Analysis suggests that the shadow of turmoil in the cryptocurrency market in October still looms, and investors are unlikely to enter the market easily until clear signals of price support emerge.

Written by: Ye Zhen, Wall Street Insights

Under the shadow of October's historic deleveraging event, the cryptocurrency market is facing a new wave of selling pressure. A key indicator shows that demand from large institutional investors is weakening, exacerbating the cautious sentiment in the market.

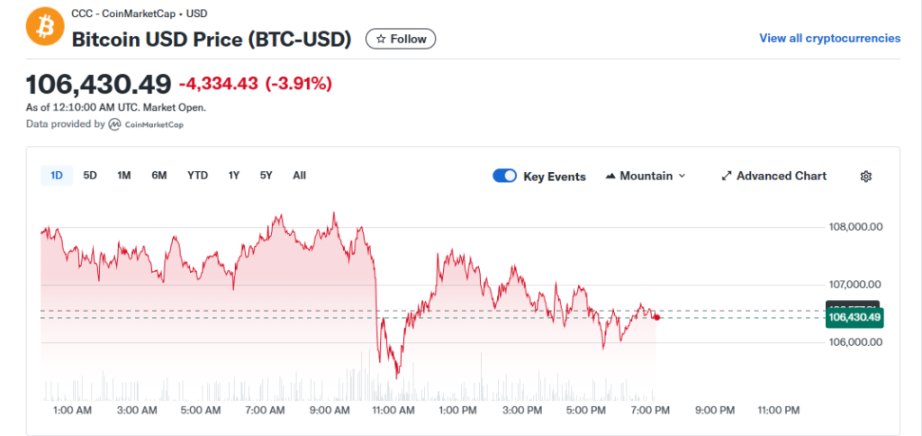

On Monday, the cryptocurrency market continued to be under pressure, with Bitcoin's price falling below $107,000. The broader altcoin market performed even more weakly, with some token prices having dropped back to the lows seen during the October flash crash, when hundreds of billions of dollars in leveraged positions were liquidated.

A concerning signal is that, according to Charles Edwards, founder of Capriole Investments, institutional demand for Bitcoin has fallen below the rate of new coin mining for the first time in seven months. This shift suggests that large buyers may be retreating, and combined with other market activities, points to a risk-averse tone across the entire cryptocurrency market.

Cautious Market Sentiment, Cooling Institutional Demand

Bitcoin fell as much as 4.3% on Monday to around $105,300. Although it is still up about 14% since last December, its recent performance has been notably weak. Meanwhile, the MarketVector index, which tracks the performance of the bottom 50 of the top 100 digital assets, has declined for the third consecutive trading day, dropping as much as 8.8%. This index has fallen about 60% year-to-date.

Market participants noted that it has been three weeks since the violent shakeout in October that wiped out about $19 billion in long positions, but its "aftereffects" are still ongoing. Jordi Alexander, CEO of cryptocurrency trading and market-making firm Selini Capital, stated that the crypto market is currently in the "hangover phase" following the October liquidation shock. He believes that rebuilding the destroyed capital base will take time, and investor sentiment remains cautious.

Alexander added, "The market must first prove that a convincing price bottom is about to form before attempting to break upward again." In his view, investors will not easily enter the market until clear signals of price support emerge.

In addition to the weak market sentiment, a key technical indicator has also raised red flags. Charles Edwards of Capriole Investments pointed out that demand from large institutions for Bitcoin has slowed, marking the first time in seven months that it has fallen below the output rate of new coins. This data suggests that one of the key forces driving the market up may be weakening.

Is there another source of selling pressure? Profit-taking and "sleeping" Bitcoins activated

Not everyone attributes this round of decline solely to the market shock in October.

Matthew Kimmell, a digital asset analyst at CoinShares, described this round of correction as "somewhat perplexing." He believes that while the market "is still experiencing some echoes of the liquidation event," other factors are also worth noting.

Kimmell pointed out that Bitcoin's public trading records show that some previously dormant wallets have been activated. "These tokens have started to move, likely re-entering the market and providing some selling pressure as investors take profits," he said. "This is something I am continuously monitoring."

Jake Hanley, managing director of Teucrium ETFs, also believes that the reason for the price decline is that "people are taking profits." He noted that the current technical picture shows a diverging market. "Since the summer, prices led by Bitcoin have been declining, while XRP has also clearly trended downward since midsummer," Hanley said. "In this process, the price itself is telling you that people are cashing in profits."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。