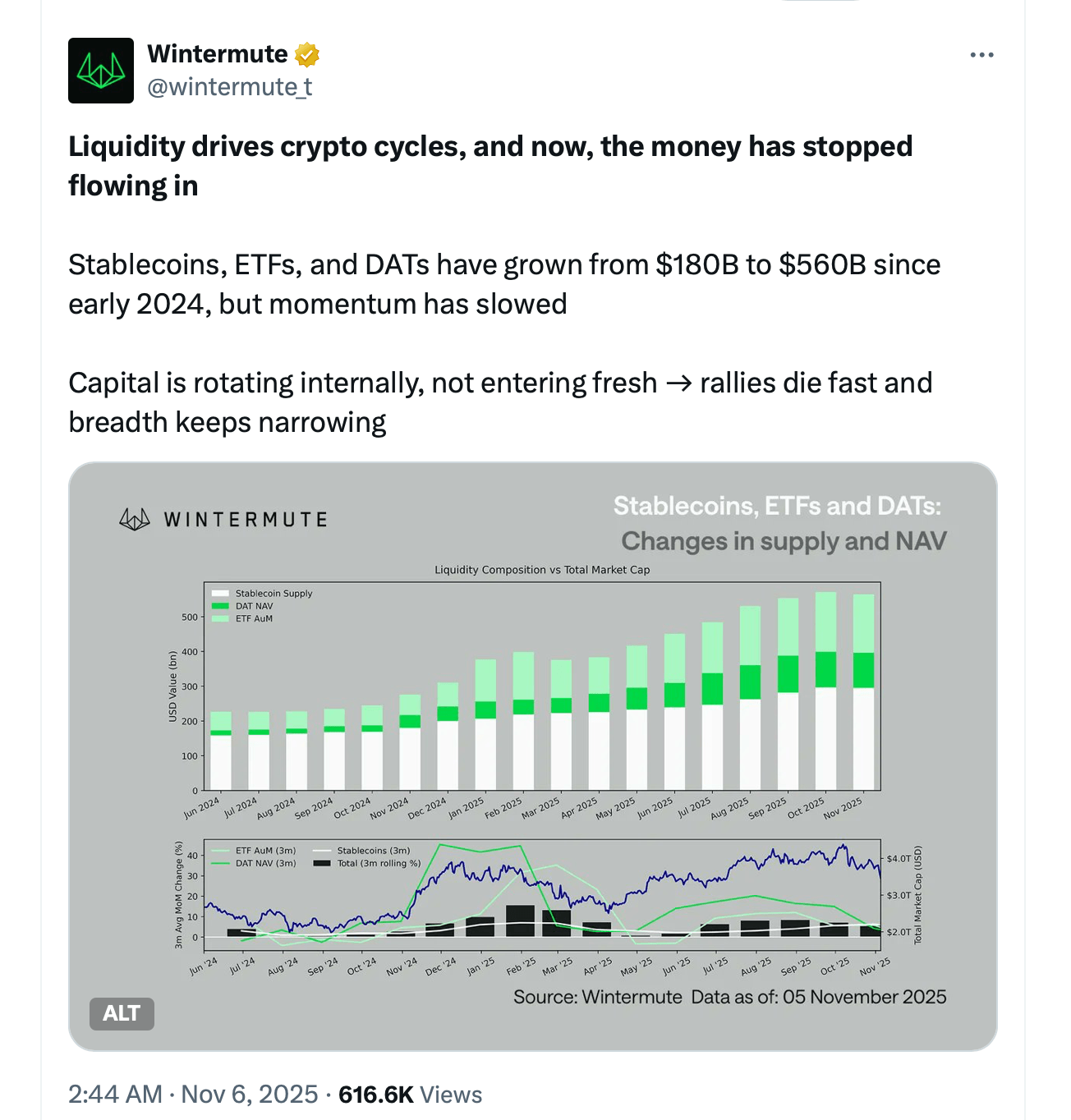

根据算法交易公司和加密市场做市商Wintermute的说法,尽管整体货币环境仍然宽松,但通过稳定币、交易所交易基金(ETFs)和数字资产国库(DATs)的资金流入已经放缓。本周,稳定币的流入量首次出现几个月以来的减少。

作者兼桌面策略师Jasper De Maere解释说,尽管采用驱动长期趋势,但流动性决定价格方向——而现在,这种流动性是循环而非增加。Wintermute的数据表明,稳定币、ETFs和DATs这三种流动性渠道在经历了2024年末和2025年初的强劲增长后,均已达到平台期。

合并的DAT和ETF持有量从大约400亿美元上升到2700亿美元,而稳定币则从1400亿美元翻倍至2900亿美元后趋于平稳。De Maere指出,这一放缓信号表明进入生态系统的新资金减少,而不仅仅是资本轮换。

De Maere表示,每个渠道反映了不同的流动性来源:稳定币显示出加密原生情绪,DATs跟踪机构的收益偏好,而ETFs代表传统金融的配置。随着这三者的平稳,Wintermute认为市场现在是内部驱动的,流动性在各个领域之间移动,而不是从外部进入。

在加密货币之外,Wintermute强调全球流动性(M2)仍然充足,但高SOFR利率继续使现金停留在国债中。即使美国的量化紧缩结束,De Maere表示,宏观流动性目前选择股票而非数字资产。

根据De Maere的说法,这一内部流动性循环解释了近期市场行为:反弹迅速消退,因清算而导致的波动性激增,尽管管理的总资产保持稳定,但价格广度却在缩小。Wintermute补充说,新的资本——无论是通过新的稳定币铸造、ETF创建还是DAT发行——将是外部流动性回归加密市场的信号。

在此之前,De Maere总结道,加密货币仍处于“自我融资阶段”,资本在循环,而不是复利——这一模式对任何见证过流动性主导之前加密周期的人来说都很熟悉。

- 谁撰写了Wintermute关于加密流动性的报告?该分析由全球交易公司Wintermute的研究员Jasper De Maere撰写。

- Wintermute认为加密的三大流动性渠道是什么?稳定币、交易所交易基金(ETFs)和数字资产国库(DATs)。

- 为什么Wintermute说资金流入放缓?高SOFR利率和投资者对股票的偏好正在将流动性转移出加密市场。

- 流动性何时可能回归加密市场?根据De Maere的说法,稳定币的重新铸造、ETF的流入或DAT的增长将标志着外部资本的回归。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。