外贴切且刺耳:如果你不知道收益从何而来,那么你本身就是收益的来源。当某些协议通过不透明的策略承诺 18% 的回报率,而成熟借贷市场的收益率仅为 3% 至 5% 时,其高收益的本质,很可能就是存款人的本金。

Stream Finance 的运行机制与风险传导

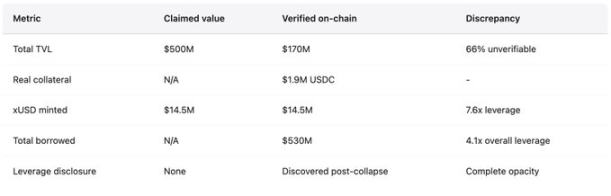

Stream Finance 将自己定位为收益优化协议,通过其生息稳定币 xUSD,向用户的 USDC 存款提供高达 18% 的年化回报。其宣称的策略包括「Delta 中性交易」和「对冲做市」等听起来高深莫测的术语,但实际运作方式却含糊不清。作为对比, Aave 为 USDC 存款提供的年化收益率约为 4.8%,Compound 则略高于 3%。基本的金融常识告诉我们,对于数倍于市场平均水平的回报应保持警惕,然而用户仍向该协议存入了数亿美元资金。崩盘前,1 xUSD 的交易价格曾高达 1.23 USDC,以显示其复利收益。在巅峰时期,xUSD 宣称其管理资产规模达 3.82 亿美元,但 DeFiLlama 的数据显示其峰值总锁仓价值仅为 2 亿美元,这意味着超过 60% 的所谓资产存在于无法验证的链下头寸中。

崩盘后,Yearn Finance 的开发者 Schlagonia 揭示了其真实机制:这是一场伪装成金融创新的系统性欺诈。Stream 采用了递归借贷模式,通过以下流程创造了没有实际价值支撑的合成资产:

-

用户存入 USDC。

-

Stream 通过 CowSwap 将 USDC 兑换成 USDT。

-

利用这些 USDT 在 Elixir 上铸造 deUSD(选择 Elixir 是因为其提供高额收益激励)。

-

将这些 deUSD 跨链至 Avalanche 等网络,并存入借贷市场以借入更多 USDC,完成一个循环。

至此该策略虽已显得复杂且依赖跨链操作,但尚可视为一种抵押借贷。然而 Stream 并未止步。它没有将借来的 USDC 仅用于扩大抵押循环,而是通过其 StreamVault 合约再次铸造 xUSD,这使得 xUSD 的供应量远远超出了其实际持有的抵押品价值。在仅有 190 万美元可验证的 USDC 作为抵押的情况下,Stream 却铸造了高达 1450 万的 xUSD,合成资产规模相对于底层储备膨胀了 7.6 倍。这无异于没有准备金、没有监管、也没有最后贷款人兜底的部分准备金银行体系。

其与 Elixir 的循环依赖关系更使得整个结构岌岌可危。在膨胀 xUSD 供应量的过程中,Stream 向 Elixir 存入了 1000 万美元的 USDT,从而扩大了 deUSD 的供应。Elixir 又将这部分 USDT 兑换成 USDC 并存入 Morpho 的借贷市场。到 11 月初,Morpho 上 USDC 的供应量超过 7000 万美元,借款量超过 6500 万美元,而 Elixir 和 Stream 是其中的主要参与者。Stream 持有 deUSD 总供应量的约 90%(约 7500 万美元),而 Elixir 的储备资产中,主要部分正是通过私人 Morpho 金库向 Stream 提供的贷款。这两个稳定币实际上是相互抵押,一损俱损。这种「金融循坏」必然导致系统性的脆弱。

行业分析师 CBB 早在 10 月 28 日就公开指出了问题:「xUSD 约有 1.7 亿美元的链上资产作为支撑,但他们却从借贷协议中借入了约 5.3 亿美元。这是 4.1 倍的杠杆,而且建立在许多流动性差的头寸之上。这根本不是收益耕种,这是赌徒式的冒险。」 Schlagonia 也在崩盘前 172 天就警告过 Stream 团队,称只需花五分钟检查其头寸就能看出崩溃不可避免。这些警告公开、具体且准确,但却被追逐高收益的用户、渴望手续费收入的策展方以及支撑该结构的各个协议所忽视。

当 Stream 于 11 月 4 日宣布一名外部基金经理亏损了约 9300 万美元的基金资产时,平台立刻暂停了所有提现。由于缺乏有效的赎回机制,恐慌瞬间蔓延。持有者争相在流动性匮乏的二级市场抛售 xUSD。几小时内,xUSD 价格暴跌 77%,至约 0.23 美元。这个曾承诺稳定和高回报的稳定币,在单个交易日内便蒸发了四分之三的价值。

风险传导的具体数据

根据 DeFi 研究机构 Yields and More (YAM) 的报告,与 Stream 相关的直接债务敞口在整个生态系统中高达 2.85 亿美元。主要涉及方包括:

-

TelosC:因接受 Stream 资产作为抵押品,面临 1.2364 亿美元贷款风险(最大的单一风险敞口)。

-

Elixir Network:通过私人 Morpho 金库借出 6800 万美元(占 deUSD 储备的 65%)。

-

MEV Capital:风险敞口 2542 万美元,其中约 65 万美元成为坏账(因预言机在 xUSD 市场价格跌至 0.23 美元时,仍将其价格冻结在 1.26 美元)。

-

其他:Varlamore(1917 万美元)、Re7 Labs(一个金库 1465 万美元,另一个金库 1275 万美元),以及 Enclabs、Mithras、TiD 和 Invariant Group 等持有较小头寸的机构。

-

Euler:面临约 1.37 亿美元的坏账。

-

总计超过 1.6 亿美元的资金在各种协议中被冻结。

研究人员指出此列表并不完整,并警告说「很可能还有更多稳定币或金库受到影响」,因为在崩盘发生数周后,风险传导的全貌依然不明。

Elixir 的 deUSD 因其储备金的 65% 都集中于通过私人 Morpho 金库贷给 Stream 的贷款,在 48 小时内从 1.00 美元暴跌 98% 至 0.015 美元,成为自 2022 年 Terra UST 崩盘以来速度最快的主要稳定币失败案例。Elixir 为约 80%(不包括 Stream 本身)的 deUSD 持有者办理了赎回,允许他们按 1:1 兑换 USDC,从而保护了大部分社区用户,但这一保护措施的代价是巨大的,损失被转嫁给了 Euler、Morpho 和 Compound 等协议。随后,Elixir 宣布将完全关停所有稳定币产品,承认市场的信任已被无法挽回地摧毁。

更广泛的市场反应显示出系统性的信心丧失。根据 Stablewatch 的数据,在 Stream 崩盘后的一周内,生息稳定币整体流失了 40% 至 50% 的总锁仓价值,尽管其中大多数仍维持着与美元的挂钩。这意味着约有 10 亿美元资金从那些并未失败、也未出现技术问题的协议中流出。用户无法区分优质项目和欺诈项目,于是选择逃离所有类似产品。DeFi 的总锁仓价值在 11 月初下降了约 200 亿美元。市场正在为普遍的连锁反应风险定价,而非仅仅针对特定协议的失败。

2025 年 10 月:6000 万美元引发的连锁清算

在 Stream Finance 崩盘前不到一个月,加密货币市场经历了另外一场灾难性暴跌。链上取证分析表明,这并非一次普通的市场暴跌,而是一场利用已知漏洞、在机构规模上发起的精准攻击。2025 年 10 月 10 日至 11 日,一次精心策划的、价值 6000 万美元的市场抛售,引发了预言机故障,进而导致整个 DeFi 生态系统发生连锁性大规模清算。这并非因为头寸本身资不抵债导致的过度杠杆清算,而是预言机系统设计缺陷在机构级别上的重演,重复了自 2020 年 2 月以来已被多次记录和披露的攻击模式。

攻击于 UTC 时间 10 月 10 日 5:43 开始,价值 6000 万美元的 USDe 被集中抛售到单一交易所的现货市场。在一个设计良好的预言机系统中,这种局部抛压的影响会被多个独立、具有时间加权平均价格机制的价格源所吸收,从而最小化操纵风险。然而实际的预言机系统却依据被操纵交易场所的现货价格,实时调低了相关抵押品(wBETH、BNSOL 和 USDe)的价值。大规模清算随即触发。系统基础设施不堪重负,数百万同时发出的清算请求耗尽了系统处理能力。做市商因 API 数据流中断和提款请求积压而无法快速提交买单。市场流动性瞬间枯竭。连锁反应形成了恶性循环。

攻击手法与历史先例

预言机忠实地报告了单一交易场所出现的被操纵价格,而此时其他所有市场的价格均保持稳定。主要交易所数据显示 USDe 跌至 0.6567 美元,wBETH 跌至 430 美元。而其他交易场所的价格与正常水平偏离不到 0.3%。链上去中心化交易所的资金池受影响极小。正如 Ethena 创始人 Guy Young 所指出的,在整个事件过程中,「有超过 90 亿美元的稳定币抵押品可随时用于赎回」,这证明底层资产本身并未受损。然而预言机报告了被操纵的价格,清算系统依据这些价格执行,最终导致大量头寸基于市场上根本不存在的估值被摧毁。

这正是 2020 年 11 月导致 Compound 遭受重创的模式:当时 DAI 在 Coinbase Pro 上有一小时时间交易价格飙升至 1.30 美元,而其他市场仍为 1.00 美元,造成了 8900 万美元的清算。交易场所变了,但漏洞依旧存在。这种攻击手法与 2020 年 2 月摧毁 bZx 的手法如出一辙(通过操纵 Uniswap 预言机窃取 98 万美元),与 2020 年 10 月重创 Harvest Finance 的手法相同(通过操纵 Curve 价格窃取 2400 万美元,并引发 5.7 亿美元的资金挤兑),也与 2022 年 10 月导致 Mango Markets 损失 1.17 亿美元的多交易场所操纵攻击一致。

据统计,2020 年至 2022 年间,共发生 41 起预言机操纵攻击,损失高达 4.032 亿美元。业界的应对缓慢且零散,多数平台仍继续使用严重依赖现货价格、缺乏足够冗余的预言机方案。攻击的放大效应说明了,随着市场规模扩大,吸取这些教训的重要性。2022 年 Mango Markets 事件中,500 万美元的操纵导致了 1.17 亿美元的损失,放大 23 倍。2025 年 10 月的事件中,6000 万美元的操纵引发了具有巨大放大效应的连锁反应。攻击手法并未变得更高明,而是底层系统在保有相同根本性漏洞的情况下,规模变得更大。

历史模式:2020-2025 年的失败案例

Stream Finance 的崩盘既非首创,也非孤例。DeFi 生态已经历了多次稳定币失败,每一次都暴露出相似的结构性漏洞。然而这个行业仍在不断重复相同的错误,且规模一次比一次巨大。过去五年有记录的失败案例呈现出高度一致的模式:

-

不可持续的高收益:算法或部分抵押稳定币提供远高于市场水平的收益率以吸引存款。

-

收益来源可疑:高收益通常由代币增发或新流入存款补贴,而非真实的业务收入。

-

过度杠杆与不透明:协议运作隐含高杠杆,真实抵押率模糊不清。

-

循环依赖:协议 A 的资产支撑协议 B,协议 B 的资产又反过来支撑协议 A,形成脆弱闭环。

-

崩溃触发:一旦出现任何冲击,暴露其资不抵债的本质,或当补贴难以为继时,挤兑便会发生。

-

死亡螺旋:用户恐慌性退出,抵押品价值暴跌,连锁清算发生,整个结构在几天甚至几小时内轰然倒塌。

-

风险传导:崩溃蔓延至那些接受该稳定币作为抵押品或与其生态有关联的其他协议。

典型案例回顾:

2022 年 5 月:Terra (UST/LUNA)

-

损失:约 450 亿美元市值在三天内蒸发。

-

机制:UST 是算法稳定币,通过 LUNA 的铸造 - 销毁机制维持挂钩。Anchor Protocol 为 UST 存款提供不可持续的 19.5% 收益。

-

触发:大规模 UST 赎回和抛售导致脱钩,引发 LUNA 超发和死亡螺旋。

-

影响:导致 Celsius、Three Arrows Capital、Voyager Digital 等多家大型加密借贷平台破产。创始人 Do Kwon 被捕并面临欺诈指控。

2021 年 6 月:Iron Finance (IRON/TITAN)

-

损失:约 20 亿美元总锁仓价值在 24 小时内归零。

-

机制:IRON 由 75% USDC 和 25% 其原生代币 TITAN 部分抵押。提供高达 1700% 年化的收益激励。

-

触发:大额赎回导致 TITAN 被抛售,价格崩溃,进而摧毁 IRON 的抵押基础。

-

教训:压力下,部分抵押和依赖自身波动性代币作为部分抵押品是极度危险的。

2023 年 3 月:USDC

-

脱钩:因 33 亿美元储备金被困于倒闭的硅谷银行,USDC 一度跌至 0.87 美元。

-

影响:动摇了市场对「完全储备」法币稳定币的绝对信任。引发 DAI(其抵押品超 50% 为 USDC)脱钩,导致 Aave 上超过 3400 笔、总值 2400 万美元的清算。

-

教训:即使是最受信任的稳定币,也面临传统金融系统的集中风险和依赖。

2025 年 11 月:Stream Finance (xUSD)

-

损失:直接损失 9300 万美元,生态系统总风险敞口 2.85 亿美元。

-

机制:递归借贷创造无实际支撑的合成资产(杠杆达 7.6 倍)。70% 资金由匿名外部经理通过不透明链下策略管理。

-

现状:xUSD 交易价格在 0.07-0.14 美元间,流动性枯竭,提款冻结,面临多起诉讼。Elixir 已关停。

共同失败模式总结:

-

不可持续的收益:Terra (19.5%)、Iron (1700% APR)、Stream (18%)。

-

循环依赖:UST-LUNA、IRON-TITAN、xUSD-deUSD。

-

信息不透明:隐瞒补贴成本、隐藏链下操作、储备资产成疑。

-

脆弱抵押结构:部分抵押或依赖自身波动性代币,压力下易形成死亡螺旋。

-

预言机操纵:失真的价格输入导致错误清算,积累坏账。

结论很明确:稳定币并不稳定,它们只是在崩盘前显得稳定,而崩盘可能仅在数小时内发生。

预言机故障与基础设施崩溃

Stream 崩盘伊始,预言机的问题便暴露无遗。当 xUSD 市场价格已跌至 0.23 美元时,许多借贷协议却将其预言机价格硬编码在 1.00 美元或更高,旨在防止连锁清算。这一出于好意的决策,却导致了协议行为与市场现实的严重脱节。这种硬编码是主动的政策选择,而非技术故障。许多协议采用手动更新预言机价格的方式,以避免在暂时性市场波动中触发清算。然而当价格下跌反映的是项目实质性的资不抵债时,这种方法就会带来灾难性后果。

协议方面临着一个艰难的选择:

-

采用实时价格:可能面临市场操纵和在波动期间引发连锁清算的风险(2025 年 10 月事件已证明其代价高昂)。

-

采用延迟价格或时间加权平均价格:无法及时反映真实的资不抵债情况,导致坏账积累(如 Stream 事件中,预言机显示 1.26 美元而实际价格为 0.23 美元,仅 MEV Capital 就产生 65 万美元坏账)。

-

采用手动更新:引入了中心化决策和人为干预风险,甚至可能通过冻结价格来掩盖资不抵债的真相。

这三种方法都曾导致过数亿乃至数十亿美元的损失。

压力下的基础设施承载能力

早在 2020 年 10 月 Harvest Finance 因遭遇 2400 万美元攻击引发挤兑,总锁仓价值从 10 亿美元骤降至 5.99 亿美元,其基础设施崩溃的教训就已非常明确:预言机系统必须考虑极端压力事件下的基础设施承载能力;清算机制必须设有速率限制和熔断机制;交易所必须为十倍于正常情况的流量预留冗余容量。然而 2025 年 10 月的事件证明,在机构级别上,这一教训仍未得到重视。当成千上万的账户同时面临清算,当数十亿美元的头寸在一小时内被平仓,当订单簿因所有买单被耗尽且系统过载无法接受新单而变得空白时,基础设施的失败与预言机的失败同样彻底。解决这些问题的技术方案是存在的,但往往因为会降低平常运行时的效率、增加成本(影响利润)而未能实施。

核心警示

如果你无法辨识收益的来源,那么你并非收益的获得者,你本身就是他人收益的成本。这个道理并不复杂,然而,数十亿美元的资金依然源源不断地流入「黑箱」策略,因为人们总是倾向于相信令人舒适的谎言,而非直面令人不安的真相。下一个 Stream Finance,或许此刻正在运营之中。

稳定币并不稳定。

去中心化金融,往往既非完全去中心化,也谈不上安全。

来源不明的收益,不是利润,而是带着倒计时的资产转移。

这些并非个人观点,而是以巨额代价反复验证过的、有据可查的经验事实。唯一的问题是:我们最终会依据这些已知的教训采取行动,还是宁愿再付出 200 亿美元的学费,去重新学习一遍?历史似乎倾向于后者。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。