Author | @arndxt_xo

Translator | Dingdang, Odaily Planet Daily

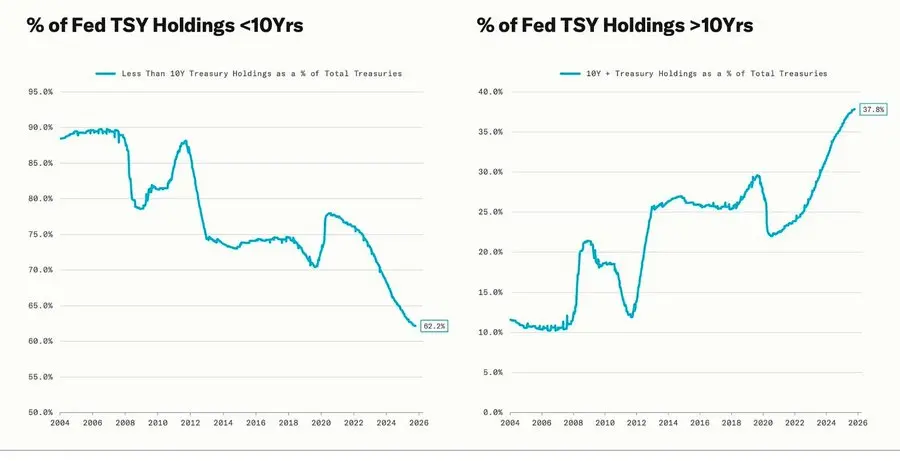

The significant correction coincides with the quantitative easing (QE) cycle—when the Federal Reserve intends to extend the maturity of its held assets to lower long-term yields (this operation is known as "Operation Twist" as well as QE2/QE3).

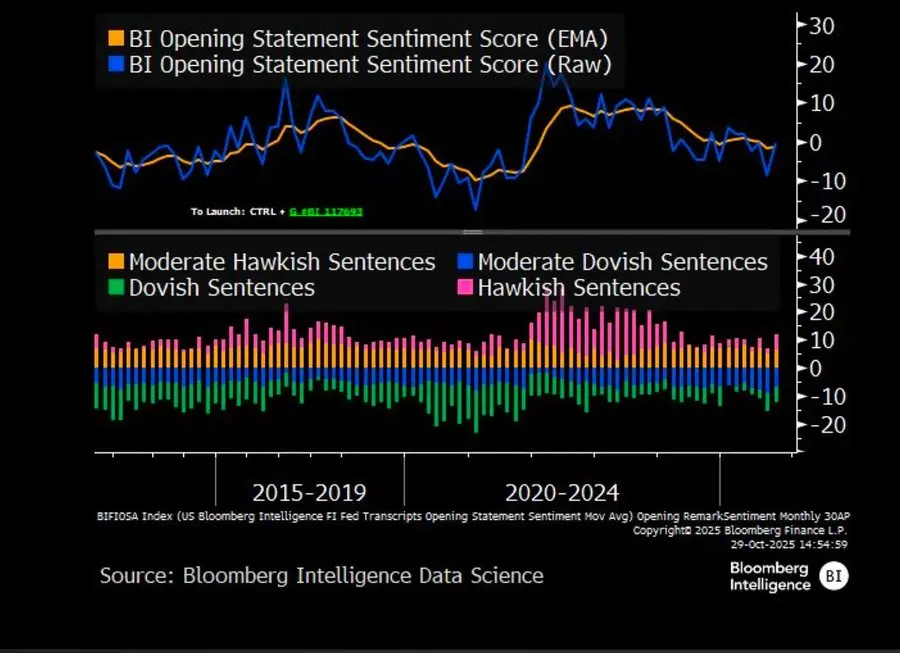

Powell's metaphor of "driving in the fog" is no longer limited to the Federal Reserve itself but has become a reflection of today's global economy. Whether policymakers, businesses, or investors, all are groping forward in an environment lacking clear visibility, relying solely on liquidity reflexes and short-term incentive mechanisms.

The new policy framework presents three characteristics: limited visibility, fragile confidence, and liquidity-driven distortions.

The Federal Reserve's "Hawkish Rate Cut"

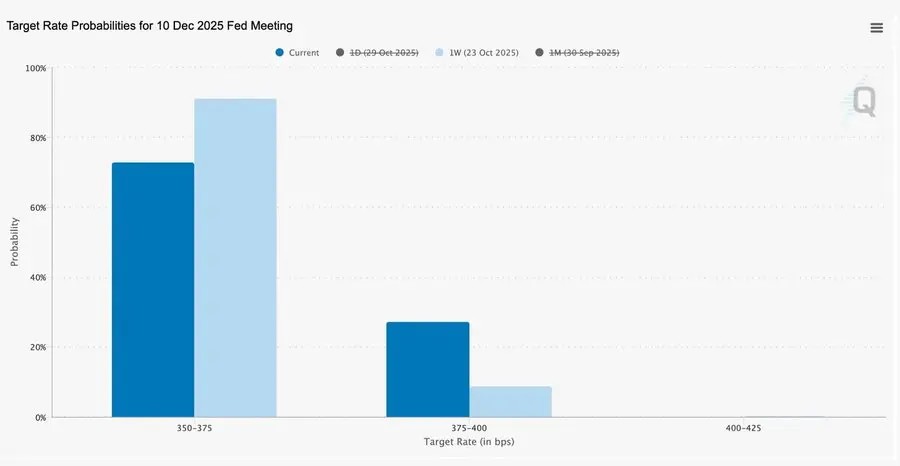

This 25 basis point "risk management" rate cut lowers the interest rate range to 3.75%–4.00%. Rather than being a loosening, it is more about "retaining options."

Due to two completely opposing opinions, Powell sent a clear signal to the market: "Slow down—visibility has disappeared."

Due to a data blackout caused by the government shutdown, the Federal Reserve is almost "blindly opening." Powell's hints to traders are very clear: it is still uncertain whether rates can be announced in December. Rate cut expectations quickly receded, the short-end yield curve flattened, and the market is digesting the cautious shift from "data-driven" to "data missing."

2025: The Liquidity "Hunger Games"

Repeated interventions by central banks have institutionalized speculative behavior. Today, what determines asset performance is not productivity but liquidity itself—this structure leads to continuously inflated valuations while credit in the real economy weakens.

The discussion further expands to a sober examination of the current financial system: passive concentration, algorithmic reflexivity, and retail option frenzy—

- Passive funds and quantitative strategies dominate liquidity, with volatility determined by positions rather than fundamentals.

- Retail bullish option buying and Gamma squeezes create synthetic price momentum in the "Meme sector," while institutional funds flock to an increasingly narrow market leader stocks.

- The host refers to this phenomenon as the "financial Hunger Games"—a system shaped by structural inequality and policy reflexivity, forcing small investors into speculative survivalism.

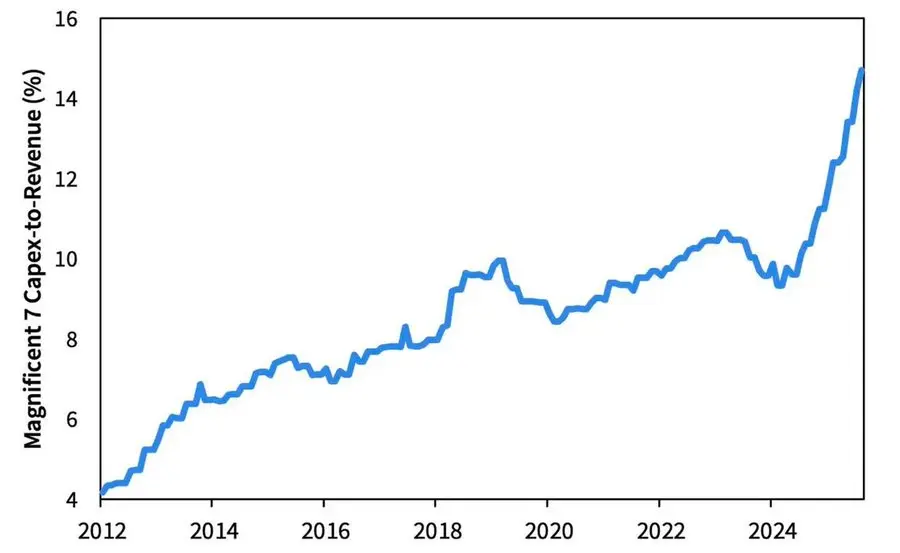

2026 Outlook: The Prosperity and Concerns of Capital Expenditure

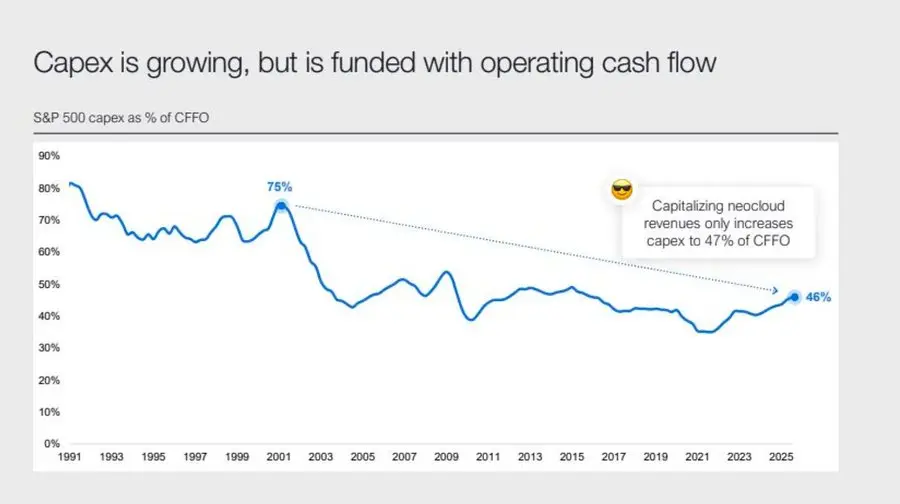

The AI investment wave is pushing "Big Tech" into a post-cycle industrialization phase—currently driven by liquidity, but facing leverage sensitivity risks in the future.

Corporate earnings remain impressive, but the underlying logic is changing: the once "light asset cash machines" are transforming into heavy capital infrastructure players.

- The expansion of AI and data centers initially relied on cash flow, but now is shifting towards record debt financing—such as Meta's oversubscribed $25 billion bond.

- This shift means profit margins are under pressure, depreciation is rising, and refinancing risks are increasing—laying the groundwork for the next credit cycle's turning point.

Structural Commentary: Trust, Distribution, and Policy Cycles

From Powell's cautious tone to the final reflection, a clear main thread runs through: the centralization of power and the loss of trust.

Each policy rescue almost reinforces the largest market participants, further concentrating wealth and continuously undermining market integrity. The coordinated operations of the Federal Reserve and the Treasury—from quantitative tightening (QT) to short-term Treasury (Bill) purchases—exacerbate this trend: ample liquidity is at the top of the pyramid, while ordinary households are suffocated by stagnant wages and rising debt.

Now, the most critical macro risk is no longer inflation but institutional fatigue. The market still appears prosperous on the surface, but trust in "fairness and transparency" is eroding—this is the true systemic vulnerability of the 2020s.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。