Author | Jian Wu Talks Blockchain

The JPEX incident is referred to as the largest cryptocurrency scandal in Hong Kong's history. Since the Securities and Futures Commission (SFC) issued a warning in September 2023 about unlicensed operations and the platform freezing withdrawals, it triggered a wave of investor reports and police arrests within just a few days. Two years later, in November 2025, the police officially prosecuted 16 individuals and issued arrest warrants for 3 masterminds, with a total of 80 arrests made and over HKD 1.6 billion involved. The case revealed the systemic risks of unlicensed platforms and false advertising, and it pushed Hong Kong's virtual asset regulation into a new phase.

This article reviews the entire incident, outlining the background, process, and impact, aiming to provide warnings for investors.

On September 17, 2023, the JPEX platform suddenly froze withdrawals, and the Hong Kong Securities and Futures Commission (SFC) issued a warning about its unlicensed operations, causing panic among investors. Just two days later, the police arrested 8 individuals in the first batch, including KOL Joseph Lam (林作), who has over 150,000 Instagram followers. Lam is suspected of luring people to invest in JPEX with false statements between July and September 2023, including claims that the platform had obtained licenses from multiple jurisdictions and that he possessed exclusive information about the platform, enticing investors to deposit funds.

On September 22, 2023, Joseph Lam held a press conference regarding the alleged JPEX cryptocurrency fraud case. Photo source: HKFP.

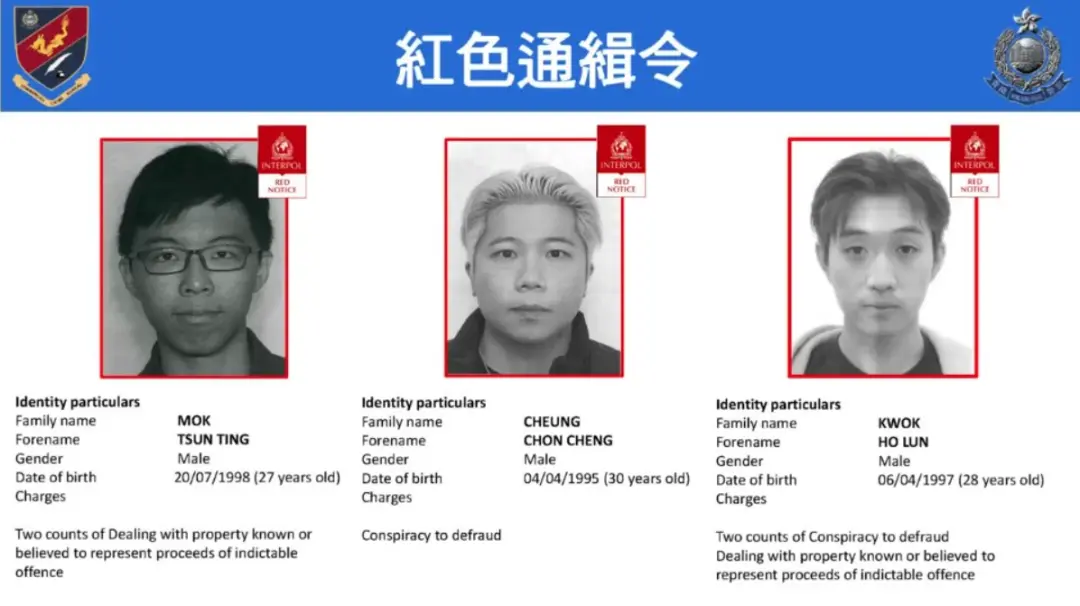

Two years later, on November 5, 2025, the police officially prosecuted 16 individuals, including Lam and YouTuber Chan Wing-yee (陈怡), who has over 100,000 followers, on charges of conspiracy to commit fraud, money laundering, and obstructing justice. Among them, 6 were core members of JPEX, 7 were OTC leaders and KOLs, and 3 were nominal account holders. Interpol issued a red notice for 3 fugitives (27-year-old Mo Jun-ting, 30-year-old Zhang Jun-cheng, and 28-year-old Guo Hao-lun), who are identified as masterminds and have fled overseas. As of now, a total of 80 people have been arrested in this case, with over 2,700 victims and losses exceeding HKD 1.6 billion (approximately USD 206 million). The police have frozen assets worth HKD 228 million, including cash, gold bars, luxury cars, and virtual assets. The incident exposed the chaos of unlicensed platform promotions and prompted regulatory authorities to strengthen virtual asset controls.

The Rise and Illusion of JPEX: High Returns, Fake Licenses, and Overwhelming Promotion

JPEX was established in 2020 and is headquartered in Dubai, claiming to be "a global digital asset cryptocurrency trading platform." It promoted itself in Hong Kong through extensive advertising (such as subway stations, bus bodies, and shopping mall exteriors), with some ads labeling it as a "Japanese cryptocurrency exchange." The platform claimed to hold financial licenses from the USA, Canada, Australia, and Dubai VARA, but SFC investigations revealed that these "licenses" were limited to foreign exchange services and could not support virtual asset trading. The Japanese Financial Services Agency and VARA also clarified that JPEX was not authorized to operate.

The core attraction of JPEX was its "Earn" product, promising high returns of 20% annualized for BTC, 21% for ETH, and 19% for USDT, which attracted a large number of investors. The platform promoted itself through over-the-counter (OTC) trading shops and social media KOLs, building an image of "low risk and high return." Early warnings from the SFC indicated that JPEX had been suspected of false statements since July 2023, but promotional activities continued until just before the collapse.

Regulation and Crisis: The Unlicensed Chaos Under Hong Kong's New System

In June 2023, the Hong Kong government launched a licensing system for virtual asset trading platforms (VATP), requiring all platforms to obtain approval from the SFC before providing services to retail investors. This system aimed to balance innovation and risk control, but JPEX did not apply for a license and continued to operate unlicensed.

In July 2023, mainland users began reporting difficulties in withdrawing funds, and complaints from mainland users about "failed withdrawals" started circulating on the well-known social platform LIHKG, claiming that the platform lured victims to Hong Kong to "handle funds," only to ambush them. The police reported that a man with a Chinese ID, surnamed Yu, attempted to withdraw funds unsuccessfully and was invited to an OTC shop in Hong Kong to "resolve the issue in person." After entering, he was ambushed and beaten near Cambridge Square on July 18. The police subsequently sought four individuals, including a Chinese national who was the head of an investment company, and three other Chinese men aged around 30 to 40, approximately 1.7 meters tall, wearing black tops and black pants, with further details unknown. Such incidents quickly spread, triggering rumors of a collapse, and the promises of high returns and liquidity crises began to surface. An internal investigation by the SFC indicated that JPEX was suspected of false statements, but promotional activities continued.

JPEX user Mr. Yu was beaten by multiple individuals (provided by the interviewee). Photo source: hk01.com

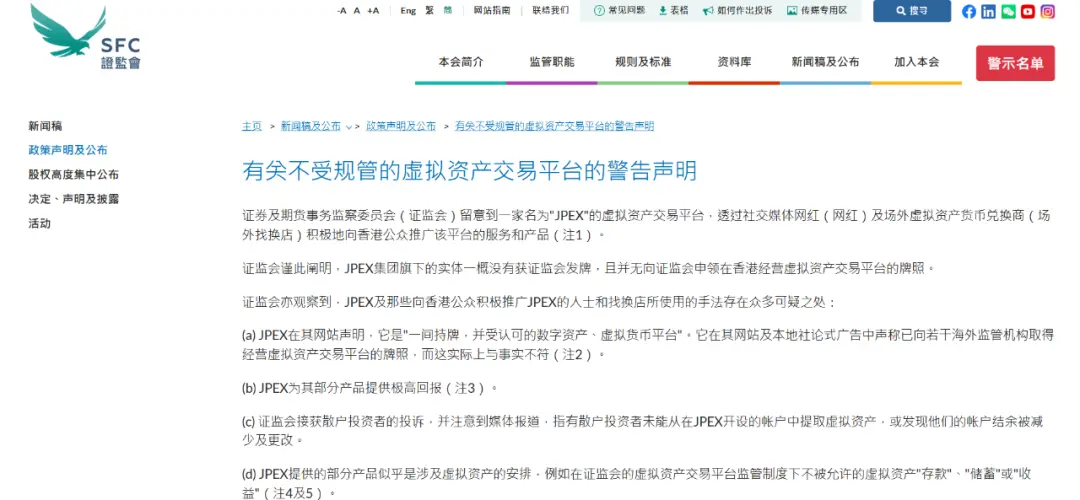

On September 13, 2023, the Hong Kong Securities and Futures Commission (SFC) issued a public warning statement against JPEX titled "Warning Statement on Unregulated Virtual Asset Trading Platform." This statement directly pointed out that JPEX was operating without a license, violating the VATP licensing system that took effect on June 1, and specifically named its false advertising through social media influencers and KOLs (such as promotional posts on Instagram) and OTC shops claiming to hold financial licenses from the USA, Canada, Australia, and Dubai VARA. SFC investigations revealed that these "licenses" were actually limited to foreign exchange services and could not support virtual asset trading. The statement emphasized that JPEX had been on the SFC's warning list since July 8, 2022, and that its products, such as the Earn service promising high returns of 21% for ETH, 20% for BTC, and 19% for USDT, were suspected of being "deposit/return" arrangements, indicating illegal fundraising, with numerous retail investors complaining about their inability to withdraw funds or suffering losses. The SFC demanded that all KOLs and OTC shops immediately cease promoting JPEX and its related services and products.

Image source: Hong Kong Securities and Futures Commission (SFC)

Hours after the statement was released, JPEX quickly responded on its official website and blog, claiming that the SFC's actions "unfairly suppressed" them, prompting them to consider withdrawing their license application in Hong Kong and adjusting their future policy development accordingly. JPEX also stated in a blog post that it had publicly announced its intention to seek a cryptocurrency trading license in Hong Kong as early as February 2023, viewing Hong Kong as a key market, but due to the SFC's statement "conflicting with Web3 policies," they were considering withdrawing their Hong Kong license application and adjusting regional policies. This response further exacerbated investor panic, with complaints skyrocketing from hundreds before the statement to over 1,600, and many users flocked to OTC shops for help, leading to a public liquidity crisis for the platform, marking the transition of the incident from regulatory warning to the brink of collapse.

On September 17, 2023, JPEX announced on its official blog that its third-party market maker had "maliciously frozen" the platform's funds, exacerbating the liquidity crisis. The announcement blamed the "unfair treatment" by Hong Kong regulators and negative news for prompting market makers to demand more information, restrict liquidity, and significantly increase operational costs, leading to operational difficulties. JPEX emphasized that this was not an issue with the platform itself but rather due to external factors, and promised to restore liquidity and gradually adjust fees. The announcement also confirmed that the Earn service (a product where users deposit assets to earn high returns, such as 20% annualized for BTC) would be fully suspended on September 18, and users would not be able to place new orders. This move marked the transition of the incident from the SFC's regulatory warning to a public collapse, escalating user panic.

Notably, JPEX raised the USDT withdrawal fee from the original 10 USDT to 999 USDT (with a maximum withdrawal limit of 1,000 USDT), meaning users could effectively only withdraw 1 USDT. This move was seen as a "de facto freezing" of assets, sparking strong dissatisfaction among users and heated discussions on social media, with many calling it a "disguised exit." JPEX explained this adjustment as a response to "business changes," but did not provide a timeline for restoration.

Screenshot from a JPEX user showing the USDT withdrawal fee skyrocketing to 999 USDT (maximum withdrawal limit 1,000 USDT)

Complete Collapse and Police Action: KOL Arrested, Funds Frozen

On September 18, 2023, just five days after the SFC warning was issued, the Hong Kong Police Commercial Crime Bureau (CCB) launched a raid code-named "Iron Gate Operation," arresting the first batch of 8 individuals, including KOL Joseph Lam (林作), who has 150,000 Instagram followers (an Oxford graduate lawyer turned insurance agent), as well as investment YouTuber Chan Wing-yee (陈怡), who has over 100,000 followers (a former TVB artist turned investment blogger), and OTC shop heads like Felix Chiu (owner of Coingaroo). The police raided 20 locations, seizing cash, computers, and documents. By that day, 1,641 victims had reported losses of approximately HKD 1.2 billion. The police revealed that JPEX built a "safe and easy to use" image through KOLs and OTC shops, with funds often transferred through multiple wallets for laundering. The police indicated that Lam was suspected of falsely claiming on Instagram posts, lectures, and live broadcasts between July and September that JPEX was "safe and licensed" (including endorsements from multiple regulators) and had "exclusive information," enticing investors to deposit assets, leading to losses. The arrests that day marked the escalation of the incident into a criminal investigation, with the SFC praising the police action and reiterating that KOLs must conduct due diligence on platform qualifications.

In October 2023, the number of arrests in the JPEX case investigation by the Hong Kong police increased to 28, including 28-year-old KOL Henry Choi Hiu-tung (founder of Hong Coin). Choi is accused of conspiracy to commit fraud, promoting JPEX's high-return Earn products through his social media pages "Hong Coin" and "TungClub," and collaborating with OTC shops to channel funds. As of October, over 2,530 victims had reported losses, and the SFC emphasized the loopholes in KOL promotions, pointing out that many KOLs, like Choi, failed to conduct due diligence on the platform's qualifications while repeatedly claiming that JPEX was "safe and licensed," violating the SFC's disclosure requirements. The case has also affected Taiwan, sparking cross-border discussions, with Taiwanese police having interviewed several KOLs and cooperating with the Hong Kong SFC to trace the flow of funds.

Latest Developments: First Round of Formal Prosecutions and Red Notices in the JPEX Case

On November 5, 2025, the Hong Kong Police Commercial Crime Bureau (CCB) formally prosecuted 16 individuals, marking the first formal prosecution in the JPEX case in two years and signaling the start of criminal proceedings. The group of defendants includes 6 core members of JPEX, 7 OTC leaders, and KOLs such as Joseph Lam and Chan Wing-yee. Chief Superintendent Ernest Wong stated at a press conference that this was the first round of prosecutions in the JPEX case, with charges primarily involving conspiracy to commit fraud, money laundering, obstructing justice, and inducing others to invest in virtual assets through fraudulent means or without regard for the consequences. The focus of the prosecution is on how the defendants used false advertising and OTC networks to entice over 2,700 investors to deposit funds, as well as the platform's unlicensed operations and involvement in money laundering.

On the same day, Interpol issued red notices for 3 fugitives, identified as masterminds and core members who have fled overseas: 27-year-old Mok Tsun-ting, 30-year-old Cheung Chon-cheong, and 28-year-old Kwok Ho-lun. The police stated that the three led the transfer and laundering of funds, and their related assets have been frozen. The red notices request assistance from global member countries for their arrest. Currently, a total of 80 individuals have been arrested in the JPEX case, with over 2,700 victims and losses amounting to HKD 1.6 billion.

On November 6, 2025, the 16 defendants (including Joseph Lam and Chan Wing-yee) appeared in the Eastern Magistrates' Court, where 14 of them were granted bail (bail amounts ranged from HKD 20,000 to HKD 100,000, with Lam and Chan each set at HKD 300,000). They are required to surrender their travel documents and report regularly. This case is the largest fraud case in Hong Kong in recent years in terms of the number of victims and the scale of losses, with assets worth HKD 228 million frozen, including cash, gold bars, luxury cars, and virtual assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。