原文标题:《USDe 发行规模暴降 65 亿美元,但 Ethena 还面临更大的问题》

原文作者:Azuma,Odaily 星球日报

Ethena 正在经历自诞生以来最大规模的一轮资金外流。

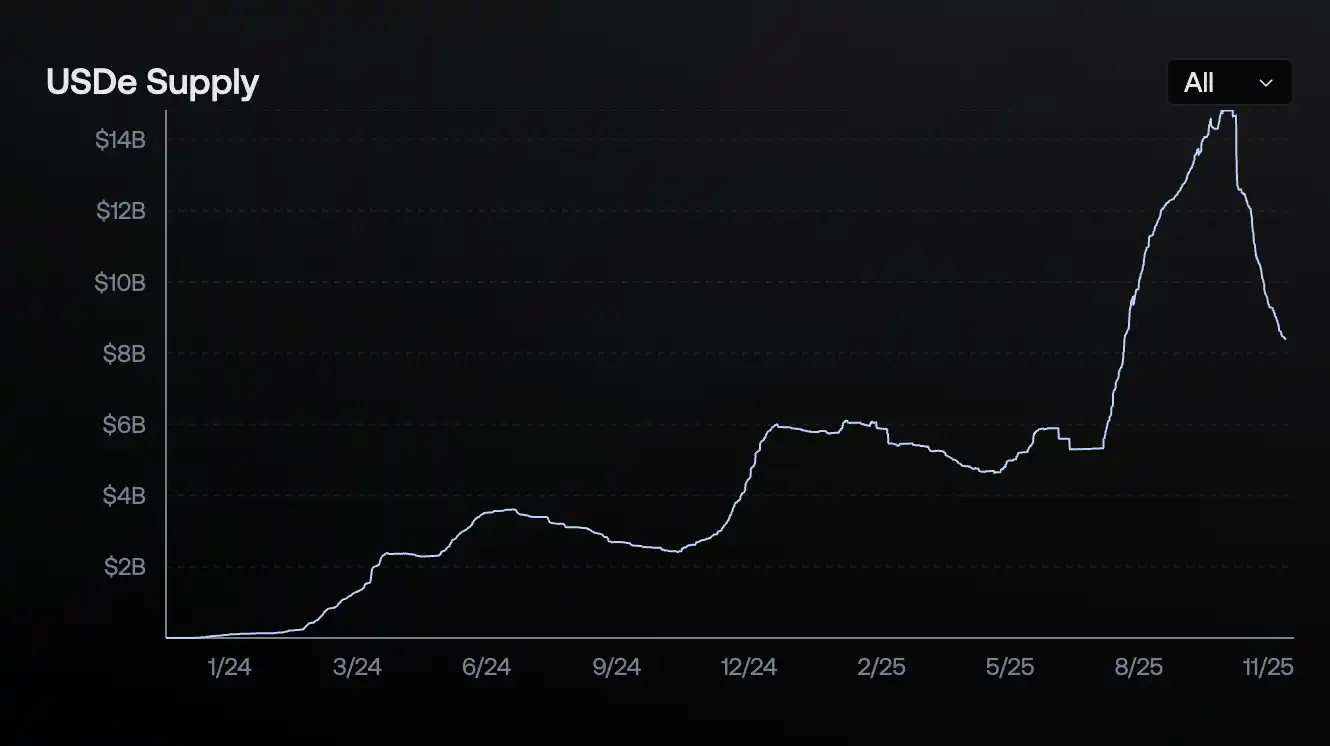

链上数据显示,Ethena 旗下最主要的稳定币产品 USDe 的流通供应量已回落至 83.95 亿枚,较 10 月初近 148 亿枚的峰值数据已缩水约 65 亿枚,虽然还不至于说是「腰斩」,但回落幅度已足够惊人。

恰逢近期 DeFi 安全事件频发,尤其是号称与 Ethena 采用类似 Delta 中性模型的两家生息型稳定币 Stream Finance(xUSD)以及 Stable Labs(USDX)接连暴雷,且有传言称暴雷导火索或为其中性平衡因 10 月 11 日的血洗行情被 CEX 的 ADL 强行被打破,再加之 USDe 当时曾在 Binance 短暂脱离锚定价格的深刻记忆,当下围绕着 Ethena 出现了大规模的 FUD 声音。

USDe 还安全吗?

考虑到 Ethena 当下的市场规模,如果真的出现什么意外,很有可能酝酿出堪比当年 Terra 的黑天鹅事件……那么 Ethena 究竟有没有出问题呢?资金的外流到底是不是避险情绪使然?继续将资金部署至 USDe 及其衍生策略还能不能放心?

先抛结论,我个人倾向于认为:Ethena 当前的策略仍保持着正常运行;围绕着 DeFi 的避险情绪虽然在一定程度上加剧了 Ethena 的资金流出,但并非主因;USDe 当下安全状况依旧相对稳固,但建议尽量避免循环贷。

之所以认可 Ethena 当下的运营状况,原因主要有二点。

其一在于,区别于多数在仓位结构、杠杆倍数、对冲交易所乃至清算风险参数上都未做清晰披露的生息稳定币,Ethena 在透明度上可以说是业界标杆。你可以很清晰地在 Ethena 官网上直接看到储备信息及证明、仓位分布及占比、实施收益状况等要素。

第二点则是前文提到的 ADL 致使中性策略失衡的问题。传闻 Ethena 与部分交易所签有 ADL 豁免协议,但此事始终未能证实,所以暂且不提。可即便没有豁免条款,Ethena 实质上也较难受到 ADL 影响。因为从其公开策略中能看出 Ethena 基本只选择了 BTC、ETH、SOL 作为对冲资产(BNB、HYPE、XRP 占比极小),这三大资产在 10 月 11 日大暴跌中的波动本就较小,对手方的承载能力也更大,而 ADL 实际上更容易出现在波动更大、对手方承载能力较小的山寨币市场,因此当下暴雷的往往是那些不够透明的协议(可能策略相较规划过于激进,甚至完全不中性)。

至于 Ethena 资金外流的主因,同样也可归为两点。一是随着市场情绪的转冷(尤其是在 10 月 11 日后),期现市场之间的基础套利空间缩小,致使协议收益率以及 sUSDe 年化收益率(截至发文已降至 4.64%)同步降低,较之 Aave、Spark 等主流借贷市场的基础利率已不具备明显优势,部分资金因此选向其他生息路径;二是 10 月 11 日 USDe 在 Binance 的价格波动提高了市场对于循环贷的风险意识,再加之链下(CEX 下调补贴力度)及链上两端的收益率下降,使得大量资金解除了循环贷并撤出了资金。

基于上述逻辑,我们认为 Ethena 以及 USDe 当前依旧保持着相对稳定的运行状态,本轮资金流出虽然在一定程度上因极端行情及市场安全事件的影响而超出了预期,但主因仍可归结为冷淡市场情绪下套利空间缩小而造成的吸引力下降,而这正是 Ethena 的设计逻辑所决定的——受市场环境波动影响,协议收益率以及资金吸引力也会同步波动。

更严峻的考验:可扩展性

相较于阶段性的资金流出,摆在 Ethena 面前的更严峻问题是,其赖以生存的这套背靠永续合约市场的 Delta 中性模型,似乎在可扩展性层面上已看到了瓶颈。

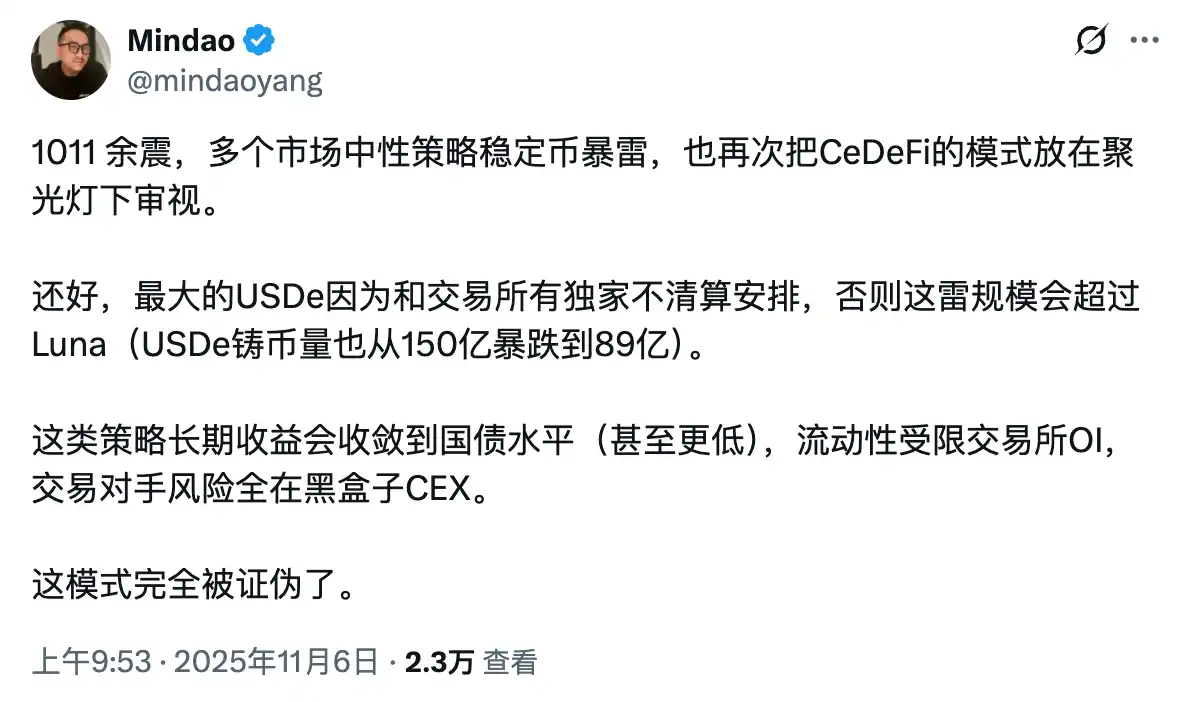

11 月 6 日,DeFi 大佬 Mindao 在点评近期关于中性策略稳定币的暴雷事件时表示:「这类策略长期收益会收敛到国债水平(甚至更低),流动性受限交易所 OI,交易对手风险全在黑盒子 CEX。这模式完全被证伪了……它们无法规模化,最终只是小众理财产品,更无法和法币稳定币竞争。」

这就好比《楚门的世界》,Ethena 也曾在一个规模有限的小世界中如鱼得水,但这个小世界却被永续合约市场的头寸规模以及交易平台的流动性、基础设施状况等要素圈定了范围,而 Ethena 渴望挑战的对象 USDT、USDT 却处于外部那个不受限的大世界中,这种先天的生长环境差别或许才是 Ethena 面前最大的挑战。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。