本期看点

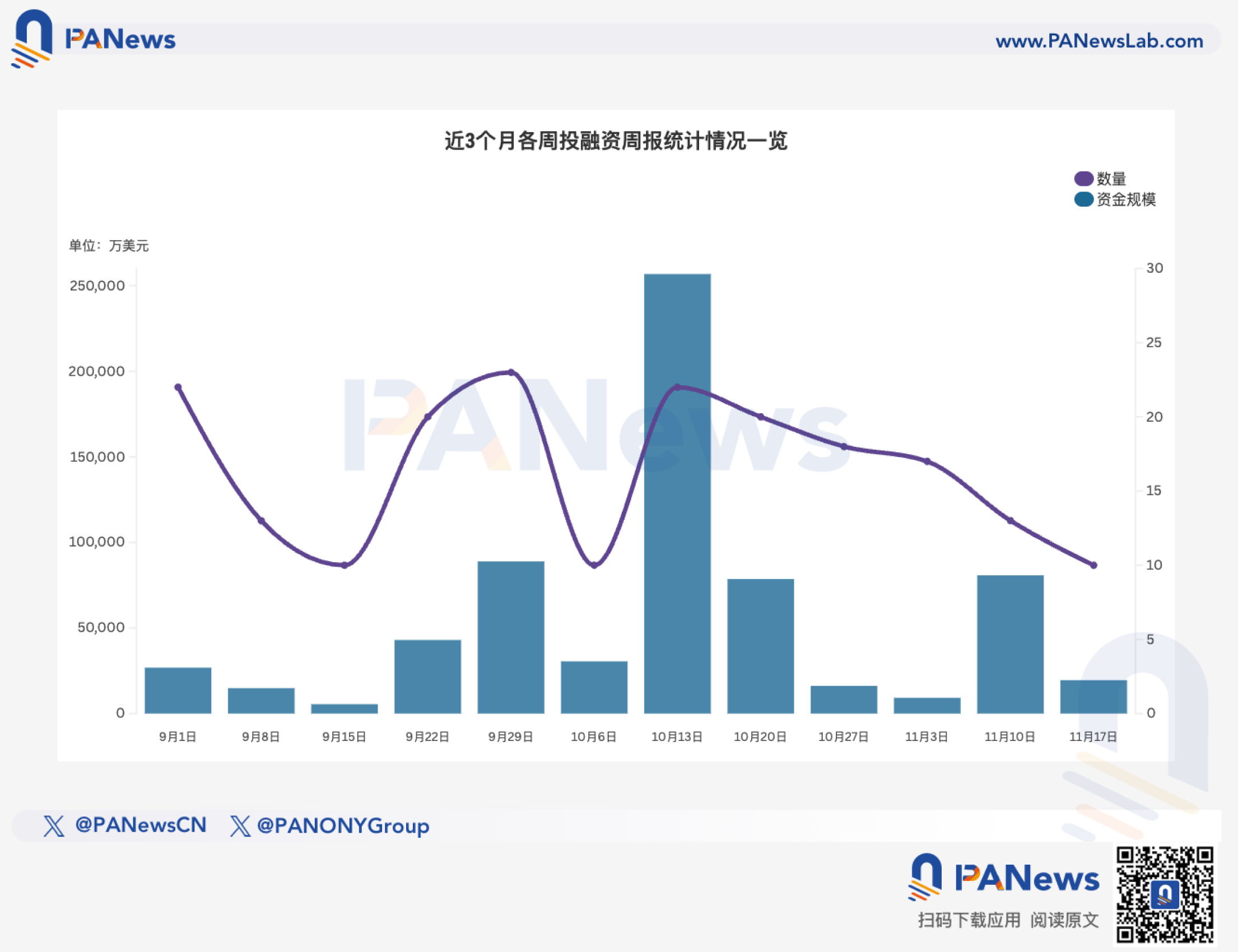

据 PANews 不完全统计,上周(11.10-11.16)全球区块链有10起投融资事件,资金总规模超1.95亿美元;此外,上市公司加密资产储备融资总额超2.1亿美元,概览如下概览如下:

- DeFi方面公布了3起投融资事件,其中Lighter完成6800万美元融资,由Founders Fund与Ribbit Capital领投;

- Web3+AI赛道公布了1起投融资事件,Web3 AI安全代理项目LISA完成1200万美元融资,Redpoint等参投;

- 基础设施&工具领域公布了3起投融资事件,其中加密初创公司Seismic完成1000万美元融资,a16z crypto领投;

- 中心化金融领域公布了1起投融资事件,Public以现金与股票合计6500万美元收购Alto的加密业务;

- 其它Web3应用方面公布了2起投融资事件,其中Kyuzo's Friends宣布完成1100万美元融资,投资方包括DeAgentAI等;

- 此外,有3家上市公司完成融资用于加密财库战略,其中Republic获1亿美元零息融资以购入ETH并扩展质押业务;

DeFi

加密交易协议Lighter完成6800万美元融资,Founders Fund与Ribbit Capital领投

去中心化交易协议Lighter完成6800万美元融资,由彼得·蒂尔(Peter Thiel)的Founders Fund与Ribbit Capital领投,Haun Ventures与Robinhood参投,本轮融资后公司估值约15亿美元。

Lighter由Vladimir Novakovski于2022年创立,主打去中心化永续合约与即将上线的现货交易功能,构建在以太坊Layer2上,旨在打造“公平、透明的金融基础设施层”。Novakovski曾16岁入读哈佛、18岁毕业后被Citadel创始人Ken Griffin亲自招入,后从AI社交平台Lunchclub转型进入加密领域。

去中心化借贷平台Curvance宣布完成400万美元战略轮融资。领投方为 F Prime Capital 与 0xPrimal,参投包括 Auros、GSR、Flowdesk、Q42、v3v ventures 等。项目定位为去中心化借贷与抵押平台,支持 LST、LRT、稳定币、Pendle PT 及 LP 等收益资产抵押。团队称架构自研,引入 双预言机定价、熔断机制、MEV 捕获清算拍卖 等安全设计;本轮资金将用于上线、审计、扩充团队及扩展集成资产。

Sui 生态 DEX Bluefin 完成 200 万瑞士法郎融资,SUI Group 参投

纳斯达克上市公司 SUI Group 宣布对 Sui 生态去中心化交易所 Bluefin 投资 200 万瑞士法郎(约合 250 万美元),双方将合作将对冲基金、资产管理公司和做市商引入链上市场。

AI

Web3 AI安全代理项目LISA宣布完成1200万美元融资,旨在打造AI与区块链结合的Agentic Security OS。此轮融资由Redpoint、UOB Venture Management、Signum Capital、NGC Ventures、Hash Global等机构参与。LISA致力于利用AI检测传统审计工具难以发现的多步复杂逻辑漏洞,提升智能合约与去中心化应用的安全性。

基础设施&工具

Acurast宣布融资1100万美元,计划于11月17日上线主网并同步发行代币ACU。项目称在消费级智能手机上实现可验证、保密且防篡改计算,并通过硬件密钥证明仅允许制造商认证设备接入。其网络数据显示,已有近15万部手机加入、处理约4.94亿笔交易、部署约9.42万项服务。投资方包括以太坊联合创始人兼Polkadot创始人Gavin Wood等。

加密初创公司Seismic完成1000万美元融资,a16z crypto领投

加密隐私基础设施初创公司 Seismic 宣布完成由 a16z crypto 领投的1000万美元融资,参投方包括 Polychain、Amber Group、TrueBridge、dao5 和 LayerZero。公司累计融资额已达1700万美元。Seismic由创始人兼CEO Lyron Co Ting Keh 创立,旨在帮助金融科技企业在使用加密技术时保护用户敏感信息,如工资、房租等不被公开区块链泄露。Seismic目前已与稳定币账户平台 Brookwell 和私募信贷服务商 Cred 合作,为其提供私有链支付轨道,避免交易数据在公开链上暴露。公司计划利用新资金扩展服务范围,包括法币出入金通道和加密卡项目,并预计将在2026年第一季度实现营收,收费模式为每笔交易1美分。竞品为Tempo(估值50亿美元)。

零知识身份与“proof‑of‑humanity”协议Self宣布完成900万美元种子轮融资,投资方包括Greenfield Capital、SoftBank旗下Startup Capital Ventures x SBI Fund、Spearhead VC、Verda Ventures、Fireweed Ventures及多位天使。Self提供零知识证明与可验证凭证的隐私身份核验,已集成Google、Aave、Velodrome,支持生物护照、国家ID及印度Aadhaar等验证,并用于抗女巫空投与符合OFAC的代币分发。公司同步上线积分计划,奖励完成身份验证与在合作平台互动的用户。

DAT

(此类交易不计入本期融资周报统计)

生物科技公司Propanc筹集1亿美元资金,用于加密货币储备和癌症疗法研发

数字资产财务公司Propanc Biopharma(纳斯达克股票代码:PPCB)周一表示,已从活跃于比特币、以太坊、Solana、狗狗币及其他数字资产领域的家族办公室Hexstone Capital获得高达1亿美元融资。此次私募交易通过可转换优先股结构进行,Propanc将获得100万美元初始投资,并在未来一年内获得高达9900万美元的后续资金。所得款项将用于构建Propanc的数字资产投资组合,并加速其主打肿瘤疗法PRP的研发进程,该疗法目前计划于2026年开展首次人体试验。首席执行官James Nathanielsz称此举为“转型阶段”,旨在强化公司资产负债表并为其基于前酶的研究项目提供资金支持。公司未具体说明计划收购哪些数字资产。融资消息并未止住Propanc股价的跌势。周一,PPCB股价下跌4%,跌破1美元,过去一个月累计跌幅已达43%。

Republic获1亿美元零息融资以购入ETH并扩展质押业务

加拿大上市公司Republic Technologies(CSE:DOCT)宣布获得来自一家机构投资者的1亿美元零息可转债融资,用于扩大其以太坊质押与储备业务。公司表示,其中逾90%的资金将用于购入ETH,首批投入规模为1000万美元。

该融资无利息、无追加保证金要求,被视为加密行业中罕见的“现金流中性”结构,配有50%市价行权认股权证。Republic运营ETH验证节点,以持币赚取质押与验证收益,并与QCP Capital合作开发ETH结构化收益策略,周化收益约1.75%。

Matador完成首笔1050万美元可转债融资,专用于增持比特币

Matador Technologies Inc.宣布已与ATW Partners完成首批规模为1050万美元的可转债融资,用于增持比特币。该公司计划通过此设施在2026年前购入最多1000枚BTC,并在2027年前累计至6000枚,目标跻身全球企业比特币持仓前20名。此次可转债年利率为8%,若公司成功从TSX Venture转板至纳斯达克或纽交所,利率将降至5%。

中心化金融

Public以6500万美元收购Alto的加密退休账户业务,AUM约6亿美元

Public宣布以现金与股票合计6500万美元收购Alto的加密业务,该部分AUM约6亿美元。AltoCrypto支持多种加密资产;相比之下,Fidelity的加密退休账户仅支持比特币。Public联合创始人Leif Abraham称IRA可在无即时税负下调整仓位。交易将于2026年完成整合,Alto保留其他业务并继续作为服务商。Public定位“upmarket”投资者,客户中位年龄约38岁。

其它

Web3游戏:

Kyuzo's Friends团队完成1100万美元融资,Key Origin平台首个正版IP授权游戏全面加速

AI驱动社交游戏项目Kyuzo's Friends宣布团队完成1100万美元融资,投资方包括DeAgentAI、Stratified Capital、Chain Capital、KnightFury、X Wave及LBank Labs。本轮融资将用于全球市场拓展、AI创作系统升级及链上基础设施强化。

Kyuzo's Friends由Key Origin平台推出,是其首个正版授权IP项目,基于知名IP“DNAxCAT(九藏喵窝)”开发,并已登陆Sui与LINE平台。项目结合AI创作与Web3游戏机制,旨在推动传统IP向去中心化时代转型。Key Origin正构建全球Web3正版IP生态,涵盖IP授权、AI共创与数字资产交易,Kyuzo's Friends的成功预计将吸引更多知名品牌与创作者加入。

众筹平台:

加密融资平台Shodai Network完成250万美元种子轮融资,Consensys等参投

加密融资平台Shodai Network宣布完成250万美元种子轮融资,投资方包括Consensys、Consensys Mesh和以太坊联合创始人Joseph Lubin。这笔投资将助力Shodai Network拓展其创始人网络,进一步开发融资支持平台。

Shodai Network汇聚了一群创业者、开发者以及加密行业资深人士,将通过其创始人网络助力早期开发者获取资源、与其他创业者建立联系,并有计划地实现项目规模化发展。通过其产品部门,Shodai专注于新型融资技术的研发以及开源资本筹集工具的开发,旨在协议构建初期便实现协议开发者与投资者之间利益激励的一致化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。