一觉醒来,UNI 涨了近 40%,带着整个 DeFi 板块都在普涨。

上涨的原因,是 Uniswap 亮出了最后的底牌。Uniswap 创始人 Hayden 发布了一个新提案,核心内容围绕着那个老生常谈的「费用开关」话题。实际上,这个提案在过去两年里已经被提出过 7 次,对 Uniswap 社区来说早已不是新鲜事。

不过这次有所不同,提案由 Hayden 本人亲自发起,而且除了费用开关之外,还涵盖了代币销毁、Labs 和 Foundation 合并等一系列措施。目前已经有一些大户表态支持,在预测市场上,提案通过的概率高达 79%。

2 年失败 7 次,屡战屡败的「费用开关」

费用开关在 DeFi 赛道中其实是一个相当常见的机制。以 Aave 为例,它在 2025 年成功激活了费用开关,通过「买入+分配」的模式将协议收益用于 AAVE 代币回购,推动币价从 180 美元涨至 231 美元,年化涨幅达到 75%。

除了 Aave 外,Ethena、Raydium、Curve、Usual 等协议的费用开关也取得显著成功,为整个 DeFi 行业提供了可持续代币经济学范例。

既然已有这么多成功先例,但为什么在 Uniswap 这里就是过不了呢?

a16z 松口了,但 Uniswap 的麻烦才刚开始

这里就不得不提到一个关键角色——a16z。

在 Uniswap 历史上法定人数普遍较低的情况下,通常只需要 4000 万 UNI 左右就能达到投票门槛。但这家风投巨头此前控制着约 5500 万 UNI 代币,对投票的结果有着非常直接的影响。

他们一直是相关提案的反对者。

最早在 2022 年 7 月的两次温度检测中,他们选择了弃权,只是在论坛上表达一些担忧。但到了 2022 年 12 月的第三次提案,当 ETH-USDT、DAI-ETH 等池子准备激活 1/10 费率的链上投票时,a16z 投出了明确的反对票,动用了 1500 万 UNI 的票权。这次投票最终以 45% 的支持率告终,虽然支持者占多数,但因法定人数不足而失败。在论坛上,a16z 明确表态:「我们最终无法支持任何未考虑法律和税务因素的提案。」这是他们第一次公开反对。

此后的几次提案中,a16z 始终坚持这一立场。2023 年 5 月和 6 月,GFX Labs 连续推出两个费用相关提案,尽管 6 月那次获得了 54% 的支持率,但在 a16z 投出的 1500 万反对票影响下,最终因法定人数不足再次失败。到了 2024 年 3 月的治理升级提案,同样的剧本再次上演——约 5500 万 UNI 支持,但在 a16z 的反对下功败垂成。最戏剧性的是 2024 年 5 月到 8 月那次,提案方试图通过建立怀俄明州 DUNA 实体来规避法律风险,投票原定于 8 月 18 日举行,却因「来自未命名利益相关者的新问题」被无限期推迟,外界普遍认为这个「未命名利益相关者」就是 a16z。

那么 a16z 到底在担心什么? 核心问题出在法律风险上。

他们认为,一旦激活费用开关,UNI 代币可能会被归类为证券。根据美国著名的 Howey 测试标准,如果投资者对「从他人努力中获得利润」抱有合理预期,那这项资产就可能被认定为证券。而费用开关恰恰创造了这样一种预期——协议产生收入,代币持有者分享收益,这与传统证券的利润分配模式高度相似。a16z 合伙人 Miles Jennings 在论坛评论中直言不讳:「没有法律实体的 DAO 面临个人责任暴露。」

除了证券法风险,税务问题同样棘手。一旦费用流入协议,美国国税局可能会要求 DAO 缴纳企业税,初步估算补缴税款可能高达 1000 万美元。问题是,DAO 本身是一个去中心化组织,没有传统企业那样的法律主体和财务结构,该如何缴税、谁来承担这笔费用,都是悬而未决的难题。在缺乏明确解决方案的情况下,贸然激活费用开关,可能让所有参与治理的代币持有者都暴露在税务风险之中。

截止目前,UNI 仍是 a16z 加密货币投资组合中的最大单一代币持仓,持有约 6400 万 UNI,仍具备单独影响投票结果的能力。

但我们都知道的是,随着特朗普当选总统、SEC 换届,加密行业迎来了稳定性的政治春天后,Uniswap 的法律风险已经减少,也能看出 a16z 态度的逐渐软化。显然这已经不再是问题,而这次的提案被通过的可能性也大大提升了。

但这也并不意味着没有其他矛盾存在,Uniswap 的费用开关机制仍存在一些争议点。

鱼和熊掌不能兼得

要理解这些新的争议点,我们得先简单说说这个费用开关具体是怎么运作的。

从技术实施层面来看,这次提案对费用结构进行了细致的调整。在 V2 协议中,总费用保持 0.3% 不变,但会将其中 0.25% 分配给 LP,0.05% 归协议所有。V3 协议则更加灵活,协议费用设定为 LP 费用的四分之一到六分之一,比如在 0.01% 的流动性池中,协议费用为 0.0025%,相当于 25% 的分成比例;而在 0.3% 的池子里,协议费用为 0.05%,占比约 17%。

根据这个费用结构,Uniswap 保守估计可以带来 1000 万到 4000 万美元的年化收入,而在牛市情景下,基于历史峰值交易量,这个数字可能达到 5000 万到 1.2 亿美元。与此同时,提案还包括立即销毁 1 亿 UNI 代币,相当于流通供应量的 16%,并建立持续销毁机制。

也就是说,通过费用开关,UNI 将从一个「无价值的治理代币」转变为真正的收益资产。

这对 Uni 持有者来说当然是一件大好事,但问题恰恰也就出在这里。因为「费用开关」的本质,是 LP 与协议收益之间的重新分配。

交易者支付的费用总额并不会改变,只是原本全部归 LP 所有的收益,现在要拿出一部分给协议。羊毛出在羊身上,协议收益增加了,LP 的收入必然会因此减少。

鱼和熊掌不能兼得。在「要 LP,还是要协议收入?」的问题上,Uniswap 显然选择了后者。

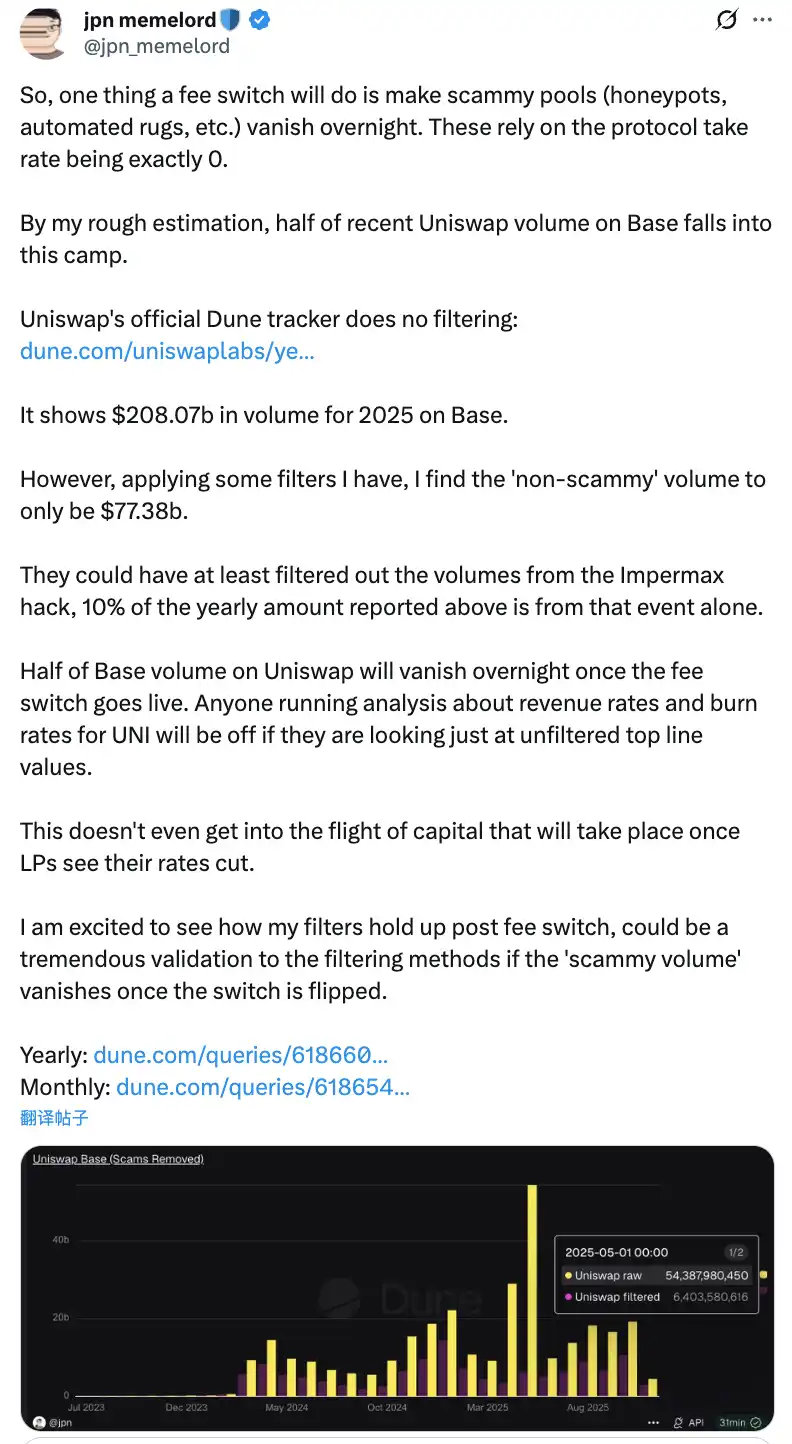

社区讨论一旦「费用开关」生效,将导致 Uniswap 在 Base 链上一半的交易量在一夜之间消失

这种重新分配带来的潜在负面影响不容小觑。短期来看,LP 的收益会削减 10% 到 25%,具体取决于协议费用的分成比例。更严重的是,根据模型预测,可能会有 4% 到 15% 的流动性从 Uniswap 迁移到竞争平台。

为了缓解这些负面影响,提案中也提出了一些创新的补偿措施。比如通过 PFDA 机制进行 MEV 内化,能够为 LP 提供额外收益,每 1 万美元的交易可以带来 0.06 到 0.26 美元的额外回报。V4 版本的 Hooks 功能则支持动态费用调整,聚合器钩子还能开辟新的收益来源。此外,提案采取了分阶段实施的策略,先从核心流动性池开始试点,实时监控影响并根据数据进行调整。

费用开关的两难困局

尽管有这些缓解措施,但能否真正打消 LP 们的顾虑,让这个提案最终落地,恐怕还需要时间来验证。毕竟,即便是 Hayden 亲自出马,也不一定能够拯救 Uniswap 在这个问题上的困局。

因为更直接的威胁来自市场竞争,尤其是在 Base 链上与 Aerodrome 的正面交锋。

Uniswap 的提案后,Aerodrome 开发团队 Dromos Labs 的首席执行官 Alexander 在 X 上讽刺:「我从未想到,在 Dromos Labs 迎来最重要日子的前一天,我们最大的竞争对手会送来的如此重大的失误」

Aerodrome 正在 Base 链上碾压 Uniswap

数据显示,在过去 30 天里,Aerodrome 的交易量约为 204.65 亿美元,占据 Base 链 56% 的市场份额;而 Uniswap 在 Base 上的交易量约为 120-150 亿美元,市场份额仅为 40-44%。Aerodrome 不仅在交易量上领先 35-40%,在 TVL 方面也以 4.73 亿美元压过 Uniswap 的 3-4 亿美元。

差距的根源在于 LP 收益率的巨大差异。以 ETH-USDC 池为例,Uniswap V3 的年化收益率约为 12-15%,仅来自交易费用;而 Aerodrome 通过 AERO 代币激励,能够提供 50-100% 甚至更高的年化收益率,是 Uniswap 的 3-7 倍。在过去 30 天里,Aerodrome 分发了 1235 万美元的 AERO 激励,通过 veAERO 投票机制精准引导流动性。相比之下,Uniswap 主要依靠有机费用,偶尔推出一些针对性激励计划,但规模远不及竞争对手。

正如社区中有人指出的:「Aerodrome 之所以能在 Base 交易量上碾压 Uniswap,是因为流动性提供者只关心每投入一美元流动性的回报。Aerodrome 在这方面胜出。」这个观察一针见血。

对于 LP 来说,他们不会因为 Uniswap 的品牌影响力而留下,他们只看收益率。而在 Base 这样的新兴 L2 上,Aerodrome 作为原生 DEX,凭借专门优化的 ve(3,3) 模式和高额代币激励,建立起了强大的先发优势。

在这种背景下,如果 Uniswap 激活费用开关,进一步削减 LP 收益,可能会加速流动性向 Aerodrome 的迁移。根据模型预测,费用开关可能导致 4-15% 的流动性流失,而在 Base 这样竞争激烈的战场上,这个比例可能更高。一旦流动性下降,交易滑点增加,交易量也会随之下降,形成负向螺旋。

新提案能救 Uniswap 吗?

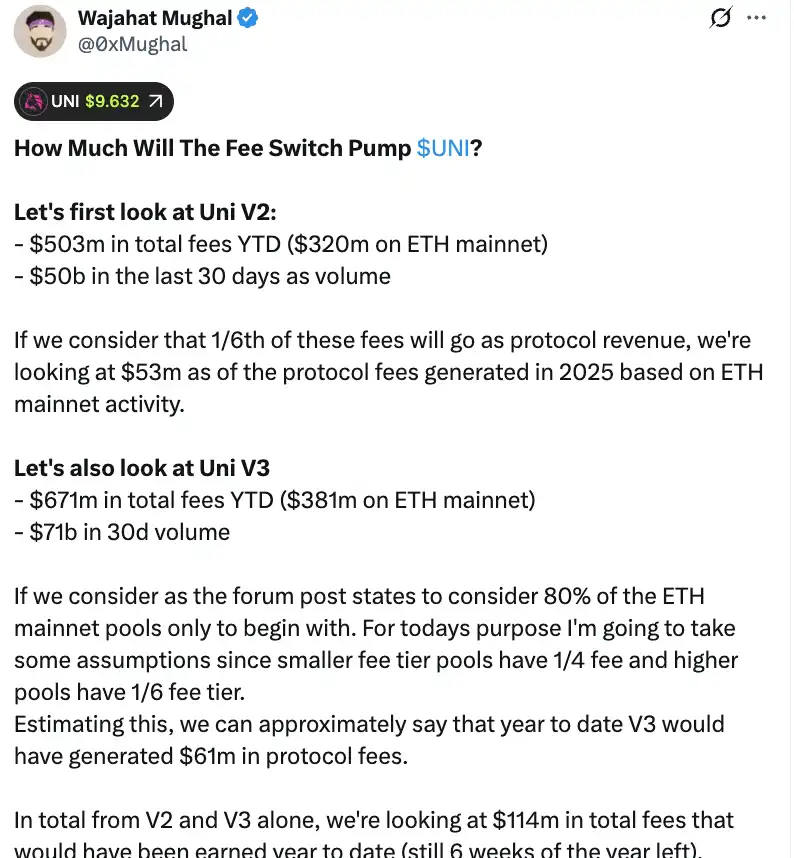

从纯粹的数字角度来看,费用开关确实能为 Uniswap 带来可观的收入。根据社区成员 Wajahat Mughal 的详细测算,仅从 V2 和 V3 两个版本来看,情况已经相当可观。

V2 协议在 2025 年年初至今产生了 5.03 亿美元的总费用,其中以太坊主网贡献了 3.2 亿美元,最近 30 天的交易量达到 500 亿美元。如果按照 1/6 的费用分成计算,基于以太坊主网的活动,2025 年协议费用收入预计能达到 5300 万美元。V3 协议的表现更为强劲,年初至今总费用达到 6.71 亿美元,以太坊主网占 3.81 亿美元,30 天交易量高达 710 亿美元。考虑到不同费率池的分成比例——低费率池收取 1/4 协议费用,高费率池收取 1/6,V3 在年初至今可能已经产生了 6100 万美元的协议费用。

将 V2 和 V3 加总,年初至今的协议费用收入预计已达 1.14 亿美元,而这还是在年底还剩 6 周的情况下。更关键的是,这个数字还远未触及 Uniswap 的全部收入潜力。这笔账并没有计入剩余 20% 的 V3 池、以太坊主网之外所有链的费用(尤其是 Base 链,其产生的费用几乎与以太坊主网相当)、V4 的交易量、协议费用折扣拍卖、UniswapX、聚合钩子,以及 Unichain 的排序器收益。如果将这些全部纳入考量,年化收入可能轻松突破 1.3 亿美元。

结合立即销毁 1 亿 UNI 代币(按当前价格计算价值超过 8 亿美元)的计划,Uniswap 的代币经济学将发生根本性改变。销毁后的完全稀释估值将降至 74 亿美元,市值约 53 亿美元。以 1.3 亿美元的年化收入计算,Uniswap 每年能够回购并销毁约 2.5% 的流通供应量。

这意味着 UNI 的市盈率约为 40 倍,虽然看起来不算便宜,但考虑到还有诸多收入增长机制尚未完全释放,这个数字有很大的下降空间。正如社区中有人感慨的:「这是 UNI 代币第一次真正显得具有持有吸引力。」

然而,这些漂亮的数字背后,同样隐藏着不容忽视的隐忧。首先,2025 年的交易量明显高于过去几年,这很大程度上得益于牛市行情。一旦市场进入熊市周期,交易量大幅下滑,协议费用收入也会随之缩水。将基于牛市数据的收入预测,作为长期估值的依据,显然存在一定的误导性。

其次,回购机制的具体操作方式仍是未知数。是采用类似 Hyperliquid 那样的自动化回购系统,还是通过其他方式执行?回购的频率、价格敏感度、以及对市场的影响,这些细节都将直接影响销毁机制的实际效果。如果执行不当,大规模的市场回购反而可能引发价格波动,让 UNI 持有者陷入「左手倒右手」的尴尬境地。

当 Aerodrome、Curve、Fluid、Hyperliquid 现货等平台都在通过高额激励吸引流动性时,Uniswap 削减 LP 收益的做法,是否会加速资金外流?数据很美好,但如果失去了流动性这个根基,再漂亮的收入预测也只是空中楼阁。

费用开关能为 UNI 带来价值支撑,这一点毋庸置疑。但它能否真正「拯救」Uniswap,让这个曾经的 DeFi 霸主重回巅峰,恐怕还需要时间和市场的双重检验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。