U.S. stocks have fallen below key support levels, cryptocurrencies are in a bloodbath, and the safe-haven allure of gold has diminished; a comprehensive financial turmoil is unfolding. On November 18, a severe sell-off swept through the U.S. financial markets, affecting nearly all asset classes from soaring tech stocks to cryptocurrencies and even gold.

Amid growing concerns about the sustainability of the AI boom and the economic outlook, investors are dumping risk assets, causing major stock indices to breach critical technical support levels, and market risk aversion is sharply rising.

Behind this turmoil is the collective anxiety of investors ahead of Nvidia's earnings report and key employment data, as well as increasing vigilance regarding the tech giants' reliance on massive debt issuance to support their capital expenditure models.

1. U.S. Stocks Break Down

Technical Signals Deteriorate, Market Breadth Worrisome

● Monday's decline is a significant technical signal for U.S. stocks. The S&P 500 and Nasdaq Composite both closed below their 50-day moving averages for the first time in 138 trading days, breaking the longest consecutive rising streak since May of this year.

● Almost all major indices have breached key technical support levels: The S&P 500, Dow Jones, and Nasdaq have all fallen below their 50-day moving averages. Technical analysts typically view such breaches of key moving averages as signals that the market's short-term trend may reverse.

● The Dow Jones Industrial Average experienced its worst three-day performance since April, closing down 1.2% or 557 points on Monday. The Nasdaq fell 0.8%, and the S&P 500 dropped 0.9%.

● The deterioration in market breadth has heightened analysts' concerns. Dan Wantrobski, a technical strategist at Janney Montgomery Scott, stated, “Market breadth is very poor, and the stock market is in a fragile position.” He predicts that by the end of December, the S&P 500 could see a pullback of 5% to 10%.

2. AI Faith Under Test

Nvidia's Earnings Report Becomes Market Focus

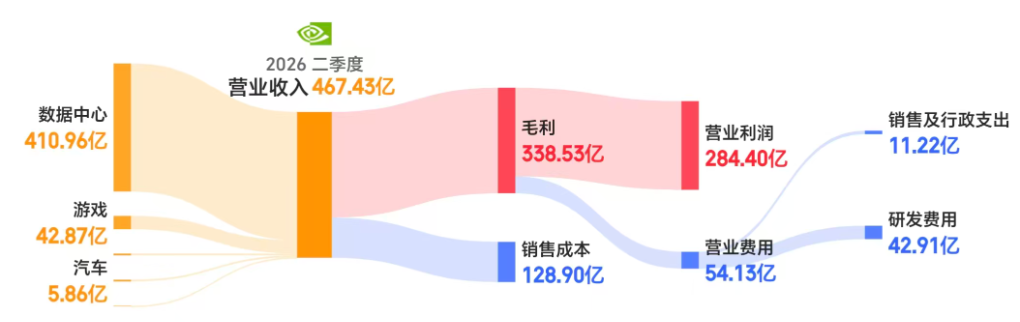

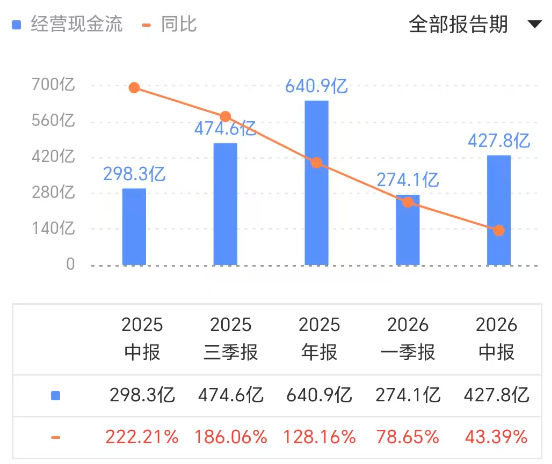

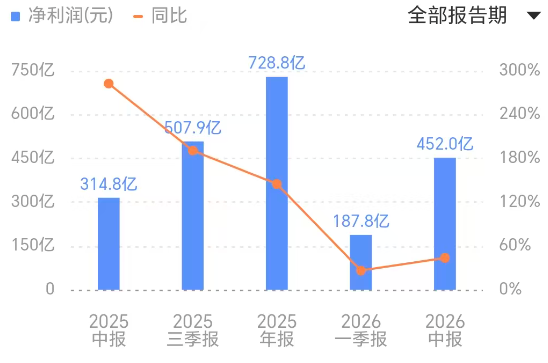

All eyes are on Nvidia's earnings report set to be released this Wednesday, which is seen as the most anticipated earnings event of the quarter and a key barometer for the AI sector.

● Analysts have extremely aggressive expectations: Wall Street anticipates a 55% year-over-year increase in data center revenue, with gross margins nearing 73%, thanks to rising product prices and a large backlog of orders. Some companies estimate that these orders could exceed $500 billion before 2026.

● Market research indicates that for Nvidia to achieve a positive stock price reaction, revenue must reach at least $55 billion, with $56 billion being more indicative of sustained growth momentum. If it fails to exceed consensus expectations, even meeting the company's own guidance could be interpreted as a slowdown in growth and may trigger a sell-off.

● Nvidia's growth is almost entirely dependent on its data center division and the timely launch of its new Blackwell chips. Investors must see the company flawlessly execute this production plan and achieve the expected $8 billion growth in data center revenue while maintaining a high profit margin close to 74%.

Production Execution of Blackwell Chips and Margin Maintenance

● The smooth mass production of the Blackwell architecture B200 chip is central to the current cycle. Investors will closely scrutinize any comments regarding production yield, supply chain stability, and delivery timelines.

● Maintaining approximately 74% non-GAAP gross margin is crucial for supporting its valuation. Any signs of rising input costs or competitive pressure that lead to gross margin guidance falling below 73.5% could trigger a strong negative reaction from the market.

Fourth Quarter Guidance and Demand Visibility

● For Wall Street, the fourth quarter revenue guidance is more important than the actual data from the third quarter. The market currently expects guidance in the range of $61.29 billion to $61.57 billion.

● Any guidance below $60 billion will be seen as a significant disappointment. Management needs to clearly articulate its confidence in demand visibility for 2026 during the conference call, especially regarding orders from cloud service providers and sovereign AI projects.

Geopolitical and Competitive Landscape

● Nvidia faces permanent structural market constraints. The third-quarter guidance has explicitly excluded shipments of H20 chips to China. Additionally, new regulations from the Chinese government in November 2025 require that state-funded data center projects must use domestically produced AI chips, exacerbating the situation.

● The competitive landscape is also changing. While AMD's Instinct series poses a direct challenge, the long-term threat from self-developed chips (ASICs) by hyperscale cloud vendors is more lethal, potentially undermining Nvidia's pricing power fundamentally.

3. Cryptocurrency Winter

Deleveraging and Structural Adjustment

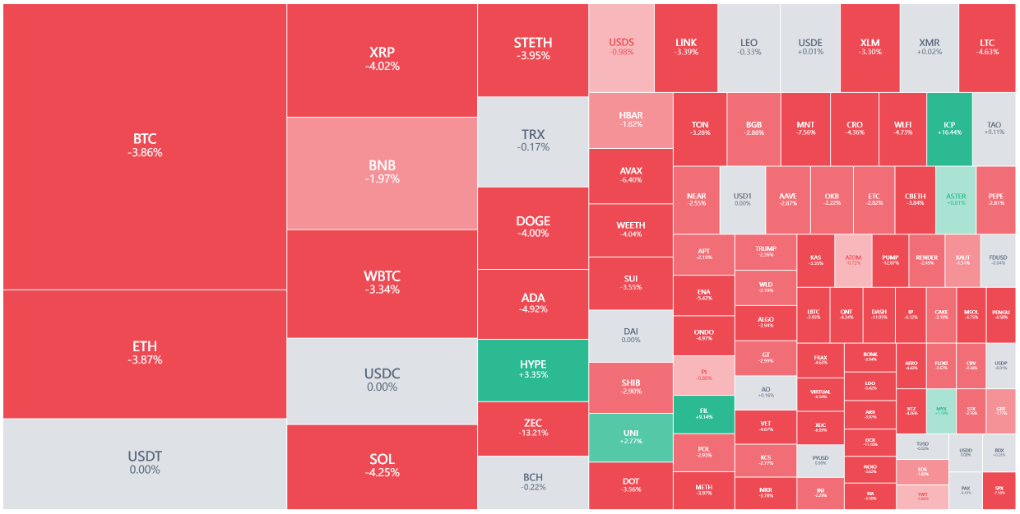

● The cryptocurrency market is in a severe winter. Bitcoin has now fallen below $92,000, down 25.5% from its historical high of $126,200, clearly entering a short-term bear market. Ethereum has fared even worse, trading below $3,000, down 37.4% from its peak of $4,955. Over the past 41 days, the total market capitalization of cryptocurrencies has evaporated by as much as $1.1 trillion, equivalent to an average daily loss of $27 billion. This sell-off has caused the total market capitalization of cryptocurrencies to drop by about 10% from earlier levels.

● This decline is quite unusual, as there have not been many substantial bearish factors from the fundamentals of the crypto market. Some analysts believe this is a structural market adjustment, primarily due to excessively high leverage.

● With 100x leverage, a mere 2% price fluctuation can lead to liquidation. When millions of traders use leverage simultaneously, it can trigger a domino effect. As seen on October 11, a $19.2 billion liquidation frenzy caused Bitcoin to experience its first-ever daily drop of $20,000.

● Excessively high leverage levels have made the market extraordinarily sensitive. In just the past 16 days, there have been three days where the single-day liquidation amount exceeded $1 billion. Daily liquidations exceeding $500 million have become the norm.

4. Gold and Bitcoin

Historic Performance Reversal

● Gold has become the most dazzling core asset of 2025, with an annual increase of 55.2%, the highest return among all tracked major asset classes. This extraordinary performance marks a rare significant rise for a defensive, non-yielding safe-haven asset, outperforming all major stock indices, bond sectors, and alternative assets.

● Meanwhile, Bitcoin has experienced a historic decline, with its yield turning negative at approximately -1.2%, earning the title of the worst performance since this dataset began in 2011.

● This is the first time Bitcoin has ranked at the bottom among asset classes, which is rare given its high volatility and frequent boom/bust cycles since 2011.

This dramatic reversal marks a powerful narrative shift in the financial markets of 2025—traditionally uncorrelated assets converging in surprising ways, rewriting the usual risk-return script.

5. Institutional Deleveraging

The True Driver of the Sell-off

● J.P. Morgan's latest research report indicates that the primary driver of the recent U.S. stock decline is not foreign capital withdrawal or retail investor sell-offs, but rather large-scale deleveraging by equity-focused hedge funds. The report reveals that since mid-February 2025, hedge funds with equity-centric strategies have cumulatively reduced their holdings in U.S. stocks by approximately $750 billion.

● Another significant force behind the sell-off comes from hedge funds relying on momentum strategies, such as commodity trading advisor funds (CTAs).

● S&P Global Market Intelligence data also confirms the large-scale withdrawal by institutions. Institutional investors net sold $42.93 billion in U.S. stocks in October, which, while lower than the $46.51 billion sold in September, is higher than the average monthly sell-off of $34.65 billion over the past 12 months. From the end of 2024 to the end of October 2025, institutions have cumulatively sold $332.17 billion in stocks, while the S&P 500 index rose by 16.3% during the same period.

● Meanwhile, both institutional and retail investors are shifting funds towards passive investment vehicles. In October, net purchases of indices and ETFs amounted to $21.76 billion, up from $12.25 billion in September.

6. Wall Street Interpretation

Technical Adjustment or Bubble Burst?

In the face of market turmoil, Wall Street strategists have shown relative calm. Most experts believe this is more of a volatility triggered by profit-taking rather than a true collapse of AI or corporate earnings fundamentals.

● Jeff Krumpelman, Chief Investment Strategist and Head of Equities at Mariner Wealth Advisors, pointed out that long-term AI investors should not panic. “We basically belong to the 'hold the line' camp,” he explained.

● Krumpelman emphasized that the early applications of AI remain a strong multi-year theme, and the current volatility should not be compared to the boom and bust of the dot-com bubble. “We are in the early stages of AI, and it is real. This is not 2000.”

● Alex Morris, CEO and Chief Investment Officer of F/m Investments, believes that while AI remains the strongest long-term driver in the market, the short-term dynamics behind last week's sell-off are more technical than fundamental.

“I think this is a simple mathematical equation,” he told market media, “the positions in AI concept stocks are highly concentrated. So once they start to wobble, given the (index's) high weight, the index's decline will naturally exceed your expectations.”

The market stands at a crossroads. Nvidia's earnings report could become the last lifeline determining the market's direction or the final straw that breaks risk appetite. With the Federal Reserve's policy path unclear and growing doubts about the sustainability of AI capital expenditures, investors are reassessing the risks and returns of every asset class.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。