Written by: Cole

In the rapidly changing world of cryptocurrency, Bitcoin and Ethereum are the stars that attract everyone's attention, while stablecoins (such as USDT and USDC) serve as the "blood," "fuel," and "chips" of this vast ecosystem. They connect everything, acting as a safe haven for traders to avoid volatility and as the underlying settlement tools in the DeFi (decentralized finance) world.

You might be using them every day, but have you ever thought about a fundamental question:

You hand over 1 dollar to the issuer (like Circle) in exchange for 1 USDC token. You hold this token, which earns no interest. When you exchange it back for dollars, you only get back 1 dollar.

However, these issuers are making a fortune. Circle's revenue reached 1.7 billion dollars in 2024, while Tether set an astonishing profit record of 13 billion dollars in 2024.

Where does this money come from? Let's take a look at how the stablecoin system operates and who the real winners of this feast are.

01 The Core "Printing Machine"

The business model of stablecoin issuers is simple to the point of being "boring," yet immensely powerful due to its scale. It is essentially an ancient financial model: playing with "float deposits."

It's like a bank accepting demand deposits or a money market fund (MMF), but the key difference is that it does not need to pay a single cent in interest for these "deposits" (the stablecoins you hold).

In the zero-interest era (before 2022), this model barely made any money. But with the Federal Reserve's recent aggressive interest rate hikes, U.S. Treasury yields have soared. Circle and Tether's profits have taken off as well.

It is no exaggeration to say that the multi-billion dollar valuations of these stablecoin giants are essentially a "leveraged bet" on the Federal Reserve's macro policy of "keeping rates higher for a longer time." Every rate hike by the Fed acts like a direct "subsidy" to this industry. If the Fed returns to zero interest rates in the future, the core income of these issuers will evaporate instantly.

Of course, besides interest, issuers have a second source of income: institutional fees;

Circle (USDC): To encourage large clients like Coinbase to use it, Circle's minting (depositing) is free. Only when institutions redeem (withdraw) amounts exceeding 2 million dollars daily will a nominal fee be charged. Circle's strategy is to maximize the scale of reserves (to grow the "float deposits" pool).

Tether (USDT): Tether is more "feathering the nest." For institutional clients, whether minting or redeeming, Tether charges a fee of 0.1% (with a minimum of 100,000 dollars). Tether's strategy is to maximize revenue from every transaction (I want both interest and fees).

02 Strategic Showdown: Circle vs. Tether

Although the foundational business models are the same, Circle and Tether have taken two completely different paths in managing their hundreds of billions in reserves. This has led to stark differences in their risks, transparency, and profitability.

Circle (USDC) Compliance and Transparency

Circle strives to position itself as a trustworthy, regulation-embracing "good student." Its core strategy is not "trust me," but rather "trust BlackRock."

Circle's reserve structure is extremely conservative and transparent. It does not manage the tens of billions itself but chooses to "outsource" this trust to the world's largest asset management company—BlackRock.

Most of Circle's reserves are held in a tool called the "Circle Reserve Fund" (code USDXX). This is a government money market fund registered with the U.S. SEC, managed entirely by BlackRock. As of November 2025, the fund's portfolio is incredibly boring: 55.8% U.S. Treasury repurchase agreements and 44.2% U.S. Treasury bonds.

- Circle's subtext is: "To all institutions and regulators, I have solved your concerns about reserve safety. My money is not sitting in some mysterious bank account; it is managed by BlackRock in an SEC-regulated fund, buying only the safest U.S. Treasuries."

This is a clever strategic defense. Circle sacrifices some potential returns (it has to pay management fees to BlackRock) in exchange for long-term trust from institutions and regulators.

Tether (USDT) Aggressiveness and High Profits

If Circle is a meticulous accountant, then Tether is an aggressive hedge fund manager.

Tether has long been criticized for its lack of transparency (it relies on BDO's "attestation report" rather than a comprehensive financial audit), but its investment strategy is far more aggressive and diverse than Circle's, resulting in astonishing profits.

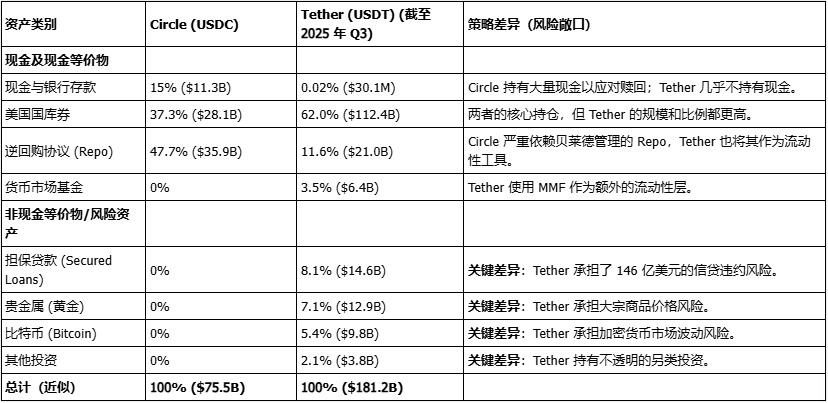

Let's take a look at what Tether's reserves contained as of the third quarter of 2025:

"Conventional" part (like Circle): U.S. Treasury bills (112.4 billion dollars), overnight reverse repos (18 billion dollars), money market funds (6.4 billion dollars).

"Aggressive" part (that Circle would never touch):

Precious metals (gold): 12.9 billion dollars

Bitcoin: 9.8 billion dollars

Secured loans: 14.6 billion dollars

Other investments: 3.8 billion dollars

Do you see it? Tether is not only earning interest on U.S. Treasuries; it is also taking on commodity risk (gold), cryptocurrency volatility risk (Bitcoin), and credit default risk (the 14.6 billion dollars in mysterious loans).

Tether's operation is not like a money market fund; it resembles an "internal hedge fund," and its funding source is the interest-free USDT held by global users.

This is the secret behind Tether's ability to achieve a profit of 13 billion dollars in 2024. It not only earns interest but also bets on capital gains from Bitcoin and gold while obtaining higher risk returns through lending.

This also explains why Tether emphasizes its "excess reserves" (or "net assets," which stood at 11.9 billion dollars as of August 2024). This money is not "profit" that can be freely distributed; it is a "capital buffer," a "lightning protection fund" that Tether must reserve to absorb potential massive losses from its risk assets (Bitcoin, loans) to prevent USDT from "de-pegging."

Tether must maintain high profits to support its high-risk asset game.

Comparison of Circle and Tether's reserve asset composition (data as of the third/fourth quarter of 2025)

03 Where Did the Profits Go?

How is this hundreds of billions in profit distributed? This again reveals the significant differences between the two companies.

Circle (USDC) "Shackles": Expensive Revenue Sharing with Coinbase

Although Circle has high revenue, its net profit has always been dragged down by a massive cost—its revenue-sharing agreement with Coinbase.

Circle and Coinbase (the co-founder of USDC) reached an agreement back in 2018, agreeing to share the interest income generated from USDC reserves. Coinbase can receive 50% of the "remaining payment base."

This agreement is calculated based on the amount of USDC held on the Coinbase platform. However, by 2024, the USDC on the Coinbase platform accounted for only about 20% of the total circulation, yet this early "outdated" agreement still allows it to claim about 50% to 55% of the total reserve income.

This distribution cost "eroded most of Circle's profits." The revenue share paid to Coinbase rose from 32% in 2022 to 54% in 2024. In the second quarter of 2025, Circle's total revenue was 658 million dollars, but the "distribution, transaction, and other costs" alone reached 407 million dollars.

Thus, Coinbase is not just Circle's partner; it is more like a "synthetic equity holder" of USDC's core revenue stream. Coinbase is both Circle's largest distribution channel and its biggest cost burden.

Tether (USDT) "Black Box"

Tether's profit distribution is a completely opaque "black box."

Tether (USDT) is owned by a private company, iFinex, registered in the British Virgin Islands (BVI). iFinex also owns and operates the well-known cryptocurrency exchange Bitfinex.

The reported 13 billion dollars in profit from Tether all flows into the parent company iFinex.

As a private company, iFinex is not required to disclose detailed costs and dividends like the publicly listed Circle. However, based on historical records and public information, this money has three destinations:

Shareholder dividends: iFinex (Bitfinex) has a history of paying substantial dividends to its private shareholders (such as executives like Giancarlo Devasini) (for example, it paid 246 million dollars in 2017).

Retained as a capital buffer: As mentioned earlier, Tether retains substantial profits (such as 11.9 billion dollars) as "net assets" on its books to hedge against the risks of its holdings in Bitcoin and loans.

Strategic investments (or internal maneuvering): Tether/iFinex is using these profits for diversified investments, making high-profile entries into new fields such as artificial intelligence, renewable energy, and Bitcoin mining. Additionally, there have long been complex internal fund flows between Tether and Bitfinex (such as the infamous Crypto Capital hole incident).

Therefore, Circle's profit distribution is public, expensive, and locked by Coinbase. In contrast, Tether's profit distribution is opaque, discretionary, and entirely controlled by a small number of insiders at iFinex, with this money becoming ammunition for building its next business empire.

04 How Can Ordinary Players "Get a Share"?

Since the issuers are taking all the Treasury interest, how do we, as stablecoin holders, make money in this ecosystem?

The money we can earn does not come from the issuers but from the demand of other crypto users, by providing services (liquidity, loans) and taking on on-chain risks to generate returns.

There are mainly three ways to play:

Strategy 1: Lending

How to play: You deposit your USDC or USDT into algorithmic money markets like Aave or Compound.

Who pays you? Borrowers. They are usually traders who need leverage or "HODLers" who urgently need cash but do not want to sell their Bitcoin/Ethereum.

How it works: Protocols like Aave and Compound automatically match lending and borrowing, adjusting interest rates in real-time based on market supply and demand. You (the lender) earn most of the interest, while the protocol treasury takes a small cut.

Strategy 2: Providing Liquidity

How to play: You deposit your stablecoins (usually trading pairs like USDC/USDT or USDC/DAI) into the "liquidity pool" of a decentralized exchange (DEX).

Star platform: Curve Finance

Curve is designed specifically for exchanging between stablecoins (e.g., USDC for USDT), with algorithms that achieve extremely low slippage (price difference).

Who pays you? Traders. Every time someone exchanges USDC for USDT on Curve, they need to pay a very small fee (e.g., 0.04%). This fee is distributed proportionally to you.

Additional rewards: To incentivize you to provide liquidity, Curve also "airdrops" its governance token (CRV) as a reward.

Why is it popular? Since the pool consists entirely of stablecoins pegged to 1 dollar, you almost do not have to bear the risk of "impermanent loss," making it an ideal "rental income" strategy.

Strategy 3: Yield Farming

How to play: This refers to various more complex "nested" strategies aimed at maximizing yields.

For example, you can:

1) Deposit USDC into Aave;

2) Use this USDC as collateral to borrow ETH;

3) Invest the borrowed ETH into other high-yield pools.

Risks: This is the riskiest strategy. You face the risk of smart contracts being hacked, the risk of collateral (ETH) being liquidated due to a price crash, and the risk of protocol rewards suddenly drying up.

05 Summary

Ultimately, the story of stablecoins is a tale of "two economies."

The first is a private, off-chain feast: issuers (Tether/Circle) invest our "idle" reserves into U.S. Treasuries and share the resulting billions in interest with their shareholders and corporate allies (like Coinbase), leaving token holders with nothing.

The second economy is the vibrant, on-chain DeFi world that we build ourselves. Here, users earn yields by lending and providing liquidity from the fees and interest paid by other users.

This reveals the core irony of the industry: a decentralized ecosystem whose "blood" is supplied by highly centralized, profit-maximizing "banks." The future of this vast empire hinges on two pillars: one is the high-interest macro environment that issuers rely on for survival; the other is the ongoing demand from DeFi users for speculation and leverage.

How long these two pillars can last may be the ultimate question for this trillion-dollar arena.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。