Author: Gu Yu, ChainCatcher

In the crypto world of 2025, an unprecedented wave of mergers and acquisitions is unfolding.

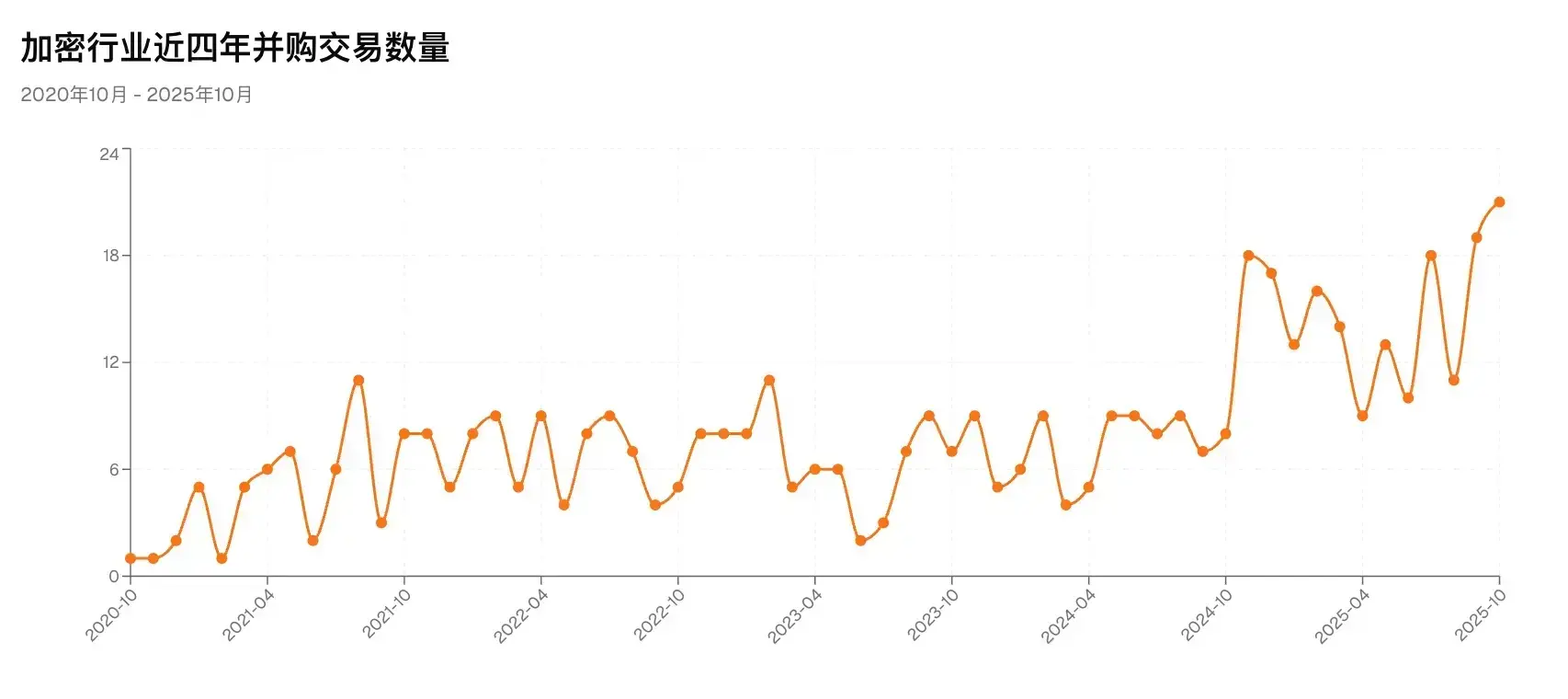

From DeFi protocols to asset management companies, from payment companies to infrastructure service providers, new M&A events are happening almost every day. Kraken has acquired the futures trading platform NinjaTrader for $1.5 billion, while Coinbase has recently made consecutive moves to acquire the derivatives exchange Deribit and the on-chain fundraising platform Echo. According to RootData, the number of crypto mergers and acquisitions has reached 143 so far in 2025, setting a new historical record and increasing by 93% compared to the same period last year.

Why are the giants so keen on mergers and acquisitions in the current sluggish market? What impact will the accumulation of M&A have on the market?

1. Giants Exchange Capital for Time

Mergers and acquisitions are the most direct means for giants to expand their battlefield and enhance competitiveness.

In recent years, giants represented by centralized exchanges have mostly relied on trading fees to thrive. However, with the secondary market turning bearish and regulations tightening, simple trading income is no longer sufficient to support growth, and external Web2 giants are eyeing the space. As a result, they have begun to expand their battlefield through acquisitions—either to fill ecological gaps or to acquire compliance resources.

Through M&A, giants can bypass the long periods of independent research and development and market cultivation, quickly bringing rivals or complementary teams under their wing, thereby expanding their product matrix in a short time, such as extending from spot trading to derivatives, and from trading to payment and custody, enhancing the service capabilities of their full-stack products.

More importantly, by purchasing entities that have already obtained regulatory approval or have a well-established compliance framework, platforms can more quickly gain the "identification" needed to enter certain markets (such as licenses, compliance processes, or clearing channels in specific jurisdictions), saving time compared to building compliance teams from scratch. This is especially crucial in the crypto world, where regulations are tightening and regional differences are significant.

Take Coinbase as an example. Since 2025, its M&A strategy has been almost "full-chain": from derivatives exchanges to on-chain financing platforms, and then to compliant custody companies, covering multiple aspects such as trading, issuance, payment, and asset management. An industry insider close to Coinbase revealed, "What they want to create is a 'Goldman Sachs map' in the crypto field—not relying on coin prices, but on a service system."

Kraken's actions follow a similar logic. NinjaTrader is a veteran player in traditional finance, and by acquiring it, Kraken essentially bought a compliance channel recognized by U.S. regulators, allowing it to bring traditional futures clients and tools into its ecosystem. In the future, Kraken will no longer need to take detours to provide more comprehensive derivatives and futures trading services.

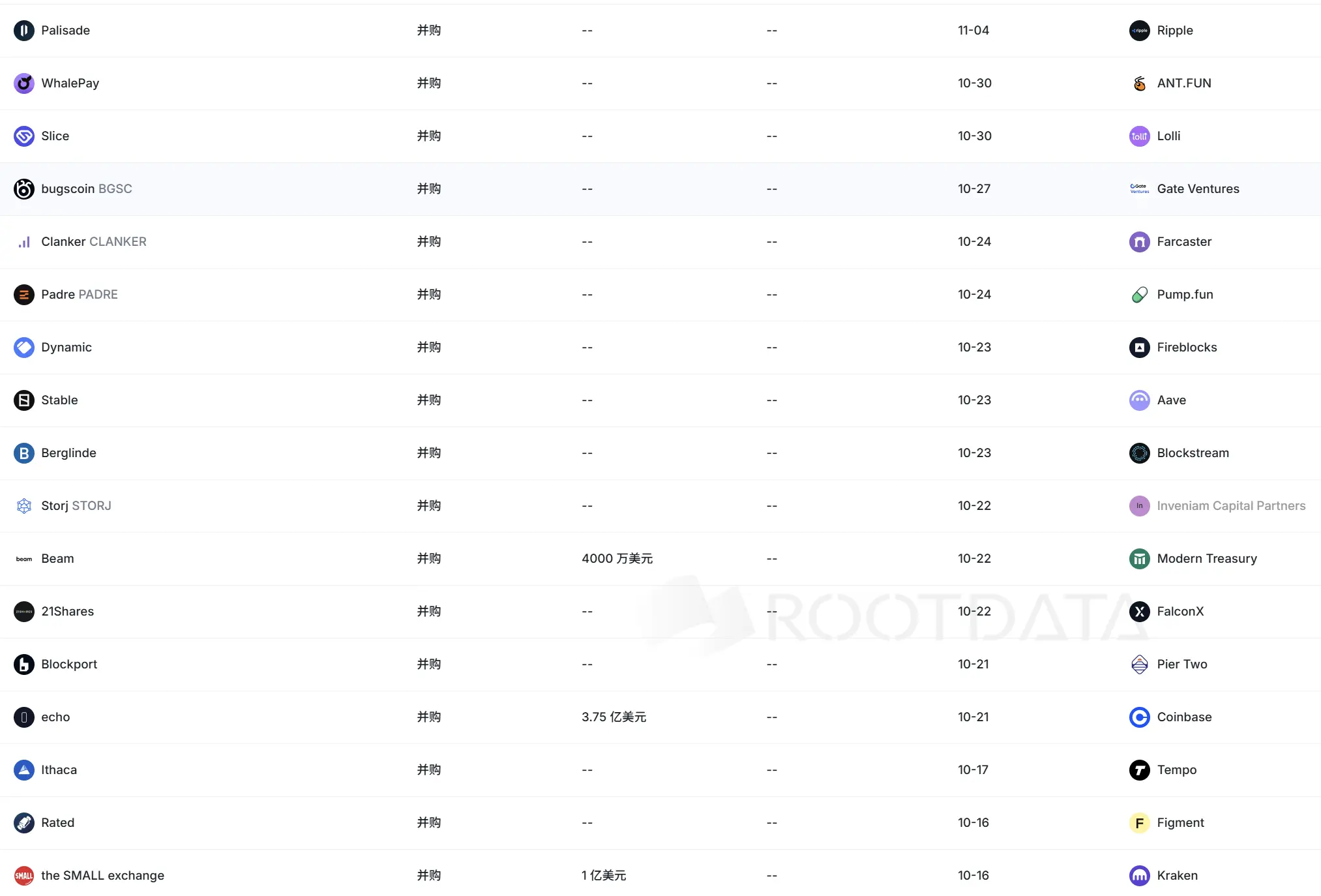

Recent M&A events Source: RootData

In other words, while small projects are still struggling with the next round of financing and token issuance, the giants are already using cash to buy time and acquisitions to secure the future.

This trend is not limited to giants like Coinbase; Web2 giants such as Robinhood, Mastercard, Stripe, and SoftBank are also participating, indicating that Web3 is no longer just a game for entrepreneurs and retail investors. It is attracting traditional capital, financial institutions, and even publicly listed companies to participate deeply. M&A has become a bridge for them to enter Web3.

Moreover, the current market conditions provide a significant opportunity for them to increase M&A investments. The crypto primary market continues to be sluggish, and the vast majority of crypto projects face challenges in financing and exiting, putting them at a disadvantage in the capital market. Therefore, giants with ample cash or capital market channels can leverage their capital advantage to dominate M&A pricing and structural design. For sellers, accepting equity swaps, partial cash + stock, or strategic cooperation transaction structures is often more prudent than taking a gamble on issuing tokens in the public market. Thus, capital-rich players hold a natural advantage in M&A negotiations, allowing them to acquire key technologies, users, and licenses at a more favorable cost.

2: Is the Golden Era for Web3 Builders Coming?

In the past, the main exit path for many Web3 projects was "issue tokens—price increase—buyback/cash out," a path highly dependent on secondary market sentiment and easily hijacked by price fluctuations. M&A provides project parties with a more stable path: integration by strategic buyers within or outside the ecosystem, obtaining cash/equity, or being incorporated into a larger platform's product line for continued development, allowing teams and technologies to have a smoother path to capitalization without having to pin all their hopes on the "bloodsucking" process of issuing tokens and going public.

The M&A activities of Coinbase, Kraken, and others have, to some extent, broadened the ways Web3 projects and teams can realize their value. In the current capital winter, this has also injected a dose of confidence into more funds directed towards the equity sector of the crypto primary market, bringing more confidence to crypto entrepreneurs.

The rise of M&A in the crypto industry is not coincidental; it is the result of market maturation, capital structure reconstruction, and the combined push of regulatory and user demands. M&A allows for faster reconfiguration of technology, users, and compliance capabilities within the crypto market, enabling leading companies to consolidate and expand their moats through acquisitions, while providing a more robust exit and development path for small and medium-sized projects.

In the long run, this wave of M&A is expected to motivate many crypto projects to evolve from technology communities or marketing companies into truly commercialized companies with clear user scenarios and solid technology, refocusing attention on product experience, compliance, and commercial implementation. Undoubtedly, this is beneficial for the long-term healthy development of the industry and accelerates the mainstreaming process of the sector.

Of course, M&A is not a panacea. Giants still face many uncertainties in this process, such as integration—how to incorporate the advantages of the acquired party into the acquirer at the organizational, product, compliance, and customer levels. If integration fails, it often means "buying a shell"; there may also be valuation bubbles that negatively impact the acquirer's cash flow and profitability.

Regardless, this is a significant boon for crypto entrepreneurs and the long-term crypto ecosystem, as the market will provide a more friendly survival space for projects that diligently cultivate technology and scenarios. Questions like "How can we exit if you don't issue tokens?" will gradually fade away from the minds of entrepreneurs and builders; their golden era is about to arrive.

The crypto industry in 2025 is at such a turning point. Rather than being a capital game, it is a necessary path for the crypto industry to mature.

In the coming years, we may see exchanges no longer just as exchanges, but as one-stop financial supermarkets; wallets not just as wallets, but as users' on-chain financial gateways; stablecoins not merely as stablecoins, but as underlying currencies for cross-border instant settlement.

And all of this begins with this wave of "merger and acquisition."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。